What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

This issue of The Business Inquirer is brought to you by DueDilio.

DueDilio is a due diligence concierge connecting business buyers and private investors with quality, pre-vetted due diligence service providers.

Our deep network of 150+ independent professionals, boutique and mid-size firms, and subject-matter-experts enable us to address finance, technology, legal, operations, marketing, and other diligence projects.

Submit your project. Review qualified proposals. Hire diligence provider.

📰 Articles

Middle Market Growth writes about the rising activity and valuations in tech-enabled coaching & professional development businesses. Interesting read and a space to keep an eye on.

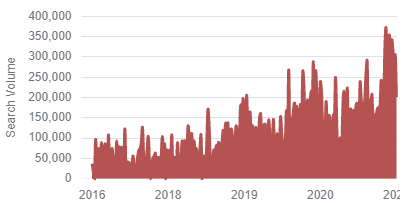

Companies that provide coaching services, both in the education arena and the broader business world, are growing fast and attracting EBITDA multiples of 12x or more, unusually rich valuations for tech-enabled services.

While the idea of coaching isn’t new, these and other businesses are finding ways to make it more effective and developing metrics that demonstrate its value, making it easier for customers to justify spending money on it.

Tech-Enabled Coaching Is Fueling Investment in Professional Development in Higher Education

— — — —

Twitter’s most famous anonymous attorney - @SMB_Attorney released session #8 of his/her/they Legal M&A Masterclass. This session talks about deal structure and the difference between a stock sale, asset sale, and more.

The two main ways an SMB buyer will purchase a business are (1) an equity purchase (or “stock purchase”) and (2) an asset purchase.

Each method has a number of competing commercial, process, tax and other issues that should be weighed, and we’ll examine each below.

Session #8: Structuring the Deal

— — — —

Mowery & Schoenfeld writes about a recent Tax Court case that could have some implications for the search fund community relating to how expenses are treated.

While the facts of Estate of Morgan v. Comm'r of Internal Revenue are not identical to those experienced by the entrepreneurship through acquisition (ETA) community, we do believe this case should be considered in analyzing future tax positions taken for search funds.

For 2021 and beyond, expenses may need to be capitalized instead of deducted as they are incurred. If a fund acquires a business, then most search expenses would be amortized over a period of fifteen years under this approach.

Important Tax Changes for the Search Fund Community

— — — —

I’ve been a big fan of The Wolf Report and their franchise business breakdowns. In the latest issue, they talk about Fitness Machine Technicians (FMT). It’s a great newsletter and I’d recommend subscribing (free).

I love niche businesses, so I was pretty pumped to discover FMT over the weekend. I was even more pumped when I saw the numbers for their affiliate location 🤑.

Anytime a franchise is showing an EBITDA higher than the initial investment, it’s a signal to explore further. FMT was able to do this during covid, and while revenue did take a hit in 2020, it’s good to see the business was still operational.

🍟 Week 19: Fitness Machine Technicians

— — — —

CLA Connect writes about the Build Back Better Act and some tax changes that may impact business sellers, private investors, and fund managers.

While the top line rates would remain unchanged, the Act would impose a 5% surtax beginning in 2022 on individuals with modified adjusted gross income (MAGI) in excess of $10 million, plus an additional 3% if MAGI is in excess of $25 million. Such a surtax would have far-reaching impacts for business sellers, investors, and fund managers. Additionally, the surtax would apply to estates and trusts at much lower MAGI thresholds, which would be a major consideration in wealth and succession planning.

Tax changes under the Build Back Better Act could impact private equity

🧵 Twitter

Time management is in constant need of improvement. Some tips…

There are two sides to every narrative. One side is telling everyone that buying a laundromat/plumbing/vending business is the path to riches. The reality is a bit more complicated…

Patrick knows sales. Listen to this man…

Something to watch out for if you’re an S-Corp or Partnership…

Good thread on the SMB ownership journey…

Another good thread on the realities of SMB ownership…

Ability to quickly validate product and business ideas is a superpower…

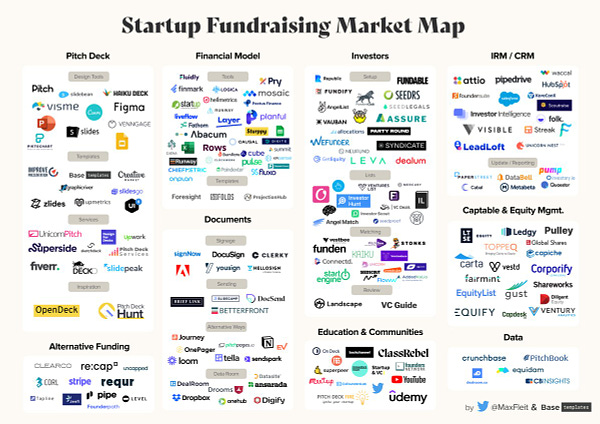

Cool market map of startup funding. Is there something like this for SMB funding?

Distribution and customer acquisition are two of the most important parts of a business. I try to absorb as much marketing material as possible and this is a good thread on some key topics…

Somehow I made the list…

🤔 Thoughts & Commentary

Client Reviews

One thing I recommend is to start collecting client reviews as early as possible. Collecting social proof takes time but it is a very valuable asset that you can’t buy. I only recently started asking DueDilio clients to leave a formal review on Trustpilot. I regret not doing it earlier. Over the last several week’s I was able to collect 7 genuine client reviews.

On Wednesday I got a kick in the head from Trustpilot. I received an e-mail stating that Trustpilot has deleted 4 out of my 7 reviews due to suspicion of fraud. No explanation, no rationale, no way for me to remedy the situation. The only way to reinstate the reviews was if each of the reviewers (clients) provided proof that they used my service. That’s an unnecessary burden on the client when the business is able to easily provide this. So far, none of my reviews have been reinstated.

This got me interested in Trustpilot. They’re publicly traded in London. They have $134M ARR, +30% annual growth since 2013, 626k businesses have been reviewed. They charge clients a minimum of $2,400 a year to get any value from their service. There are some competitors but not many. Feels like there may be an opportunity here for disruption.

🛠 Tools & Resources

These are tools & resources that I personally use or have used. They may contain affiliate links so I’ll get a few pesos if you sign-up.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - peer-to-peer deal flow exchange. Free, open, transparent.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.