What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

As I only recently started this additional newsletter, please provide some feedback. What do you like and not like? How can it be improved? What else would you like to see? Do I focus too much on one topic and not enough on some others? Any and all feedback is welcome. Use the links at the bottom if you want to do this anonymously.

What I Learned Last Week is brought to you by DueDilio. DueDilio is the first M&A due diligence marketplace connecting business buyers and investors with quality, verified due diligence experts.

📰 Articles

Barlow & Williams is a law firm in the DueDilio network. They published a great article on how to structure a partnership between investors and operators.

Structuring a Partnership Between an Investor and a SaaS or E-Commerce Operator

— — — —

Gagan Biyani wrote an article making the case for moving away from MVPs and toward MVTs. The thesis is that it’s best to build a minimum viable test of your startup idea before moving forward with building a minimum viable product. I agree wholeheartedly with this approach. Test and learn as much as you can before launching.

The Minimum Viable Testing Process for Evaluating Startup Ideas

— — — —

The Website Flip published their first “State of the Industry” report covering website investing. I believe this first report is available to everyone but you may need to purchase a subscription to view others. The report covers raw data from brokers, news, insights, and more. Relevant for anyone investing in the content website space.

State Of Website Investing Industry: August 2021 Report

— — — —

Big Deal Small Business had a great guest post from someone who is in charge of proprietary search for PE firms in the SaaS space. The post talks about the deal funnel, some common myths, and learnings. Really great read.

Lessons from a Thousand CEOs

— — — —

MicroAcquire has published the inaugural issue of their Bootstrappers publication. It features stories of bootstrapped founders. Love the idea. Not clear how it’s different than Starter Story or Failory but I think there’s a lot of demand for this type of content.

BOOTSTRAPPERS by MicroAcquire

— — — —

VC investments in the consumer space are at an all-time high. Eric Feng, leader of commerce incubations at Facebook provides his thoughts on whether this is warranted. In short, as long as consumers are willing to try something new, there will be companies creating something new, and investors eager to fund that something new. I’m paraphrasing of course.

Consumer VC investing is at an all time high, but should it be?

— — — —

Digital 360 writes about e-commerce trends. Recommend checking out their blog if you’re an online merchant. Their recent report looked at back-to-school shoppers highlighting that 77% of their purchases are made online. A lot of great infographics in this report.

77% of back-to-school shoppers purchase online

— — — —

XO Capital interviews Dom Wells of Onfolio. Onfolio is an online business holding company that buys and operates online businesses. They recently raised capital to fund their acquisitions. Great interview to get some insights into their process and how to structure a holding company if you want to raise capital.

Fund Stuff Episode 6 - Dominic Wells From Onfolio

— — — —

Bloom Equity Partners has been putting out great content about acquisitions. Their latest piece talks about the difference between bolt-on and tuck-in acquisitions.

add-on acquisitions: bolt-on v.s. tuck-in

🧵 Twitter

Great thread on choosing the right legal structure…

Real estate is often included in SMB deals. This thread discusses how to value it…

Owning a bunch of tiny businesses instead of one big business isn’t all fun and glory…

Good insights on the two most common deal structures - Asset Purchase vs. Stock Purchase…

Sometimes things just go right, quickly. Good story but actually a good reminder to do your own diligence…

A few good lessons on entrepreneurship here…

This is a pretty crazy story…

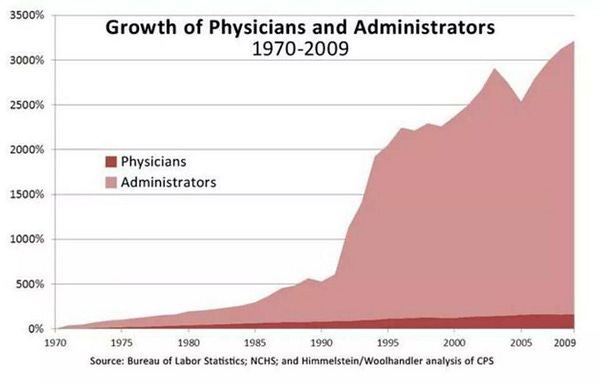

I hear this discussed by all my friends in the medical profession. Crazy to see actual numbers…

How politicians get rich…ok, it’s just one of the many ways…

Great insights for anyone starting a cold-calling campaign…

🤔 Thoughts & Commentary

(Apologies for the poorly written content here today. Super busy day and rushing against the clock to get this out)

Alternative Data

One of my first entrepreneurial ventures was a consultancy focused on the alternative data industry. I helped hedge funds source alternative data. I also worked with alternative data providers to help them validate, price, market, and sell their data.

One of my data clients was Apptopia which sold mobile app data (DAU, MAU, etc). There was a large competitor in the same space called App Annie. App Annie was the clear leader and sold their data for a very large premium. They were VC-backed, had 100+ employees. Admittedly, their data was many times more accurate than anything Apptopia had at the time. They were a very tough competitor to go against. In fact, their data was too good. We were all shocked at just how accurate their data actually was. This week it became clear why.

App Annie was basically using insider data that they were not allowed to share or use to inform their algorithms. Apologies that this is vague but you can read all about it in this short SEC filing.

My guess is that this is just the beginning. There’s a lot of grey area in this industry.

— — — —

Private Deal Exchange

Last week I shared the idea of Twitter Digest. Create a weekly e-mail newsletter that shares the top 10 tweets on a particular topic. I’m happy to say that a subscriber reached out and we are slowly working on this.

I have another idea that I want to share and get feedback on…

Acquirers (especially searchers) review multiple deals each week. Sometimes it’s up to 50 deals per week. The process looks something like this:

Source a deal (broker, friend, proprietary)

Get some preliminary info (probably sign NDA)

Do pre-LOI due diligence

Move forward or pass on it.

There are many reasons why someone would pass on a deal. The saying “one person’s trash is another man’s treasure” applies here as well. When someone passes on a deal, they typically reach out to a few friends to give them a heads-up to see if it’s a deal that may be suitable for them. If there are no bites, the deal and the pre-LOI diligence that has been done get thrown in the trash. This is clearly a waste.

So here’s the idea: Create a private, invite-only deal exchange. Closed to brokers and intermediaries. Only open to buy-side. Buyers can post details about the deals that they pass on including their preliminary notes. In return, other members of the platform who act on the deal pay the person who posted the deal a finders fee (1-5%). If the deal is proprietary, maybe they even pay to have access to the details of the deal.

This creates a win/win situation. It adds deal flow for members of the platform. It also allows members of the platform to monetize their proprietary deal flow and diligence.

One wrinkle in this: Have to consult with an attorney regarding NDAs. Buyers typically sign an NDA to get access to detailed information about each deal. Not sure how to solve this. Without some solution, members may not be able to share their notes. This idea can still work without this component.

If anyone has feedback, please let me know.

— — — —

Crowdfunding

A day doesn’t go by when I don’t see another crowdfunding campaign from some company. One quick thing I want to say about all the recent crowdfunding activity. Do your homework/diligence. Just because someone tells you that they are graciously opening up their funding round to “the small guys” doesn’t mean it’s a good investment. Trust me when I tell you this - anyone who can raise VC/PE money, would much much much rather do that than open it up to random people. Are there exceptions? Of course. This isn’t a blanket statement. Just do your due diligence.

⚙ Tools & Resources

These are tools & resources that I personally use or have used. They may contain affiliate links so I’ll get a few shekels if you sign-up.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount.

PrivSource - Deal aggregator for lower and middle-market listings.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.