What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

This issue of The Business Inquirer is brought to you by DueDilio.

DueDilio is an expert network focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with quality, pre-vetted due diligence service providers.

Our deep network of independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, and other areas of business diligence.

Submit your project. Review qualified proposals. Hire diligence provider.

📰 Articles

Bloom Equity Partners published a State of the Market as it relates to SaaS.

Summary:

Business fundamentals remain healthy for public software companies

Private markets have not yet meaningfully corrected

There is a lot of uncertainty around the future of both the private & public markets (Ukraine, rising rates etc.)

— — — —

Twitter’s favorite anonymous attorney continues with his/her/they’s SMB Legal M&A Masterclass with Session #17 talking about SBA 7(a) loans. This is a really great intro to the program.

One program in particular – the 7(a) Loan Program – tends to work really well for small business acquisitions.

The SBA has a statutory charge to advance the interests of United States small businesses, among those interests is access to capital.

To accomplish this goal, the SBA’s 7A Loan Program provides a guaranty from Uncle Sam to the SBA lender for a portion of the loan effectively in lieu of what collateral might normally be present. Because this guaranty can serve as a potential source of repayment, the presence of the guaranty is often the difference between a deal happening for a buyer or not.

For both a seller and a buyer, however, there are some best practices to be made aware of before going exclusive with a lender.

Session #17: Introduction to the SBA 7(a) Loan Program

— — — —

Searchfund member Jonathan Oh of Straightforward Equity had a great post about his firm’s first SaaS acquisition. In the post he discusses the process of sourcing, structuring, transitioning, and operating the business. I actually jumped on a call with Jon and he’s building something interesting to help with deal sourcing. Stay tuned.

A couple of lessons we learned along the way:

1) Fortune Favors the Fast:

When buying, once you’ve found a target that meets your requirements, move quickly and make sure you communicate the intent to move quickly.

Early in our search, we came across a deal we loved — we’ll call this TheOneThatGotAwayInc. Financials were solid, our team was very familiar with the tech stack (Ruby on Rails), and we liked the founder. He had built a great business, had clear other priorities leading him away from the project, and he seemed eager to work with us. This deal matched everything we were looking for, but it almost felt too good to be true: this was so early in our search, that we felt like we needed to create some space for us to come up with other options before doubling down on a purchase.

We took a week to get him an LOI, and we were too slow. In that time, another party had sent over an LOI, with a strong intent to close in less than 30 days.

When we found TheOneWeClosedLLC, we were aggressive. We sent over an LOI, with intent to close in 30 days. We closed in 14 days. Even in that time though, the seller received multiple offers (with most offering a higher valuation) — but the seller chose to stick with us, because none of the other offers came close to offering a swift and easy close, and we were the only offer that had funds in hand.

We flew to meet the seller in person on the day of closing to sign purchase agreements, transfer funds, and transfer owner accounts in person.

2) Signals from Seller Personality:

When we sold our previous SaaS company, we went under several LOIs with potential buyers. In hindsight, those we engaged with fell into two camps:

(a) Folks we trusted were dealing with us in good faith, and that we trusted would steward our product and people well, and

(b) Folks we couldn’t read well, and gave us pause on whether they would steward our product and people as well as we hoped.

We realized that this revealed a lot more about us as Sellers, rather than providing a rubric to evaluate our potential buyers. We cared a lot about the product and team we had built, and so we wanted to sell to a Buyer that would care about the business and people in a way that would benefit all, especially our employees that would stay on post-acquisition.

As Buyers, we tried to find a Seller that cared about their business and people well. Of course, we had a fairly rigorous financial and technical due diligence — but perhaps the most important gauge for us was whether our read of the Seller gave us signals on how he had built and led his organization. With TheOneWeClosedLLC, we knew we had found a Seller who had operated with integrity with his clients and his employees, and it made the transition of ownership pleasant and relatively smooth.

Reflections after closing our first SaaS acquisition

— — — —

IBBA and M&A Source published their Marketpulse Q42021 Survey. Branden Yamada of Ecom Exchange posted a great summary of findings:

𝗜𝘁'𝘀 𝗮 𝗦𝗲𝗹𝗹𝗲𝗿'𝘀 𝗠𝗮𝗿𝗸𝗲𝘁!

There are more interested, active buyers than there are quality deals on the market.

𝗙𝗶𝗿𝘀𝘁 𝘁𝗶𝗺𝗲 𝗯𝘂𝘆𝗲𝗿𝘀 𝗮𝗿𝗲 𝘁𝗵𝗲 𝗺𝗼𝘀𝘁 𝗰𝗼𝗺𝗺𝗼𝗻 𝗯𝘂𝘆𝗲𝗿𝘀 𝗳𝗼𝗿 ~𝟮𝗠 𝘃𝗮𝗹𝘂𝗲* 𝗯𝗿𝗮𝗻𝗱𝘀⠀⠀

This means you should consider using a broker or M&A advisor to guide them and save you headache, unless you're familiar with exits. First time buyer + First time seller = complete disaster.⠀⠀ ⠀⠀⠀

𝟰𝟬% 𝗼𝗳 𝗯𝘂𝘆𝗲𝗿𝘀 𝗶𝗻 𝘁𝗵𝗲 𝗟𝗼𝘄𝗲𝗿 𝗠𝗶𝗱𝗱𝗹𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 (𝟮-𝟱𝟬𝗠𝗠) 𝘄𝗲𝗿𝗲 𝗲𝘅𝗶𝘀𝘁𝗶𝗻𝗴 𝗰𝗼𝗺𝗽𝗮𝗻𝗶𝗲𝘀 ⠀⠀

Buyers and Owners should both be aware of strategic buyers and their competition. Companies are having trouble finding talent which may be what's driving more acquisitions for company growth.

𝟱𝟰% 𝗼𝗳 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀 𝗮𝗿𝗲 𝗰𝗹𝗼𝘀𝗶𝗻𝗴 𝘀𝘂𝗰𝗰𝗲𝘀𝘀𝗳𝘂𝗹𝗹𝘆, 𝗼𝗻𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗵𝗶𝗴𝗵𝗲𝘀𝘁 𝗿𝗮𝘁𝗲𝘀 𝗿𝗲𝗽𝗼𝗿𝘁𝗲𝗱⠀⠀⠀

I believe this was due to strong economic confidence, deal refinement by brokers and increased competition.⠀

𝗕𝘂𝘆𝗲𝗿𝘀 𝗮𝗿𝗲 𝗽𝗮𝘆𝗶𝗻𝗴 𝗺𝗼𝗿𝗲 𝗳𝗼𝗿 𝟱𝗠+ 𝘃𝗮𝗹𝘂𝗲* 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀𝗲𝘀⠀⠀⠀

Bigger businesses fetch higher multiples in general, so owners and buyers alike should be aware of which brackets their brands fall into.

𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗕𝘂𝘆𝗲𝗿𝘀:

You should be exploring more ways to source 𝗼𝗳𝗳-𝗺𝗮𝗿𝗸𝗲𝘁 𝗱𝗲𝗮𝗹𝘀 and have your limits clearly defined so you're not over-investing on high competition deals. Direct/mass outreach, relevant communities, referrals etc.

𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗢𝘄𝗻𝗲𝗿𝘀:

About 56% of owners who sold their business 𝗱𝗶𝗱𝗻'𝘁 𝗽𝗹𝗮𝗻 𝗳𝗼𝗿 𝗶𝘁 𝗮𝘁 𝗮𝗹𝗹. This means they likely left money on the table (timing & other factors). Very few owners think about selling when the business is at its peak, explore your options now.

— — — —

Bain & Co released Global Private Equity Report 2022

— — — —

Jordan Novgrod continues to put out great content in his Small Business Acquisition newsletter. His latest issue breaks down all the basic terms that you may see in a business listing such as cashflow, SDE, and EBITDA.

Cashflow and other broker definitions

🧵 Twitter

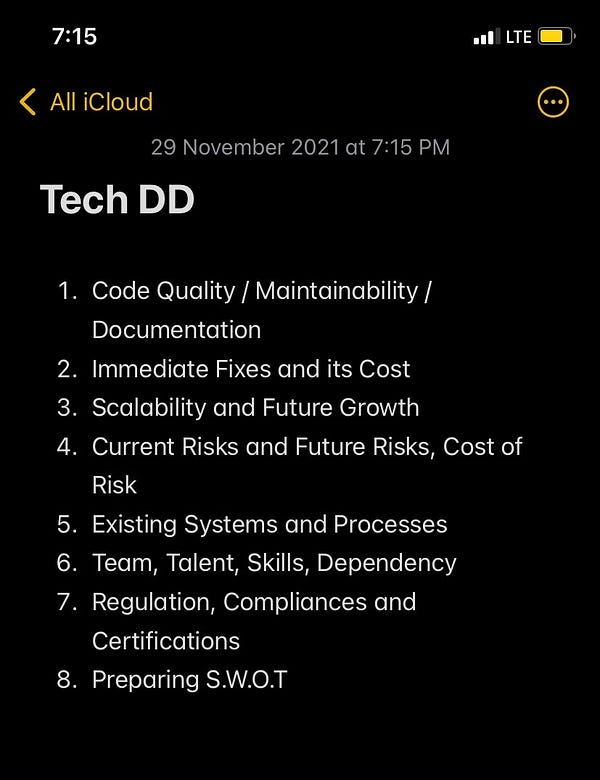

I haven’t seen a more detailed thread on tech due diligence…

Widely applicable advice on keeping your investors happy…

It’s a must to learn the basics of accounting but for $50/m you can also just hire someone to take care of this for you…

This is a great “follow along”…

Brett knows what he’s talking about. Check this out if you’re thinking of launching a productized service…

Learn deal sourcing from one of the best…

This is the way… 👇

A lot to unpack in this thread. Returns vs. leverage…

🤔 Thoughts, Events, Other

Flippa

The CEO of Flippa sent out an e-mail update on their marketplace. I’m not sure if it’s available online so I copied parts of it below…

For the period January to March 23rd:

30,774 buyers joined Flippa

14,107 completed profiles and were broken down into three buyer types:

Company - defined as an established organization looking to grow through acquisition

Entrepreneur - defined as a full time entrepreneur looking to own and operate

Side Hustler - defined as a prospective buyer looking to earn a side income

Companies only made up 8.9% (1,255) of overall buyers but with an average budget of $3.9M, this cohort dwarfs the other two

76% of Side Hustlers intend to buy more than one asset. This is interesting. Side Hustlers tend to buy multiple assets. They run them all separately - typically content assets or apps - and they amass small fortunes

The numbers here are wild. Just YTD they had 30k+ new buyers join their platform with 14k completing a profile.

🛠 Tools & Resources

These are tools & resources that I personally use or have used. They may contain affiliate links so I’ll get a few pesos if you sign-up.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Calendly - Leading scheduling platform to easily schedule meetings without the back and forth. I’ve been using it for several years now. Free 14-day trial.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of What I Learned Last Week!

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.