What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

What I Learned Last Week is brought to you by Groupshop.

eCommerce businesses are seeing acquisition costs skyrocket with the new Apple updates (I wrote about this last week).

It’s a trend—not an anomaly.

But what if there was a better way to grow your sales utilizing your best asset—your customers.

Introducing Groupshop.

Groupshop helps you leverage your customers’ influence with personalized shopping pages they own. Your customers earn cashback when their friends shop. Friends earn discounts. It’s that simple!

You control your ROI as your Groupshop rewards never exceed what you’re willing to spend on acquisition.

In a limited release with a major e-com brand, they generated over $11,900 in revenue, a 6.86x ROI, 178 additional orders, and $1,655 cashback given to customers.

Groupshop is a must-have app for your Shopify store.

They’ll be onboarding select eCommerce brands in the next few months. Signup for their waitlist and follow them on Twitter for product and company updates.

📰 Articles

Bloomberg Tax writes about the tax structures involved in buying or selling a business.

Most transactions involving the buying and selling of a business can be organized into one of two categories: an asset sale or a stock sale. Mark Gallegos, CPA, MST, a tax partner at Porte Brown, reminds us that structuring the transaction as an asset sale will have different tax ramifications than a stock sale, and discusses some key issues.

Tax Structures in Buying or Selling a Business

— — — —

Jay Vasantharajah is a Toronto-based entrepreneur and SaaS investor. I’ve highlighted several of his blog articles in this newsletter. In the latest blog post he writes about the many ways to take advantage of the current inflationary environment.

Recent reports show that inflation is as high as 6.2% currently, and could easily climb up from there. Though not as high as 15% in a single day, over time a 6.2% annual inflation rate will lead to a drastic devaluation in any currency.

So if you know that the dollar is going to significantly devalue, how do you benefit from this?

How to Short the Dollar and Benefit From Inflation

If you’re interested in this topic, check out this great piece from Crescat Capital.

Based on the firm’s current equity and macro models, and our investment team’s analysis, we believe we are in the explosive first wave of an inflationary cycle in the US and globally that will elevate consumer prices at a much higher annualized rate and for significantly longer than priced into financial markets today. The factors driving our view include structural shortages in primary resource industries due to chronic underinvestment, incipient wage-price spirals, and unsustainably high government debt-to-GDP imbalances which make a new inflationary trend the policy path of least resistance.

NOVEMBER RESEARCH LETTER – THE CATALYST FOR THE GREAT ROTATION

— — — —

Business Development Bank of Canada published a study showing that entrepreneurs who choose to grow through acquisition are twice as likely to experience sales growth above their industry average as those who grow organically.

Key Findings:

Entrepreneurs who grow through acquisition are twice as likely to experience sales growth above their industry average as firms that grow organically.

In the next five years, 25% of Canadian entrepreneurs want to sell or close their business.

The COVID-19 pandemic has changed the factors motivating business acquisitions. Acquiring new talent has jumped to 30%, up from 20% before the pandemic, as a motivator for an acquisition. Obtaining technology as a motivation to acquire increased to 25%, up from 14% before the pandemic.

Business Acquisitions: A Strategy That Drives Growth

— — — —

Bloom Equity Partners writes about the importance of proper tech due diligence in SaaS M&A transactions. If you need help, DueDilio got you covered.

In this week’s newsletter, we wanted to share some insights on the due diligence process, and highlight some key risks that buyers should look out for during tech due diligence. Depending on the complexity of the software co that you are buying, seeking a 3rd party for tech DD can minimize the potential risks.

Tech Risks in SaaS M&A Transactions

— — — —

WaPo reports on how small stores are struggling with the supply chain much more than the big box retailers, which can charter their own ships and pay up for logistics and merchandise.

Small retailers and manufacturers, already crushed by large national brands during the pandemic, are being disproportionately walloped by delays, shortages and other supply chain disruptions ahead of the holidays. In many cases, they’re losing out to giants like Walmart and Amazon, which are spending millions to charter their own ships and planes to move merchandise. Independent shop owners, who have no such recourse, say they’re often the last in line for products because manufacturers prioritize larger, more lucrative contracts.

In the supply chain battle of 2021, small businesses are losing out to Walmart and Amazon

— — — —

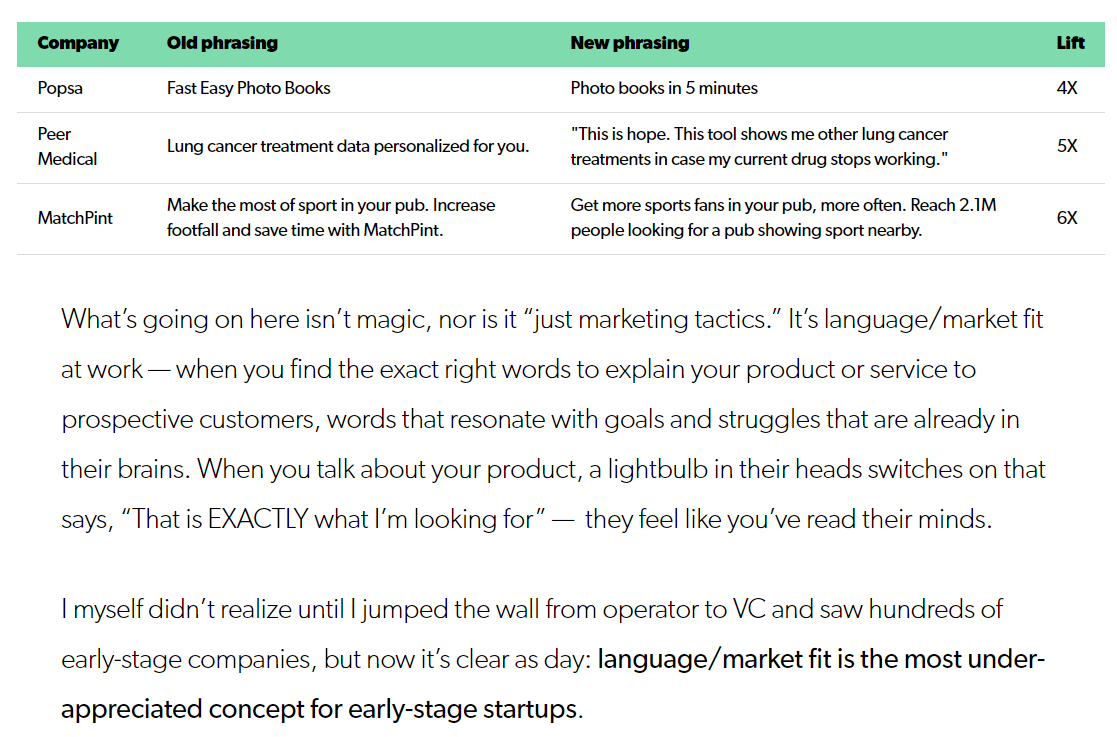

First Round Capital writes about finding language/market fit to accelerate your business growth and conversion rate. Really interesting read that applies not just to startups but any type of business.

Finding Language/Market Fit: How to Make Customers Feel Like You’ve Read Their Minds

— — — —

🧵 Twitter

Interesting thread on a situation I hear about often. What happens when a seller wants to keep existing cash for themselves at close…

Great insight into the operations of a vertically integrated cannabis company…

Some good tips and resources in this one…

Dream come true…

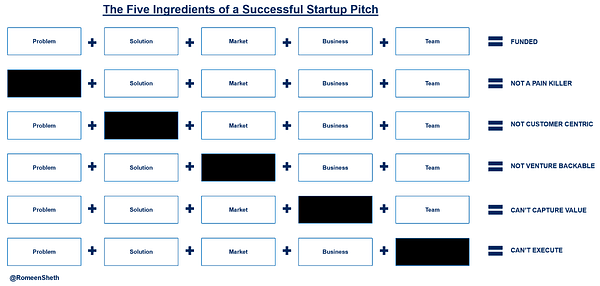

Pitching a startup for fundraising or your business to lenders/investors, there are some common ingredients…

If you read this newsletter in the future and it sounds like it’s written by a robot, here’s how…

🤔 Thoughts & Commentary

MicroAcquire pricing

Last week MicroAcquire announced that they are raising their Premium Buyer pricing from $290 to $390 starting December 1st. Existing subscriptions will be grandfathered in at the lower price indefinitely. If you’ve been thinking of signing up, now’s the time to do it.

— — — —

Boston Happy Hour

Join me and a few other Boston-based folks in the SMB, acquisition, and entrepreneurship space for happy hour on Thursday, December 2nd. Details here: https://www.eventbrite.com/e/boston-small-biz-meetup-tickets-211468296367

— — — —

Deal Flow Scout

Just a quick reminder to check out Deal Flow Scout. It’s a website I launched to help you build your own deal scout network and facilitate open sharing of deal flow.

🛠 Tools & Resources

These are tools & resources that I personally use or have used. They may contain affiliate links so I’ll get a few pesos if you sign-up.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount.

BizNexus - Proprietary deal flow, deal aggregator, and business exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - peer-to-peer deal flow exchange. Free, open, transparent.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.