What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

If you haven’t voted already, which newsletter is more interesting and relevant for you?

This issue of The Business Inquirer is brought to you by DueDilio.

DueDilio is an expert network focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with quality, pre-vetted due diligence service providers.

Our deep network of independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, and other areas of business diligence.

Submit your project. Review qualified proposals. Hire diligence provider.

📰 Articles

GP Bullhound released their 1Q 2022 global sector updates:

Jonathan Cantwell, Partner & Head of Software at GP Bullhound, said: “In Q1, we saw a variety of factors at macro and micro levels impacting the SaaS market. IPO activity was down significantly, as economic conditions and geopolitical tensions tremble the market. The closed IPO door has resulted in more M&A processes embarking and deal activity by strategics and PE funds. Private financings remain stable across all regions, although check sizes are moderate and deal processes have taken longer to complete. Furthermore, many businesses and government entities carried out security assessments via software to identify ways of improving detection and mitigation of future vulnerabilities across the internet, following several security breaches.”

Simon Nicholls and Greg Smith, Partners at GP Bullhound, commented: “In Q1 2022, we saw creative automation technology to be a key driver of recent acquisition and investment activity. We are also witnessing strategic M&A within cloud, as enterprises tap into hyperscaling service capabilities. Lastly, headless technology is transforming marketing and commerce.”

Claudio Alvarez, Partner at GP Bullhound, commented: “While fundraising and M&A activities in fintech slowed slightly in Q1 versus the highs of 2021, the market remained very active, not least due to the completion of Block’s acquisition of Afterpay, and a few other large funding rounds. Several trends are driving fintech this quarter – Big Tech is joining challenger banks in disrupting the status quo of legacy banks; corporate card and spend management platforms are attracting unprecedented interest from SMBs, resulting in large investments from growth funds; and a new race to replicate the model of WeChat and Alipay to become 'the SuperApp of the West' is now on."

Alec Dafferner, Partner at GP Bullhound, said: “In Q1 we have seen large media companies rival Big Tech, as they reach scale and leverage their significant audiences. In the gaming industry, Q1 proved impressive, with three major acquisitions already thwarting the total value of 2021’s western gaming deals. In the music industry, Web3 strategies show potential to close profit gaps. Lastly, news publishers need new strategies to maintain readerships, as non-news content attracts more and more traffic.”

Alessandro Casartelli, Executive Director at GP Bullhound, said: “In Q1 we saw ongoing investment in green infrastructure, as commuter transport preferences shifted post-pandemic. The NFT market, which grew rapidly, experienced a pull-back in Q1, and barriers to entry in e-commerce are being knocked down as it takes over traditional retail. M&A activity tailed off after a record-breaking 2021, as with most other sectors.”

— — — — — —

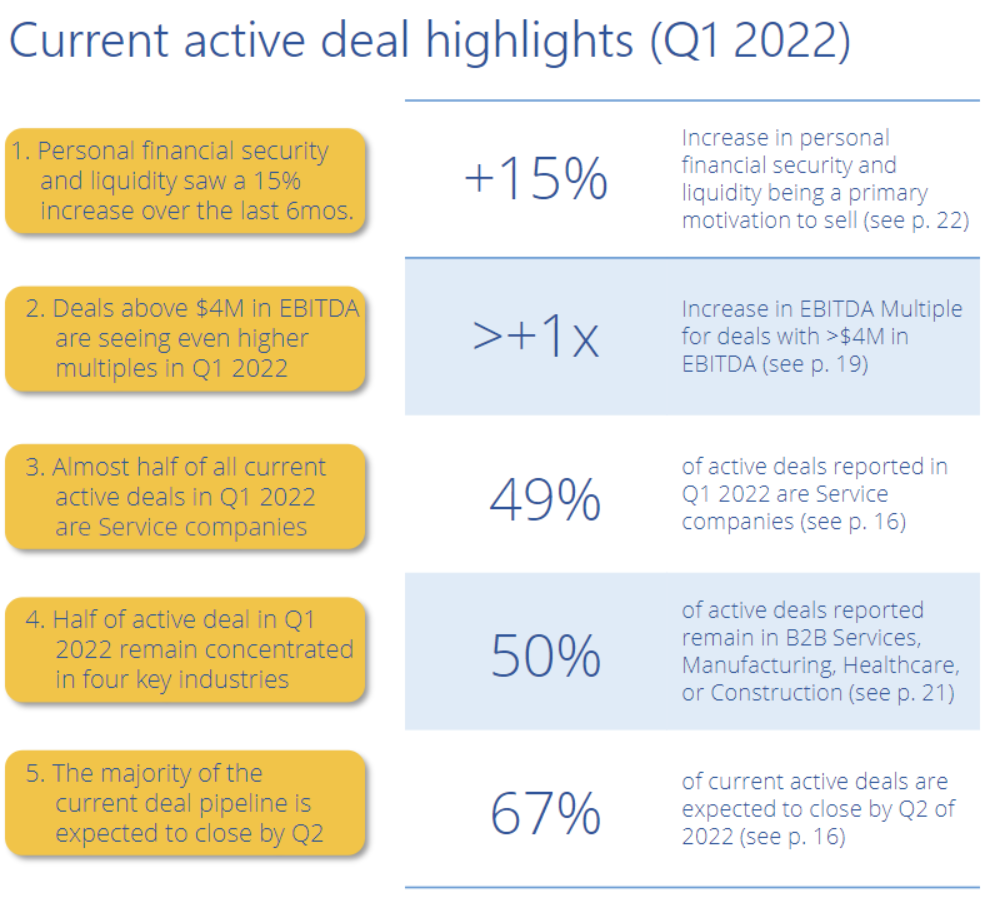

Alliance of Merger & Acquisitions Advisors released their 1Q 2022 market report.

— — — — — —

Starter Story has an interview with the founder of SureSwift Capital about buying their first company…then buying 40 more. Great read.

At the most basic level, our business model is “buy, grow, and hold.” Some of the names in our portfolio you might recognize are Docparser, Mailparser, Back in Stock (we own several Shopify apps), and MeetEdgar.

We’ve completed 40+ acquisitions since I launched the company with financial partners in 2015. That sounds like a lot now, but it started with just me and my partners — we bought one business, then we bought another. I hired a few contractors to help. It all grew from there.

Instead Of Starting A Company I Bought One. Then I Got Hooked & Bought 40 More

🧵 Twitter

Some great advice for first-time business buyers…

How to poach employees…

This is a great entrepreneur story…

Excited to see this new launch. Like Y Combinator but for acquisition entrepreneurs…

This is pure gold. Some things to watch out for in due diligence…

Not a topic I’ve seen discussed previously. How you allocate the purchase price matters…

Being #2 is arguably the better risk/reward than being the #1…

🤔 Thoughts, Events, Other

Sneaky Due Diligence Items

Inspired by the Tweet above, I surveyed the financial due diligence service providers in the DueDilio network to see what are some “sneaky” ways that they have seen business sellers inflate their financials or business performance.

Here are just a few of the responses:

Imagine a construction company that negotiated a fixed fee contract for work that will be delivered over 3 months. The contract starts on December 1st and the fiscal year ends on December 31st. One way to recognize the revenue for the month of December is to take 1/3 of the total contract amount. But maybe only 10% of the work is done in the first month (eg. pre-work study, ordering materials etc) and 90% of the work and costs will be done over Jan and Feb, so only 10% of revenue should be recognized in Dec.

In the context of a sale, the Seller will have all interests to recognize 1/3 of the revenue to increase valuation and let the buyer assume the costs of delivering 90% of the project post-transaction.

Adding back dividend distributions to SDE/EBITDA is a common way to inflate earnings incorrectly that we have to correct when it comes to sale processes / financial DD. Also, I've seen sellers commonly add back true business expenses like marketing spend on testing online ad keywords (as "one-time R&D").

Paying employees "off the books" partially or in some cases entirely- therefore understating not only payroll but also payroll taxes and worker’s comp insurance costs. We had a buyer discover this with a moving company they were looking at buying where nearly 50% of the true labor cost was hidden via cash payments off the books vs the true cost that should have been recorded. It was discovered by reviewing the posted work schedule and customer counts with the official payroll and noticing that there was a big discrepancy between the amount of work done and the payroll being paid out. It was a six-figure difference!

Boosting revenue/cash via transfers from owners/family members into the bank account and then edits to the pdf bank statements. We generally catch these, notably when we recognize the text is different in the edited PDFs and when we do suspect something having the owner or accountant show pull the statements from the bank via screenshare or in person they generally fess up.

Violating of matching, meaning including all revenue near the end and into the next fiscal year and pushing back to current and then pushing all similar expenses to the next period. Easy catch when we do our revenue sample.

Fraudulent contracts, meaning completely falsifying revenue. We catch these quick when we look at DSO and AR agings.

Interco cost agreements that push costs to other owned entities. We generally catch these in carve-outs, not necessarily fraud but costs don't translate on an arms-length basis leading to a large pro forma COGS/COR adjustment.

🛠 Tools & Resources

These are tools & resources that I personally use or have used. They may contain affiliate links so I’ll get a few pesos if you sign-up.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.