What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

This issue of The Business Inquirer is brought to you by DueDilio.

DueDilio is a due diligence concierge connecting business buyers and private investors with quality, pre-vetted due diligence service providers.

Our deep network of 150+ independent professionals, boutique and mid-size firms, and subject-matter-experts enable us to address finance, technology, legal, operations, marketing, and other diligence projects.

Submit your project. Review qualified proposals. Hire diligence provider.

📰 Articles

GP Bullhound released its 4Q21 sector updates where they discuss the latest trends.

GP Bullhound today publishes its latest quarterly market reports. Read all about the CEOs and the key trends we see in the Software, Digital Services, Fintech, Digital Media and Digital Commerce sectors, as well as an update on Asian tech investments.

Key market insights into Software, Digital Services, Fintech, Digital Media and Digital Commerce

— — — —

Middle Market Growth highlighted a section of their 2022 Guide to Dealmaking that is focused on supply chain disruption. It’s a look at the impact and the solutions that companies are implementing to combat supply chain issues.

For today’s businesses, evaluating and identifying risks at every point in the supply chain is key to addressing issues and making processes more resilient for the future. Depending only on one geographic region (or factory or supplier) for raw materials or inventory can be disastrous in the case of a crisis or shutdown in that area, as countless companies have learned over the past year or two. As a result, many middle-market companies are looking to move suppliers closer to home and also increase the number of suppliers so there is a backup if needed.

Supply Chain Strain Hits the Middle Market

— — — —

Lenny Rachitsky writes about the lessons he’s learned since getting into the angel investing game five years ago (140 investments). The full post is for paying members but there are some good points in the free preview version.

I’ve spent the past week reviewing all of my past investments, and below I’ve laid out my seven biggest surprises about angel investing so far. I’ve also included advice about getting started, a bit about how I evaluate startups, and, as a bonus, I’ve roped in a ton of my favorite angel investors to share their insights throughout.

Lessons from 140+ angel investments

— — — —

Kyle Pyar of OpenView wrote a guide on self-serve onboarding. The idea is to create a frictionless onboarding experience for your customers. Kyle discusses this from a SaaS viewpoint but the concepts are important to keep in mind for any type of business.

The first-day experience is the most critical part of the user journey. And it’s where most products fall flat. It’s on the first day that you have a user’s full attention and you have an extremely narrow window to impress them.

Why should you care?

Drop-off rates after the first day can be surprisingly high. At the average SaaS company 40-60%+ of new users never return to the product on a second day.

If a user does see value on their first day, they’re far more likely to become a paid customer and share your product with others compared to if they don’t.

Improvements to new user activation tend to improve all downstream KPIs: free-to-paid conversion, retention, net expansion, CAC payback, NPS, etc. If you can nail it, you’ll be on the path to a very strong business model.

Your guide to self-serve onboarding

— — — —

Primary VC published takeaways from a survey of 150+ leaders, operators, and investors focused on e-commerce.

We have a robust CMO advisory counsel, a go-to-market counsel that advises our portfolio company boards, and hundreds of brands in our network. As we come to the end of this year and gear up for what is sure to be a wild ride in 2022, we took a step back and launched a survey with over 150 respondents, from smaller Shopify merchants all the way to Fortune 500 retailers.

Ecommerce Trends That Shaped 2021

— — — —

Customer concentration is something I often mention as part of business due diligence. Tanay Jaipuria writes a post on how concentration is not always a negative.

This week I’ll be touching on the idea of concentration risk in fintech and infrastructure B2B / B2B2C companies. We’ve seen many such companies recently go public where they’ve had a glaringly high percent of their revenue come from a few customers, which is usually seen as a big risk.

But sometimes, it’s not as big a risk as it seems, which is what I’ll go deeper into.

Customer Concentration Risk in B2B Tech Companies

— — — —

Searchfunder members have free access to the IBISWorld database. They recently published the top 20 industries viewed by their members. I think it’s a good proxy of the most in-demand industries for SMB acquirers. I think it’s safe to say that #2 is just for curiosity sake (but maybe not).

• Landscaping Services in the US

• Adult & Pornographic Websites

• Home Care Providers in the US

• HVAC Service Franchises

• Business Process Outsourcing Services

• 3D Printer Manufacturing

• 3D Printing & Rapid Prototyping Services

• Third-Party Logistics

• Heating & Air-Conditioning Contractors in the US

• IT Consulting in the US

• Property Management in the US

• Janitorial Services in the US

• Remediation & Environmental Cleanup Services in the US

• E-Commerce & Online Auctions in the US

• In-Home Senior Care Franchises

• Ambulance Services in the US

• Accounting Services in the US

• Packaging & Labeling Services in the US

• Adult Day Care

• Security Alarm Services in the US

IBISWorld: Top 20 US Industries Viewed in 2021 by Searchfunder Members

— — — —

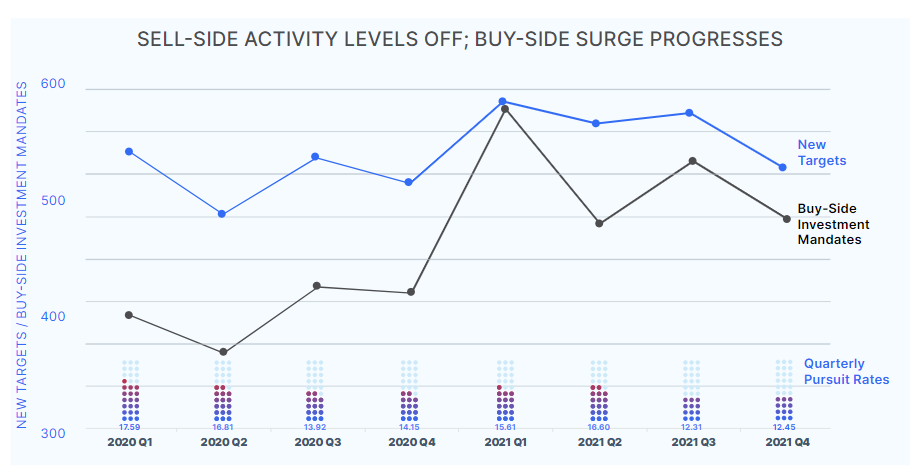

Axial released their latest Lower Middle Market Pursuits report titled “2022 Pipelines Set to Refill”. It’s a great look at deal activity and expectations for 2022.

If traditional M&A data is somewhat static (ie, closed deals aren’t reported until they actually close), Axial data, alternatively, tracks anonymized deal flow from the platform’s thousands of active members as it moves from the very top of the funnel to the bottom. And pursuit rates, which measure buyer intent, are generated as prospective acquirers request more information as deals progress further down the funnel. In addition to sell-side activity, we also track the number of new buy-side investment mandates initiated by prospective acquirers seeking very specific assets, which add further to our support pursuit rate insights.

Lower Middle Market Pursuits: 2022 Deal Pipelines Set to Refill

🧵 Twitter

I’ve shared this one before but it’s still a great thread on the basics of SMB acquisition…

Quick tips on financial due diligence…

Twitter hosts a thriving SMB/ETA community. This thread is an amazing guide to the participants. Must read…

Always best to learn from others’ mistakes rather than your own…

How I think about reverse engineering my goals for DueDilio…

Good thread on Net Working Capital…

🤔 Thoughts, Commentary, Other

Williams Mullen will be hosting a free webinar on tax trends in M&A transactions on Feb 15th.

We are kicking off 2022 with the latest tax considerations for M&A transactions. Click here to join practice chair Larry Parker and tax partner Anna Derewenda as they outline key incentives and tax trends for you to contemplate for your next deal.

M&A Webinar Series: Tax Trends in M&A Transactions

— — — —

Statista & Similarweb are hosting a free webinar on e-commerce trends on Feb 3rd.

Statista and Similarweb have teamed up to bring you actionable eCommerce insights and outlooks for the new year. Join us for the exclusive webinar – State of eCommerce 2022 on Feb. 3, 2022.

We'll cover:

Digital performance, including website traffic, revenue, and market health

The latest changes in consumer preferences

Trend forecasts for the year ahead

The State of E-Commerce in 2022 - Insights from Similarweb and Statista

— — — —

Empire Flippers has 15 job openings in various departments. There are a lot of opportunities if someone wants to work at a brokerage/marketplace.

🛠 Tools & Resources

These are tools & resources that I personally use or have used. They may contain affiliate links so I’ll get a few pesos if you sign-up.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Calendly - Leading scheduling platform to easily schedule meetings without the back and forth. I’ve been using it for several years now. Free 14-day trial.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 30% discount using code “DUEDILIO” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.