The Business Inquirer #016

In this week's issue I highlight an upcoming event for SaaS acquisitions, a request for due diligence providers, an ecommerce business, two SaaS businesses, and What I Learned Last Week.

Every week I highlight interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Join the Facebook Community.

Hello Friends!

In this week’s issue:

Clubhouse Event - SaaS Acquisitions; Today 4pm ET

Due Diligence Providers

eCommerce - CupidBox

SaaS - Remote Employee Onboarding

SaaS - WordPress Plugins & Extensions

What I Learned Last Week

Clubhouse Event - SaaS Acquisitions w/ MicroAcquire

Later today I’ll be moderating a chat on Clubhouse with Andrew Gazdecki of MicroAcquire. We’ll get into his path of starting MicroAcquire, what he’s seeing in the market, some of the acquisitions he’s personally made, tips for SaaS acquirers, and other relevant topics. Join the conversation, ask questions.

When: Today (Feb 16th) at 4pm ET

Where: Clubhouse - Buying Businesses Club

You can access the event on the Clubhouse app.

Due Diligence Providers

There’s too much friction currently to conduct due diligence on a potential micro-acquisition. The PE/VC firms have large tech teams, finance groups, lawyers, and consultants to do due diligence on a potential acquisition/investment. If you’re a micro-acquirer, you probably don’t have the same resources. There should be an easy, frictionless, value priced way to get due diligence help on any acquisition in the $10k - $500k range. I’m compiling a list of due diligence providers and will share it.

The Ask: If you are able to offer basic due diligence services in tech, legal, or finance - please fill out this questionnaire. If you know someone who is able to offer such services, please forward them the questionnaire link. Could be a freelancer, an agency, a company, or an individual - doesn’t matter.

eCommerce - CupidBox (Asking: $13k)

Description

For sale is CupidBox which is a 2-year old Shopify store selling a monthly subscription box. The CupidBox contains everything you need for a date-night. The Shopify store is UK based but can be run from anywhere. This is a full-job business which means you’re responsible for sourcing the contents of the box, putting it together, shipping, sales, customer support, etc.

Details

Sales generated from website as well as being listed on other subscription box directories. eBay store sells obsolete inventory

836 store sessions/month

60 sales/month

Revenue: $1,120/m; Profit: $775/m; Margin: 44%;

Asking: $13,000

Profit Multiple: 1.4x

🤓 Why I’m Highlighting This Business

Broadly, I like this niche and search trends show it’s growing. This particular business isn’t for everyone. The valuation here seems reasonable and I bet you can negotiate it down. I think there are a lot of levers to pull with this business to make it more streamlined.

US Google search trends for “date night ideas”…

UK Google search trends for “date night ideas”…

✅ What I Like:

Great brand name and UK URL

Growing search trends

A lot of levers to pull to improve this business

Valuation seems reasonable

A few competitors in the US to learn from

❌ What I Don’t Like:

You’re buying a job. You’re sourcing products, assembling them, shipping them, etc. You’re not just selling.

Listing isn’t very detailed. Doesn’t discuss marketing spend, e-mail list, suppliers, inventory, acquisition channels, etc.

Could this business be replicated for < asking price?

Store design is horrific. If I was selling burial caskets for couples, this is probably how I would design that store. CupidBox would actually be an amazing name for a couples casket store. 🤣

🚀 How I Would Grow This:

Redesign the whole Shopify store immediately. Make it more colorful, more appealing, more conversion focused. Who thought that a love/date/couples focused store should be dark and gray?

Move away from carrying inventory. Perhaps you can partner with another company who can either be a dropshipper or provide ready-made boxes.

Add a digital component. Perhaps there’s a monthly e-mail or some sort of monthly couples game you can offer to subscribers.

Add product segments. Example: couples who just started dating, couples who have been married <5 years, couples who have been married >10 years, etc.

Partner with influencers who can help promote these products. Plenty of influencers out there who are couples.

Implement an affiliate program to promote your subscription

Implement an affiliate program to advertise other products to purchasers of your subscription box

Expand to US market

You can view the listing on Shopify Exchange Marketplace.

SaaS - Remote Employee Onboarding (Asking: $9k)

Description

For sale is a 9-month old microSaaS which helps companies onboard remote employees. Not a lot of detail in the listing regarding monetization.

Details

120 companies registered on the platform

1,700+ registered users (unclear if employees or hiring managers)

Growing organically at 150-250 new users per month, organically

2,000 organic pageviews per month

Built using Bubble.io

Bootstrapped

TTM Revenue: $840; TTM Profit: $500; Margin: 60%

Asking: $9,000

🤓 Why I’m Highlighting This Business

To state the obvious, remote worker onboarding is important and is in high demand. I think it would be very interesting to niche down in this space. Perhaps focus on onboarding remote VAs, remote writers, remote developers, teachers, startups, etc. Let’s assume all the numbers are verified and true. The organic growth we see here is very impressive. We don’t know the most important metric which is the # of employees that have been onboarded using the software. That’s something that can be discovered in due diligence.

✅ What I Like:

SaaS riding current trend of remote work

Organic growth is impressive

Built using no-code tools. Easy maintenance

120+ companies registered on the platform

❌ What I Don’t Like:

Listing doesn’t provide details on product pricing

240+ onboarding software companies listed on Capterra

No clear advertising playbook

Can be replicated using no-code tools

Valuation isn’t clear cut. You’re paying $75/company

You can view the listing on MicroAcquire.

SaaS - WordPress Plugins (Asking: $1.65M)

Description

For sale is a portfolio of 80+ premium WordPress plugins and extensions. The business was founded in 2013 and generates revenue through product sales & subscriptions.

Details

80+ plugins & extensions for WordPress

65k customers; 4.6/5 rating

2020: 34% revenue growth; 39% profit growth

TTM Revenue: $554,064; TTM Net Income: $342,168; Margin: 62%

Multiple: 4.82x

🤓 Why I’m Highlighting This Business

WordPress continues to be one of the most popular website building and content management platforms in the market. This is a chance to own a large portfolio of add-ins which enhance the platform.

✅ What I Like:

Well established business with operating history

Strong growth in 2020

Large customer base to monetize

❌ What I Don’t Like:

A lot of competition in the space

Unclear churn and ARPU from the listing

Valuation isn’t cheap

You can view the listing on Dealflow Brokerage.

🧐 What I Learned Last Week

eCommerce 3.0

VC firm Lightspeed Venture Partners recently published an article titled “eCommerce 3.0: Defining the Next Generation of Purchasing”. It adds to the narrative that COVID has accelerated the shift to online purchasing away from brick & mortar. In particular, we saw the equivalent of 10 years of growth packed into 3 months.

This acceleration will create multi-billion dollar companies which facilitate the transition.

eCommerce 3.0

Today, we are at the cusp of another fundamental shift in the world of commerce. On the consumer side, the most innovative retailers have realized that they need to deliver a purchasing experience wherever the consumer is — whether that is on a website, mobile app, social feed, text thread, live video shopping, email or in-store. It is not just about incorporating a website or mobile app or building some demo store. The sheer number of channels where a consumer can make a purchasing decision has grown significantly.

—-

As global retail spend is set to reach $6.3T by 2024, there is a massive opportunity for a number of valuable technology companies to emerge that help retailers cross this chasm. eCommerce 3.0 is going to be all about composable commerce.

The Medium article is a good, quick read and can be accessed here.

——

Thrasio continues to raise money

Boston-based Thrasio raised $500m of debt in January and raised another $750M of equity this month. This put’s their total raised at $1.75B with a valuation of “less than $10 billion,” according to their spokesperson. They’re reportedly now adding $1.5M in revenue per day by acquiring ecommerce businesses on the Amazon third party marketplace. I’ve written about Thrasio and their other Boston-based counterpart Perch several times now because I find the business model fascinating and the growth of competing services has been explosive. Over $1B was raised by FBA acquisition companies in 2020 and now one company has raised 75% of that amount in a single deal.

Last week they did an AMA and were asked how they plan on diversifying businesses off of Amazon once they’re acquired. Their answer was pretty interesting. According to the team, they’re focusing on building a process that makes it easy for all of their portfolio companies to spin up a DTC storefront off of the FBA storefront. These Amazon acquirer businesses are interesting because, just like Amazon itself, they have an opportunity to productize their cost centers and make them into new revenue streams:

Offer a full service “DTC in a Box” for eCommerce entrepreneurs.

More generally, “Diversification as a Service” for these same entrepreneurs.

Build a marketplace for physical retailers to shop for new products.

Spin out whatever analytics tools they’re developing.

“Pitchbook” for eCommerce companies?

On the flip side, I’ve seen several Twitter threads comparing Thrasio to Theranos. One of those is from Molson Hart which I’ve linked below.

——

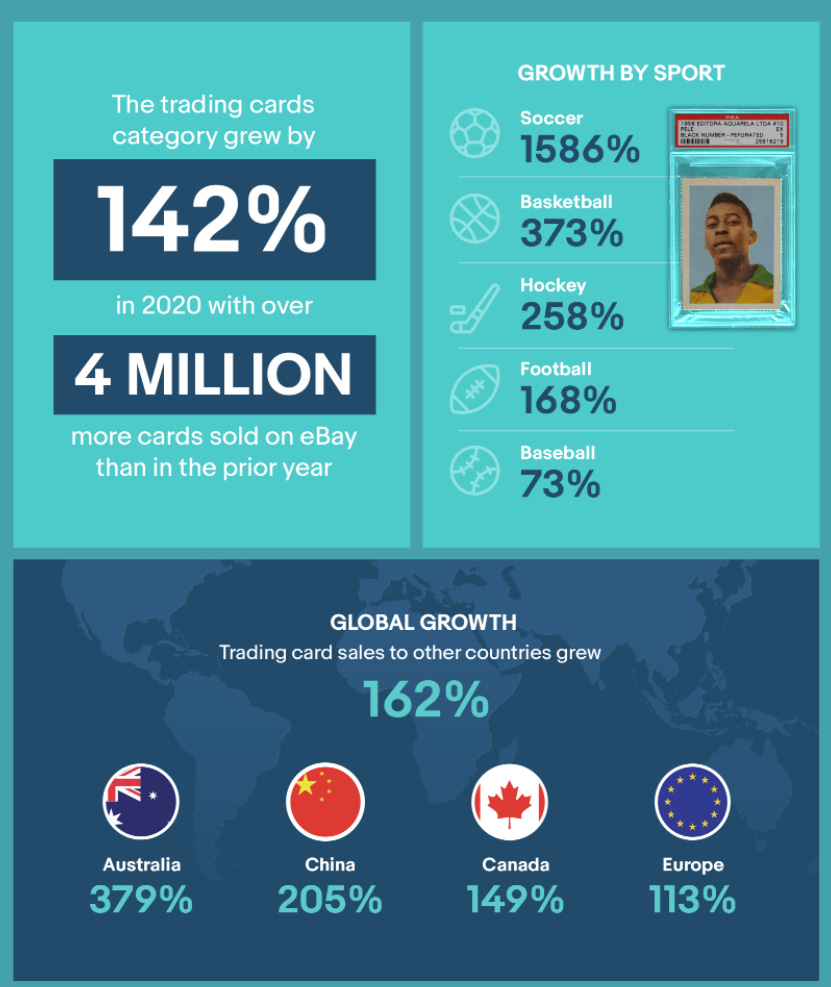

Trading cards are exploding in popularity

eBay released their 2021 “State of Trading Cards” report highlighting trends and predictions. They saw a record 142% domestic growth in trading card sales. Pokemon tops list as most popular trading card category.

Some of their predictions for 2021:

Nontraditional trading cards will continue to grow

Invest in vintage basketball cards

Collect Kobe Bryant cards

Sports memorabilia will come back

Game tickets from past memorable events will appreciate

Lower graded trading cards will increase in value

You can read the full report here.

——

Chamath Palihapitiya - The Major Problems Facing the World

Ismael Diaby publishes the VODCAST newsletter. It’s a unique and interesting newsletter where he curates and highlights a few business-related videos each week. The latest issue was particularly insightful as they provided a summary of a conversation with Chamath Palihapitiya. I’ve copied below some of the more interesting points from the summary but I would encourage you to read the full post.

Chamath’s experience with debt when he was younger and how he thinks about personal finance 💳

Ran a casino in Highschool, 25 cents to a dollar, where he was the house. Made $50-100 a week

Graduated with $30k in student debt. His first boss when he got into derivatives trading, Mike Fisher, offered to pay it off for him after a great year. It changed his life. “All of a sudden I had capital because, at the end of the month, I was not necessarily breaking even.”

“Being poor is a systemic condition in North America. It is a disease that's equivalent to diabetes and heart disease or depression or any other kind of mental illness, except that it's structural and institutionalized”

Insights into investments and strategic framing 📈

“What I didn't realize before is that companies don't exist in a vacuum. I would meet a company, private or public, and I would look at the product and I would meet the CEO, then meet the team, then talk to the customers, and my biggest mistake was thinking about it in a vacuum.”

“How do you underwrite a sector”

Absurdities in the value investing style 🏛️

I consider myself a value investor. I know that sounds crazy to you, but I really do. I think I'm like, "Okay, what will be worth a great deal of money in the future? What is valuable? What is something of great worth?"

Quantifying value isn’t easy -- “Are your kids valuable?”

Fixing healthcare 🏥

“There needs to be a state-sponsored alternative to healthcare. I think it's ludicrous that the richest country in the world doesn't guarantee every single citizen and permanent residents of its country guaranteed healthcare.”

“The most predictable thing in the world has been healthcare inflation over the last 20 years… And I think it's the same in education.

You can read the full summary here.

——

Buying a Shopify app

Jayger McGough publishes the BizBuyGrow newsletter where he talks about business acquisitions. In the latest issue he goes into some detail on the due diligence he performs when looking to acquire a Shopify app. It’s a great case study on what to look for in this space. This framework can actually be applied to any acquisition.

How Jayger performs a SWOT analysis on a Shopify app purchase…

SWOT Analysis ✍️

At this stage I think we have enough information to do a basic SWOT analysis to set the stage for thinking about whether or not this is a good purchase.

Strengths 👍

Paying customers

It is growing organically

Great SEO for certain keywords

It has a competitive pricing strategy that allows for Expansion Revenue!

Weaknesses 👎

Code Quality

It doesn't work with all Shopify themes

Low volume keywords

3.2 star rating

It doesn't rank well in the Shopify Marketplace

Poor reputation for support

Opportunities 💡

Add a paid marketing channel (Current owner has not done this)

Improve the codebase to remove the bugs that are hurting the reviews

Improve ratings by enhancing the product and reaching back out to customers

Expand into other platforms: Woocomerce, Magento, etc

Answer related questions in the Shopify Community to increase organic discovery

Improve documentation to make it easier to add to your Shopify store

Threats ❌

Shopify changes it's API, policies or product to make this app impossible or irrelevant

Two competitors

This could be a feature added to any large carting tool. Many of which exist.

Check out the full “Should Ben Buy This Shopify App?” post on BizBuyGrow.

——

That’s all for this issue of The Business Inquirer!

Help us improve. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group