The Business Inquirer #023

In this issue, I highlight 9 business listings including a Minecraft community, a workspace management platform, along with What I Learned Last Week.

Every week I highlight interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Join the Facebook Community.

Hello Friends!

Last week I asked what type of business you’re looking to purchase. The results are in and SaaS is the big winner…

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 6 listings

🕸 Content - 1 listing

🧐 What I Learned Last Week

🛒 eCommerce

Kitchen Brand - $310k

For sale is a 1.5 year old kitchen brand FBA business which sells 3 SKUs of beautiful table serving pieces.

Run by 1 person

Inventory shipped to Amazon and a 3PL

TTM Revenue: $550k; Profit: $102k; Margin: 19%

Asking: $310k; Multiple: 3.03x

📝 TBI Commentary

Business has run out of inventory on multiple occasions so it needs a cash infusion for stock. Opportunity to launch more products and expand beyond Amazon. Started by a first-time store owner, someone with experience can probably get some easy wins with this business.

You can view the listing on Quiet Light Brokerage.

——

Women’s Closthing & Accessories - $550k

For sale is a 4-year-old Shopify store selling women’s clothing and accessories. The business model is 100% dropshipping focusing on non-binary customers. Owners are cashing out to pursue other opportunities.

Store traffic spread evenly between social and direct.

44% of orders are US, others are international

Revenue +201% Y/Y; SDE +308% Y/Y

TTM Revenue: $1.6M; Profit: $248k; Margin: 16%

Asking: $550k; Multiple: 2.22x

📝 TBI Commentary

I have a preference for businesses that serve a niche market and this one fits the bill. I also like geographic diversification as it offers additional growth levers. The margin seems very low but I assume that’s because there’s heavy advertising spend. Something to look into.

You can view the listing on Quiet Light Brokerage.

☁ SaaS

Content Marketplace - $2M

For sale is an 11-year old content marketplace which connects clients with approved copywriters. Revenue is generated from subscriptions and one-time projects.

Competitors: Textbroker, Writer Access, Verblio

TTM Revenue: $1.2M; Profit: $411k; Margin: 34%

Last month revenue: $110k; Profit: $39k; Margin: 35%

Asking: $2M; Multiple: 4.87x

📝 TBI Commentary

This business requires a growth marketer who can scale it using SEO and other marketing channels.

You can view the listing on MicroAcquire.

——

Stock Screener - $100k

For sale is a 1.5-year-old mobile stock screener which helps you find stocks, build screens, and get stock alerts on your mobile device. Priced at $7/week.

TTM Revenue: $26k; Profit: $21k; Margin: 81%

Last month revenue: $2.2k; Profit: $2.1k; Margin: 95%

Asking: $100k; Multiple: 4.76x

📝 TBI Commentary

This would make a great compliment to someone who already runs an investment newsletter. Otherwise focus should be on increasing conversions and ramping up marketing.

You can view the listing on MicroAcquire.

——

DFY Dropshipping - $150k

For sale is 3-year-old WooDropship which is a productized service that helps ecommerce store owners sell dropshipping products from Alixpress. It also offers a service that builds a dropshipping store for you.

Competitors: Oberlo, AliDropship, Dropified, Spocket

$72k ARR

TTM Revenue: $43k; Profit: $35k; Margin: 81%

Asking: $150k; Multiple: 4.29x

📝 TBI Commentary

Competitive space with some large players. The listing is a bit vague regarding who actually performs the work. There’s clearly a market fit based on revenue. Could be an interesting business to built-upon by offering additional services.

You can view the listing on MicroAcquire.

——

Agency Reporting Tool - $250k

For sale is a 1.5-year-old SaaS that provides automated client reporting for marketing agencies. The software pulls data from multiple sources and compiles a monthly report for each agency client.

Competitors: Ninjacat, Agency Analytics, Google Data Studio

Priced at $49/client/agency

TTM Revenue: $45,128; Profit: $29,455; Margin: 65%

Asking: $250k; Multiple: 8.49x

📝 TBI Commentary

This SaaS requires a marketing push and some additional integrations. Content marketing would work well to target agencies. Valuations for SaaS appear to be creeping higher.

You can view the listing on MicroAcquire.

——

Flexible Workspace Management - $1.5M

For sale or investment is 5-year-old Sana which is a fully integrated flexible workspace management solution. Think software for running WeWork. The product was developed for a co-working space in Australia. The sole customer left the platform once COVID hit. Now the platform is looking for a sale or an investor.

Includes lead capture, CRM, invoicing, admin portal, and client portal.

Total invested is $485k

📝 TBI Commentary

I’m not sure what the $1.5M asking price represents in this listing. You’re basically buying a software solution without any clients. Perhaps this would make sense for someone in an adjacent industry, a REIT, or a co-working space.

You can view the listing on MicroAcquire.

——

Real Estate Marketplace - Open to Offers

For sale is a 1.5-year-old B2B real estate marketplace that competes with Redfin and Offrs. The company was built on research that homeowners would sell their homes if the home selling process was easier and affordable. Therefore, they created a proprietary algorithm to identify homes that were likely to sell before they went on sale.

7 person team

Bootstrapped

TTM Revenue: $115k; Profit: $30k; Margin: 26%

Last month revenue: $49k; Profit: $33k; Margin: 67%

📝 TBI Commentary

Interesting business idea. I think this is more of a data play rather than a marketplace.

You can view the listing on MicroAcquire.

🕸 Content

Minecraft Community - $360k

For sale is one of the top Minecraft communities for online and mobile. Revenue is generated from advertising.

11M Monthly Active Users (MAU) and 30k social follows

TTM Revenue: $122k; Profit: $93k; Margin: 76%

Asking: $360k; Multiple: 3.87x

📝 TBI Commentary

Minecraft is still an immensely popular game that continues to attract users. I’d look into adding additional revenue streams such as in-app purchases and branded merchandise. Someone with experience in community building would be a good buyer for this business.

You can view the listing on AppBusinessBrokers.

🧐 What I Learned Last Week

Clubhouse may have reached its peak

There have been a lot of viral Tweets about the eventual downfall of Clubhouse. I have no clue whether they’re right or wrong. I’ve been using it less but that’s not a sign of anything. I asked my friends at Apptopia to send me some data and here’s what the numbers show…

——

Lessons from a failed acquisition

I haven’t seen too much discussion of failed acquisitions. Failory does a nice job of highlighting business failures but that’s a separate topic. I recently came across Michael Frew and a great blog post he wrote about a failed acquisition. I really wish there were more of this type of content. Michael purchased an e-commerce business that sold plugins for Magento. After a year, he realized the business acquisition was a failure.

Reasons for failure:

Business was framed incorrectly. Michael thought he bought a software company that sold products via e-commerce. In reality, he bought an e-commerce company that sold software.

Market was analyzed incorrectly. Michael did not have the deep technical expertise to operate such a technical business.

Customer was analyzed incorrectly. Michael did not realize that getting people to pay for a Magento plugin was as difficult as it turned out to be.

Prior business success was attributed incorrectly. Michael underestimated how much the owner brought to the business and how difficult it would be to replace him.

This quote should be interesting for anyone thinking of getting into the WordPress plugin space:

Incidentally, this is the one of the reasons some investors shy away from business offerings centered around WordPress. Most people using WordPress are conditioned to believe they can run their website without paying for anything other than hosting. It’s difficult to create WordPress plugins that do well financially, despite WordPress’ market share and success. (At the end of 2020, there were over 54,000 free WordPress plugins. The number of paying WordPress plugins is likely only a small fraction of that total.)

Highly recommend reading the full blog post on his website.

I thought this blog post was good as well: “Online Business Acquisition Costs You Won’t Find In a Broker Prospectus”.

——

Nano funds

TechCrunch has an article about Cendana Capital, an SF-based fund of funds manager that has raised capital to invest in nano funds. Nano funds typically manage less than $15M in capital and write investment checks for <$500k.

The goal is to find the next Lowercase Capital. Not everyone knows this, but Chris Sacca’s first fund was $8 million and it returned 250x. Manu Kumar of K9 Ventures — his first fund was $6.25 million and returned 53x. So you can generate substantial alpha with these smaller funds.

It’s a space to keep an eye on. Social media has made it easier to build an audience, share ideas, raise capital. New tools are making it easier for anyone to start an investment vehicle.

——

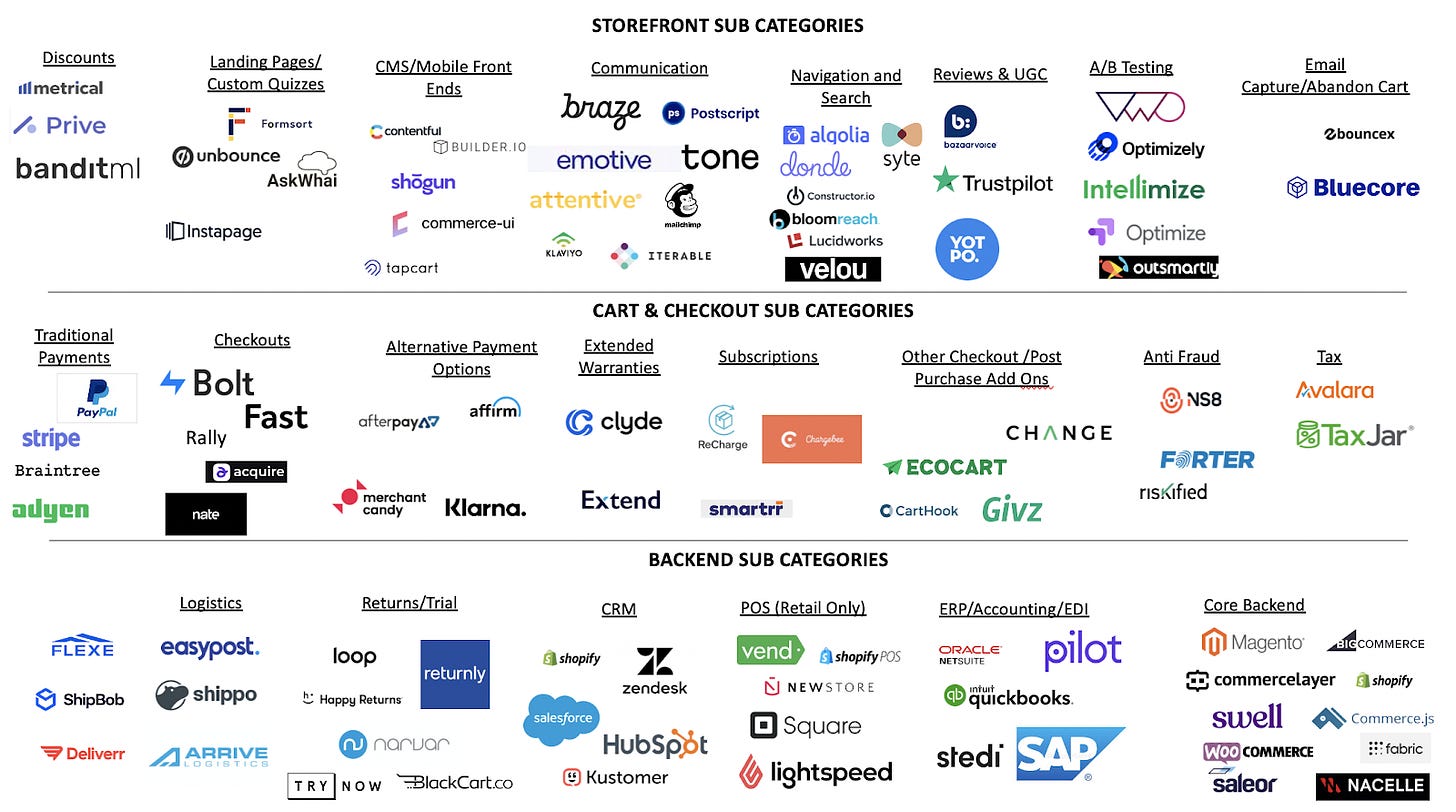

Evolution of the e-commerce tech stack

Great read from Taylor Brandt of Red Sea Ventures about the evolution of the e-commerce tech stack.

——

Due diligence for content businesses

Empire Flippers produces the Opportunity Podcast and the latest episode was with Dom Wells of Onfolio. Dom is an expert at acquiring online businesses across a range of verticals with a focus on niche content.

Dom really understands what the right opportunity in online business looks like. He describes how people commonly get caught up on price or what they think might be growth potential for a business only to miss out on more stable investment opportunities. He describes common pitfalls – like when to know an unmonetized email list is really good or not – and how to avoid them. Dom also explains the growing demand for online business investments and explains why it can be a worthwhile investment for others to pursue.

Great episode to listen to for anyone who’s actively looking to acquire a business.

——

That’s all for this issue of The Business Inquirer!

Help us improve by sharing anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.