The Business Inquirer #025

In this issue I highlight 9 business listings including a top chess brand, an AI copywriting SaaS, a luxury good reseller, and What I Learned Last Week.

Every week I highlight interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Join the Facebook Community.

Hello Friends!

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 5 listings

🕸 Content - 2 listings

🧐 What I Learned Last Week

DueDilio - The world’s first due diligence marketplace connecting business buyers with due diligence experts. Post project. Receive proposals. Hire expert. Simple as that.

🛒 eCommerce

Luxury Goods Resale - $350k + Inv

For sale is a 7-year-old pre-owned luxury goods business that generates revenue from eBay as well as 10 other sales channels. Current owner purchases products for resale in addition to selling via consignment. Authentication is done by an external service.

600-700 SKUs in stock at any given time

50% sales come from handbags

25% Y/Y growth in gross revenue

TTM Revenue: $1.2M; Profit: $234k; Margin: 19%

Asking: $350k; Multiple: 1.49x

📝 TBI Commentary

Pre-owned luxury is an evergreen niche - everyone wants a great deal. This is definitely not a hands-off business or for someone who’s just starting out. A good fit for someone who’s already in this space. Business requires investment in advertising, inventory, and finding sellers. Competing on eBay and with sites like The RealReal is not easy and I think it will be tough to expand margin.

You can view the listing on Quiet Light Brokerage.

——

Chess Products & Software - $1.4M

For sale is a 23-year old e-commerce brand specializing in chess products as well as chess software. Chess sets make up about 60% of sales with chess software generating 30%.

11k e-mail subscribers; 6.3k social media followers

$83.95 AOV

85% of sales from Amazon

TTM Revenue: $901k; Profit: $362k; Margin: 40%

Asking: $1.4M; Multiple: 3.87x

📝 TBI Commentary

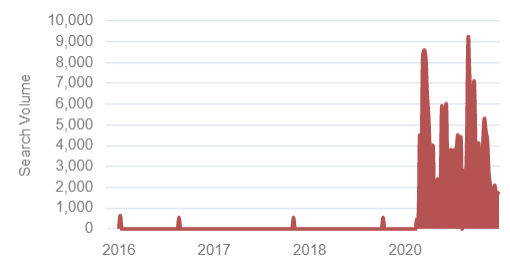

Chess has clearly had a strong uptick in interest due to “The Queens Gambit” show but that interest has also come back down closer to normal levels.

I personally wouldn’t make a bet on the growing popularity of chess. Purely from a business perspective perhaps there’s an opportunity to be the chess supplier to schools and chess clubs. I’d look into expanding to other platforms away from Amazon. This is an opportunity to purchase a well established brand in the chess market.

You can view the listing on Website Closers.

☁ SaaS

Content Writing Platform - $900k

For sale is a 2-year-old outsourced content writing platform specifically for e-commerce stores. Writers author product descriptions, titles, meta descriptions, blog posts, social media posts, and more. Revenue is generated from one-time purchases as well as subscriptions.

500 quality writers on the platform

Writers paid per task, not salary

TTM Revenue: $140k; Profit: $120k; Margin: 86%

Asking: $900k; Multiple: 7.50x

📝 TBI Commentary

This platform is on-trend with deconstructing and niching down popular marketplaces like Fiverr and UpWork.

You can view the listing on MicroAcquire.

——

Shopify SMS App - $500k

For sale is a 2-year-old Shopify app that uses SMS to retrieve abandoned carts, post-purchase upsells, and marketing campaigns.

Competitors: Postscript, SMSBump, Tone, Cartloop

130+ positive reviews

TTM Revenue: $200k; Profit: $50k; Margin: 25%

Last month revenue: $21k; Profit: $4.5k; Margin: 21%

Asking: $500k; Multiple: 9.26x

📝 TBI Commentary

As I’ve previously written, I think SMS is going to become more and more important in the future for e-commerce. This app clearly has traction. I assume there’s something that the sellers see that warrants such a valuation. I’d also want to understand why the margin is so low.

You can view the listing on MicroAcquire.

——

E-Mail List Builder - Open to Offers

For sale is 5-year-old Bookyourdata which is an e-mail list builder for prospecting. Competitors include Zoominfo, Lead411, and more.

AOV of $750

TTM Revenue: $1.59M; Profit: $1.08M; Margin: 68%

Open to Offers

📝 TBI Commentary

Website is very well designed. Competitors are VC backed so competing on PPC may be tough. Partnerships, SEO, direct outreach are best growth levers for this type of business.

You can view the listing on MicroAcquire.

——

3 WordPress Projects - $150k

For sale is a portfolio of 3 WordPress projects listed on Envato with one of the projects listed as Elite Author. Revenue is generated from a one-time purchase and an annual support renewal.

Competitors: WordFence, WP Project Manager Pro, ValvePress

30,000 customers

TTM Revenue: $58k; Profit: $50k; Margin: 86%

Asking: $150k; Multiple: 3.00x

📝 TBI Commentary

WordPress is still the dominant CMS platform. May be a good fit for someone who already has a few WP projects and has capacity to add and grow a few more to their portfolio. I’d want to get more details about the reviews and the ARR component.

You can view this listing on MicroAcquire.

——

AI Copywriter - $25k

For sale is a 1-year-old copywriting SaaS that uses OpenAI’s GPT-3 algorithm.

#4 Product of the Day on Product Hunt (12/31/2020)

Built on Bubble, OpenAI API

Competitors: Copy.ai, CopySmith.ai, Headlime.com

Revenue last month: $353; Profit: $286; Margin: 81%

Asking: $25k; Multiple: 7.28x

📝 TBI Commentary

The AI powered copywriting space is growing quickly. Copy.ai seems to be the winner so far but the space is still new and wide open. There’s plenty of opportunity to niche down. Someone with a strong marketing background is needed for this project.

Search volume for Copy.ai

You can view this listing on MicroAcquire.

🕸 Content

Wine Experience Marketplace - $100k

For sale is a marketplace that facilitates in-person and virtual wine experiences. The marketplace connects consumers with wineries and sommeliers and facilitates the booking of wine experiences, tastings, and more. Revenue is generated as a commission on marketplace transactions.

Built on React, RoR, AWS

TTM Revenue: $20k; Profit: $15k; Margin: 75%

Last month revenue: $3,000; Profit: $2,000; Margin: 67%

Asking: $100k; Multiple: 4.16x

📝 TBI Commentary

Virtual wine tasting is very much a COVID-driven experience…

I think switching the focus to in-person tastings and/or creating a standalone SaaS tool for virtual tastings is the way to move forward with this business. Another avenue would be to build relationships with apartment and office buildings so they can offer this experience as a perk to their tenants. My apartment building did this and it was a big hit.

You can view the listing on MicroAcquire.

——

Vegan Certification Program - $500k

For sale is a 22-year-old certification program in the vegetarian, plant-based products industry. The company makes money from an annual membership fee which brands pay to have their products certified as plant-based.

110 clients

65% of clients are food products, 20% vitamins, 14% skin care, 2% oils

Growth has been entirely organic

97% revenue is recurring

TTM Revenue: $124k; Profit: $104k; Margin: 84%

Asking: $500k; Multiple: 4.81x

📝 TBI Commentary

Interest in plant-based products should continue to grow and this company is well positioned to capitalize. This could be a good lifestyle business for someone interested in this space. There may also be an opportunity to do a roll-up or combine this with a vegan content business.

You can view the listing on Website Closers.

🧐 What I Learned Last Week

——

Etsy now has 10M sellers

Marketplace Pulse published an article with some good statistics on Etsy.

Etsy is adding more than 300,000 new sellers every month, according to Marketplace Pulse research. Over the three years leading up to the pandemic, it was adding roughly 100,000 on average, a number that remained stable since the start of 2017. It started to accelerate in April 2020, and by April 2021, it reached three times the previous figure.

I’m sure this isn’t news to anyone but Etsy has become a very important platform for sellers of all types. I can share just from my personal experience that I listed a few products, did no marketing, and got a few sales. And this is for high price range items.

——

Tech-enabled fulfillment

Michelle Nacouzi is an investor at Northzone VC and does a lot of work analyzing the e-commerce ecosystem. Her latest article on Medium is about the rise of tech-enabled fulfillment solutions. For better or worse, Amazon has raised the bar in terms of fulfillment and delivery timeframes. New solutions are helping SMBs to streamline their supply chains.

E-Commerce Fulfillment: how new tech players are bringing supply chains online

——

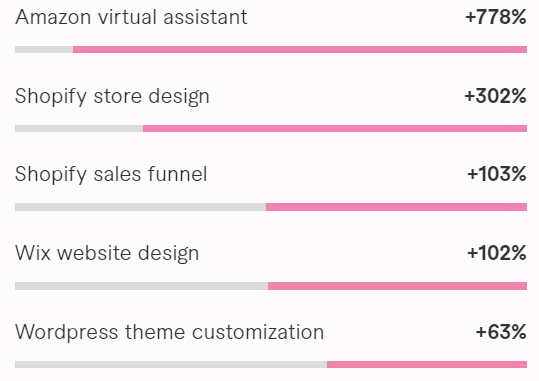

What services are in-demand on Fiverr

Fiverr released their Small Business Needs Index where they analyze search volume on their marketplace to spot trends. I wish the report was more comprehensive but they do highlight trends that have seen significant increases over the last 6-months.

Below are some trends which are most interesting to me because they are perfect candidates for a productized service.

——

WordPress trends

I recently came across WP Trends which is a free monthly newsletter providing WordPress market insights, trends, and acquisition opportunities. It’s a great read.

From what I’ve read so far, Iain puts out some great content. It’s free to sign-up and I’m not affiliated in any way.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.