The Business Inquirer #027

In this issue, I highlight 6 business listings including a body-positive swimwear brand, a WP hosting reseller, a culinary content website, and What I Learned Last Week.

Every week I highlight interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Join the Facebook Community.

Hello Friends!

If you enjoy and/or get value from this newsletter, please share it. We’re close to 500 subscribers now and I’d love to get it over the edge. Share it with your friends, colleagues, syndicate, etc - anyone who would get value from this type of content. Not about quantity but ya know…it helps.

In this week’s issue:

🛒 eCommerce - 3 listings

☁ SaaS - 2 listings

🕸 Content - 1 listing

🧐 What I Learned Last Week

🛒 eCommerce

Body Positive Swimwear - $750k

For sale is Lilly & Lime which is a 5-year-old e-commerce swimwear brand based out of Australia. The brand’s niche is D-cup and plus-sized women.

Main markets are AUS, NZ, US, CAD

30k e-mail subs; 47k IG; 25k FB page fans;

30% of revenue comes from e-mail marketing

11k customers; 38% repeat rate; $193 AOV

14k unique monthly visitors; 134k monthly page views

Avg monthly revenue: $39k; Profit: $11k; Margin: 28%

Asking: $750k; Multiple: 5.68x

✔ What I Like

I like that the swimwear brand targets a very specific niche. I also like that the sellers are the original founders, are passionate about the business, but admit to making business mistakes that are forcing the sale. My read is that they’re an open book and ready to help the new owner with the business. The high AOV and repeat order rate is encouraging. Nice traffic and social media presence. The US is not a top market so there’s an opportunity to grow here.

❓ Concerns & Questions

The business appears to be very seasonal and seeing lower highs…

The business requires a significant $$$ investment for inventory and marketing. It’s certainly not for a first-time owner but for someone who is already in this business and wants to expand. The valuation seems a bit rich for my taste.

You can view the listing on Flippa.

——

Subscription Baby Fashion Product - $180k

For sale is Bek & Jet which is a 2-year-old children’s accessories brand with a focus on bows, headwraps, bibs, and changing mats. There is a monthly subscription component in addition to one-time purchases.

Shopify store

1k monthly subscribers

40k IG followers; 14k e-mail subs

9,771/m unique visitors; 88k/m page views.

Avg monthly revenue: $30k; Profit: $7k; Margin: 23%

Asking: $180k; Multiple: 2.14x

✔ What I Like

Parents are a very engaged niche audience. 1k subscribers is a nice validation that this product is in demand and could grow. I’d actually focus on this part of the business. Website traffic has been very consistent over TTM. Valuation isn’t crazy. The website is well-designed.

❓ Concerns & Questions

The orders are self-fulfilled which is already a deal-breaker for me. With this, the margin is also very low - where’s the leakage? Doesn’t appear there’s been a lot of online marketing put into the business with just 29 referring domains and 129 backlinks. October saw a large drop in net profit, I’d investigate that.

You can view the listing on Flippa.

——

Dropshipping Security Camera - $40k

For sale is a 1-year-old e-commerce brand that sells a compact consumer-grade security camera with multiple unique features.

Shopify store

5,800+ orders in TTM

Dropshipping model

TTM Revenue: $182k; Profit: $32k; Margin: 18%

Asking: $40k; Multiple: 1.25x

✔ What I Like

There’s consistent demand for security cameras…

I like the simple one-product dropshipping model. There are opportunities to add additional products based on search trends…

Valuation seems reasonable if all financials are as-represented.

❓ Concerns & Questions

A friend owns one of the largest consumer security camera online stores and he’s not a guy I’d want to compete against. I also know the headaches he deals with in terms of suppliers and it’s not a fun business. There’s a lot of competition in the space. The 18% margin is minuscule here and I’d want to understand how that’s calculated. The margin my friend sees is at least 2x this so it’s worth investigating. I also prefer to look at businesses which have at least 2-years of operating history.

You can view the listing on MicroAcquire.

☁ SaaS

WordPress Hosting - $150k

For sale is a 6-year-old WordPress hosting company. Each website they host uses a DigitalOcean or Vultr VPS.

Competitors: Flywheel, Kinsta

Tech: Django, Python

TTM ARR: $60k; Profit: $45k; Margin: 75%

Asking: $150k; Multiple: 3.33x

✔ What I Like

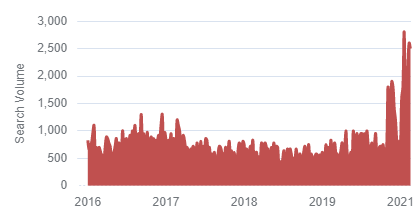

I’m not sure why there’s such a spike in interest in “WordPress Hosting” but this is certainly a positive for this business…

Appears to me like this business simply resells hosting from DigitalOcean & Vultr which would be a very good, asset-light model. There are a lot of opportunities to niche down and provide hosting for a specific type of business.

I also like that the business has been operating for 6-years so there’s some history and lessons learned that the new owner can use. From personal experience, I see a lot of online discussions about hosting providers and which ones are best - there’s no clear winner.

On this topic - I’ve tried a bunch of hosting co’s and Siteground is great. Easy to use, great optimizers built-in, quick support. I think I pay $250/yr. I have no clue if this is cheap or expensive but I don’t care, it works great and it’s worth it. Here’s my referral link if you’re thinking of checking out Siteground. Ping me if you want a more detailed review.

❓ Concerns & Questions

There’s tons of competition in this space with some very big players. Competing on CPC is very expensive…

I’d want to have a clear understanding of how this business has won clients and what strategies they have tried, failed, results, etc. I think churn is also very important as there’s very little friction to switching hosts. If they are just resellers, what do those relationships look like and how vulnerable are the margins?

You can view the listing on MicroAcquire.

——

SEO Services - $10.5M

For sale is a 4-year old B2B/B2C SEO agency with several revenue streams. The business model has one-time services, subscriptions, and an a la carte marketplace. They generate audits, help with recoveries, and primarily focus on the long-term success of each client by providing various SEO solutions.

450 monthly subscription clients paying $798/m

Diverse source of traffic from FB, YT, Google, and direct

Custom SEO audit tool designed specifically for this business

TTM Revenue: $6.8M; Profit: $2.3M; Margin: 34%

Asking: $10.5M; Multiple: 4.57x

✔ What I Like

I’ve always been a fan of SEO service providers as I think it’s a great business model that’s always in demand with a lot of exit opportunities down the line.

Diversified revenue streams are always good and even better if one of them is recurring. There’s still no “go-to” SEO agency which I find strange.

❓ Concerns & Questions

Every SEO agency owner I’ve met burned out at some point. It’s not an easy business. I’d want to understand their churn and traffic sources. What % turn into monthly subscribers? My initial thought was that 34% margin is low but according to Agency Analytics, a typical SEO agency margin is in the 11-20% range.

You can view the listing on Quiet Light Brokerage.

🕸 Content

Culinary Niche - $229k

For sale is a 3.5-year-old WordPress website in the culinary niche featuring recipes and how-to guides on a particular cooking style. The website generates revenue from display ads, affiliate, and Amazon Associates.

Diversified page views. Most traffic is organic.

160k/m page views; 95k/m unique visitors

6.5k e-mail list

Avg monthly revenue: $4,585; Profit: $4,401; Margin: 96%

Asking: $229k; Multiple: 52.05x

✔ What I Like

Evergreen niche. Well aged website which appears to be very well diversified in terms of traffic, page views, and revenue sources. Traffic and revenue are very steady and do not seem to have been impacted by recent Google updates. Relatively easy to hire writers for the niche. Could be an opportunity to negotiate better affiliate deals or sell your own products.

❓ Concerns & Questions

Valuation is higher than average. This website may already be fully optimized without much room for improvement. Always have to check that the display network can be transferred - I don’t think Mediavine can be unless you already have an account.

You can view the listing on Empire Flippers.

🧐 What I Learned Last Week

——

Tips for gaining instant equity

The Hustle hosted a webinar with Joe Valley of Quiet Light Brokerage. It was a very insightful discussion titled Tips for Gaining Instant Equity. Topics covered:

How valuations are really done

What may be missing & why it’s good for the buyer

Deal structures that work today

I saved the presentation which you can access on my Google Drive.

——

Domains are a hot commodity

Escrow.com released its 1Q21 Domain Investment Index report. Basically, things are already better than pre-pandemic levels - if you’re a seller.

——

Amazon Marketplace grew 60%

Amazon reported 1Q21 earnings and their marketplace revenue grew over 60%, the strongest growth in at least five years. I’ve been thinking that Amazon is also a beneficiary of FBA roll-ups like Thrasio as they come in and optimize revenue.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.