The Business Inquirer #028

In this issue, I highlight 10 listings including a B2B expert marketplace, a wedding vendor directory, a LinkedIn prospecting plugin, a digital staging service, and What I Learned Last Week.

Every week I highlight interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Join the Facebook Community.

Hello Friends!

Thank you to everyone who spread the word last week. We’re now over 500 subscribers!

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 2 listings

🕸 Content/Marketplace/Service - 6 listings

🧐 What I Learned Last Week

🛒 eCommerce

Inflatables Dropshipping - $239k

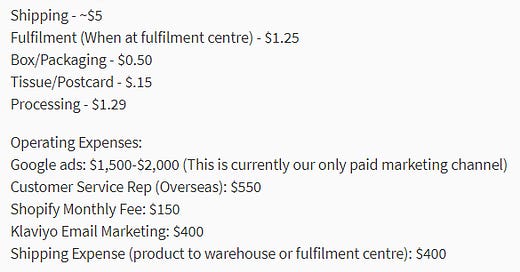

For sale is a 13-year-old dropshipping business that sells large outdoor inflatable sporting equipment in the US market.

+156% increase in TTM SDE

TTM Revenue: $398k; Profit: $92k; Margin: 23%

Asking: $239k; Multiple: 2.60x

✔ What I Like

Well aged business. A simple dropshipping business that doesn’t appear to have a lot of returns. Busy season is just getting started so buyer would capture that revenue. Relatively easy to target the buyers in this niche. Perhaps opportunity to expand to other platforms like Etsy or Amazon.

❓ Questions & Concerns

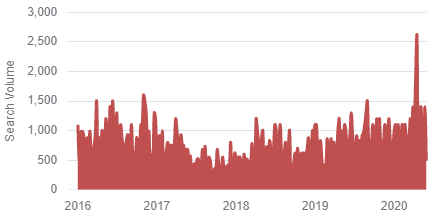

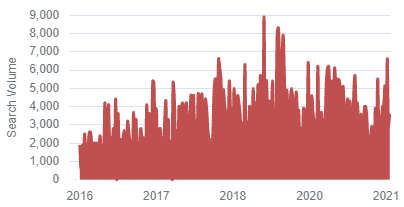

Clearly, this is 1) a seasonal business and 2) inflated by COVID…

I’d want to understand what the normalized numbers look like. Is the seller cashing out at the top? Is there an opportunity to expand to an adjacent product line that is less seasonal? What’s the CAC and what type of marketing has been done?

You can view the listing on Quiet Light Brokerage.

————

Adult Novelty Subscription - $160k

For sale is an 8-year-old store in the adult novelty product niche. The store sells monthly subscriptions as well as one-off items.

Fulfilled in own warehouse but 3PL used in past

$36 AOV; 6,393 TTM orders from 2,937 customers;

5,935/m unique visitors; 29,058 page views; 42% bounce rate;

Avg monthly revenue: $20k; Profit: $9k; Margin: 45%

Asking: $160k; Multiple: 1.48x

✔ What I Like

Well established business that appears to be healthy. Good margins and valuation multiple. The listing is detailed and well laid out. Interesting to see a breakdown of expenses for this type of business…

❓ Questions & Concerns

I don’t like holding inventory but I think this business can be easily transitioned to a 3PL. Are there any advertising restrictions on adult products? Website traffic is steady but page views have been cut in half over the TTM - why? Is there any supplier risk?

You can view the listing on Flippa.

☁ SaaS

Reputation Management - $25K

For sale is a 3-year-old B2B reputation management business. The business provides automated software that monitors review sites, generates new positive reviews, and collects feedback from clients.

Competitors: Birdeye, Podium

TTM Revenue: $3,905; Profit; $3,000; Margin: 77%

Asking: $25k; Multiple: 8.33x

✔ What I Like

This could be a good “starter” business. It’s in an industry where you’ll always see demand…

There are 8,400 monthly searches for their main competitor, Birdeye.

❓ Questions & Concerns

I’d go through reviews of their competitors and see 1) where they fall short, 2) who the clients are. Then I’d look into addressing some of those concerns and then niche down to focus on an industry that the competition is not addressing. This biz requires a solid marketing plan and some $$$ to put to work. I think partnerships, affiliate relationships would work best here as it’s expensive to compete on CPC.

Reviews = social proof. I’d try to figure out a way to reposition this as a B2B “social proof” tool.

You can view the listing on MicroAcquire.

————

LinkedIn Automation - $240k

For sale is a 1-year-old LinkedIn automation Chrome extension that allows users to automate any task on LinkedIn. It’s specially designed to find, reach, and engage with potential customers on LinkedIn.

Competitors: LinkedHelper, Prospectin

SaaS pricing model at $22 - $29/month

TTM Revenue: $85k; Profit: $82k; Margin: 96%

Asking: $240k; Multiple: 2.93x

✔ What I Like

LinkedIn prospecting is something most B2B sales teams have to do - large TAM. Same customer base as those who pay for LinkedIn Sales Navigator…

At a time when we’re seeing valuations explode across the board, it’s nice to see something well priced.

❓ Questions & Concerns

With any business that’s less than 2-years-old, there are a lot of questions. What’s the customer acquisition strategy and how much is the CAC? How are the reviews on the Chrome store compared to the competitors?

You can view this listing on MicroAcquire.

🕸 Content/Marketplace/Service

B2B Expert Marketplace - $3M

For sale is a 9-year-old B2B expert marketplace. Users are able to book 1:1 calls with 42k world-class B2B experts for a consultation. The business generates revenue by taking a commission from each transaction.

Raised $2.7M in funding

TTM Revenue: $855k; Profit: $128k; Margin: 15%

Asking: $3M; Multiple: 23.44x

✔ What I Like

Clearly, I’m a big fan of marketplaces. Just a great business model if you can find PMF and scale. I think there’s a big opportunity in niche expert marketplaces. It’s also a business model with a lot of prior examples to learn from.

❓ Questions & Concerns

I don’t know how to think about this valuation. Love the business, hate the valuation. I know that their investors want an ROI. I’m also concerned about that margin. They must be hemorrhaging money to acquire customers. Lynk, Clarity.fm, Catalant are big competitors. This has to be a bolt-on acquisition to make sense.

You can view the listing on MicroAcquire.

————

B2B AI Services Marketplace - Open to Offers

For sale is a 1-year-old AI talent marketplace where businesses can hire an AI/data science team. This startup won the MIT Hackathon recently. The team has contracts in place but founders are “not about the startup life” so looking for an exit.

Competitors: Turing, Toptal, Experfy

TTM Revenue: $56,500; Profit: $45,000; Margin: 80%

Asking: Open to Offers

✔ What I Like

AI & data science talent is in high demand. No charts are required to demonstrate this. Clearly, the business has found a certain PMF. One of the founders is willing to stay on and work on the business with a salary. This makes it an interesting listing.

❓ Questions & Concerns

This is a startup. Scaling a marketplace is not easy. It’s not a “set it and forget it” business. I’d want to have a clear understanding of how they are sourcing the AI talent and in particular, the vetting process. What’s the customer acquisition strategy that produces the best results? Can you lock in the founder in this business for 18-24 months?

You can view the listing on MicroAcquire.

————

Wedding Directory - $35k (reserve not met)

For sale is a 3-year-old wedding directory website. The website generates revenue from selling subscriptions to wedding industry vendors to be listed in the directory.

260k IG followers; 3.2k FB; 1.5k email subscribers; 20k/m Pinterest views;

810/m unique visitors; 1,749/m page views;

130 annual memberships; 28 monthly memberships;

Avg monthly revenue: $2,082; Profit: $2,018; Margin: 96%

Asking: $35,000 (reserve not met)

✔ What I Like

Straightforward, asset-light business. Drive traffic to the website and collect subscriptions. A lot of opportunities to expand the business by selling advertising or even some branded products. The listing is detailed.

❓ Questions & Concerns

A lot of due diligence is required for this business. Need to understand the opportunities to increase traffic and how the recent Google updates have impacted traffic. COVID of course had a negative effect on the wedding industry. The listing mentions new website and SaaS opportunity - a lot of questions there.

You can view the listing on Flippa.

————-

Pet Telehealth - $5.5M

For sale is a 3-year-old pet telehealth business that connects pet owners with health professionals for the purpose of obtaining Emotional Support Animal (ESA) letters. Revenue is generated from assessments and products.

$106 AOV

75% of revenue are ESA letters; 15% annual renewals; 10% products

3k unique daily visitors; 130 orders/day; 83k clients; 250k e-mail list;

TTM Revenue: $6.2M; Profit: $1.1M; Margin: 18%

Asking: $5.5M; Multiple: 5.00x

✔ What I Like

Love the pet owner niche as they are very engaged and easy to target. There’s clear demand for ESA letters…

The business has a lot of great customer data that can be leveraged and monetized. I like the renewal revenue which I assume has very little churn.

❓ Questions & Concerns

I believe that demand is largely driven by airline regulations. The listing mentions that this business is no longer involved in that part of the business and only focuses on housing. This is something to look into. The profit margin seems a bit low for this type of business. There’s a lot of competition in this space. How is this business differentiated?

You can view the listing on Website Closers.

————

Arms Dealer Directory - $21k

For sale is a 3-year-old membership directory website of Federal arms licensees (FFL Dealers). The dealers use this directory for marketing themselves. Revenue is generated from subscriptions.

600+ paid and free users on the website

LTM Revenue: $9,229; Profit: $7,163; Margin: 78%

Asking: $21k; Multiple: 2.9x

✔ What I Like

The directory business model is attractive. The listing isn’t very detailed so there’s not much more I can say.

❓ Questions & Concerns

I’m always concerned about regulations and restrictions when it comes to arms, vitamins, supplements, and other similar businesses. How does the business generate traffic?

You can view this listing on BuySellEmpire.

————

Real Estate Photo Service - $54k (discount available)

A subscriber and personal acquaintance is selling his 3-year-old real estate graphic design business. VirtuallyRestaged provides virtual staging and virtual renovation photo design to real state agents, brokers, and firms all across the world.

Avg monthly revenue: $3,245; Profit: $1,508; Margin: 47%

Asking $54k but a discount is available for TBI subscribers

You can view the listing on Flippa or just ping me for an intro to the seller.

🧐 What I Learned Last Week

——

Amazon Marketplace could be transformed

Bloomberg published an interesting story about a court case that could reshape the Amazon Marketplace.

Last month, a California appeals court ruled that Amazon can be held liable, even though the seller stored and shipped the device itself. The decision sent shockwaves through the e-commerce world. Though it will probably be appealed again, the ruling raises the possibility that Amazon might have to exert more control over the activity on its own website. “Courts are rejecting the internet exceptionalism idea when it comes to a company like Amazon,” Agnieszka McPeak, a Gonzaga University professor, told Bloomberg Law.

This case isn’t dissimilar to the ones faced by social media platforms. It’s a broader question of whether platforms and marketplaces should be held liable for the content they host or the transactions they facilitate.

——

Quick website due diligence

Flippa published a blog post by Mohit Tater who is a website investor and operator - 7 (Proven) Ways to Quickly Weed Out Bad Sites. The title is self-explanatory. It’s a good read with tips on how to easily spot red flags.

A declining website - traffic, sessions, page views

No comprehensive traffic analysis - no analytics, no sale

Site generates traffic from a handful of keywords - you want diversification here

Buying a site outside of your expertise - “buy what you know” is not just for stock investing

Site that has been hit by latest Google update - too much uncertainty

Direct traffic only - direct can be faked or manipulated. Go after that organic search

No site transition plan - know what has to be in place for a smooth transition

——

Learnings from DueDilio

It’s been a month since I officially launched DueDilio. The goal is to easily connect investors and business buyers with vetted due diligence experts. We now have 70+ experts on the platform and have facilitated over 15 due diligence requests. I want to share just a couple of quick learnings.

Hypothesis was that demand would come from 1) micro-acquisitions (<$1M EV) and 2) for technical due diligence. So far, totally wrong on both fronts.

Biggest demand from searchfunds and middle-market PE shops doing deals in the $5M - $50M range. Financial and specific industry expertise are most requested.

Old-line businesses seeing the most interest. These are contracting companies, healthcare services, franchises, food manufacturing, etc. Haven’t received a single request for a website or e-commerce business.

Searchfunds need a lot of tech help. Productized services could be set up to address this large and growing market. Ping me if you’d like to discuss this.

——

Another FBA acquirer

Acquco was founded in 2020 by two former Amazon employees to acquire third-party sellers. They just raised $160M Series A. I wish I had an Amazon FBA business to sell.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.