The Business Inquirer #033

In this issue, I highlight 7 listings including a video transcription SaaS, an influencer marketing platform, WordPress themes, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 4 listings

🕸 Content/Marketplace/Service - 1 listing

🧐 What I Learned Last Week

🛒 eCommerce

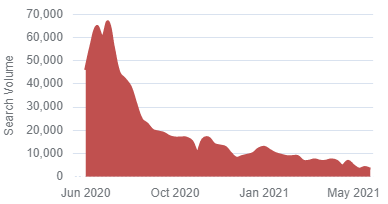

Masks.com - $250k

Still for sale is Masks.com which is a bulk supplier of cloth face masks to B2B and B2C clients. I highlighted this business previously when it was listed for $1.25M. It’s now $250k (negotiable). An interesting business with a leased domain.

L3M Avg Revenue: $69k; Profit: $28k; Margin: 35%

Asking: $250k; Multiple: 0.75x

✔ What I Like

It’s an interesting listing with a lot of detail. Really impressive what the seller was able to do in a short time. I’m not sure I’ve seen a business with a premium leased domain. There’s some asking price where this business becomes interesting but I have no clue what that number is.

❓ Questions & Concerns

Clearly, the mask mania has died down with COVID…

How do you assign a multiple here? Obviously, you can’t use TTM and I’d argue even L3M is optimistic. Really curious to see how much this business sells for at the end.

You can view the listing on Flippa.

————

Industrial Heat Press Dropshipping - Open to Offers

For sale is a 6-year-old Shopify store selling industrial heat presses. The business sells a specific type of industrial printing machine that can be used for home hobbyists and larger businesses, schools, and manufacturers. Items are shipped directly from 5 US manufacturers.

5 US based suppliers

11,536 sessions/month; $1,200 AOV

TTM Revenue: $35k; Profit: $6k; Margin: 17%

Asking: Open to Offers

✔ What I Like

SwiftExits is a new Shopify marketplace that verifies all their listings. Well-aged business with a simple business model. Several US-based suppliers. Seller focused on SEO which has been paying off. Very niche business.

❓ Questions & Concerns

Any customer reviews? Repeat orders? 6-years and $36k annual revenue is not a business that’s growing - why? Can the suppliers go direct to consumers? Are you competing with Amazon? Can paid advertising be implemented profitably? How reliable is the supply chain? What’s been the driver of increased interest in this product category?

You can view the listing on SwiftExits.

☁ SaaS

Video Transcription - Open to Offers

For sale is a 3-year-old transcription SaaS that allows content creators to automatically caption, voiceover, and subtitle their videos to 50+ languages. Sellers founded business out of college and now want to explore other options.

Competitors: Rev

5-person team

TTM Revenue: $176k; No Profit

Asking: Open to Offers

✔ What I Like

There’s clearly demand for this type of service as the creator economy grows. Rev appears to be the only competitor and they’re big. There’s one-time as well as recurring revenue. There’s clear traction and PMF. I suspect that this biz is all about marketing. I feel like this would work great as a bolt-on acquisition for someone who already has access to this market.

❓ Questions & Concerns

I’d want to understand the tech stack and how difficult it is to find support. What type of marketing has been tried and what’s worked? CPC advertising looks very expensive. Are there any marquee creators using this? Any affiliate deals? What’s worked for Rev and can be copied? Can a distribution platform like YouTube simply offer this type of service for free in the future? Are there other markets besides creators that this business would work in? Why are there 5 people for such a small company?

You can view the listing on MicroAcquire.

————

Influencer Marketing - $31k

For sale is 1.5-year-old Collaber which is an influencer marketing platform. Brands offer their products to influencers for free in the form of giveaways in exchange for exposure. It’s a unique matching service. Seller just had a baby and doesn’t have time to focus on this business.

Competitors: Obviously, Upfluence

Custom built website & platform

TTM Revenue: $2,227; Profit: $1,546; Margin: 69%

Asking: $31k; Multiple: 20.05x

✔ What I Like

Seller was in this industry, saw an opportunity, started a business, had a baby, no time to focus on this, decided to sell. Maybe I’m gullible but the listing makes sense to me. I like businesses that are started by identifying a clear need in the market. There’s some very minimal traction. The website looks great. I can understand how this type of product would be attractive to brands and influencers. I think the seller would be open to a partnership here instead of just a sale.

❓ Questions & Concerns

You’re buying a project, not a business. I’d want to understand the asking price and how it was calculated. Have the seller walk you through the customer persona from both sides. Has a marketing plan been developed? What type of team do you need to have in place to grow this business? How’s the tech stack?

You can view the listing on MicroAcquire.

————

Team Building Trivia - $1.6M

For sale is a 3.5-year-old high-growth SaaS in the team-building space with weekly trivia quizzes. The product makes the work week more fun with weekly trivia contests that the whole office can participate in.

Competitors: Quizbreaker, GameMonk, Donut

Consistent 5-15% M/M growth

Notable clients: Google, Bain, Amazon

20k paid end-users; 800 paid companies

TTM Revenue: $225k; Profit: $130k; Margin: 58%

Asking: $1.6M; Multiple: 12.31x (NTM Est: 7.27x)

✔ What I Like

Clear traction and PMF. No customer represents more than ~1% of MRR. The beneficiary of remote work environment and trends. Simple tech stack (C#, .NET, Java). Pending trademarks and copyrights.

❓ Questions & Concerns

How are customers acquired? Listing says the seller works <10 hrs a week on this biz. I’m always curious about such statements. What’s the differentiator from competitors? How’s the churn?

You can view the listing on MicroAcquire.

————

Live Event Ticketing - $1.25M

For sale is a 1-year-old online ticketing SaaS that specializes in K-12 ticketing. Product is free but business makes money from adding fees to ticket purchases.

Competitors: Ticket Spicket, Hometown Ticketing, School Event Tickets

Includes servers, websites, mobile apps for selling and scanning tickets.

TTM GMV: $2.05M; Profit: $250k;

Asking: $1.25M; Multiple: 5.00x

✔ What I Like

A lot of questions here but if all the numbers are verified, then the speed at which the seller was able to scale this business is very impressive. This is a marketplace business model which I love. I’d think there would be high switching costs so churn should be low.

❓ Questions & Concerns

How does a live event ticket business founded in July 2020 with COVID lockdowns go from $0 to $2.05M in transaction volume? A lot of questions here.

You can view this listing on MicroAcquire. There’s another live ticket marketplace for sale on MicroAcquire as well w/ $446k in TTM revenue.

🕸 Content/Marketplace/Service

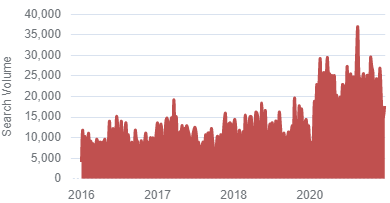

11 WordPress Themes - $569k

For sale is a 5-year-old brand selling 11 award-winning WordPress themes.

5-Star rating on ThemeForest; Multiple Envato awards.

4.6k purchases over LTM; $46 AOV

TTM Revenue: $254k; Profit: $161k; Margin: 63%

Asking: $569k; Multiple: 3.53x

✔ What I Like

WordPress continues to be the most popular CMS. The awards and ratings provide a competitive moat. Nice margins. Could be an opportunity to add some recurring revenue component. Healthy business for someone who is already in this space.

❓ Questions & Concerns

You’re locked into the ThemeForest marketplace that takes 30-64% commission on each sale. I think these are one-time purchases with no recurring revenue. Not sure what type of technical upkeep is required. There’s a steady decline in people searching for WordPress themes…

You can view the listing on FE International.

🧐 What I Learned Last Week

——

Lower middle-market deal sourcing

PrivSource is an M&A membership site focused on private lower middle-market deals. They have private deal flow but the majority comes from their relationships with hundreds of sellside groups and brokers. You can think of them as a deal aggregator for businesses doing $500 - $20M in EBITDA. I’ve been poking around their platform and I’m a fan. Unless you’re able to personally keep track of 200+ broker websites, PrivSource is a good solution for deal flow. It’s especially valuable if you’re looking for a “Main St.” business - not the stuff you see on Flippa, EF, MicroAcquire, etc.

Full disclosure - I have an affiliate relationship with PrivSource and I’ll get a few shekels if you sign-up.

——

Opportunities in SMS

I had the pleasure of connecting with a subscriber last week - Jason G. Jason recently launched SMSchool to help businesses engage with their audience over SMS. I’ve written many times that SMS is an overlooked channel that will only become more popular. Jason’s project is on-trend here. SMSchool is new and Jason’s currently working with early adopters. He’s looking to connect with more people to discuss the benefits of SMS engagement. If you’re interested in adding SMS as an engagement & conversion channel to your business, let me know and I’ll put you in touch with Jason. Of course, feel free to reach out to him through his website as well.

On the same topic, I found these SMS marketing statistics to be interesting (especially the CTR comp):

——

Chrome webstore report

Marketplace Apps published a deep dive into the Chrome Webstore. The Chrome web browser captures 63% of the global market and presents a great opportunity for investors and acquirers.

General stats

There are 129,509 extensions in the Chrome Webstore, produced by 83,040 developers across 11 categories.

There have been a total of 7,295,278 reviews left with an average rating of 4.38.

The average number of reviews per extension is 99.8 and the median is 3.

There are a total of 1,003,376,445 users (1bn) that are using Chrome extensions.

The average number of users per extension is 8,470 and the median is 33.

The top 26 extensions (0.02% of all extensions) account for 25% of the user base. And the top 517 extensions (0.40% of all extensions) account for 75% of the Chrome user base. Signifying the concentration of the Chrome webstore.

Of the extensions that are offered 5,922 are paid (4.57%) and 123,587 are free (95.43%).

Check out the full report here.

——

Deal follow along

I find a lot of value in reading content by deal makers, entrepreneurs, and operators as they give a glimpse into their process. I recently came across the Big Deal Small Business newsletter. It’s written by a middle-market PE professional who’s looking to acquire and operate a business. Through the newsletter, you get to follow along their journey. There are a lot of great insights here from finding and analyzing a deal to structuring the transaction and operating the business. It’s a free Substack newsletter like this one. Would recommend checking it out.

——

Flippa news

There have been a few interesting announcements from Flippa recently. First, Flippa has partnered with Yardline to help business buyers access capital for acquisition or growth. Second, they’ve partnered with ContractsCounsel to launch Flippa Legal. Great move here. Through Flippa Legal you can purchase legal document templates ($99) and/or hire an attorney to help you on your next acquisition. Templates are $99 and attorneys can be hired with package pricing ranging from $1k - $2,200. That package pricing isn’t bad. I think I paid an attorney around $800 for an APA.

——

Amazon CPC is increasing

Great analysis from Marketplace Pulse about the rising costs of advertising on Amazon.

Advertising on Amazon now costs, on average, $1.20 per click. Up 30% from $0.93 at the start of the year and up over 50% year-over-year. Demand for advertising on Amazon is rising faster than the ad inventory on and off Amazon, thus driving up advertising prices.

A lot of implications here. Keep this in mind when analyzing the P&L of an Amazon business as past advertising costs may not be reflective of today/tomorrow.

——

EXITPreneur’s Playbook

Joe Valley of Quiet Light Brokerage recently published EXITPreneur’s Playbook. I haven’t read it yet but no doubt it’s a great read. Joe shared the intro and three free chapters from the book.

Chapter 3 - Valuation Overview

Chapter 11 - Identify All Your Add-Backs

Chapter 15 - Structuring the Deal

——

That’s all for this issue of The Business Inquirer!

Help me improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.