The Business Inquirer #037

In this issue, I highlight four listings including two niche e-commerce stores, on-demand printing, a conference management SaaS, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

Due to the US holiday, there weren’t as many new business listings to review and not many caught my eye.

Quick poll…

If you’re actively searching to acquire a business, what type are you focusing on?

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 1 listing

🕸 Content/Marketplace/Service - 1 listing

🧐 What I Learned Last Week

🛒 eCommerce

Spiritual Jewelry Dropshipping - $299k

For sale is a 3-year-old e-commerce business selling spirituality-inspired jewelry, apparel, footwear, and more.

700 niche SKUs; 12% repeat orders; 16x ROAS; $31.81 AOV;

7 remote employees;

TTM Revenue: $885k; Profit: $120k; Margin: 14%

Asking: $299k; Multiple: 2.49x

✔ What I Like

Religion, politics, and pets sell. Most engaged users, highest-spending, easy(ish) to target with ads…all the stuff you want in your target market for an e-commerce store. What I want to point out in this listing is that dropshipping models work. They get a bad reputation but if done right, it’s a nice business model. As I mentioned in the last issue if you want to learn online business basics, start or acquire a dropshipping business.

❓ Questions & Concerns

With the new iOS update and continued privacy concerns, it’s just getting more and more expensive to acquire customers online. I suspect we’ll see a lot more e-commerce stores come on the market because of this. Your due diligence will be important here. Just because their CAC was $2.50 last year doesn’t mean it’s not $7 today or $15 tomorrow. That 16x ROAS is probably not something you’d see if you buy this listing. The 14% margin leaves no room for CAC costs to go up. I’d also inquire about the reliability of their suppliers, any product concentration, competition, and source of customer acquisition.

You can view the listing on WebsiteClosers.

————

Patriotic Apparel - $8M

For sale is a 5-year-old brand that sells patriotic clothing such as t-shirts, shorts, hats, hoodies, and more.

300+ SKUs; All products shipped from USA;

55% of sales from FBA, rest on Shopify website; $35-$64 AOV; 28% repeat orders;

300k followers on FB; 233k on IG;

TTM Revenue: $6.9M; Profit: $2.2M; Margin: 32%

Asking: $8M; Multiple: 3.64x

✔ What I Like

There’s a lot to like about this business. Like the listing above, it’s targeting a very engaged patriotic audience. A lot has been automated with the owner spending just an hour or two a day on the business. Sales come direct and from Amazon. Opportunity to expand to Walmart, Etsy, and other platforms. They even launched a monthly t-shirt subscription that seems to be off to a great start. A huge customer base means that you can remarket to them with new products (jewelry, etc). I like the detail in this listing. I run a patriotic jewelry business and this listing is interesting.

❓ Questions & Concerns

A business like this is all about customer acquisition and COGS. You really want to understand how they’re acquiring the customers and if it’s sustainable. Having the products made in the USA removes some logistical challenges but you still want to dig into those supplier relationships.

You can view this listing on WebsiteClosers.

☁ SaaS

Conference Management - $3M

For sale is a 5-year-old conference registration and attendee management platform. The business allows conference organizers to easily plan, execute, and analyze their events. This is priced to be a strategic acquisition.

Competitors: Cvent, Aventri, Swoogo

6-person startup team; $130k in funding

Last month revenue: $30k; Profit: $21k;

TTM Revenue: $305k; Profit: $96k; Margin: 31%

Asking: $3M; Multiple: 31.25x

✔ What I Like

Clearly, this is positioned for strategic acquisition and not an individual buyer. The sellers built a nice SaaS with PMF that got through the pandemic. They need investment to figure out how to scale.

❓ Questions & Concerns

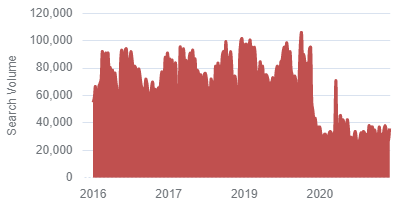

Conference management software is not new and there’s tons of competition. What edge do these founders have? Is this a more modern solution? Not clear the type of company that would be a strategic acquirer. Judging by search interest, conference activity is still very depressed…

You can view the listing on MicroAcquire.

🕸 Content/Marketplace/Service

Int’l On-Demand Printing - $325k

For sale is a 13-year-old on-demand printing service for books, magazines, catalogs, and other products.

B2B clients; $3,500 AOV; 50% repeat orders;

Owner operated with 2 sales assistants

TTM Revenue: $521k; Profit: $72k; Margin: 14%

Asking: $325k; Multiple: 4.51x

✔ What I Like

The listing is missing some key details. My understanding is that this business acts as a middle-man between global clients and China-based printing services. They have an automated system in place to be able to provide a fast, accurate price quote. It’s basically a dropshipping model but for B2B printing. I like that the business is well-aged with a high % of repeat orders. It costs $0 to acquire those repeat clients.

❓ Questions & Concerns

My interpretation of the listing could be totally off. No one can write so much, yet say so little in their listings as WebsiteClosers (SellerForce is a very close 2nd). I’d want to really understand who does the actual printing and shipping. The 14% margin is very small and doesn’t leave room to invest in marketing. What is eating into that margin and how is it calculated? Having a high repeat order rate has its pros and cons. Yes, it’s a stable customer base that you’re not paying to acquire but it’s also high risk if some of those repeat orders stop. Really interesting business but a lot of questions.

You can view the listing on WebsiteClosers.

🧐 What I Learned Last Week

——

Lunch with BizNexus

Last week I had lunch with Adam Ray, founder of BizNexus. I don’t get to meet too many people in the EtA space in Boston so I was looking forward to this one. Turned into a great meeting with a fellow entrepreneur. We have quite a few things in common. There are synergies between BizNexus, DueDilio, and TBI.

Adam founded BizNexus as a transaction advisory firm and has expanded from there. They built an impressive deal aggregator for middle-market deals (7k+) along with a white-glove concierge service where they’ll help you source your next acquisition. For sellers, they have ExitPrep that will match you with the best deal team for your situation/transaction. Their daily newsletter is helpful.

——

Technology M&A: 2021 Mid-Year Review

FE International released its 2021 mid-year review. I’m not sure there are any surprising takes here. As you’d expect, valuations and deal volumes are 🚀

——

DueDilio is growing

DueDilio is the due diligence marketplace I launched a few months back. The idea is to connect business buyers with vetted due diligence experts. So whether you need help with a $100k acquisition or a $150M transaction, we’ve got experts who can help. We typically see 1 to 3 due diligence requests per week. Since last week it’s been two or three a day. It’s not magic. I know many of you have shared DueDilio on social media, through word of mouth, and in online communities. Thank you!

——

Pricing matters

NFX has published a really detailed guide on how to think about pricing. An interesting stat from the article is that pricing has a 72% correlation to startup failure. No clue how exactly they calculate that. I know I say this often but these types of articles, guides, frameworks aren’t just useful for startups. They can really be applied to any business. Check out The Hidden World of Pricing: Uber, Trulia, Etsy, Superhuman & More.

——

Advertising quintopoly

Five Internet platforms now account for 46% of all global ad revenues, according to GroupM. The big players today – Google, Facebook, Alibaba, ByteDance (TikTok), and Amazon – have 2.7x the share of 2010’s top five – Google, ViacomCBS, News Corp, Comcast, and Disney.

——

The economics of micro-SaaS

Andrew Pierno of XOXO Capital published a great piece where he provided an update on his holdings. The key message he wanted to demonstrate is net margins can vary widely depending on the product. Really enjoyed the article and the transparency. Check it out here: The Economics of Micro SaaS

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.