The Business Inquirer #038

In this issue, I highlight six listings including an RV accessories brand, a feedback micro-SaaS, a WooCommerce plugin, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

Last week I published a poll asking about the type of business you’re looking to acquire. Here are the results:

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 4 listings

🕸 Content/Marketplace/Service - 1 listing

🧐 What I Learned Last Week

🛒 eCommerce

RV Accessories - $7.5M

For sale is a 12-year-old e-commerce brand in the RV accessories niche. Owners are ready to retire and hand off the business.

Sold through Amazon (20%) & direct (80%)

All operations are in-house; 8 employees;

TTM Revenue: $9.6M; Profit: $1.7M; Margin: 18%

Asking: $7.5M; Multiple: 4.41x

✔ What I Like

The business is well-aged and on-trend. There’s been a huge uptick in interest in RVs since the pandemic. Opportunity to expand sales to other channels like Walmart, eBay, and more. Amazon only represents 20% of sales so there’s room for growth.

❓ Questions & Concerns

The business has gotten a boost from the pandemic. How do the financials look in a normal year? Are there any issues with the supply chain? Will the employees stay on? Can the business be relocated? What’s the CAC?

You can view the listing on QuietLight Brokerage

☁ SaaS

Instagram Post Scheduling - $320k

For sale is a 4-year-old Instagram planning and automation platform. The service includes post planning, scheduling, inbox management, and automation.

Competitors: Ingramer, Instazood

300k users; Built on PHP;

TTM Revenue: $82k; Profit: $76k; Margin: 91%

Asking: $320k; Multiple: 4.27x

✔ What I Like

Instagram continues to be one of the most popular social media networks with >1M downloads per day…

We’re seeing a wider variety of companies and advertisers on the platform compared to just a year ago. Demand for these types of tools continues to grow. This business has a solid 300k user base to build on and has found some PMF. There is plenty of competition in this space to learn from. I think the added benefit of inbox management and automation could be a solid differentiator. The right acquirer for this business would be someone who is already in this space and can market the product to their existing audience and vice-versa. Otherwise, partnerships and affiliate relationships would be another growth lever to explore.

❓ Questions & Concerns

There is tons of competition in this space. The listing itself highlights the difficulty in scaling this product. I’d want to understand the current customer base and if there is a particular niche or industry that views this product as attractive. If there is, I’d double down on serving their needs. I still think the best path would be to have an existing audience to who you can market this. If you’re running an Agency, this may be a good bolt-on acquisition.

You can view the listing on MicroAcquire.

————

Camping Alerts - $100k

For sale is an 8-year-old SaaS that is a California Beach Campground alert system. Subscribers receive text messages when availability opens up at a campground matching their preferences. The project has been neglected for some time.

Competitors: Campsitephotos

TTM Revenue: $18k; Profit: $15k; Margin: 83%

Asking: $100k; Multiple: 6.67x

✔ What I Like

Interest in camping is really strong with 10k - 500k monthly searches…

The business has been neglected but still generating a profit. I take this as a sign that there’s a strong market for the service that could be tapped with some investment in marketing/sales. I assume that is why the valuation is where it is - easy wins.

❓ Questions & Concerns

With a business that’s been neglected, you never quite know what you’re getting. In particular, what needs to be fixed and how much investment is really required to grow. How long has this business been neglected? Why has the owner chosen to not pursue this business? Are there forces at play that make this business unattractive today relative to when it was founded? With this valuation, there have to be some easy wins a new owner can implement. I wonder how difficult it is to expand this service wider than just CA.

You can view the listing on MicroAcquire.

——

Collect Feedback - $5k

For sale is 1-year-old EmojiOnSite which allows users to collect feedback from their audience.

Competitors: FeedLetter, Emojics

Last month revenue: $620; Profit: $480; Margin: 77%

Asking: $5k; Multiple (Est.): 0.87x

✔ What I Like

Collecting feedback is extremely valuable for creators. I use FeedLetter for this. Looks like this is another solution. The website looks pretty good. There are some paying clients already. Would be a nice micro-SaaS for someone who wants to learn and grow it. If all data checks out, the valuation is pretty cheap. I’d market this on Twitter to creators.

❓ Questions & Concerns

Very young project so you have to check all the numbers. What’s the tech stack and how much does it cost to update? What features are most requested? What’s the competition doing that you can improve on?

You can view this listing on MicroAcquire.

——

WordPress/WooCommerce Plugin - $50k

For sale is a 1-year-old extension for WooCommerce that converts the default checkout into a higher converting experience.

Competitors: CheckoutWC

Sold exclusively via WooCommerce.com

Last month revenue: $632; Profit: $367; Margin: 58%

Asking: $50k; Multiple: 11.35x

✔ What I Like

Globally, WooCommerce has a 23% market share among online stores…

The chart above may look off but keep in mind that this is a global number. If we look at just the US, WooCommerce has closer to 26% market share and Shopify would be closer to 19%. I think any plugin that increases conversions would be in high demand.

❓ Questions & Concerns

I’d want to understand the rev share that WooCommerce takes from developers and how that’s been trending. Is there a likelihood that WooCommerce itself would add this feature and make this plugin obsolete? What’s the tech stack and how much would it cost to update? What features need to be added? CPC is expensive so marketing would have to be done organically, through partnerships, and affiliates.

You can view this listing on MicroAcquire.

🕸 Content/Marketplace/Service

Reverse Phone Lookup - $18M

For sale is a 3-year-old content and subscription business in the reverse phone lookup niche. The website provides users with a quick way to find out information about any person behind a phone number. It sells background reports. Interesting listing.

$35 AOV; 700k e-mail subscribers; 2.5M visitors per month

8 employees; Owner spend 30min/day on the business;

TTM Revenue: $18M; Profit: $3.6M; Margin: 20%

Asking: $18M; Multiple: 5.00x

✔ What I Like

We’ve all received calls from unfamiliar numbers and then typed them into Google. It’s not just me who does this, right? This listing is for one of those businesses that show up and offer to sell you a detailed background report on the person behind the phone number. I think it’s an interesting business with the listing providing a good amount of detail. There are a lot of adjacent services you can market to this audience.

❓ Questions & Concerns

Clearly, this is a business for someone who is familiar with this space. I’d worry about regulations and industry dynamics. As call blocking and caller ID become more intelligent, there will be less use for these types of services. It’s an interesting listing but requires industry know-how and a lot of due diligence.

You can view the listing on WebsiteClosers.

🧐 What I Learned Last Week

——

Content website aggregator

Mushfiq Sarker of The Website Flip announced the launch of DealFeed. DealFeed is a tool that aggregates content sites for sale from major website brokers all in one place in real-time. Check it out here: DealFeed™ - Discover Content Sites For Sale From Brokers (thewebsiteflip.com). Broadly, if you’re thinking of doing anything in the content website space - buying, investing, financing, or operating - check out The Website Flip.

If you’re looking for other deal aggregators or just a comprehensive directory of deal sourcing destinations, check out my Deal Sourcing Guide.

——

Website investing for passive income

The Website Flip published a great piece talking about the myths and realities of website investing for passive income.

Check out the article here: Myths vs. Realities of Buying Websites for “Passive Income”

————

Understanding adjusted EBITDA

Jay Vasantharaj is a Toronto-based entrepreneur and investor at Bloom Ventures. He published a great article explaining the difference between EBITDA and adjusted EBITDA from a buyers and sellers perspective. If you’re looking to acquire a business, this is something that you should know inside and out.

Here are some examples of common EBITDA adjustments:

One-off events – lawsuits, natural disasters, or anything else that is a one-time event. The adjustment could be to remove the expense from EBITDA.

Overpaid or underpaid employees – a business can over or under compensate employees. The adjustment here would be to use market rate salaries for key employment positions.

Personal expenses – many businesses, especially smaller ones, will have the owner’s personal expenses reflected on the P&L. Adding back items such as meals & entertainment, travel, home office and automobile expenses might make sense. In smaller transactions, it’s common for the owner’s salary to also be added back to EBITDA in full to arrive at “seller discretionary earnings” or SDE.

Other streams of revenue – if a business has other streams of revenue that aren’t connected to the core business, then consider subtracting it from EBITDA.

Intercompany transactions – if you’re dealing with a business that has mutliple entities, there could be intercompany revenue and expenses that aren’t true economic activity. These should be adjusted for accordingly.

Quick read here: Everything you need to know about adjusted EBITDA

————

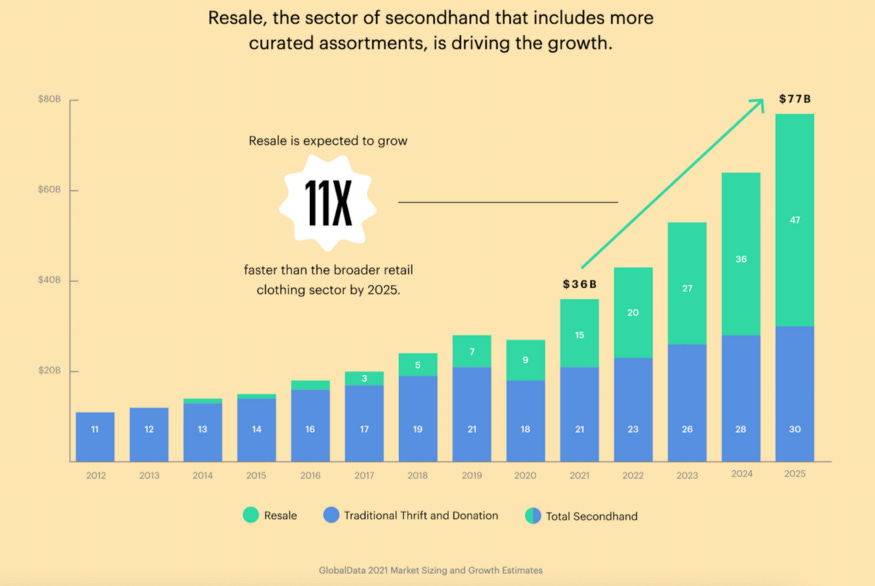

Resale market expected to double

Aubrie Pagano is an entrepreneur and investor at Alpaca VC. Her latest piece talks about the rise of recommence otherwise known as the secondhand market.

For any investor, this stat should stop you dead in your tracks: The Secondhand Market is projected to double in the next 5 years, reaching $77B. Secondhand, or recommerce, will grow at 11x the rate of regular retail. If that doesn’t smell like opportunity, I don’t know what does.

Really insightful read - Field Study: The Rise of Recommerce

————

How can this newsletter be more helpful?

We’ve just crossed 800 subscribers with a lot of the growth coming over the last few weeks. How can I make this newsletter more helpful, relevant, interesting for you? Should I highlight more listings? More/less commentary? More links to interesting articles? Just reply to this e-mail or use the feedback buttons below.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.