The Business Inquirer #039

In this issue, I highlight 6 listings including a home cleaning marketplace, a live shopping platform, a Shopify newsletter, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

Quick FYI - I am constantly updating the Deal Sourcing Guide with new resources. Check in there from time to time for updates.

In this week’s issue:

🛒 eCommerce - 0 listings

☁ SaaS - 3 listings

🕸 Content/Marketplace/Service - 3 listings

🧐 What I Learned Last Week

🛒 eCommerce

Nothing exciting to share this week.

☁ SaaS

Cleaning Services Marketplace - $24k

For sale is Wand, a marketplace for booking home and commercial cleaning services. Users can book services through the website or mobile app. Early-stage startup. I’d look at this as just buying the tech.

120 cleaners on the marketplace across 3 US markets

Tech: Flutter, Salesforce, licensed API

Avg monthly revenue: $1,200; Profit: $300; Margin: 25%

Asking: $24k; Multiple: 6.67x

✔ What I Like

There are a few opportunities with this business. Can keep it as-is but I think another business model is to pivot this into a SaaS for cleaners to manage, transact, and communicate with their clients. The business model would be a typical SaaS instead of a marketplace. This chart makes me want to look at other businesses in the home cleaning space…

I’ll be going through some of these Tweets: "home cleaning business" - Twitter Search / Twitter

❓ Questions & Concerns

Some functions of the website seem to be broken. This raises some red flags immediately. If keeping the business as-is, then need to understand the legal issues around using freelance labor. Read up on Handy and the issues they ran into. How hard is it to onboard new cleaners? If pivoting the business to more of a SaaS for cleaners, that presents separate challenges.

You can view the listing on IndieMaker.

————

Customer Support Platform - $100k

For sale is a 2-year-old customer support platform that is an AI-based cloud solution for faster, more personalized customer support. Designed for call centers, BPOs, inbound, and outbound sales teams in various industries.

Competitors: Conversocial, Snapcommerce, Kustomer

Solo-founder; Raised $500k in funding;

TTM Revenue: $330k; Profit: $70k; Margin: 21%

Asking: $100k; Multiple: 1.43x

✔ What I Like

A few larger competitors that you can learn from. More personalized sales and service solutions are on-trend. Opportunities to niche down to a specific industry. The valuation here is surprisingly cheap (maybe typo).

❓ Questions & Concerns

Valuation is suspiciously cheap and could be an error. I assume this is a tech-intensive business so need to figure out what type of upkeep is required. What additional features need to be built? Implementing a B2B sales team is expensive.

You can view the listing on MicroAcquire.

————

Live Shopping - $300k

For sale is a 3-year-old live shopping and live streaming SaaS that helps brands of all types adopt live video shopping on their websites and mobile apps. Not profitable.

Competitors: Bambuser, Livescale, Flux Panda

Bootstrapped w/ $430k invested by founders; 11 person team;

TTM Revenue: $37k; Profit: $0

Asking: $300k

✔ What I Like

Live shopping started in China and became a massive success accounting for $171B in GMV. Now it’s moving to the US and transforming the shopping experience for US consumers. Check out this McKinsey report for more details. This is a high-growth area of e-commerce where new businesses and technologies are being implemented. This startup appears to be a part of that trend.

❓ Questions & Concerns

This is a tech-focused startup so you need a solid tech team in place. I’d want to understand how it compares to the competitors. Who are the existing clients? This is most likely a strategic acquisition for a brand, an Agency, or a tech firm.

You can view the listing on MicroAcquire.

🕸 Content/Marketplace/Service

Shopify Apps Weekly Newsletter - $20k

For sale is 10-month old Shopify Apps Weekly. The weekly newsletter is for Shopify merchants to help them stay aware of any new apps released. Store is scraped each week to isolate any new apps. Revenue is generated from sponsorships.

2,400 subscribers; Open Rate: 10%; RoR tech stack;

Monthly revenue: $1,100;

Asking: $20k; Multiple: 21.82x

✔ What I Like

I love the concept of this newsletter. Pretty simple to execute but I do think adds value to Shopify merchants. A lot of opportunities to expand content with sponsored posts, new app reviews, and more. Website looks well built. I actually wonder if something similar would work in other niches - WooCommerce, WordPress, Slack, Zoom, MS Teams, etc - basically any platform that has an app store.

❓ Questions & Concerns

Just listing new apps is nice but you need to add more value. Adding a sponsored review of a new app would be very helpful. I know first-hand that e-mail open rates are hard to measure but 10% is extremely low (TBI is at 40-50%). Expenses aren’t listed in the listing. Ultimately, how hard would it be to replicate this from scratch and save $20k?

You can view the listing on Duuce.

————

Content Writing for E-Commerce - $68k

For sale is a 1-year-old content writing service for e-commerce merchants. EcomContent is a productized content writing service using freelancers managed through UpWork. Detailed listing.

Writers sourced and managed through UpWork; 2 VA’s handle sales;

Avg monthly revenue: $3,804; Profit: $2,694; Margin: 71%

Asking: $68k; Multiple: 2.10x

✔ What I Like

A simple business model for a very in-demand service. The listing here is pretty detailed so a lot to learn about how the business functions. One idea is to integrate this service directly into Shopify with a custom Shopify App. There are a few apps that do this already but one seems to be dominating the product description space. I think there’s room for more apps in this category. Can differentiate by writing website copy, FAQs, and more. But back to this particular listing - if it passes due diligence, an interesting business to explore.

❓ Questions & Concerns

A few big questions here. First, the business is very young so you need to check all the numbers and do proper due diligence. Second, in the listing comments, you can see that the seller appears to run an Agency on the side in addition to this business. This raises more questions. Not clear if he’ll be competing with the buyer. The website design could be improved. Need to understand the CAC. Financials are very choppy. Need to perform a lot of due diligence here.

You can view the listing on Flippa.

——

Marketplace for Handcrafted Goods - $50k

For sale is a 3-year-old marketplace that connects handcrafted goods makers to independent retailers.

Competitors: Faire, Tundra, Bulletin, IndieMe

250 active sellers; 30 subscribers;

20-30 inbound applications for vendors per month

TTM Profit: $11k; Profit: $6k; Margin: 54%

Last month profit: $430

Asking: $50k; Multiple (Est.): 5.56x

✔ What I Like

Seller built the business due to a personal need. Widely featured in retail and handcrafted goods publications. Some large competitors to learn from. Relatively simple tech stack. $0 CAC so far.

❓ Questions & Concerns

Not a lot of revenue for a 3-year-old business. Need to understand the business model here and if something is broken. The seller hasn’t done any marketing so that will increase expenses once implemented. Valuation is on the higher-end.

You can view the listing on MicroAcquire.

🧐 What I Learned Last Week

——

Micro-SaaS Insider

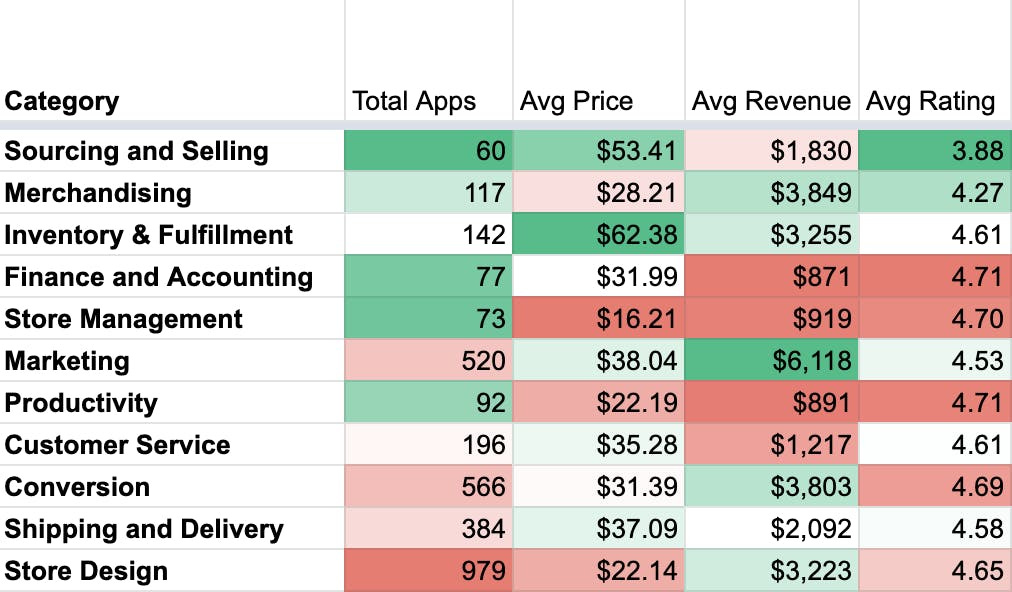

Alternative Assets recently launched Micro-SaaS Insider where they use Moneyball tactics to analyze micro-SaaS deals. The goal is to discover undervalued, mispriced, and hidden gem micro-SaaS businesses for sale. In the latest issue, they 1) uncover the categories that present the most opportunity and 2) found and analyzed a for-sale Shopify App that fit into one of those categories.

We were inspired by this post from Marketplaceapps.co last week, and wanted to expand upon the findings. So we scraped data from the Shopify App Store to try and understand which ones present the best opportunities for developers and buyers.

It looks like the best overall opportunities are in the following categories:

Sourcing and Selling

Merchandizing

Inventory and Fulfillment

Finance and Accounting

To continue reading, check out the free version of their analysis to see which for-sale Shopify App they found that fit into the criteria. Micro SaaS Insider - July 21

On the same topic, for a deep-dive on the Shopify App Store, I would recommend subscribing to the Marketplace Apps newsletter. Shameel and team just introduced a ton of new analytics into the tool.

——

How to buy, grow, and sell small businesses

Colin Keeley recently launched his Indie PE course on how to buy, grow, and sell a small business. There’s a large focus on SaaS as that’s where Colin’s experience lies. The course consists of an introduction, deal sourcing, due diligence & negotiation, financing & closing, growth. The course is just $199 which presents a pretty good deal. I do have an affiliate relationship with Colin so I’ll get a few nickels if you purchase it. Micro PE: How to Buy, Grow, & Sell a Small Business

——

Zoom is the next big platform

Jim Scheinman is an early investor in Zoom and Managing Partner at Maven Ventures. He wrote a great article on why Zoom is going to be the next big platform.

Zoom reminds me of previous births of past tech platforms like broadband, mobile, and cloud. I saw these platforms emerge from inside the tech industry, as an internet exec, then an early employee at consumer social companies Friendster and Bebo, then as an Angel investor in many mobile-first companies in the early 2000s, including Zoom. When I started advising Zoom pre-launch, they were building mobile-first and on the cloud. The new mobile and cloud platforms gave rise to Zoom, and now Zoom will enable the launch of many more tech successes. I love how the tech ecosystem keeps enabling new startups to innovate on prior successful platforms. Here are the five reasons Zoom is now positioned to be the next big platform to launch new, multi-billion dollar companies.

I encourage you to read the full article. Five Reasons Why Zoom is the Next Big Platform to Launch Billion-Dollar Startups.

On the same topic, I recently deleted Zoom and now do everything using Google Meet. It’s free and its features have finally caught up with Zoom. Zero reasons to pay for Zoom today.

——

IOIs (Why, When & What)

Big Deal Small Business is a great free newsletter written by a self-funded searcher. I can’t reveal the author’s true identity but they have a lot of experience in the PE space that they are applying to their search. The newsletter is a “follow along” as they source and analyze deals. The latest post talks about the difference between an LOI (Letter of Intent) and an IOI (Indication of Interest).

To me, an LOI is a detailed list of terms under which you are willing to do the deal assuming diligence checks out.

An IOI is just the rough valuation & capital structure you would use to do the deal, but before you’ve done real diligence or even decided if you want to do the deal.

These serve very different purposes.

My goal in an IOI is to 1) show I’m a serious buyer in order to get access to better information and 2) make sure me and the Seller aren’t wasting each other’s time.

For #2, there’s no point wasting each other’s time if you and the Seller are way off on the value of their business.

And sometimes, the Sellers are right. I just posted an IOI where I indicated at 5.0x-5.7x 2020A & 4.5x-5.0x 2021E. The broker told me that I’ll probably be too low and I needed to be north of 6.5x 2020A / 6.1x 2021E. Turns out, he was right — they accepted an all-cash offer at 6.9x 202A / 6.1x 2021E.

When I’m ready to submit an LOI, it means I’ve determined that I want to own the business at the price & structure shown on the page. I want exclusivity to finish my confirmatory diligence, but assuming everything matches what’s been told to me, I’m going to transact at the levels shown in the LOI.

Check out the full post to continue reading the why, when, and what of an IOI.

——

Startup acquisition boom

Crunchbase is out with an interesting article showing that VC-backed startups are acquiring other VC-backed startups at an unprecedented pace.

MicroAcquire, a startup acquisition marketplace that focuses on bootstrapped, profitable companies, has seen a lot of activity in terms of VC firms, startup founders, and private and public companies joining its platform.

About 90 percent of the companies on MicroAcquire’s platform are private, according to CEO Andrew Gazdecki. “We’re seeing about 300 to 400 new buyers registering each day,” he said in an interview. “We see an acquisition happening probably every other day.”

MicroAcquire itself has raised $6.3 million in total funding, most recently with a $3.5 million round from investors including Anthony Pompliano and Sam Parr.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.