The Business Inquirer #040

In this issue, I highlight 9 new listings including a babysitting marketplace, invoicing & payments app, WordPress design plugin, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

In this week’s issue:

🛒 eCommerce - 0 listings

☁ SaaS - 8 listings

🕸 Content/Marketplace/Service - 1 listing

🧐 What I Learned Last Week

The Business Inquirer is brought to you by DueDilio. DueDilio is the first M&A due diligence marketplace connecting business buyers and investors with quality, verified due diligence experts.

🛒 eCommerce

Nothing caught my eye this week. Seeing a lot of supplement brands for sale which is not interesting to me.

☁ SaaS

Relationship Management - $90k

For sale is a 2-year-old SaaS that offers reputation management, two-way texting, and automated SMS reminders to medical and dental practices.

Competitors: Podium, LightHouse 360, Yapi

TTM Revenue: $30k; Profit: $26k; Margin: 87%

Asking: $90k; Multiple: 3.46x

✔ What I Like

Large TAM with over 200k dental offices in the US alone. There’s some traction here already. Sounds like this business could target other industries as well such as hair salons, nail places, and others. Even if just going after the dental market, marketing is relatively straightforward - direct mail, online, conferences, dental schools, affiliate. Valuation is reasonable. Not an exciting business but someone with a marketing background could really run with this.

❓ Questions & Concerns

I assume that the tech is pretty simple but still have to do your due diligence. How expensive would it be to add features? Who are the current clients? What’s the competition doing in this space? Are there niches that the competition isn’t going after?

You can view the listing on MicroAcquire.

————

Invoicing & Payments App - $270k

For sale is a 6-year-old payment and invoicing solution available on a mobile app and online. Allows users to send invoices, collect payments, and stay organized.

Competitors: QuickBooks, Invoice Simple

1k+ clients; Monthly or yearly subscription model;

TTM Revenue: $70k; Profit: $60k; Margin: 86%

Asking: $60k; Multiple: 4.50x

✔ What I Like

Growth in the number of freelancers is a tailwind for these types of solutions. I don’t think there’s a lot of friction in switching invoice providers. I looked at Capterra reviews for Invoice Simple and the biggest complaints are poorly designed invoices and lack of customer support. Those could be areas to differentiate. This purchase would make the most sense for someone who is already in this space and wants to combine it with an existing solution.

❓ Questions & Concerns

This is a competitive space. I’d want to understand if this product targets a specific niche. Who are the current customers? What type of marketing has been done and how are clients acquired? What has prevented the seller from scaling this further?

You can view the listing on MicroAcquire.

————

LinkedIn Lead Gen - $7.9M

For sale is a 3-year-old LinkedIn lead automation software powered by IBM Watson AI.

90% of client leads come from using the actual product on LinkedIn

100k+ e-mail database;

TTM Revenue: $1.6M; Profit: $988k; Margin: 62%

Asking: $7.9M; Multiple: 8.00x

✔ What I Like

There’s a lot of demand for such lead capture products from startups as well as enterprises. We can see robust search activity for “LinkedIn Sales Navigator”…

Incorporating IBM Watson AI into the product sounds interesting and could be a unique selling point. Nice margins.

❓ Questions & Concerns

Would the current tech team stay on with the product? Does this require special tech know-how? Seller claims AI is the big differentiator for this product but is that really true? Is there any customer concentration? At this valuation, the seller is looking for a strategic acquirer.

You can view the listing on Flippa.

————

Call Recording App - $2.6M

For sale is a 2-year-old mobile app that is used for recording phone calls. Available on iOS and Android.

iOS version has 4M downloads and $2.6M revenue; Android version has 4M downloads and $425k revenue; Avg customer uses app for 1 to 3 months.

Monthly downloads: 185k; MAU: 269k; DAU 11k;

TTM Revenue: $1.3M; Profit: $742k; Margin: 57%

Asking: $2.6M; Multiple: 3.50x

✔ What I Like

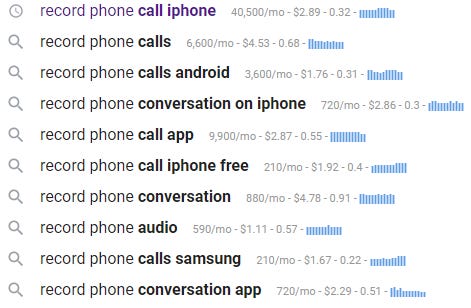

A simple, purpose-built app. There’s strong demand for these types of apps as indicated by the search volumes…

Revenue is generated from subscriptions but perhaps there’s an opportunity to incorporate ads into the product as well.

❓ Questions & Concerns

Regulations and legal are big concerns here. What’s the legality of recording phone calls in various jurisdictions? Would this feature be implemented into the operating system eventually? What’s the LTV of a customer? How are customers currently acquired? CPC is on the higher end.

You can view the listing on AppBusinessBrokers.

————

DevSocOps Automation - $5M

For sale is a 4-year-old startup that’s a DevSocOps automation tool working with government entities. The startup assists the US DoD in adopting innovative technology.

Competitors: BoxBoat Tech, Norseman Tech, Geocent

8 person team

TTM Revenue: $980k; Profit: $340k; Margin: 35%

Asking: $5M; Multiple: 14.71x

✔ What I Like

The security space is on fire right now from a demand and investment perspective. This is clearly reflected in the valuation of this startup.

❓ Questions & Concerns

Selling and working with government entities is a unique business model and requires know-how. How much of this business is dependent on the owner? Is the current team staying on? The owner runs another similar startup but focusing on a different technology - is this a problem?

You can view this startup on MicroAcquire.

————

WordPress Design Plugin - $125k

For sale is an 8-year-old plugin that helps people create a specific design feature. It is mainly for WordPress but is compatible with Salesforce, Drip, Mailchimp, and SMS.

262 current customers; 11 new clients added monthly; 100k e-mail list;

TTM Revenue: $30k; Profit: $24k; Margin: 81%

Asking: $125k; Multiple: 5.21x

✔ What I Like

A well-aged business that’s compatible with several platforms. Great margins and seeing some slow but steady growth. The owner spends just 2-hours on the business. The listing mentions that dev is not required for upkeep. The financials and traffic numbers are consistent. Low customer churn. Opportunity to monetize the e-mail list.

❓ Questions & Concerns

Not a lot of detail in the listing itself. What has the owner tried to grow the business? What new features are required and which ones are just nice to have? What’s the LTV and CAC? Valuation is on a higher-end. Listings on Empire Flippers tend to have higher valuations.

You can view this listing on Empire Flippers.

————

Meeting Scheduler - $18k

For sale is a 1-year-old platform that helps teams schedule external meetings without back-and-forth email. Based in UK.

Competitors: FreeBusy, FindTime, Doodle

$1k ARR; Asking $18k

✔ What I Like

My wife is a Big Law attorney and I hear the frustrations firsthand about scheduling meetings. I’ve been thinking for some time that there should be an enterprise solution to address this. Perhaps something already exists or perhaps this listing is the solution. I asked for more information from the seller on MA. Can’t share all the details here but the website looks great and there’s a 4.8 rating on Capterra. Security of the solution is emphasized so I think this is well-positioned to be sold to law firms, accountants, and any other industry where security/privacy is a top concern.

❓ Questions & Concerns

I’d want to find out why the team is selling so early. What have they learned about the market? How’s the tech stack working? It’s an early-stage startup so a lot of DD is required.

You can view this listing on MicroAcquire.

————

Classifieds Website Builder - $305k

For sale is a 12-year-old SaaS that is a classifieds website building software. The business allows users to easily launch and maintain a classified website in real estate, job board, or other niches.

B2B; 143 active clients; 99k unique visitors LTM; 9M backlinks;

LTM Revenue: $111k; Profit: $69k; Margin: 62%

Asking: $305k; Multiple: 4.42x

✔ What I Like

Well-aged business. The strong SEO profile provides a moat and lowers CAC. Classifieds and marketplaces are in high demand. There is friction in switching providers so I have to assume there’s low churn.

❓ Questions & Concerns

Crowded field with a lot of classified and marketplace builders launching recently. No code tools are another competitive threat. As the business is 12-years-old when was the last time the tech or design was updated?

You can view this listing on FE International.

🕸 Content/Marketplace/Service

Babysitting Marketplace App - $35k

For sale is 4-year-old Usit which is an on-demand babysitting marketplace app in the iOS store. Based in Atlanta, the app connects vetted college students with parents who need childcare.

173 4.5-star reviews; 600 downloads/month;

Pre-COVID the GMV was $50k/month;

TTM Revenue: $77k; Profit: $12k; Margin: 15%

Asking: $35k; Multiple: 2.92x

✔ What I Like

Finding babysitters is a huge pain point for parents. Finding someone last-minute is even more difficult. This app and business are in high demand. I view this as a babysitting marketplace startup that has some minimal traction already. The reviews are generally good but there are also clear things that need to be improved to make this app more appealing to parents. If someone is interested in this space, this could be a great acquisition to get a head start.

❓ Questions & Concerns

Building a marketplace is notoriously hard. Working with college students is challenging. How do you source the supply? What prevents them from leaving the app? What’s the LTV? What’s the exposure to liability?

You can view the listing on Flippa.

🧐 What I Learned Last Week

——

Who’s buying startups?

Ever wonder who exactly is buying businesses? Honestly, me neither. MicroAcquire shared a tweet highlighting the types of buyers they are seeing on their platform.

——

Acquisition insights from SureSwift

SureSwift Capital held a webinar titled “The Future of Internet Businesses”. I wasn’t able to attend but I did find some relevant notes from Ryan Doyle on the topic of getting your SaaS acquired. Here’s his Twitter thread.

The biggest green flag to an acquirer? Having full-time dev help in place. This most likely means that a new dev can come in and work on the code without problems.

Responsiveness on business acquisition platforms is part of due diligence. If a seller isn’t responsive, that’s a red flag.

If you’re building a portfolio of acquisitions, start small. Lots of folks expect it to be more passive than it really is. Build a team over time.

It’s a minimum of 3 hires to replace one founder. Founders are always optimistic about how much time they spend on the business. Double or triple whatever they say. It really takes 3 people to replace one founder.

Hold out on your first acquisition until you get a feel for the marketplace. Don’t rush into it.

——

When sellers change their mind

Through this newsletter as well as DueDilio, I’m lucky to have the chance to speak to a lot of business acquirers and hear their stories. Last week I heard the same story twice. The buyer submitted an LOI and the seller signed it. Buyer paid for legal, financial, and commercial due diligence on the business. Everything checked out and it was time to close the deal. At the last minute, the seller got cold feet and just backed out of the sale. In both instances, the buyers spent considerable time and money on due diligence. They lost both.

In real estate and larger M&A, there are typically clauses in the APA that compensate the buyer if a seller simply chooses to walk away from the deal. I typically don’t see something like this implemented in micro-acquisitions and/or SMB deals. Perhaps it’s something to consider. Has anyone dealt with something like this?

——

Assembling your deal team

I’ve previously talked about the Big Deal Small Business newsletter. The author puts out great content about the search process. Last week he published a piece about assembling your deal team. Check out the full post here.

Here are the core deal team members:

Financial Diligence CPA: Quality of Earnings, Working Capital Analysis, etc.

Deal Lawyer: Purchase Agreement, Shareholder Agreements, Consulting Agreement for Seller, etc.

Lender: It probably makes sense to chat with a couple in order to learn what geographies, deal sizes, and industries they cover. You can check out my post on Navigating the SBA 7(a) Maze for more.

Insurance: Confirm that the business today has sufficient & well-priced insurance. If they don’t have enough, you need to model in higher premium costs going forward. If their policy is too expansive, you may have some day one cost savings.

Tax CPA: Purchase price accounting, general questions around pass-thru taxation/corp taxation, etc.

Industry Expert: This can be hard to pre-plan for if you’re doing an industry-agnostic search, but a sector-specific expert that you can trust is invaluable. They help you avoid gaping blind spots and show you what questions you should be asking the Sellers.

I built DueDilio for this exact purpose - to help you assemble your deal team. We have a wide network of due diligence experts including independent professionals, due diligence firms, M&A advisors, professional service firms, subject matter experts, and more. Simply submit your project on the website, receive multiple proposals, and connect with a due diligence expert. It’s simple and free.

——

Website due diligence

I don’t focus on content websites in this newsletter but it’s an area that is seeing a lot of interest from business buyers. Mushfiq S is one of the best in this space and he’s part of the DueDilio network of due diligence experts. He recently published a guest article outlining the major issues to lookout for when doing due diligence on a content website. Website Due Diligence: 3 Major Red Flags When Buying Content Websites

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.