The Business Inquirer #042

In this issue, I highlight 7 listings including an electronics manufacturer, a niche SaaS for trucking, an automotive marketplace, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

Reminder - TBI has partnered with ProjectionHub to offer subscribers a 25% discount on any of their 50+ CPA-developed financial projection templates. You can view the full library of templates here. Once you find a template that you would like to purchase, simply contact me (e-mail, Twitter, FB) to request your discounted template.

In this week’s issue:

🛒 eCommerce - 3 listings

☁ SaaS - 2 listings

🕸 Content/Marketplace/Service - 2 listings

🧐 What I Learned Last Week

The Business Inquirer is brought to you by DueDilio. DueDilio is the first M&A due diligence marketplace connecting business buyers and investors with quality, verified due diligence experts.

🛒 eCommerce

Furniture Dropshipping - $975k

For sale is a 15-year-old collection of three dropshipping e-commerce businesses that sell branded home furniture.

30 US-based suppliers

2k LTM orders; $922 AOV; 1.8M page views over LTM;

TTM Revenue: $1.8M; Profit: $300k; Margin: 17%

Asking: $975k; Multiple: 3.25x

✔ What I Like

Broadly, I like the dropshipping model if it’s done right. The business has a lot of operating history and uses US-based suppliers. SBA eligible. Furniture sales are tied to housing activity which is booming.

❓ Questions & Concerns

Have to learn a bit about the branded products. If the products are store-branded and differentiated that’s a positive. Margin is low but that’s typical for dropshipping. Have to really optimize marketing and CAC which may be more difficult today than previously. I’d want to understand return rates. How are shipping times and customer service? How’s the e-mail list looking?

You can view the listing on FE International.

————

Empowering Jewelry Brand - $160k

For sale is 4-year-old Awareness Avenue jewelry brand. It sells inspirational jewelry to women.

Shopify store monetized through FB Ads, Google Shopping, and e-mail list.

Fulfillment is handled by a quality supplier.

80k monthly page views; 29k monthly visitors;

55k FB followers; 3.9k IG; 71k e-mail list; $55-$60 AOV

Monthly revenue: $60k; Profit: $10k; Margin: 17%

Asking: $160k; Multiple: 1.33x

✔ What I Like

I like the customer profile and niche. Good price point with some room to increase pricing. Somewhat diversified traffic sources. Financials and website traffic have been relatively steady over the LTM. The store is very well designed. Some operating history. Valuation is cheap.

❓ Questions & Concerns

Relying on just one supplier can be risky. Driving sales through FB ads is getting more expensive so that will eat into the margin. I’d really want to know how the business has done in the last 2 months or so. Very low margin. Valuation looks suspiciously cheap.

You can view the listing on Flippa.

————

Electronics Manufacturer & DTC Brand - $10M

For sale is a 4-year-old consumer electronics manufacturing facility based in India as well as a DTC e-commerce brand. Products are in the mobile phone accessory category. Interesting listing.

40k sqft factory, 6k sqft warehouse, 2k sqft office

40 wholesale clients; AOV of $2,412;

DTC is done through Amazon

TTM Revenue: $2M; Profit: $608k; Margin: 30%

Asking: $10M; Multiple: 16.45x

I haven’t seen a lot of listings that include a manufacturing plant. The write-up has decent detail. One of those listings you can learn from.

You can view the listing on Website Closers.

☁ SaaS

Content Perzonalization WordPress Plugin - Open to Offers

For sale is a 5-year-old WordPress plugin that allows clients to segment their audience by defining conditions and goals, and display personalized content to those audience segments.

Competirors: If-So, Gramatik

TTM Revenue: $30k; Profit: $22k; Margin: 73%

Asking: Open to Offers

✔ What I Like

WordPress plugin that increases website conversion rates. If-So is the big competitor in this space and they charge a lifetime license fee - offering more flexibility could be attractive to potential clients. The typical client is an Agency or advanced user who is familiar with marketing & segmentation. A lot of possible cross-sell opportunities. Good acquisition for someone who has access to a similar audience. Marketing know-how seems to be the missing piece here.

❓ Questions & Concerns

Scaling has been challenging. Is it the team, additional investment required, or additional features? Who are the current users? What do the reviews show? Churn? What’s been the most successful acquisition channel so far?

You can view the listing on MicroAcquire.

————

Tax Returns for Trucking - $600k

For sale is a 6-year-old niche SaaS that is a DIY tax solution that helps transportation/trucking companies prepare their quarterly tax returns.

Competitors: Tax Firms, State Websites

SaaS business model based on # of active trucks

1,000 new signups each quarter; Owner spends just a few hours on business.

30-Day Revenue: $31k; Profit: $24k; Margin: 77%

TTM Revenue: $234k; Profit: $176k; Margin: 75%

Asking: $600k; Multiple: 3.41x

✔ What I Like

I like businesses focused on a niche. Good operating history. Large TAM. Sticky business model. A lot of cross and upsell opportunities. Can add a service offering or partner with someone that offers this. Opportunity to increase pricing for an easy revenue boost. The listing mentions 1k+ new signups per quarter. Can continue as-is or take a more hands-on approach to scale the business. There could be an opportunity to expand to another vertical. Nice margins. Valuation isn’t crazy. There’s a data play here as well. I bet the CAC is low and a lot of new business is driven by referrals.

❓ Questions & Concerns

I would want to understand the value prop here vs. other solutions. With 1k+ new signups per quarter - the revenue should be growing at a rapid clip, is this the case? What’s the churn? How are the clients acquired and what’s the CAC?

You can view the listing on MicroAcquire.

🕸 Content/Marketplace/Service

Support Group Platform - $145k

For sale is a 1-year-old marketplace that hosts support groups run online by qualified professionals. Offers a one-stop-shop to find groups covering a variety of different challenges so that users can seamlessly find the right group for them and join in just a few clicks.

Competitors: Pace Group, Circles Up

Founded by technical team; Detailed listing;

Priced at $20/m + 6% transaction fee;

TTM Revenue: $23k; Profit: $2k; Margin: 9%

Asking: $145k; Multiple: 72.5x

✔ What I Like

I like the mission of this startup. Built by a technical team so I assume the tech is solid. Needs biz dev/marketing to scale. There’s good detail in the listing around customers and requirements to scale.

❓ Questions & Concerns

Not a lot of operating history. Listing mentions they couldn’t raise VC money to scale. Would be good to understand feedback from that effort. Valuation seems a bit silly here unless there are some easy revenue opportunities not mentioned in the listing.

You can view the listing on MicroAcquire.

————

Automotive Marketplace - $1.1M

For sale is a 10-year-old automotive marketplace that helps dealers sell more cars and generate leads.

Competitors: DealerCarSearch, CarsforSale, Hammer

3-person team; Built on RoR, AWS, Twilio;

30-day Revenue: $37k; Profit: $22k; Margin: 59%

TTM Revenue: $385k; Profit: $206k; Margin: 54%

Asking: $1.1M; Multiple: 5.10x

✔ What I Like

Big fan of the marketplace model. The business model itself here is simple. Easy tech stack to maintain. Long operating history. Competitors to learn from. Huge TAM. I think marketing/sales is the missing component here.

❓ Questions & Concerns

I’d want to see the full P&L to spot any trends. The auto market is pretty whacky right now so need to understand what impact that has had on this business. Valuation seems extended but perhaps there’s a recent dip in earnings. Can the website accommodate advertising as an additional revenue source? Is there a newsletter? Are there any cross-sell opportunities?

You can view the listing on MicroAcquire.

🧐 What I Learned Last Week

——

Chief Operators

I recently got an invite to join the Chief Operators community by Sam Bass. It’s a community of business operators and investors looking to network, learn, partner, and help each other. The messaging is that it’s focused on content website operators/investors but I’m finding a lot of great conversations around SaaS, e-commerce, and other areas. It’s a relatively new community but I see a bright future. Check them out: Chief Operators

——

Using time wisely

First Round Review had a great article by Sam Corcos, Co-Founder/CEO of Levels, about how he manages his time. Sam is obsessed with time management and tracks every 15-minute increment. He’s been doing it this way for many years. Time management is something I personally often struggle with so the article was an interesting look at how someone obsessed with it does it. Not everything is directly applicable but worth a read. An Exact Breakdown of How One CEO Spent His First Two Years of Company-Building

——

MicroAngel makes an acquisition

Eyal Toledano probably doesn’t need an introduction as he’s very active in the SaaS space, MicroAcquire FB group, etc. Eyal runs a micro-SaaS fund where he acquires mostly Shopify apps and grows them. He is documenting the journey in his Micro Angel newsletter (free & paid). The latest free post provides an exclusive look into his latest acquisition of a six-figure Shopify app - Postcode Shipping. It’s a $200k ARR app that he bought for $425k + 7% liquidation participation. Interesting deal.

A few points:

Eyal found the deal through his network and not through a broker or marketplace. Demonstrates the point - if you want a good deal, go source it yourself.

I haven’t seen too many deals with liquidation participation for the seller but it’s a great strategy. Lowers the cash outlay, keeps the seller involved.

The whole post provides great insights into sourcing, analyzing, and structuring a SaaS deal.

MicroAngel acquires Postcode Shipping, a profitable SaaS producing $200k ARR

——

SaaS Mag

I was reading a recent e-mail from FE International and noticed that they have a publication called SaaS Mag. Maybe I’m late to the game but I had no clue they had a magazine specifically covering SaaS. It’s actually a free quarterly publication that they ship you for free. Yes, physical magazine.

SaaS Mag, the world's definitive quarterly SaaS publication for those working or interested in the industry, speaks directly to the biggest players in the SaaS space to gather key business and technical insights, as well as current market trends. The biggest quarterly SaaS publication to date, SaaS Mag is distributed to a network of tens of thousands of professionals in the SaaS space, offering expert techniques, advice and profiles from owners, advisors and leading commentators in SaaS.

Sign-up for free on their homepage.

——

Operating history

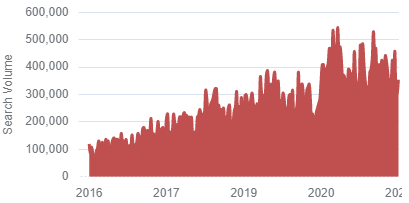

I typically don’t look at businesses that don’t have at least 3-years of operating history. It’s clearly not a rule but just a personal preference. I was curious about the business age breakdown of listings on MicroAcquire so I put together some quick stats.

Today, just 49% of businesses listed are at least 3 years old. I’d love to see how this trends over time.

——

Best niches for affiliate marketing

Matt Diggity combed through 300+ affiliate websites listed with Empire Flippers to analyze their niche, monetization model, and revenue. I hear it’s the most comprehensive data-driven study of its kind that’s ever been published.

We got a mountain of data to cover more than 300 affiliate, display advertising, and amazon associate sites sold since 2019. We’ve broken down this data to give you some niche ideas and help you choose the most lucrative affiliate niches for your 1st or 50th site.

You can check out the article here: The Best Niches For Affiliate Marketing in 2021 [Data Study] (diggitymarketing.com)

Note: I learned about this article from the investing.io newsletter. Gotta give credit where credit is due.

——

Search Fund Alliance

I recently came across Search Fund Alliance.

The SFA was founded in the fall of 2016 by a visionary group of search fund investors and experiences CEOs who desire to help search fund entrepreneurs build better companies. Membership is by invitation only, and our members represent the leading thinkers and practitioners in this expanding field of investment. As the number of participants in the search fund model continues to grow, the SFA will help to ensure that the traditional search fund ethos is retained. Our broad goals include facilitating mentorship, leveraging shared resources and identifying best practices, all in the service of building better companies.

Anyone a member of this organization?

Curious if it’s worth the cost of joining. Pricing is pretty steep - $3k initiation + $1k annual dues.

From another perspective - what a great business model! 🤑💸💰

——

Calculating net working capital

I’ve highlighted previously a few great posts from bloom venture partners. They’re a B2B SaaS-focused VC firm investing and acquiring great companies. They also put out some great content in the weekly bloom newsletter. Last week’s post focused on understanding net working capital.

At a high level; NWC (current assets - current liabilities) may seem very straightforward, but what makes calculating this figure so complicated for selling a business are the various line items that impact it and both parties’ interpretation of these items.

The intricacy of NWC makes it the most tedious and complicated part of closing any deal, let alone a huge pain for both parties.

TLDR; Whether you are an investor, operator, or founder, understanding the dynamics of NWC may not be critical now but most likely will be some time down the road.

Make sure to check out the following reads for a NWC deep dive:

📚 Working Capital: How to Define (and Understand) It in Transactions vs. Operations

Check out their full post which has some great links and insights.

——

Due diligence

If you or anyone you know needs help with business due diligence, check out my startup DueDilio. We’re a marketplace that connects business buyers with quality, verified due diligence experts. With 100+ experts on the platform, we can help with most types of due diligence requests and budgets. Today, we’re facilitating 3 to 5 due diligence requests per week coming from search funds, investors, LMM firms, and small corporates. Whether you need technical, financial, operations, sales, or other types of due diligence, we got you covered. Best of all, DueDilio is free to use.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.