The Business Inquirer #043

In this issue, I highlight six business listings including guitar repair e-commerce, a family law SaaS, a risk profile tool for financial advisors, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

Partnership Announcement

I’m excited to announce a partnership with a fellow Boston-based company - DeepBench to offer TBI subscribers a $200 discount off their expert network services.

DeepBench is an MIT-developed expert matching platform that delivers critical, timely insights by connecting clients with custom 1:1 advisory with industry experts.

Redeem your $200 credit here.

DeepBench employs a blend of proprietary technology and dedicated account managers to source, vet, and connect investors, consultants, and product & strategy professionals with experts across:

Industries: Technology, healthcare, TMT, entertainment, finance, and more

Geographies: North America, Western Europe, Latin America, Asia, and more

Roles: Manager through C-suite, academics, healthcare professionals, and more

In this week’s issue:

🛒 eCommerce - 1 listings

☁ SaaS - 4 listings

🕸 Content/Marketplace/Service - 1 listings

🧐 What I Learned Last Week

The Business Inquirer is brought to you by DueDilio. DueDilio is the first M&A due diligence marketplace connecting business buyers and investors with quality, verified due diligence experts. Technical, Legal, Financial, Operations, Marketing, + More.

🛒 eCommerce

Electric Guitar Repair - $475k + Inv

For sale is a 12-year-old e-commerce business selling a full suite of electric guitar parts and accessories that are used to build, repair, upgrade, modify electric guitars.

Sold across 3 platforms; Run from anywhere

+26% 3-year avg revenue growth

TTM Revenue: $1.4M; Profit: $219k; Margin: 16%

Asking: $475k + Inv; Multiple: 2.17x

✔ What I Like

Good evergreen niche. I assume this is a dropshipping business due to the low margin and “operate from anywhere” but I could be wrong. Nice revenue growth. Valuation appears reasonable. You’ve got Walker Diebel as the broker on this listing.

❓ Questions & Concerns

Is the product differentiated? Who are the suppliers? What are the AOV and CAC? Are there opportunities to expand to other platforms? I’d think that affiliate partnerships would be important here. Are there any in place? The listing mentions high gross margin - where’s the rest of the money going?

You can view the listing on Quiet Light Brokerage.

☁ SaaS

E-Mail Marketing Tool - $88k

For sale is 5.5-year-old Upscribe which is used for sending e-mail newsletters, sequences, and embedding opt-in forms.

Competitors: MailChimp, Substack, ConvertKit, Revue

20k registered users over the lifetime of the company

30-Day Revenue: $3,200; Profit: $1,200; Margin: 38%

TTM Revenue: $40k; Profit: $16k; Margin: 40%

Asking; $88k; Multiple: 5.50x

✔ What I Like

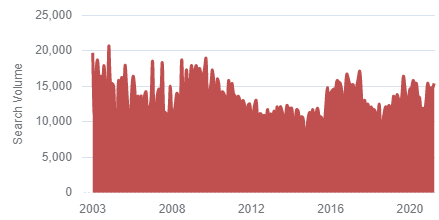

E-mail marketing overall is growing in importance. Especially true as online advertising becomes more expensive. These forms can be embedded across multiple platforms like Medium, WordPress, and more. Large TAM and many competitors to learn from. Search trends for e-mail marketing have been steady over the last few years…

❓ Questions & Concerns

What does this solution offer that the 1k other e-mail marketing tools don’t? Who are the existing clients? Is there a niche that really loves this product and you can double-down on it? How do you market this? The CPC is (unsurprisingly) off the charts…

You can view the listing on MicroAcquire.

————

Family Law Lead Gen SaaS - $150k

For sale is 13-year-old National Family Solutions that is a Saas as well as a lead gen website for family law attorneys. Clients sign up for a flat fee and receive service from a member of an attorney provider network.

250k e-mail list; 15k page views/m; 10k unique visitors/m; 83% is organic;

500 leads/m; 15% conversion; $480 CLTV

30-Day Revenue: $50k; Profit: $7k; Margin: 14%

TTM Revenue: $733k; Profit: $66k; Margin: 9%

Asking: $150k; Multiple: 2.28x annual or 27.4x monthly

✔ What I Like

A well-aged business that’s turnkey. Multiple revenue streams (SaaS + leads). Well-designed website. Large e-mail list. Valuation looks reasonable. Evergreen niche that’s seeing growing demand.

❓ Questions & Concerns

Very low margins. Regulatory questions. According to sellers: “Too much pressure from state agencies that do not like us operating as a threat to the status quo of lawyers that bill clients to the tune of tens of thousands. LegalZoom is experiencing the exact same issues.”

You can view the listing on Flippa.

————

Shopify Sitemap - Open to Offers

For sale is a 4-year-old Shopify App that automatically generates an HTML Sitemap page for Shopify stores. This is important for SEO.

Competitors: SEO Sitemap Builder, Sitemapper, Sitemap & NoIndex Manager

$36k ARR;

30-Day Revenue: $2,520; Profit: $2,420; Margin: 96%

TTM Revenue: $28k; Profit: $27k; Margin: 96%

Asking: Open to Offers

✔ What I Like

A niche product that every store/website needs. Some operating history, good margins, nice revenue. Built by dev team so I assume the tech is solid. Maybe some easy marketing wins. Would be perfect for someone who already has an app or two on the store to cross-sell.

❓ Questions & Concerns

Competitive niche. Might require $$ to build additional features in order to differentiate and scale. How are users acquired? What’s the churn? Can pricing be increased for an easy win? Gut feeling tells me that Shopify could & will add this as a standard feature.

You can view the listing on MicroAcquire.

————

Financial Risk Software - $850k

For sale is 7-year-old Pocket Risk which is software that helps financial advisors assess how much investment risk their clients are willing to take.

Competitors: Riskalyze, Toleri$k, Finamentrica

Tech: AWS, RoR, PostgreSQL

$3,550 CLTV

30-Day Revenue: $13k; Profit: $11k; Margin: 85%

TTM Revenue: $120k; Profit: $102k; Margin: 85%

Asking: $850k; Multiple: 8.33x

✔ What I Like

Good operating history. Proven product with a large TAM. High CLTV. Great margins. I’d think the client base is sticky. Founder focused on the product.

❓ Questions & Concerns

Product-focused founder, so there is a large question mark around marketing and customer acquisition. That margin will shrink if you have to run marketing experiments. Requires investment to add new features and integrations. Valuation is on the higher end.

You can view the listing on MicroAcquire.

🕸 Content/Marketplace/Service

Dev Job Newsletter - $6k

For sale is a 1.5-year-old newsletter that shares freelance web developer jobs from a variety of sites. They recently added a job board to drive additional revenue.

Tech: Webflow, Jetboost, Typeform, Mailerlite

5.7k subscribers

TTM Revenue: $2,010; Profit: $1,072; Margin: 53%

Asking: $6k; Multiple: 5.60x

✔ What I Like

Evergreen niche. Plenty of advertisers to target. Nice subscriber base. Already made some revenue from sponsors. Job board is a natural extension. Nice acquisition for someone who wants to skip some of the early pains of starting a newsletter.

❓ Questions & Concerns

Feels like there are a lot of newsletters targeting this market. Newsletters are all about getting subscribers and engagement. If you have that, sponsors and other opportunities will come. I’d ask about the usual newsletter metrics as well as the results that the sponsor saw from the ad.

You can view the listing on MicroAcquire.

🧐 What I Learned Last Week

——

Curated content in your inbox

I’m limited by the amount of content I can share in this 1x week newsletter. That includes limits on listings and WILLW. There’s tons more content I can share in this section that I think y’all would find interesting. I’m talking curated links to articles, tweets & threads, insights, conversations I’m having, new tools/resources, and more. I want to split this section into a separate e-mail that would go out Friday or Saturday. I’d love your opinion on this.

What do you think? Get some relevant, bite-sized curated content Friday/Saturday?

——

Save on taxes

Codie Sanches is a content machine. She’s also involved in tons of cash-flowing businesses. Someone just told me that she highlighted my Deal Sourcing Guide in a module in one of her courses - nice (explains the 30+ new signups over the weekend). Anyhow - her recent newsletter goes over some basic ways a CPA can save you taxes. Some highlights:

Right about the 32% tax rate bracket. Once you hit $165k as a single person or $326k as a married couple, you must find ways to not make money.

Basics: Setup S-Corp, buy an office building, buy real estate, create a trust

Advanced: Tax credits, captive insurance, remote business property, historic credits

How A CPA 🧾 Shaves Off 6 Figures in Taxes With These 5 Steps

——

Search fund structures

Yale School of Management published a 19-page study “Exploring Various Search Fund Structures”. The title is self-explanatory. Many of the concepts apply outside of search funds as well.

——

Independent Sponsors

Another great one from bloom venture partners. This time they’re talking about the rise of independent sponsors, what are they, and why they’re attractive to investors. At DueDilio, we get a good amount of due diligence projects from these entities. Check out: The rise of Independent Sponsors

——

Distribution = revenue

I’ve failed at enough business ventures to know that distribution is most important. Great product? No one cares. Great team? Good for you. Great distribution? That directly translates to revenue. Andrew Gazdecki of MicroAcquire shared some great resources he put together for 500 Startups (accelerator) about getting distribution right.

——

Honest commentary on VCs

I first heard about Carey Smith and his business Big Ass Fans on the My First Million Podcast. Carey is a no-nonsense entrepreneur and tells sit like it is. His latest article is a must-read: An Insider’s Perspective On VC Craziness And The Startup Bubble

On the same note - My First Million Podcast and the All-In Podcast are two of my favorites right now.

——

Twitter highlights…

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.