The Business Inquirer #044

In this week's issue, I highlight eight listings including a keto-friendly food brand, a SaaS for Amazon merchants, and a marketing research company.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

Two quick announcements…

1) Thank you to everyone who shared their feedback on separating the “What I Learned Last Week” section into its own weekly e-mail. And the survey says - 91% YES.

What I Learned Last Week will be a separate e-mail sent out on Friday or Saturday. It will include links to interesting articles, resources, Twitter threads, commentary, and anything else I feel is relevant.

If the additional weekly e-mail is not your jam, you can simply hit unsubscribe when you get the first issue. You’ll still be subscribed to this one with the listings.

2) With the Jewish holiday of Rosh Hashanah next week, I will not be publishing a TBI. Shanah tovah um'tukah to all those who will also be celebrating.

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 3 listings

🕸 Content/Marketplace/Service - 4 listings

The Business Inquirer is brought to you by DueDilio. DueDilio is the first M&A due diligence marketplace connecting business buyers and investors with quality, verified due diligence experts.

🛒 eCommerce

Keto Packaged Food FBA - $450k + Inv

For sale is a 3-year-old FBA business selling Keto-friendly, low-calorie, low-carb packaged foods. Most sales are through Amazon but also a DTC website.

99% lifetime positive rating

TTM Revenue: $1.2M; Profit: $201k; Margin: 16%

Asking: $450k + Inv; Multiple: 2.24x

✔ What I Like

The seller is passionate about the business and has a personal story attached. The Keto diet is popular with a large TAM. Opportunity to drive more sales through the website as well as expand to other distribution channels. Valuation is reasonable.

❓ Questions & Concerns

How much business is driven by the owner’s personal story? Can the new owner keep it as part of brand marketing? Who are the manufacturing partners of the food? Any specific licensing or regulation required? How shelf-stable is the food? Has inventory management ever been an issue? Small margins are concerning. Has interest in Keto peaked?

You can view the listing on Quiet Light Brokerage.

☁ SaaS

Matchmaking for Muslims - Open to Offers

For sale is a 5-year-old matchmaking SaaS specifically for the Muslim community. The platform can be modified to support other communities.

Competitors: MuzzMatch, Minder

Strong brand name; $3-$5 CAC; 11 person team;

30-Day Revenue: $17k; Profit: $4k; Margin: 24%

$200k ARR; Asking: Open to Offers

✔ What I Like

A few years of operating history. Great niche with a large TAM. Low CAC. Built by tech team so the product is solid and easy to maintain. The listing mentions a strong brand name. Opportunity to expand to other markets.

❓ Questions & Concerns

Feels like margins should be higher for this business model. What does the 11 person team do? Large team relative to revenue. How are customers acquired?

You can view the listing on MicroAcquire.

————

SaaS for Amazon Merchants - $545k

For sale is a 1.5-year-old software business for Amazon sellers that helps with package inserts and rebates that lead to more and better reviews.

Mix of recurring (65%) & affiliate (35%) revenue

$105 CAC; $423 CLTV; 68% trial to paid conversion;

Y/Y Revenue +155%

TTM Revenue: $230k; Profit: $129k; Margin: 56%

Asking: $545k; Multiple: 4.22x

✔ What I Like

Sellers are experienced Amazon merchants and started the business out of a personal need. Diversified revenue streams. Strong trial to paid conversion rate. Big TAM of Amazon sellers. Nice early growth and margins.

❓ Questions & Concerns

Not a lot of operating history. The strong Y/Y growth doesn’t mean much since it’s (probably) measured off a small base. Amazon is cracking down on fake and sponsored reviews and there may be implications for this type of business as well - although not directly related. The developer is not staying with the business which creates some risk.

You can view the listing on Quiet Light Brokerage.

————

Crowdfunding Marketing Tools - $400k

For sale is a 7-year-old crowdfunding marketing SaaS. Business includes crowdfunding backer directory, PR, and social media tools.

Competitors: Crowdfunder, Crowdfunding

2.5k monthly visitors; 6.5k monthly page views

30-Day Revenue: $9k; Profit: $8.7k; Margin: 97%

TTM Revenue: $170k; Profit: $140k; Margin: 82%

Asking: $400k; Multiple: 2.86x

✔ What I Like

Well aged business. Strong margins with a reasonable multiple. Wonder if equity crowdfunding is part of the TAM here. Could be interesting acquisition for someone in a similar space.

❓ Questions & Concerns

Listing is not very detailed. Not a lot of clarity on how clients are acquired. Unclear where the recurring revenue comes from. Why are owners selling? Commentary like this in the listing is a huge turnoff…

Never knew that a business could present a great growth opportunity if I’m able to scale it 20x. You learn something new everyday.

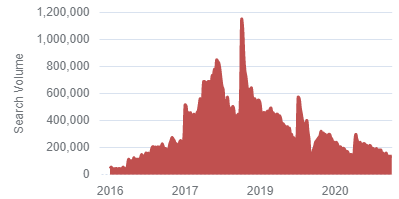

Steady decline in interest for crowdfunding but perhaps it starting to stabalize…

You can view this listing on MicroAcquire.

🕸 Content/Marketplace/Service

Graphic Design & Frontend Code Agency - $380k

For sale is a 3-year-old Agency focused on graphic design and frontend code. Clients include brands, SMBs, freelancers, and other agencies.

Competitors: DesignPickle, Penji, Kimp

Automated customer lifecycle

Tech: WordPress; Majority of new clients from organic search and referrals;

30-Day Revenue: $17k; Profit: $10k; Margin: 59%

TTM Revenue: $150k; Profit: $90k; Margin: 60%

Asking: $380k; Multiple: 4.22x

✔ What I Like

A few years of operating history. Growing demand and TAM. New clients coming organically with (assuming) very low CAC. Strong margins. Multiple isn’t crazy if there’s enough growth to back it up. Listing mentions a lot of the workflows are automated. That makes this business more attractive.

❓ Questions & Concerns

Unclear who does the actual work. Hiring can be difficult which could lead to scalability issues. A very competitive market. Will clients churn if a new owner comes in? Relying on organic search for the majority of new clients is a double-edged sword. Google algo changes and your ranking could drop. What differentiates this Agency from others?

You can view the listing on MicroAcquire.

————

B2B Marketing Data Company - Open to Offers

For sale is a 10-year-old B2B market research, consulting, and training company. The business helps clients research buyer personas and create tailored marketing strategies. Owner is retiring.

30-40 engagements per year

80% of revenue comes from existing clients or referrals

Owner involved day-to-day with support from remote staff

Proprietary database of buyer insights; Research Intake App

2021 Est Revenue: $2.1M; Profit: $1.3M; Margin: 62%

Asking: Open to Offers

✔ What I Like

Well aged business that can be operated virtually anywhere. Well known brands as clients. Low CAC since most new clients are referrals. Seller will train new owner and is flexible on transition plan. Opportunities to monetize the data and the Intake App. Would make an interesting acquisition for someone in similar field and can bring additional services.

❓ Questions & Concerns

High-touch service business. No recurring revenue. I assume it’s a very long sales cycle. Seller has many connections that bring in business, how does this transition? Is there a key man risk? Will the other employees stay with business? What’s the competition? How would new clients be acquired?

You can view this listing on Searchfunder.

————

Live Video Chat Mobile App - $305k

For sale is a live video chat mobile app that enables users to get on video calls with other random users. Revenue is generated when users buy/earn virtual currency to get on video calls.

1.2M downloads in LTM; +180k organic new users every month;

TTM Revenue: $125k; Profit: $69k; Margin: 55%

Asking: $305k; Multiple: 4.42x

✔ What I Like

Business seems like it would be very addicting. Strong margins. Valuation isn’t crazy considering the growth trajectory. A lot of opportunities for additional monetization like upsells, ad networks, etc.

❓ Questions & Concerns

A lot of questions around moderation, regulation, and content. What’s the demographic of the users? What are the DAU and MAU numbers? How are users acquired and what’s the CAC? What’s a typical CLTV?

You can view the listing on BuySellEmpire.

————

Finance Blogs - $8,500

For sale is 12-year-old Currency Converter Calculator finance blog that’s been neglected. Sale includes a 2nd sister website with the same content but in the Spanish language. Revenue from guest posts and display ads.

Authority Score: 34; Referring Domains: 581; Backlinks: 30.2k; KW: 249k;

90k page views/m; 32k visitors/d;

30-Day Revenue: $145 from ads, $545 from guest posts

Asking: $8.5k (reserve not met)

✔ What I Like

Reading the comments section, I get a good feeling about the seller and their trustworthiness. Traffic steadily increasing since they optimized the site for mobile. A lot of ways to monetize the website/traffic. Not sure what the reserve is but current price is attractive.

❓ Questions & Concerns

Content websites are not my thing so there’s a very high chance that this is a horrible listing and I just don’t see it. Find someone on DueDilio to help you with due diligence.

You can view this listing on Flippa.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.