The Business Inquirer #047

In this week's issue, I highlight 13 listings including AR software for SMBs, software for photographers, a Twitter scheduling tool, and an e-commerce web development Agency.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 6 listings

🕸 Content/Marketplace/Service - 6 listings

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio. DueDilio is the first M&A due diligence marketplace connecting business buyers and investors with quality, verified due diligence experts.

🛒 eCommerce

Pet Food eCommerce - $279k

For sale is a 6-year-old producer of high-quality dog nutritional products focused on reducing joint paint and increasing mobility and comfort.

Fulfillment done by FBA, Chewy, and in-house

Wholesale & retail customers;

Turnkey business with all operations cloud-based; Can be operated anywhere;

TTM Revenue: $120k; Profit: $67k; Margin: 56%

Asking: $279k; Multiple: 4.16x

✔ What I Like

A lot of operating history. Large TAM with very engaged buyers. Product focused on a niche. Strong margins. Wholesale and retail clients. Simple business to operate with sellers providing full training.

❓ Questions & Concerns

A lot of key details missing from the listing. Unclear who does the manufacturing of the pet food. Why have sellers not scaled this business further in 6-years? Valuation is elevated.

You can view the listing on BizBuySell.

☁ SaaS

AR Software for SMB - $2.2M

For sale is a 4-year-old SaaS that automates the accounts receivable process for SMBs. The software automates invoicing and payments resulting in 80% time savings for users. The seller is the second owner of the business.

Integrates with QBO, Xero; Approved app on Clio;

2-year avg contract length; $2k LTV;

Focus on SEO; 7k monthly visits; 1,340 KW rankings; 13k e-mail subs;

3-person team;

TTM Revenue: $837k; Profit: $281k; Margin: 34%

Asking: $2.2M; Multiple: 7.83

✔ What I Like

Some operating history. Decent contract length and LTV. I assume these are sticky contracts with not a lot of churn. I like the focus on SEO. In general, this will be a huge advantage for any company as paid advertising becomes more and more expensive. Sounds like there are a lot of opportunities to add additional integrations as well as go after new industries.

❓ Questions & Concerns

I believe this is a very competitive space. Besides SEO, how are clients acquired and what’s the CAC? Does this business need a dedicated sales team in order to grow? What’s the reason that clients churn? How has growth looked like? Seller purchased the business in 2017 and completely reworked it - what’s the real operating history? How’s the tech stack? Why are the margins not higher? Valuation is elevated so I’d want to make sure it’s justified.

You can view the listing on WebsiteClosers.

————

Twitter Scheduler - $75k

For sale is a 1.5-year-old microSaaS that is a Twitter tool to grow an audience. It includes analytics, scheduling, and more.

Competitors: Feedhive, Threadstart, Hypefury

1-person team; Organic growth; $6k ARR;

30-Day Revenue: $403; Profit: $300; Margin: 74%

TTM Revenue: $4k; Profit: $3k; Margin: 75%

Asking: $75k; Multiple: 16.67x (est)

✔ What I Like

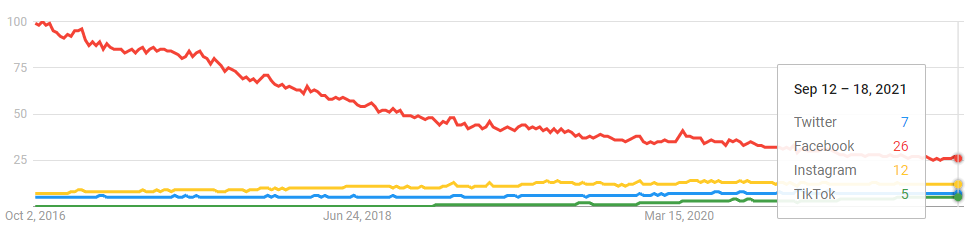

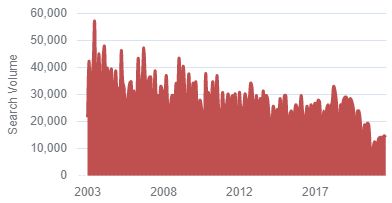

I think Twitter is growing in importance but I realize I am a heavier user than 99% of the population so I may be wrong. Here are some Google Trends data comparing Twitter to other popular social networks…

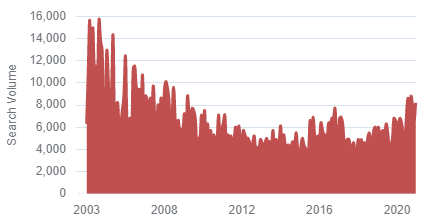

Search for Twitter analytics is relatively strong…

Back to the business itself. There’s some minimal traction as the seller was able to get subscribers through organic reach. Pricing seems cheaper than other solutions on the market and this could appeal to a niche audience.

❓ Questions & Concerns

Very early in the business. Needs someone with marketing know-how and capital in order to grow/scale. Valuation is a bit ridiculous but I’m sure there’s room to negotiate.

You can view the listing on MicroAcquire.

— — — —

Real Estate Data - Open to Offers

For sale is a 12-year-old real estate Saas that automatically imports and updates all financial, REO portfolio, and non-performing loan data for every bank and credit union in the US. Not a lot of detail in the listing.

4-person team; No direct competitors

Tech: WordPress, PHP, AWS, Lambdas, Node

30-Day Revenue: $51k; Profit: $26k; Margin: 51%

TTM Revenue: $586k; Profit: $300k; Margin: 51%

Asking: Open to Offers

✔ What I Like

A lot of operating history. Niche business. Great margins. Simple tech stack.

❓ Questions & Concerns

The seller is not interested in financing or earnouts. The listing mentions that there are no direct competitors, why is that? Hard to imagine a great business not having any competitors after 12-years. Have to ask the typical SaaS due diligence questions. Requires someone who is familiar with this industry.

You can view the listing on MicroAcquire.

— — — —

Studio Management Software for Photographers - Open to Offers

For sale is a 6-year-old SaaS that helps photographers manage their business with features such as online booking & scheduling, automated workflows, contract management, invoicing, scouting location management, questionnaires, and more.

Competitors: Honeybook, Dubsado, 17Hats

5-person team; Pipe financing available;

30-Day Revenue: $46k; Profit: $7k; Margin: 15%

TTM Revenue: $546k; Profit: $52k; Margin: 10%

Asking: Open to Offers

✔ What I Like

Some operating history. Niche market. Could be an opportunity to serve additional industries with the same software. A few competitors to learn from.

❓ Questions & Concerns

Unless there’s some calculation issue, there is something fundamentally wrong with this SaaS business to operate for 6-years and achieve 10% margin. Seeing a lot of competition in the space that listing doesn’t mention. I think this listing needs a buyer who can rework the business and knows how to scale it.

You can view the listing on MicroAcquire.

— — — —

Community Plugin for WordPress - $30k

For sale is a 7-year-old Users Ultra community WordPress plugin including 36 add-ons. Not a lot of detail in this listing.

Annual subscription license; 5.9k active subscriptions;

Avg monthly revenue: $2.8k

✔ What I Like

Not a lot of detail in the listing so tough to measure the health of the business. There’s a lot of operating history. Nice revenue base with a large amount of active subscriptions. I assume the margin is pretty high so valuation could be attractive.

❓ Questions & Concerns

There’s no detail in the listing so tons of questions.

You can view this listing on SideProjectors.

The same seller is selling this WordPress plugin as well - Easy WP Members - $7.9k

🕸 Content/Marketplace/Service

Online Mentor Platform - Open to Offers

For sale is 2.5-year-old Transizion which is an educational platform that pays young professionals to mentor students. Focus is on test prep, college admissions, and career mentoring. Revenue is generated through subscriptions.

Competitors: CollegeVine, Empowerly, Crimson Education

Raised $230k SAFE; 6-person team;

30-Day Revenue: $50k; Profit: $20k; Margin: 40%

TTM Revenue: $600k; Profit: $40k; Margin: 7%

Asking: Open to Offers

✔ What I Like

Evergreen niche. A lot of competitors to learn from including some large ones that could be strategic acquirers down the line. Listing mentions proprietary software. Interesting listing for someone who is in a similar space.

❓ Questions & Concerns

This is a startup. Some funky numbers in the listing. I assume that they spent a lot of money on advertising and software development which is why the TTM margin is so low. If you’re interested in this listing, I’ve got the perfect due diligence partner for you.

Interesting to see that search volumes for SAT prep have been steadily declining. Maybe this isn’t such an evergreen niche as I thought…

You can view the listing on MicroAcquire.

————

Digital Education for Moms - $3.7M

For sale is a 6-year-old digital education and ecommerce business that helps educate moms about starting an online business. Revenue is generated from courses, ebooks, templates, and affiliate marketing.

1.1M social media followers; 70k e-mail subscribers;

TTM Revenue: $977k; Profit: $862k; Margin: 88%

Asking: $3.7M; Multiple: 4.29x

✔ What I Like

A lot of operating history. Started as a hobby by the seller. Great niche. Strong margins. Large e-mail list to market to. A lot of opportunities for additional products, affiliate agreements, and more.

❓ Questions & Concerns

Is there any key-woman risk? How much of the business brand relies on the seller? How are customers acquired and for how much? How can the business be scaled further? Why are the sellers selling?

You can view the listing on BizBuySell.

— — — —

Transalation Services - $5M

For sale is 4-year-old Stillman Translations that provides global language translation services. Matches translation experts with machine translation to provide perfect translations, editing, and proofreading.

Mostly remote workforce;

231% 3-year revenue growth; 336% 3-year SDE growth;

TTM Revenue: $3.7M; Profit: $1.8M; Margin: 49%

Asking: $5M; Multiple: 2.78x

✔ What I Like

Large TAM. The company serves other translation service providers which send steady business. Great margins. Valuation seems reasonable. Demand appears to be picking up for translation services.

❓ Questions & Concerns

How are technology and automation impacting this industry? Listing mentions there are offices in multiple countries - can this business be fully remote? Are there any required certifications or regulations for this business?

You can view the listing on BizBuySell.

— — — —

eCommerce Web Development & Support Agency - $649k

For sale is a 7-year-old website design and support agency focusing on e-commerce businesses.

50/50 revenue split between development & support

$73k avg LTV; 78% of support clients request new dev work;

Owner spends 40-50 hours a week on the business

TTM Revenue: $541k; Profit: $141k; Margin: 26%

Asking: $649k; Multiple: 4.60x

✔ What I Like

A lot of operating history. I like how the business is structured in that clients buy set blocks of time and not just pay by the hour. Large TAM. Maybe an interesting add-on for an existing agency.

❓ Questions & Concerns

This is a job, not a business. Valuation seems high unless there are a lot of addbacks.

You can view this listing on WebsiteClosers.

— — — —

Software Dev & Vendor - $4.4M

For sale is a software developer and vendor that specializes in developing add-ons and apps for MS SharePoint and Office 365. Also offers training and consulting services.

60% recurring revenue; 5,500 clients worldwide;

TTM Revenue: $2M+; SDE: $1M+; EBITDA: $1M+

Revenue Multiple: 1.99x; EBITDA Multiple: 4.33x; SDE Multiple: 3.77x

You can view this listing on BizNexus.

— — — —

Lead Gen - Open to Offers

For sale is 6-year-old GrowthList which is a lead gen service providing an updated list of well-funded B2B tech startups to sales teams. Reach out to Chris (@KintuLabs) on Twitter for more details.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount.

PrivSource - Deal aggregator for lower and middle-market listings.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.