The Business Inquirer #052

In this issue, I highlight six listings including a coffee substitute brand, a team-building SaaS, and an ERP software business.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

I just want to say thank you for being a subscriber to TBI. This is the 52nd issue which means that I’ve been writing this newsletter for a year now. Crazy how time flies. Thanks for allowing me into your inbox.

I also want to provide a quick update on Deal Flow Scout. We have 37 active search mandates posted. I also added a deal directory. You can post deals that you have passed on or ones that just came across your desk. The goal of Deal Flow Scout is to facilitate the free, open, transparent sharing of deal flow.

In this week’s issue:

🛒 eCommerce - 2 listing

☁ SaaS - 3 listings

🕸 Content/Marketplace/Service - 1 listing

🛠 Tools & Resources

The Business Inquirer is brought to you by Wynter. Wynter is a messaging research tool focused on copy. It gets you data from real people on where your messaging misses the mark, so you can fix it and convert more customers.

Want to give back to the community while having a low-key side hustle?

Join Wynter’s research panels. Take 10’-15’ market research surveys, get paid up to $50 per survey. Learn more and sign up.

🛒 eCommerce

Mushroom Drinkable Blends - $400k

For sale is 2-year-old Super Shrooms which is an e-commerce brand selling ready-to-drink mushroom blends that boost energy. Based out of Australia.

$46 AOV; 7k TTM orders; 9,254 TTM customers;

16k page view/m; 5k unique visits/m;

Built on Shopify

Avg monthly revenue: $36k; Profit: $25k; Margin: 69%

TTM Revenue: $435k; Profit: $296k; Margin: 68%

Asking: $400k; Multiple: 1.35x

✔ What I Like

Very popular niche. Read any of the thousands of “3 business ideas you can start today” newsletters and something about mushrooms comes up in each issue. For a reason…

I recently watched Fantastic Fungi on Netflix and would recommend it. A bit promotional but it’s good nonetheless. Anyhow…

The traffic and financials are steady. Nice margins. They’ve grown only through paid marketing so I assume they have that nailed. Website and photos are well done. Buyer could explore additional distribution channels like wholesale. Perhaps expand into the US market.

❓ Questions & Concerns

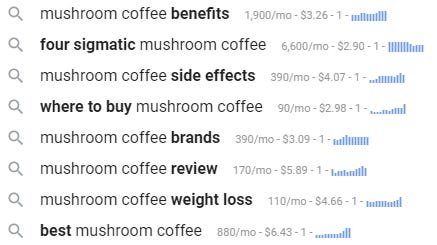

Very popular niche with competitors popping up daily. Business is based in Australia and fulfillment is done in-house. Client acquisition is all through paid channels and the cost of those is going up (see above). Not sure if this is somehow regulated as a supplement.

You can view the listing on Flippa.

————

DTC Apparel for Military, Policy, Fire - $1M

For sale is a 4-year-old DTC brand selling gear and apparel for military, police, and firefighters. Top 500 on Inc 5k list. Interesting listing. Open to deal structures.

Competitors: GruntStyle

TTM Revenue: $1.9M; Profit: $150k; Margin: 8%

Asking: $1M; Multiple: 6.67x

✔ What I Like

I want to know more about this business and the products it sells. If it’s anything like FIGS then it’s a very interesting space. I have a feeling it’s not the same but want to highlight it. If you’re not familiar with FIGS, they basically created the lululemon of medical scrubs. Fascinating $10M - $50M business. Google them.

❓ Questions & Concerns

Have to dig into the numbers. 8% margins with no advertising costs seem to me like a sinking ship but who knows. The competitor they mention in the listing is just a print-on-demand store.

You can view the listing on MicroAcquire.

☁ SaaS

Team Building Quiz - $1.3M

For sale is a 4-year-old team-building SaaS that provides weekly trivia quizzes that the whole office can participate in.

Competitors: Quizbreaker, Donut, GameMonk

20k paid users across 850 companies; Google, Bain, Amazon, etc.

Includes web app, Slack app, MS Teams app;

TTM Revenue: $295k; Profit: $185k; Margin: 63%

Asking: $1.3M; Multiple: 7.03x (5.91x est)

✔ What I Like

Relatively detailed listing. Love the numbers here. Solo founder spending 3-4 hours a week. 63% margins. Revenue growing 3-15% per month. All growth is organic. No customer concentration. Large client base with name-brand clients.

❓ Questions & Concerns

Need to understand the marketing costs and CAC. If it’s sold to enterprise customers, how is that sales process handled? Hiring a sales team will shrink those margins. On annualized estimated numbers, the valuation isn’t crazy but a lot of things have to go right.

You can view the listing on MicroAcquire.

————

Scheduling & Invoicing for Sports - $1.5M

For sale is a 9-year-old invoicing and scheduling SaaS serving the sports industry.

Low operating cost and time commitment; 2-person team;

Qualifies for Pipe financing;

30-Day Revenue: $54k; Profit: $48k; Margin: 89%

TTM Revenue: $300k; Profit: $254k; Margin: 85%

Asking: $1.5M; Multiple: 5.91x

✔ What I Like

Not a lot of detail in the listing but I like niche SaaS. Great margins. Doesn’t seem to require a large team to operate. The listing says low workload. A lot of operating history.

❓ Questions & Concerns

What has prevented additional growth? How are clients acquired? Any client concentration risk? Who are the competitors?

You can view the listing on MicroAcquire.

— — — —

ERP Software for Manufacturing SMBs - $1.1M

For sale is a 34-year-old ERP software business that in 2007 entered the manufacturing market for SMBs. A stagnant business that needs a turnaround.

Owner retired in 2014 and business is on autopilot; No growth;

TTM Revenue: $600k; Profit: $337k; Margin: 56%

Asking: $1.1M; Multiple: 3.26x

✔ What I Like

Confusing listing but perhaps there’s a good turnaround opportunity here for the right buyer. The business has been generating $600k in sales for 7-years from the same clients so I assume they’re doing something right.

❓ Questions & Concerns

Too many to list.

You can view the listing on BusinessesForSale.

🕸 Content/Marketplace/Service

Coding Educational Website & Community - $275k

For sale is a 2-year-old website and community containing curated roadmaps, study guides, and resources for aspiring coders/developers. Unmonetized

47 Authority Score; 55k backlinks; 100k organic visits/month;

50k Gum Road subs; 38k e-mail subs; 7k views/day of GitHub repository.

Unmonetized

Asking: $275k

✔ What I Like

High authority score, good backlink profile, a lot of organic visitors. There could be a lot of opportunities here for someone who has experience with community or course monetization.

❓ Questions & Concerns

Great metrics except for the one that actually counts, revenue. Why is the seller listing it without monetizing it? Requires due diligence to validate the traffic numbers and their quality. How many subscribers and repeat visitors does this website get? Was asking price just a dart throw?

You can view the listing on BizBuySell.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount.

PrivSource - Deal aggregator for lower and middle-market listings.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - peer-to-peer deal flow exchange. Free, open, transparent.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.