The Business Inquirer #053

In this week's issue, I highlight eight listings including a Shark Tank backed brand, a real estate CRM, and a winery management SaaS.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 6 listings

🕸 Content/Marketplace/Service - 1 listing

🛠 Tools & Resources

The Business Inquirer is brought to you by Domain Magnate.

Investing in online businesses can offer strong yields, upside potential and is a non-correlated asset to add to your portfolio. But statistically, beginners are likely to lose money on their first deal.

This is because online businesses are high-risk assets, where, for example, the wrong kind of SEO applied can lead to large drops in organic search traffic after Google algorithm updates.

Domain Magnate has been buying businesses and doing deals for the past 15 years, and have developed their own private deal flow.

They have a weekly newsletter where they offer industry news, podcasts, case studies, and their own off-market deal flow. They also offer investment services that offer a hands-off approach to ownership, such as their buy & manage service and fund (open to accredited investors). Subscribe to learn more.

🛒 eCommerce

Afro-Centric Hair Comb - $4M

For sale is a 3-year-old Shark Tank backed e-commerce business that sells a comb for afro-centric hair. Before seeing this listing, someone reached out to me asking if I can connect them with anyone who would want to partner up on this acquisition. If you are interested, please e-mail me.

Backed by Mark Cuban & Daymond John

5 products; 2 utility patents; 1 Trademark;

Sold wholesale, direct, and Amazon; 43% Y/Y growth rate;

TTM Revenue: $1.5M; Profit: $691k; Margin: 46%

Asking: $4M; Multiple: 5.79x

✔ What I Like

I actually remember this Shark Tank episode. The founder is very charismatic. Simple product with an affordable price point. Very large TAM. Lifetime of free publicity as long as Shark Tank is airing on TV. Large and growing social media presence. A lot of opportunities to add complementary products.

❓ Questions & Concerns

Why are the owners selling? How sustainable is the business model? As advertising rates go up, how has that impacted the business? Are COGS going through the roof? Is this a one-time purchase?

You can view the listing on WebsiteClosers. (Reach out if you want to partner with someone)

☁ SaaS

Interview Prep for Coders - $150k

For sale is a 1.5-year-old SaaS that is an all-in-one place for coding interviews. The platform helps developers prepare for hiring interviews.

Competitors: Leetcode

200+ coding problems, mock interviews, 50+ videos, data structures & algorithms course.

Quarterly & annual subscriptions

30-Day Revenue: $1.6k; Profit: $1.550k; Margin: 97%

TTM Revenue: $11k; Profit: $10k; Margin: 91%

Asking: $150k; Multiple: 15x

✔ What I Like

Interesting SaaS in that I see a lot of ways this can be used. You can keep the existing model and add a job listing component, resume prep, and other add-ons to serve the client base. You can offer this product to people/companies who want to hire a developer but have no easy way of testing their skills. As the listing mentions, the clients are valuable software engineers seeking jobs. Appears that Pramp is the big competitor here and getting all the search traffic.

❓ Questions & Concerns

Listing mentions that there’s no advertising, then how are clients acquired? How do you keep the content fresh? What does this solution offer that Pramp doesn’t? Valuation is ridiculous.

You can view the listing on MicroAcquire.

————

Office Relocation Management - $990k

For sale is a 27-year-old property management cloud-based SaaS that helps tenants manage their physical office moves with efficiency. Helps manage deadlines, deliverables, expenses. Seller transitioning from partial to full retirement.

Owner works ~24 hours per week; Can be operated anywhere;

TTM Revenue: $237k; Profit: $196k; Margin: 83%

Asking: $990k; Multiple: 5.05x

✔ What I Like

Very long operating history by the same owner. I don’t have raw data but have to assume that right now a lot of businesses are relocating and moving offices due to various factors. May be a good bolt-on acquisition for someone in the same industry.

❓ Questions & Concerns

Listing mentions California. Is that the only market it operates in? How long has the current owner been semi-retired? There’s a risk that competitors have leapfrogged this business and a new owner can’t grow it. A lot of due diligence is required here.

You can view the listing on BusinessesForSale.

— — — —

DMCA Takedowns - $59k

For sale is a 5-month-old micro-SaaS that scans the internet for illegal copies of content and then sends DMCA Takedowns to Google and hosting sites.

Competitors: RedPoints, Rulta, MarqVision

All organic marketing;

30-Day Revenue: $828; Profit: $650; Margin: 79%;

Asking: $59k; Multiple: 7.56x

✔ What I Like

Business has some traction. I can see how this type of software/service would be in very high demand as the creator economy expands. Opportunities to partner with creator platforms.

❓ Questions & Concerns

Very young business. Unclear how sustainable it is and if it can compete with other offerings. Early traction is not indicative of future performance. What happens once the organic traction ends? Very risky acquisition.

You can view this listing on MicroAcquire.

— — — —

Winery & Vineyard Management - Open to Offers

For sale is a 20-year-old software that enables wineries to efficiently measure and control every step of the production process.

Small to multi-national clients;

5-employees; Founder available to stay on as a consultant;

TTM Revenue: $1.2M; Profit: $404k; Margin: 34%

Asking: Open to Offers

✔ What I Like

Very large TAM. Can probably barter software license for wine 🍷 🤣. One bottle of Screaming Eagle in exchange for a 12-month subscription?

❓ Questions & Concerns

I’d be curious to understand pricing strategy. Is there any client concentration? What’s the churn? There’s a lot of consolidation in the wine industry so understanding industry dynamics is important. This is for someone who knows the wine industry or has complementary products.

You can view this listing on BusinessesForSale.

— — — —

AI Sales & Support - $1.7M

For sale is a 10-year-old B2B SaaS that combines real-time chat support with AI. Shopify App and WordPress plugins are included in the sale.

2.2M page views LTM; 720k backlinks;

$670 LTV; 4.7% churn; 4.8 rating on Capterra;

TTM Revenue: $500k; Profit: $313k; Margin: 63%;

Asking: $1.7M; Multiple: 5.43x;

✔ What I Like

Well-aged business. Recurring revenue. High LTV and relatively low churn. Nice margins. Large competitors to learn from such as Zendesk and LiveChat. The market for online chat software is expanding. Could be interesting if this particular software focuses on a niche.

❓ Questions & Concerns

Not a lot of detail in the listing. What’s the tech stack and how much does it cost to maintain? Does this business focus on a particular niche? Could be hard to compete if it doesn’t. How are clients acquired? Can you increase pricing for an easy win?

You can view the listing on FE International.

— — — —

Real Estate CRM - $500k

For sale is a 13-year-old CRM software for real estate agents.

289 active clients; 6.5% customer churn; $9.6k MRR;

TTM Revenue: $126k; Profit: $99k; Margin: 79%

Asking: $500k; Multiple: 5.05x

✔ What I Like

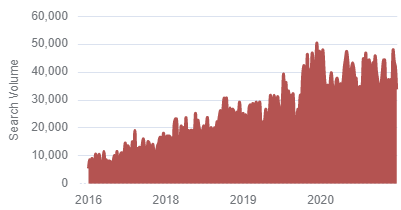

Well-aged business. Recurring revenue. Nice margins. Very large TAM. CRM software is well known so there’s no need to educate the market. Can grow by adding add-on services and/or partnering with other providers.

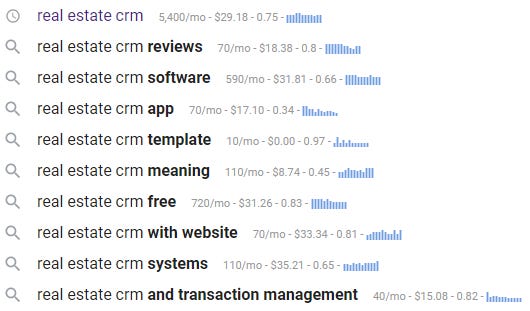

❓ Questions & Concerns

Very competitive industry with a lot of large and small players. I think you have to keep adding features in order to stay competitive. What’s the LTV? How are clients acquired? The CPC is very expensive for this niche.

You can view this listing on FE International.

🕸 Content/Marketplace/Service

Dropshipping Web Dev Agency - $238k

For sale is a 1-year-old web development agency that specializes in creating new Shopify-based dropship websites for aspiring entrepreneurs.

Competitors: Alidropship, Dropship Lifestyle

Tech: Shopify, Slack, Everwebinar, Active Campaign

TTM Revenue: $481k; Profit: $178k; Margin: 37%

Asking: $238k; Multiple: 1.34x

✔ What I Like

Dropshipping has a bad reputation but it’s still a very popular business model. I actually think it’s one of the best first-time businesses to start. This business is young but there’s clearly some traction. I would think that affiliate and partnerships would be the right growth strategy here. Might be an interesting acquisition for someone already doing e-commerce development.

❓ Questions & Concerns

Not a lot of detail in the listing. How are clients acquired? If the only way to scale is through paid advertising, those margins will shrink. I think this is a very competitive space. Is there recurring revenue? The new iOS update has had a severe negative impact on dropshipping businesses (which is why you see so many for sale). A lot of due diligence is required for this young business.

You can view the listing on MicroAcquire.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount.

PrivSource - Deal aggregator for lower and middle-market listings.

BizNexus - Deal aggregator, proprietary deal flow, and exit planning.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - peer-to-peer deal flow exchange. Free, open, transparent.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Some interesting SaaS businesses this week. Question: what software or service do you use for the CPC keyword data?