The Business Inquirer #056

In this issue, I highlight six listings including an early childhood education blog, a streetwear e-commerce store, a property management SaaS, and more.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

I want to welcome all the new readers. The Business Inquirer was recently featured in Niall Doherty’s newsletter eBiz Weekly with about 19k subscribers so there’s been a lot of activity.

Reminder - if you’re in Boston and surrounding areas, join me and others in the SMB/entrepreneurship space for networking and beers this Thursday Dec 2nd. Details here: Boston Small Biz Meetup Tickets, Thu, Dec 2, 2021 at 4:00 PM | Eventbrite

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 4 listings

🕸 Content/Marketplace/Service - 1 listing

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is a due diligence concierge connecting business buyers and private investors with quality, pre-vetted due diligence service providers.

Our deep network of 150+ independent professionals, boutique and mid-size firms, and subject-matter-experts enable us to address finance, technology, legal, operations, marketing, and other diligence projects.

Submit your project. Review qualified proposals. Hire diligence provider. Free.

🛒 eCommerce

Streetwear Apparel - $450k

For sale is a 3-year-old Shopify e-commerce store selling premium independent streetwear apparel brands.

5-person team; 60k e-mail list subs;

30-Day Revenue: $77k; Profit: $33k; Margin: 43%;

Asking: $450k; Multiple: 1.14x (est)

✅ What I Like

The business is on-trend as streetwear is a popular clothing style. Margins are pretty good for a clothing e-commerce business. Large e-mail list to market additional products. Shopify is relatively easy to manage. Might be opportunities to expand to other markets. Low multiple.

❓ Questions & Concerns

Not a lot of detail in the listing in terms of sourcing, logistics, returns, AOV, CAC, etc. If this business relies on Facebook ads then those costs have increased dramatically. Is there anything differentiated about this store and the brands that it carries? How reliable are those relationships with brands? What do the 5 employees do and are they staying on with new owner?

You can view the listing on MicroAcquire.

☁ SaaS

AI Sales & Support Software - $1.7M

For sale is a 10-year-old B2B SaaS that combines real-time chat support with AI. Includes a Shopify app and WordPress plugin.

2.2M pageviews in LTM; 720k backlinks;

$42k MRR; $670 LTV; 4.7% churn;

4.8 rating on Capterra;

LTM Revenue: $500k; Profit: $313k; Margin: 63%

Asking: $1.7M; Multiple: 5.43x

✅ What I Like

Long operating history. Low churn. High LTV leaving enough margin to profitably acquire customers. The website appears to have a strong SEO profile and traffic. Nice margins. Includes a Shopify and WordPress plugin.

❓ Questions & Concerns

This is a crowded space with a lot of options. How is this differentiated? Would a new owner require knowledge of AI to maintain? What are the growth channels that have been succesful? Is there a specific niche that this solution targets?

You can view the listing on FE International.

————

Property Management - $500k

For sale is an 8-year-old all-in-one property management SaaS that allows users to collect rent, screen tenants, track accounting, manage tenant communication, work orders, and more. Used by property owners, managers, and tenants.

Competitors: Buildium, Zillow Rental Manager, Cozy, AppFolio

Bootstrapped; Single owner;

TTM Revenue: $72k; Profit: $0;

Asking: $500k

✅ What I Like

Clearly defined market with a large TAM. Large competitors to learn from. Sticky clients. Evergreen niche.

❓ Questions & Concerns

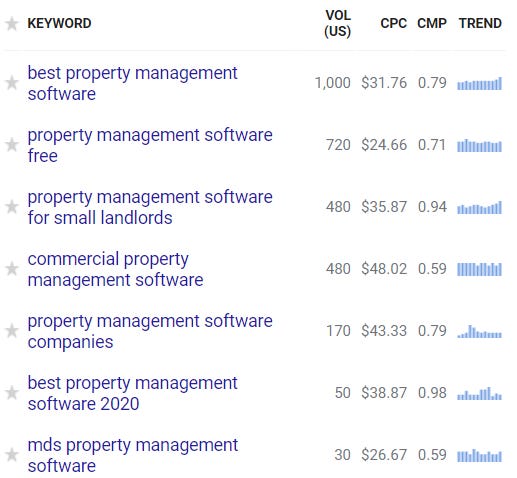

The listing makes it seem like the business has revenue but no profit. Unclear if that’s the situation or not. Why has the business not scaled in 8-years? What’s the LTV and how expensive is it to acquire clients? Does the solution target a specific segment of the market? Very expensive CPC.

You can view the listing on MicroAcquire.

— — — —

Recurring Payments - $90k

For sale is a 4-year-old payments SaaS that easily allows users to collect recurring payments.

Competitors: Moonclerk, Payfunnels, Samcart

$500 LTV; $23 monthly ARPU;

TTM Revenue: $24k; Profit: $23k; Margin: 96%;

Asking: $90k; Multiple: 3.91x;

✅ What I Like

Payment apps tend to be sticky. This type of software benefits from new business formation and growth in freelancing (see below). Valuation isn’t aggressive. Listing mentions that it’s well built and documented. Good fit for someone with a marketing background who can scale it.

❓ Questions & Concerns

Competitive industry. Unclear how this is differentiated from other solutions. Could be very expensive to scale which is why the owner is selling.

You can view this listing on MicroAcquire.

— — — —

VC Scout Network - $7k

For sale is Infosite - a new crowdsourcing investment scouting tool for VCs. They give aspirational investors the ability to create & source their own deal flow and get recognized & credited for their leads by big funds.

Built using no-code tools

No revenue or users

✅ What I Like

Really interesting project that’s somewhat similar to my idea for Deal Flow Scout. This definitely seems to be more robust and better designed. As the number of solo-VCs increases, tools like this will gain traction. Could be a nice acquisition for someone interested in this space. Especially if you already have an audience that’s aligned with this industry. Hopefully, someone picks this up and runs with it.

❓ Questions & Concerns

This is just a website and a no-code app. The hard work of marketing, growing, and everything in between is still ahead. Tough to put a valuation on this project but it’s not a crazy asking price.

You can view this listing on Tiny Acquisitions or contact Liam McSherry on Twitter.

🕸 Content/Marketplace/Service

Early Childhood Education Blog - $199k

For sale is This Toddler Life blog that helps parents implement the popular Montessori teaching system into their everyday homes. Revenue is generated from affiliate links, digital products, and subscription.

19k pageviews per month;

60k Facebook group; 28k e-mail subs;

Avg monthly net profit: $3,341

Asking: $199k; Multiple: 4.96x or 59.56x

✅ What I Like

I like the new parent demographic as they are very engaged and relatively easy to reach/target online. Large social media following and e-mail list. Diversified sources of revenue including affiliate, products, and subscriptions. Monetossori is a very popular education system.

❓ Questions & Concerns

Have to do a lot of diligence around traffic sources and engagement. Any impact from the latest Google algo update? Listing doesn’t mention how revenue breaksdown between the three sources. How is content creation managed? What are the digital products being sold?

You can view the listing on Blogs for Sale.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount with code “duedilio”.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - peer-to-peer deal flow exchange. Free, open, transparent.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.