The Business Inquirer #057

In this week's issue, I highlight nine listings including a tourism website, an electronics store, a doctor review SaaS, and more.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 5 listings

🕸 Content/Marketplace/Service - 2 listings

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is a due diligence concierge connecting business buyers and private investors with quality, pre-vetted due diligence service providers.

Our deep network of 150+ independent professionals, boutique and mid-size firms, and subject-matter-experts enable us to address finance, technology, legal, operations, marketing, and other diligence projects.

Submit your project. Review qualified proposals. Hire diligence provider. Free.

🛒 eCommerce

Electronics Amazon Store - $390k + Inventory

For sale is a 6-year-old e-commerce business selling on Amazon. The store sells fun and helpful electronic items. Not a lot of detail in the listing. Very motivated seller.

11 ASINs; 99% positive lifetime ratings;

Only sold through Amazon;

TTM Revenue: $1.2M; Profit: $209k; Margin: 17%

Asking: $390k + $250k Inv; Multiple: 1.87x

✅ What I Like

This may be an interesting distressed listing for someone to pick up. Appears that the seller is very motivated and there could be acquisition financing already lined up. I like that the store just sells 11 products. That makes it very manageable if you have to do your own logistics. There may be an opportunity to explore other distribution channels like DTC, Walmart, etc. Valuation is very reasonable and may even be room to negotiate down.

❓ Questions & Concerns

There’s not a lot of detail in this listing. Would need to understand who handles the warehousing and shipping. What happened when they tried other sales channels? Why are they selling the business now? Why is the margin so low?

You can view the listing on Quiet Light Brokerage.

————

Pet Products Dropshipping - $150k

For sale is a 2-year-old dropshipping business selling premium pet products.

Competitors: Waudog, Lands End

Built on Shopify

Lifetime revenue: $374k; Profit: $144k; Margin: 39%

TTM Revenue: $133k; Profit: $51k; Margin: 38%

Asking: $150k; Multiple: 2.94x

✅ What I Like

In 2020, $104B was spent on pets in the US market. Pet is a great niche with a very engaged audience that is relatively easy to target with advertising. Dropshipping is a very asset-light business model. These types of businesses are great for first-time business owners as you get to learn the basics. The margins here are actually pretty high for a pure dropshipping business.

❓ Questions & Concerns

Dropshipping stores typically lack differentiation and have low barriers to entry. The key is to find a winning product and lower your customer acquisition costs. As advertising costs go up, that eats into the margin. How are the products sourced and who handles returns? What’s the lead time? What’s the CAC and how is it trending? At first glance, valuation is a bit high for this type of business.

You can view the listing on MicroAcquire.

☁ SaaS

B2B Lead List Builder - $7M

For sale is a 5-year-old lead list generation SaaS for B2B.

Competitors: ZoomInfo, DataAxle, Grata Data

Bootstrapped by single owner; 26M verified contacts in database;

Fortune 500 clients;

TTM Revenue: $1.5M; Profit: $1M; Margin: 67%

Asking: $7M; Multiple: 7.00x

✅ What I Like

List building services are widely used in the B2B space and are always in demand. This is an evergreen niche. This listing appears to have thousands of customers including Fortune 500 firms. There is a focus on SEO that has paid off with 100k monthly search results.

❓ Questions & Concerns

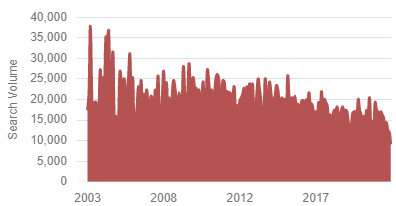

This is a very crowded space. It’s unclear what the differentiation is between different providers. The tech stack here is very important IMO. What type of maintenance is required? How and how often is the contact database updated? What type of support tickets come in from clients and how are they addressed? Is there a niche that this business serves more than others? Any legal gray areas in how the data is collected? Interesting to see a steadily declining search volume (top chart). Is this indicative of overall business trends? Valuation seems aggressive.

You can view the listing on BuySellEmpire.

————

Teacher/Therapist SaaS & Content - $920k

For sale is a 7-year-old content and SaaS business for a specific type of teacher/therapist. The SaaS allows users to manage their client caseloads.

1,000+ pieces of content;

Professional & HIPPA compliant website;

Most revenue is recurring;

TTM Revenue: $473k; Profit: $230k; Margin: 49%

Asking: $920k; Multiple: 4.00x

✅ What I Like

I like SaaS that focus on a very specific niche. Having an education component is a valuable lead gen strategy and could be a moat. Sounds like the content is also a source of revenue for this business. Nice margins. Valuation is reasonable.

❓ Questions & Concerns

Not a lot of detail in the listing. How sticky are the clients? What does the competition look like? How often does the content need to be updated and how much do writers charge? How are clients acquired and for how much? What’s the overall TAM of this market?

You can view this listing on Quiet Light Brokerage.

— — — —

Doctor Review SaaS - $1.5M

For sale is a 2.5-year-old France-based SaaS that allows doctors, medical practices, clinics, and hospitals to easily send surveys and collect reviews. Major shareholder wants to cash out.

Competitors: DoConnect

Headquartered in France and leader in the market; Bootstrapped

10-person team;

Revenue model includes one-time install fee + annual subscription;

30-Day Revenue: $58k; Profit: $27k; Margin: 47%

TTM Revenue: $360k; Profit: $100k; Margin: 28%

Asking: $1.5M; Multiple: 4.63x (est)

✅ What I Like

Young business but there’s clearly traction. Comparing TTM numbers to the latest 30-days indicates that the business is experiencing huge growth (or weird seasonality). Listing mentions that they are the market leader in France. If you annualized the 30-day profit then valuation appears cheap.

❓ Questions & Concerns

Why does the major shareholder want to cash out? What’s been the driver of change between TTM fundamentals and the last 30-days? How easily could this be implemented in the US market? Are there any sort of HIPPA or other regulations that this type of business comes in contact with? What’s eating up the margin?

You can view this listing on MicroAcquire.

— — — —

Shopify Apps - $390k

For sale is a 3-year-old collection of three Shopify apps across various categories. The business has been ignored for 6+ months.

Competitors: Recart FB Messenger Marketing, TrackiPal: Sync PayPal Orders

30-Day Revenue: $11k; Profit: $8k; Margin: 73%

TTM Revenue: $167k; Profit: $130k; Margin: 78%

Asking: $390k; Multiple: 4.06x (est)

✅ What I Like

Broadly, the Shopify app system is expanding and the whole market is growing. These apps have some decent traction. Owner has ignored these apps but they’re still getting conversions and generating revenue. This could be a nice purchase for someone who already has an app portfolio and can cross-sell these to their existing audience.

❓ Questions & Concerns

If these apps have been ignored for 6+ months, what type of updates are required? How do customer support tickets look? What’s the conversion rate, churn, reviews? Margins will shrink once new owner starts paying for advertising.

You can view this listing on MicroAcquire.

— — — —

Virtual Employee Screening - $375k

For sale is a 12-year-old employee screening firm. The company uses advanced software tools and it’s network of resources to do background checks.

Clients in the eldercare, commercial, and government sectors;

4 government contracts and 79 commercial contracts; 69 are in eldercare franchises;

97% customer retention rate; New clients coming from referrals;

Hands-off owner spending < 5 hours per week on the business

TTM Revenue: $444k; Profit: $89k; Margin: 20%

Asking: $375k; Multiple: 4.21x

✅ What I Like

I like the employee and background screening industry as it’s an evergreen niche that’s only growing in importance and demand. Government contracts are very sticky and being an approved vendor opens up more opportunities. Eldercare is one of the fastest-growing industries in the US and offers another large market to expand in.

❓ Questions & Concerns

Not clear if this is a SaaS or a productized service or a combination of the two. The business certainly has client concentration risk with 4 government contracts and 69 eldercare contracts from the same company (I think). What are the risks that these contracts don’t renew? Why has the owner not put in more time in the business? The margins appear small for a business like this. Valuation is reasonable if it’s a SaaS but a bit elevated if it’s just a service business. Due to the nature of the business, this is a stock sale and not an asset sale. This adds additional complications to the transaction.

You can view this listing on Website Closers.

🕸 Content/Marketplace/Service

Maine Tourism - $475k

For sale is 22-year-old VisitMaine.net which is a tourism and hotel marketing website.

171 hotel clients;

92% organic traffic; 246k unique views/month; 49 Domain Authority score;

Avg monthly revenue: $9k.4k; Profit: $9.3k; Margin: 99%

TTM Revenue: $113k; Profit: $111k; Margin: 98%

Asking: $475k (BIN); Multiple: 4.28x or 50x

✅ What I Like

Being a New Englander this listing piqued my interest. Well-aged business. Detailed listing. This website has a high Domain Authority score and most of the traffic is organic. The website design could be updated to make it more appealing. Could also implement a referral program with Booking.com or similar. Opportunity to add e-commerc component to monetize the traffic.

❓ Questions & Concerns

Website traffic and revenue are very seasonal. How have the Google algorithm changes impacted traffic? What type of content upkeep is required? What’s the overall TAM and how many more hotel clients can this business get? Valuation is very high if you use the BIN price.

You can view the listing on Flippa.

————

Audience Engagement Platform - Open to Offers

I was browsing a community and saw this post about an unfinished project being for sale. This might be an interesting acquisition for someone interested in the music/festival niche. The post from the seller is copied below:

Twizzl is a great opportunity that we were looking to finish development of the app and launch immediately prior to the pandemic, when live music events and festivals halted.

Now that the music and festival industry is back, we unfortunately have moved on to other business pursuits.

I still believe strongly in the possibilities for this so would love to find someone interested in acquiring it and running with it. I would be happy to help you finish development and bring it to market, although I can’t devote full time effort at this point.

Prototype: Twizzl Home (invisionapp.com)

Overview Deck: Twizzle Deck

Ping me and I’ll connect you with the seller.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - peer-to-peer deal flow exchange. Free, open, transparent.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.