The Business Inquirer #059

In this issue, I highlight 6 listings including a psychic reading marketplace, Zendesk app, SMS marketing platform, and more.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

For those celebrating, I want to wish you and your family a very merry Christmas!

In this week’s issue:

🛒 eCommerce - 0 listings

☁ SaaS - 5 listings

🕸 Content/Service/Other - 1 listing

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is a due diligence concierge connecting business buyers and private investors with quality, pre-vetted due diligence service providers.

Our deep network of 150+ independent professionals, boutique and mid-size firms, and subject-matter-experts enable us to address finance, technology, legal, operations, marketing, and other diligence projects.

Submit your project. Review qualified proposals. Hire diligence provider. Free.

🛒 eCommerce

☁ SaaS

B2B Content Optimization Platform - $4.5M

For sale is a 4-year-old B2B content optimization platform that increases organic traffic.

Competitors: Clearscope, MarketMuse, Surfer SEO, Frase

95 paying customers; 2 F1000 clients; $281 ARPU;

TTM Revenue: $211k; Profit: $0; Margin:

Asking: $4.5M

✅ What I Like

I’m (very) far from a marketing expert but it feels like we’re moving to a place where content, SEO, SMS, and e-mail marketing are becoming more and more important. These are much cheaper and more sustainable channels compared to paid advertising. Tools for generating and optimizing content are only going to increase in demand.

❓ Questions & Concerns

The business isn’t profitable so that’s the big question. Possibly a typo in the listing but I doubt it. Are there issues with CAC? Are they reinvesting all of the profits into the business? If hiring a B2B sales team is the way to scale this business, that’s going to be very expensive. Valuation is bonkers for a $0 profit startup. They’re probably looking for a strategic acquirer but even at that price, it seems like a reach.

You can view the listing on MicroAcquire.

————

Zendesk & Freshdesk Apps - $450k

For sale are two 4-year-old apps that add an additional feature to Zendesk and Freshdesk. These are top-ranked apps on both marketplaces.

95% of revenue comes from Zendesk;

Many of the largest Zendesk customers are using the app;

2-person founding team;

TTM Revenue: $131k; Profit: $115k; Margin: 88%

Asking: $450k; Multiple: 3.91x

✅ What I Like

I haven’t seen apps for Zendesk for sale before. Zendesk is a customer service software and CRM mainly used by SMBs. My understanding is it competes with Hubspot, Zoho, and Freshdesk. This is an interesting business. Has nice traction and great margins. Marketplace apps have a natural distribution channel so they can spend less on marketing. Valuation is OK.

❓ Questions & Concerns

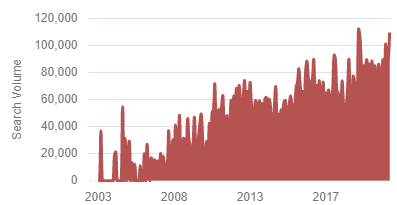

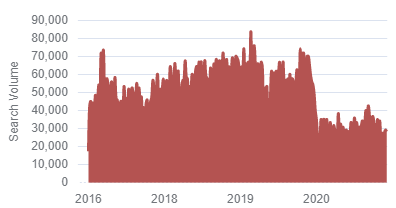

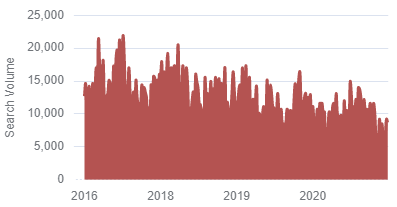

What’s the overall TAM for these apps? The listing mentions that all the largest Zendesk clients are already using the app. Is there a limited upside from here? Why has the Freshdesk app not taken off? What’s the ARPU and churn? What type of support tickets do they get? One concern with any marketplace app is that the platform can just build the same features. There’s a sharp drop in search volume for Zendesk - why?.

You can view the listing on MicroAcquire.

————

Privacy Law Compliance - Open to Offers

For sale is an 8-year-old portfolio of websites and apps including a WordPress plugin that helps users comply with various privacy laws and regulations such as GDPR, CCPA, CalOPPA, etc.

Competitors: CookiePro, Osana, Lubenda

Priced as one-time payment but transitioning to SaaS; 6 team members;

1,500 paying customers; 100k active installs of WP plugin; 1.5M e-mail list;

Spend $12k/m on content; $10k/m on affiliate commissions; $5k/m on CPC;

TTM Revenue: $2.7M; Profit: $2.2M; Margin: 81%

Asking: Open to Offers

✅ What I Like

Privacy compliance is a growing market with ever-increasing regulations. The business generates strong revenue and cash flow. Main clients are SMBs which tend to be stickier than consumers. Strong focus on SEO seems to be paying off. Massive e-mail list of past users to market to. Transitioning to a SaaS model may open up opportunities. Current owner may be open to staying on as a minority shareholder.

❓ Questions & Concerns

Company based in EMEA which may present complications if the buyer is based in the US. Not a lot of detail around the website and apps. Have they started the transition to a SaaS or is it still one-time payments? How does the competition look? Why is the owner cashing out now?

You can view this listing on BitsForDigits.

— — — —

Virtual Executive Assistant Marketplace - 15% Stake

Available for a 15% investment is a 4-year-old online marketplace that matches executives with virtual executive assistants. Looking for a strategic advisor/investor with operational expertise.

Competitors: Belay, Boldly, Zirtual

Tech: Stripe, Airtable, Zapier

450+ clients including startups, executives, and VCs

350% Y/Y revenue growth; 200% Y/Y profit growth;

TTM Revenue: $6.5M; Profit: $1.5M; Margin: 23%

15% stake for sale; Open to offers;

✅ What I Like

Long-term subscribers know this but marketplaces are my favorite business models. I think this is a very interesting niche that’s growing in demand. I love that the whole thing runs on Stripe, Zapier, and Airtable. I assume that it doesn’t require a lot of maintenance. This is a recurring revenue business model.

❓ Questions & Concerns

There are 4 current owners with various equity stakes in the business. Having too many cooks in the kitchen can be an issue for a business. The business saw very strong growth this year that may be driven by COVID (but maybe not). Figuring out the right valuation may be challenging.

You can view this listing on BitsForDigits.

— — — —

SMS Marketing Platform - $599k

For sale is an 11-year-old SMS & MMS marketing platform. The solution allows businesses, brands, and organizations to send SMS and MMS containing sale alerts, notifications, web links, coupons, and more.

125 current clients; 95% retention; Low churn;

TTM Revenue: $378k; Profit: $208k; Margin: 55%

Asking: $599k; Multiple: 2.88x

✅ What I Like

You can find some interesting statistics about SMS marketing here. As I mentioned previously, I think e-mail, content, SMS and other direct marketing channels are only going to be more and more important. This seems like a nice single-owner business selling for a normal multiple.

❓ Questions & Concerns

This is a bit of a turnaround story. Many clients are in the restaurant & retail industry so there was a COVID dip. The listing mentions that the company is now stabilized and adding new clients.

You can view this listing on WebsiteClosers.

🕸 Content/Service/Other

Marketplace for Psychic Reading - $5.7M

For sale is a 10-year-old online marketplace for psychic readings. The two-sided marketplace allows users to easily find and book a psychic reading. For psychics, the platform facilitates communications and payments. Just an interesting listing.

230 independent psychic advisors; 17k active users; 95% repeat order rate;

Rake ranges from 22% to 27% based on hourly rates of $4 - $30;

Business is highly automated; 4 full-time employees; 100% remote;

TTM Revenue: $2.8M; Profit: $1.3M; Margin: 46%

Asking: $5.7M; Multiple: 4.38x

✅ What I Like

I love businesses in unique niches and this definitely fits that description. A very well-aged business that has invested a lot in technology. The marketplace rake is relatively high. There’s an opportunity to take the technology and white-label it for other types of expert marketplaces. That could be spun off in a separate business.

❓ Questions & Concerns

Just book a psychic reading and they’ll tell you all you need to know.

You can view the listing on WebsiteClosers.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

Calendly - Leading scheduling platform to easily schedule meetings without the back and forth. I’ve been using it for several years now. Free 14-day trial.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - peer-to-peer deal flow exchange. Free, open, transparent.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.