The Business Inquirer #061

In this issue, I highlight six listings including a POD business, a real estate CRM, a social media page builder, and more.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

Welcome to the first issue of 2022!

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 3 listings

🕸 Content/Service/Other - 2 listings

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is a due diligence concierge connecting business buyers and private investors with quality, pre-vetted due diligence service providers.

Our deep network of 150+ independent professionals, boutique and mid-size firms, and subject-matter-experts enable us to address finance, technology, legal, operations, marketing, and other diligence projects.

Submit your project. Review qualified proposals. Hire diligence provider. Free.

🛒 eCommerce

Print-on-Demand Canvas Art - $125k

For sale is a 1.5-year-old print-on-demand ecommerce business that sells motivational wall art.

Competitors: Ikonick, I Love DIY Art, All Paint by Numbers

150 products; 4k e-mail subscribers; 4k IG followers;

30-Day Revenue: $7.6k; Profit: $2.9k; Margin: 38%

TTM Revenue: $190k; Profit: $17k; Margin: 9%

Asking: $125k; Multiple: 7.35x

✅ What I Like

Print-on-demand (POD) is a great first business to operate. It’s really all about customer acquisition. No inventory or logistics to worry about. I like this particular niche as there’s a consumer and corporate market. I’ve wanted to buy prints from Ikonick and I think they’re the market leader in this space. The business has turned off paid ads (which is why margins are higher) and generated healthy revenue. I’d look into influencer marketing as well as other channels to drive growth.

❓ Questions & Concerns

There’s typically not a lot of differentiation in POD products. You constantly have to test paid advertising channels and creative. Low barriers to entry for new competitors. Paid advertising costs are going up while there’s a price ceiling of how much someone will pay for a motivational art poster. Valuation is off the charts for this type of business.

You can view the listing on MicroAcquire.

☁ SaaS

Social Media Page Builder - $2.5k

For sale is a 1-year-old social media page builder designed to show your online presence. Users can easily create a one-page website with links to all of their social channels, blogs, videos, etc. Used by entrepreneurs, marketers, social media pros.

Competitors: Linktree

350 clients; Built with PHP;

$1k ARR

✅ What I Like

You have a micro-SaaS with revenue and a decent client base. The tech stack is easy to manage. There’s a large competitor to learn from. Large TAM. Priced right. I would start by targeting newsletter publishers since they’re easy to reach.

❓ Questions & Concerns

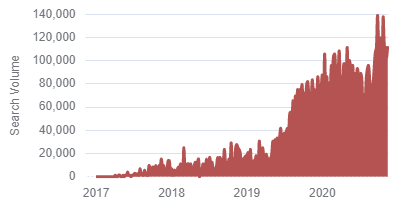

I think Linktree is the leader in this space (see chart above) but there are other competitors. You’d have to figure out the right pricing and marketing strategy. This is a low-cost product so CAC matters a lot.

You can view the listing on Microns.

————

Visual Sitemap Builder - $300k

For sale is an 8-year-old SaaS that helps web agencies plan websites with their clients. It’s a visual sitemap builder.

Competitors: Slick Plan, Flowmapp, Octopus.do

Tech: React, Django

30-Day Revenue: $6.4k; Profit: $5.4k; Margin: 84%

TTM Revenue: $83k; Profit: $71k; Margin: 86%

Asking: $300k; Multiple: 4.23x

✅ What I Like

Well aged business with operating history. Great margins. Simple tech stack to manage. Large TAM. I think agencies would be sticky clients. Maybe opportunity to go after the consumer market.

❓ Questions & Concerns

How does this product compare to the competition? Is there any client concentration risk? Adding a sales team will erode margins. What are some low-cost ways to increase the sales funnel?

You can view the listing on MicroAcquire.

————

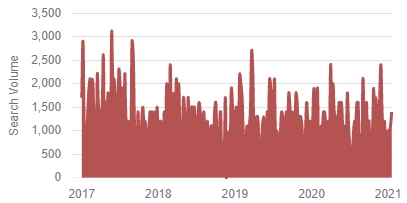

Real Estate CRM - $500k

For sale is a 12-year-old CRM that is specifically for real estate agents.

278 clients; 5.7% churn; $9k MRR;

TTM Revenue: $122k; Profit: $96k; Margin: 79%

Asking: $500k; Multiple: 5.21x

✅ What I Like

Well aged business with a lot of operating history. Niche with a large TAM. Great margins. No need to educate the market. Easy to target clients online. Not a lot of churn for this industry.

❓ Questions & Concerns

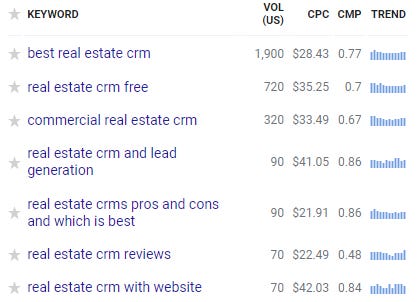

A lot of competition in this space. Why has the seller not been able to scale the business more? Has the software been updated or does it need an overhaul? What type of client support is required? CPC is very expensive. How are clients acquired?

You can view the listing on FE International.

🕸 Content/Service/Other

Restaurant Concept Agency - $8M

For sale is a 1.5-year-old Agency that provides virtual restaurant brands or concepts to restaurants. Interesting business.

Competitors: Virtualdiningconcepts, Cloudkitchens, Futurefoods

5-person team; Created #1 selling restaurant concept in the nation

TTM Revenue: $1.6M; Profit: $150k; Margin: 9%;

Asking: $8M; Multiple: 53.33x

✅ What I Like

I think it’s an interesting niche that I haven’t encountered previously. One of the business models is that they partner with restaurant operators to create new concepts for a % of revenue. I imagine that this type of business will only grow as the idea of cloud kitchens gains wider adoption.

❓ Questions & Concerns

Have to understand that margin calculation. It makes sense if the majority of their business is just a revenue share. I’m not sure how motivated the sellers are if the multiple is 53x. I think they’re just fishing for offers.

You can view the listing on MicroAcquire.

— — — —

TN Real Estate Project 8% Yield

This listing is from One Interesting Deal newsletter by Michael Girdley. You have a group developing a real estate project in rural Tennessee. What makes it interesting:

It’ll be a fly-in outdoor adventure resort and residential community with 800 homes, 15 rental hangars, and 180 vacation homes.

What I like about this deal is the unfair advantage the GPs get from their ownership of the Flying Magazine/Media brand. I imagine lots of events being held here and relatively cheap customer acquisition since they have this brand under control.

You can view the listing on One Interesting Deal.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Calendly - Leading scheduling platform to easily schedule meetings without the back and forth. I’ve been using it for several years now. Free 14-day trial.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.