The Business Inquirer #070

In this week's issue, I highlight six listings including a very niche e-commerce store, a screen recording SaaS, an app for Intercom, and more.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

I’m always looking for feedback on how I can make this newsletter more interesting and valuable.

Would you like more listings? More targeted listings? More analysis? Different analysis? Less of everything? Interviews? How-to articles? What would add value to you?

Please let me know your thoughts. Just reply to this e-mail or use the feedback buttons at the bottom if you want to keep it all anonymous.

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 4 listings

🕸 Content/Service/Other - 1 listing

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is an expert network focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with quality, pre-vetted due diligence service providers.

Our deep network of independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, and other areas of business diligence.

Submit your project. Review qualified proposals. Hire diligence provider.

🛒 eCommerce

Horse/Equine Business - $385k + Inv

For sale is a 10-year-old niche e-commerce brand selling products to the miniature horse & donkey hobbyist.

All sales are organic; $0 spent on marketing;

Sold through Amazon; Owners spend 10 hours/wk on operations;

TTM Revenue: $185k; Profit: $102k; Margin: 55%

Asking: $385k+ Inv; Multiple: 3.77x

✅ What I Like

Simple business model. Very niche business but as they say “there are riches in niches.” This seems to be a lifestyle business with owners spending limited time on growing it. If they have the attention of this niche market then perhaps there are cross-selling opportunities.

❓ Questions & Concerns

Need to understand the supply chain and how logistics are handled. Is there a way to profitably acquire customers through paid channels in this niche? Advertise in niche communities and newsletters? Maybe the TAM is too small to really grow the business.

You can view the listing on Quiet Light Brokerage.

☁ SaaS

Shareable Screen Recordings - $30k

For sale is an 11-month-old micro-SaaS that allows users to easily record their screen and create a shareable link.

Competitors: Loom, Screencapture, Calipio

Tech: React, Firebase, Vercel

Most revenue comes from AppSumo; $550 AppSumo + $160 in MRR last month;

30-Day Revenue: $630; Profit: $625;

Asking: $30k; Multiple: 4.00x (est)

✅ What I Like

Broadly, I like this solution. Sharing a quick screen recording is very productive when doing sales or customer support. The biggest competitor here is Loom and they’re doing a lot of work to raise awareness about this type of solution. There’s some minimal traction and revenue coming in. Sounds like some SEO is paying off.

❓ Questions & Concerns

This is a young startup that needs a lot of work to validate and scale. I’d remove it from AppSumo as I don’t think that’s the best approach here. Figure out the tech stack and what you would need to maintain it.

You can view the listing on MicroAcquire.

————

Retail Investor Analytics - $100k

For sale is a 1-year-old SaaS that tracks and analyzes retail investor stock interests and sentiment.

Competitors: Quiver Quantitative

Featured on Marketwatch, Forbes, CNBC, and more

30-Day Revenue: $2,650; Profit: $2,000; Margin: 75%

TTM Revenue: $30.6k; Profit: $23.5k; Margin: 77%

Asking: $100k; Multiple: 4.26x

✅ What I Like

A lot to like about this product. First, it’s very on-trend as these types of tools and newsletters have been very popular over the last few years. Second, there are a lot of ways to monetize this tool for various audiences (SaaS, data API, newsletter, and more). Margins are where they should be for a SaaS. Sounds like there’s been some press coverage that has helped promote the product. Valuation isn’t too crazy.

Check out this post on Reddit from one of the co-founders of Ticker Nerd. Somewhat similar business except they started a newsletter. They recently sold the business (acquihire).

❓ Questions & Concerns

It’s still a young product without a lot of operating history. I assume they do a lot of web scraping to gather data and measure investor sentiment. Any legal issues with how they collect and analyze the data? A lot of due diligence is required on the tech stack. How much are maintenance costs? How do they acquire customers? I’d reach out to the Ticker Nerd team and ask what data source they used for their newsletter.

You can view the listing on MicroAcquire.

————

Product Feedback for Intercom - $500k

For sale is 4-year-old UserFeed which is a product feedback tool that integrates with Intercom. Recently added another product (Bump) to snooze, follow-up, and close conversations on auto-pilot.

Competitors: Canny, ProductBoard

Two Intercom apps

All growth has been organic; $100k ARR

TTM Revenue: $79k; Profit: $74k; Margin: 94%

Asking: $500k; Multiple: 6.76x

✅ What I Like

Intercom is a rapidly growing customer communication platform counting over 25,000 organizations as clients. It’s never a bad thing to hitch a ride to a rapidly growing platform. I like that the sellers are honest in their listing pointing out a lot that still needs to be done (tech, marketing). Product seeing 100%+ organic Y/Y growth. You’re getting two products that have different use cases.

❓ Questions & Concerns

It sounds like there’s still some work to do on the technical front. Marketing hasn’t been tested. Those margins will certainly shrink once you start spending money on those two areas. Valuation is a tad aggressive even with the organic growth.

You can view this listing on MicroAcquire.

— — — —

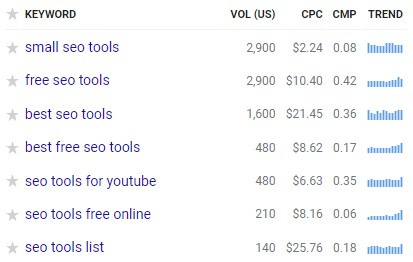

SEO Tool - $26K

For sale is a 1-year-old SEO tool for indie markers and startups.

Competitors: Ubersuggest, SERanking, Mangools

Bootstrapped; 2 person team;

30-Day Revenue: $957; Profit: $614; Margin: 64%

Asking: $26k; Multiple: 3.53x (est)

✅ What I Like

Large and growing TAM. As social media advertising becomes more expensive, SEO is only going to become more important. Established tools like SEMRush and Ahrefs are expensive and serve a different market. This product has traction and maybe well-positioned for someone to take over and grow.

❓ Questions & Concerns

Very young project without a lot of history. A lot of diligence is required on the tech stack to make sure you don’t need to spend $$$ rebuilding it. Have to have a marketing strategy in place before acquiring this. CPC is not cheap. This could be a good lead gen tool for an agency.

You can view this listing on MicroAcquire.

🕸 Content/Service/Other

Political Content Portfolio - $1.7M

For sale is a 3-year-old portfolio of content websites and an e-commerce store. The target audience is US conservatives/Republicans.

7 content sites; 1 e-commerce site;

Revenue is 45% ad network, 47% lead gen, 8% e-commerce;

All traffic comes from 2.3M e-mail list;

16M+ page views in TTM;

TTM Revenue: $1M; Profit: $789k; Margin: 79%

Asking: $1.7M; Multiple: 2.15x

✅ What I Like

If you’ve been reading this newsletter then you know I’m a big fan of products or services that target politics. It’s a very large and engaged audience. I like that there’s an e-commerce store that’s already generating revenue. Not relying on Facebook ads is another plus. Nice margins. Valuation isn’t crazy. This business requires someone who knows the content and media space.

❓ Questions & Concerns

Curious to understand the rationale for not focusing on SEO. Will the current team of writers stay on with the new owner? How easy are they to replace? Who does e-mail marketing? How can e-commerce sales be increased? A lot of moving pieces in this business.

You can view the listing on Quiet Light Brokerage.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

Calendly - Leading scheduling platform to easily schedule meetings without the back and forth. I’ve been using it for several years now. Free 14-day trial.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.