The Business Inquirer #079

In this week's issue, I highlight three listings including a pickleball admin software, an A/V installer, and more.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

In this week’s issue:

🛒 eCommerce - 0 listings

☁ SaaS - 1 listing

🕸 Content/Service/Other - 2 listings

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is an expert network focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with quality, pre-vetted due diligence service providers.

Our deep network of independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, and other areas of business diligence.

Submit your project. Review qualified proposals. Hire diligence provider.

🛒 eCommerce

☁ SaaS

LinkedIn Automation - $100k

For sale is 1.5-year-old Linvo which is a LinkedIn tool for automating cold outreach and follow-ups.

Competitors: Expandi, Zopto, LinkedIn Helper, Waalaxy

1,053 users; 3,120 newsletter subscribers;

Mainly sold through two affiliate partners;

30-Day Revenue: $7k; Profit: $2k; Margin: 29%

Asking: $100k; Multiple: 4.17x

✅ What I Like

This is a young project that has all the fundamentals in place for someone with a marketing background to come in and scale. There’s some decent traction. Already has affiliate programs, webinars, and a white-labeled solution. I feel like there is increasing interest in content and marketing on LinkedIn.

❓ Questions & Concerns

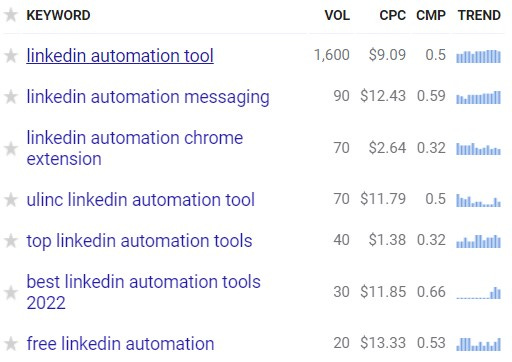

Not a lot of operating history. LinkedIn has a lot of incentive to block these types of tools in order to drive users to their Sales Navigator product. CPC is expensive. How is this product differentiated from everything else out there?

You can view the listing on Tiny Acquisitions.

🕸 Content/Service/Other

Pickle Ball Tournament Administration - $80k

For sale is a 5-year-old web-based service that’s designed to help with the administrative tasks of running a pickleball tournament. This includes user registrations, payments, brackets, score reporting, and messaging.

Competitors: PickleBallTournaments, PickleballBrackets

Business model is to charge a small fee per user;

TTM Revenue: $12k; Profit: $120; Margin: 1%

Asking: $80k; Multiple: 666.67x

✅ What I Like

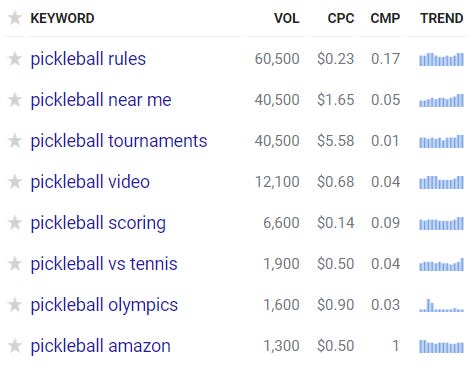

Pickleball is the fastest growing sport in the US. A lot of ways to promote the product through affiliate partnerships. CPC doesn’t look expensive. Perhaps changing the business model into a SaaS would unlock some opportunities.

❓ Questions & Concerns

There isn’t a lot of revenue for a 5-year-old project. I would figure out what has prevented the current owner from scaling this further. What are the biggest expenses of running this business since the margin is shown as 1%?

You can view the listing on MicroAcquire.

————

Audio/Video Installation in FL - $496k

For sale is a 35-year-old audio/video integration company that designs and installs high-end A/V solutions. Located in North Central Florida serving several regional markets.

Management and employees will transfer with business;

Includes physical showrooms; Serves residential and commercial accounts;

TTM Revenue: $1M; SDE: $200k; Margin: 20%;

Asking: $496k; Multiple: 2.48x

✅ What I Like

A lot of operating history. Evergreen niche. Decent margins. Good multiple. Management and employees in place. A lot to like in this business at first glance.

❓ Questions & Concerns

I assume that revenues have been inflated by COVID over the last few years as everyone was upgrading their home/apt. How do normalized numbers look? How does this business compare to the competition? What’s going on in the market? What’s the day-to-day of the owner look like?

You can view the listing on BizNexus.

🛠 Tools & Resources

These are tools & resources that I personally use. They may contain affiliate links so I’ll get a few shekels if you sign-up.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep.

PrivSource - Deal aggregator for lower and middle-market listings.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best business phone solution that I have found. $20 credit.

Eloquens - Knowledge marketplace. I’ve bought a few guides and templates here.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.