The Business Inquirer #084

In this week's issue, I highlight seven listings including a sleep aid brand, a senior care SaaS, an IRS reporting SaaS, and more.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 4 listings

🕸 Content/Service/Other - 2 listings

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is an expert network focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with quality, pre-vetted due diligence service providers.

Our deep network of independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, and other areas of business diligence.

Submit your project. Review qualified proposals. Hire diligence provider.

🛒 eCommerce

Sleep Masks - $425k

For sale is a 2-year-old ecommerce brand that sells sleep aids such as sleep masks.

DTC sales through their own website

2FT employees, manager, and customer service agent;

TTM Revenue: $1.2M; Profit: $113k; Margin: 9%

Asking: $425k; Multiple: 3.76x

✅ What I Like

I like this evergreen niche. Massive market that is growing. The business appears to have an operating team in place and the owner only spends 10hrs/week on the business. Opportunities to expand to additional products and distribution channels.

❓ Questions & Concerns

A lot of competition in this space. Not clear if there’s anything proprietary in the products. Not a lot of operating history. Very low margin. 50% of revenue comes from Facebook ads which is a huge red flag. Not a large social media presence. Valuation is aggressive.

You can view the listing on SellerForce.

☁ SaaS

Senior Care - $420k

For sale is a 4-year-old SaaS that uses Amazon Alexa technology to help seniors living in senior living environments decrease depression and live healthier lives.

Sold through senior living communities and adjacent markets

YoY TTM revenue and SDE growth of 19% and 21%

TTM Revenue: $111k; Profit: $106k; Margin: 95%

Asking: $420k; Multiple: 3.96x

✅ What I Like

A business that you can feel good about. There is a rapidly growing market for senior care solutions. I imagine the TAM to be quite large. Good to see strong revenue growth in TTM.

❓ Questions & Concerns

The business hasn’t reached scale so there’s still a lot of work to do. You’re really buying a job with this level of profit. I think the sales cycle can be long in this market. Not a lot of discretionary spending power. Hiring a sales team would be very expensive. What led to the TTM revenue growth? What type of tech upkeep does this require? What’s the ARR, churn, CLTV? Valuation seems to be very aggressive.

You can view the listing on QuietLight Brokerage.

————

Social Proof Platform - $3.7M

For sale is a 4.5-year-old social proof platform that integrates with Shopify, Magento, WooCommerce, Wix, BigCommerce, and more.

Competitors: Proof, Fomo

1,800 paying clients; Adding tens of clients per day; 2% annual revenue growth;

$1,000 CLTV; Strong website ranking;

2x selected as a Staff Pick by Shopify; Chosen as Most Popular App by Wix;

TTM Revenue: $781k; Profit: $640k; Margin: 82%

Asking: $3.7M; Multiple: 5.78x

✅ What I Like

Solid operating history and financials. Integrates with multiple platforms with only 15-20% of revenue coming from Wix & Shopify. Focus on SEO and strong website ranking provides a moat.

❓ Questions & Concerns

Why is the team selling this product? How does it compare to competitors? What type of tech upkeep is required and who performs it? How does client churn look like? Valuation is elevated unless there’s really strong growth and a clear path to scalability.

You can view the listing on MicroAcquire.

————

Warehouse & Retail Management System - $500k

For sale is a 15-year-old warehouse and retail management platform that helps businesses gain visibility into their inventory. Not a lot of detail in the listing. The owner is retiring.

Competitors: The Access Group, SAP

HQ in the UK; 10 employees;

Integrates with Amazon, eBay, and more;

TTM Revenue: $300k; Profit: $240k; Margin: 80%

Asking: $500k; Multiple: 2.08x

✅ What I Like

The owner who started the business and is the senior software engineer is retiring. Son doesn’t want to take over, so they listed the business. There may be creative deal structures available. At first glance, valuation looks interesting.

❓ Questions & Concerns

No detail in the listing. Why hasn’t the business scaled further in 15 years?

You can view the listing on MicroAcquire.

— — — —

IRS Reporting - Open to Offers

For sale is a software platform that provides streamlined, timesaving digital Affordable Care Act (ACA) reporting to the IRS for businesses.

No competitors: Proprietary software solution;

TTM revenue: $1.6M; EBITDA: $1.2M; Margin: 75%;

Asking: Open to Offers

✅ What I Like

Large market of 250k+ employers in the US that have an ACA reporting requirement. The clients are sticky with most revenue recurring.

❓ Questions & Concerns

What are the regulatory risks? How are clients acquired and for how much? Is there an operating team in place? Why is there no competition?

You can view the listing on PrivSource.

🕸 Content/Service/Other

Media Brand - $5.5M

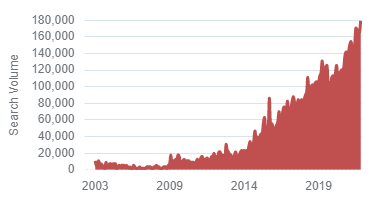

For sale is a 3-year-old digital media & ecommerce brand that makes viral memes around finance, stocks, crypto, NFTs, and the general economy. Interesting business.

Multiple revenue streams including e-commerce, advertising, NFTs, and events

2-owners working 20hrs/week on the business

TTM Revenue: $2.2M; Profit: $1.8M; Margin: 82%

Asking: $5.5M; Multiple: 3.06x

✅ What I Like

Innovative business model that takes advantage of the popularity of memes. I like that there are multiple revenue streams. Just an interesting business. Not for first-time buyers.

Here’s a Forbes article from 2018 that talks about the meme marketing space: More Than A Trend: Meme Marketing Is Here To Stay (forbes.com)

❓ Questions & Concerns

As with anything new and innovative, there’s always the risk that trends change and fads go away. Will memes continue to be popular? Will NFTs and crypto continue to draw interest? This listing requires a buyer who knows this space intimately and can perform the proper DD.

You can view the listing on Website Closers.

————

Cybersecurity As A Service - $1M

A 6-year-old SaaS-enabled agency that helps clients establish or level up their security programs is looking for a cash injection. I believe that this is an investment opportunity and not a business sale.

Competitors: Edendata, Sidechannel

Plans from $5k to $15k per month;

Building SaaS-enabled solution

TTM Revenue: $400k; Profit: $200k; Margin: 50%

Asking: $1M;

✅ What I Like

Great space to be in that’s growing massively. At first glance, appears that there’s a solid team in place. The founder has a podcast and newsletter which helps with marketing.

❓ Questions & Concerns

Not clear if this is a business sale or an investment. There’s a key-person risk if the founder leaves. Requires someone who is familiar with this industry.

You can view the listing on MicroAcquire.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best VoIP phone solution that I have found. I use this for DueDilio. You get a $20 credit if you sign-up.

Eloquens - Knowledge marketplace. I’ve purchased a few templates from them.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.