The Business Inquirer #091

In this week's issue, I highlight five listings including a WordPress plugin, a law firm marketing SaaS, a NY HVAC business, and more.

The Business Inquirer covers the most interesting business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

In this week’s issue:

🛒 eCommerce - 0 listings

☁ SaaS - 3 listings

🕸 Content/Service/Other - 2 listings

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is a leading online marketplace focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with pre-vetted due diligence service providers.

Our large and growing network of verified independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, commercial, and other key areas of business diligence.

Submit your project. Review qualified proposals. Hire service provider.

🛒 eCommerce

☁ SaaS

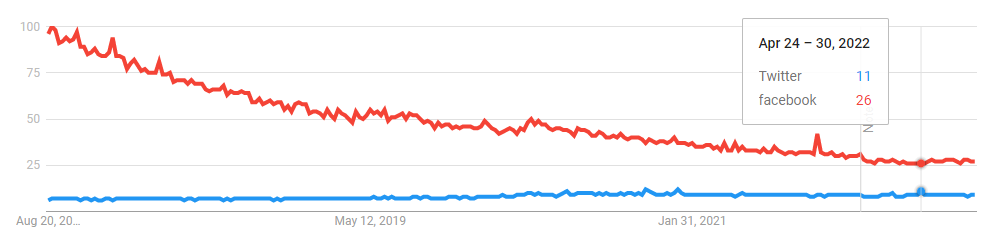

Twitter Analytics & Growth - $100k

For sale is a 1-year-old SaaS that helps analyze, grow and maintain your online presence. This platform discovers new content and audiences, and automation to save you time, analyze, grow your Twitter account, and maintain your online presence

Competitors: BTweeps

TTM Revenue: $50k; Profit: $40k; Margin: 80%

Asking: $100k; Multiple: 2.50x

✅ What I Like

I’m very bullish on Twitter. Every business owner I talk to who utilizes Twitter is blown away by the number of leads they get from the platform. I personally see this with DueDilio. I think tools such as this one will continue to gain popularity. There’s some great traction here for a business that’s only a year old.

❓ Questions & Concerns

Not a lot of detail in the listing. Very young project. There’s a decent amount of competition in this space with Typefully, Tweet Hunter, Hypefury, Tweepsmap, and more. A lot of due diligence is required.

You can view the listing on MicroAcquire.

__ __ __ __ __ __

Law Firm Marketing - $1.5M

For sale is a 1.5-year-old SaaS that enables attorneys to programmatically send emails and text messages to prospective clients recently arrested in the user’s practice areas, usually within 24 hours of arrest.

140 active clients

T6M revenue and SDE growth of 300% and 572% respectively

TTM Revenue: $509k; Profit: $385k; Margin: 76%

Asking: $1.5M; Multiple: 3.90x

✅ What I Like

Really interesting niche business. A lot of automation is built-in which leaves the owner to focus on growth. Huge TAM. Opportunities to expand to other practice areas.

❓ Questions & Concerns

I’d love to know how this SaaS actually works. How do they get arrest info and the person’s contact information, automatically? I would be extremely cautious with a business that’s showing such extreme short-term growth. Valuation is based on that growth which is probably not sustainable.

You can view the listing on QuietLight Brokerage.

— — — — — —

WordPress Elementor Plugin - $135k

For sale is 3-year-old Exclusive Addons for Elementor WordPress plugin. The plugin enhances the capabilities of Elementor and includes over 100 widgets and extensions. I use these for the DueDilio website.

39,000 installs; Revenue is a mix of lifetime deals and subscriptions;

TTM Revenue: $48k; Profit: $33k; Margin: 69%

Asking: $135k; Multiple: 4.09x

✅ What I Like

I think this is the first time I see a listing for a business where I am actually a customer (non-paying). I think these types of add-ons have a sticky customer base. I’d gladly pay for it but the free version is good enough. So maybe there’s an opportunity there. The website looks great.

❓ Questions & Concerns

Very competitive space. Requires constant updating to keep up with the latest versions of WordPress and Elementor. How do the support tickets look? How do they acquire new customers?

You can see this listing on Microns.

🕸 Content/Service/Other

Marketing Agency - $3.9M

For sale is a 20-year-old marketing and communications agency offering strategic marketing, communication plans, brand strategies, social media, public relations, advertising campaigns, website development, and print and digital media.

Fully remote team of contract workers; Serves public sector clients;

95% of revenue is repeating or referral clients;

The owner is nearing retirement but wants to stay on for a few years

TTM Revenue: $2.3M; Profit: $938k; Margin: 41%

Asking: $3.9M; Multiple: 4.16x

✅ What I Like

A lot to like here. Solid operating history with this business. I like that there’s a fully trained staff in place and the owner has been hands-off for a while. That means the business can operate with minimal involvement. Owner is willing to stay on for a few years. Probably some creative financing options are available.

❓ Questions & Concerns

I’d want to understand how involved the owner actually is. Is there any key-person risk? Who runs the business day-to-day? Employees are all contractors which creates some risk. How are clients acquired? Is there pricing power? Valuation is a bit elevated.

You can view the listing on BusinessesForSale.

__ __ __ __ __ __

NY HVAC & Refrigeration Servicing - $525k

For sale is a 23-year-old NY-based HVAC and refrigeration services company whose customer base includes both commercial and residential accounts.

Clients concentrated in the restaurant and food processing industry

Facilities include warehousing/storage, repairs area, welding station, offices

TTM Revenue: $1M; Profit: $312k; Margin: 31%

Asking: $525k; Multiple: 1.68x

✅ What I Like

A lot of operating history. The listing mentions that there is not a lot of client churn. Decent margins. Valuation looks very attractive at first glance.

❓ Questions & Concerns

The key concern here is the day-to-day operations and personnel. Are the employees staying on? How involved is the owner? Are you buying a business or a job? Why is the current owner selling?

You can view the listing on BizNexus.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best VoIP phone solution that I have found. I use this for DueDilio. You get a $20 credit if you sign-up.

Eloquens - Knowledge marketplace. I’ve purchased a few templates from them.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.