The Business Inquirer #092

In this week's issue, I highlight four listings including an IT services firm, an online business broker, a ZoomInfo competitor, and more.

The Business Inquirer covers the most interesting business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

Over the next few weeks, I’m going to be experimenting with this newsletter. You may see a different e-mail title. I may edit the format of this newsletter. As an example, in this issue, I added a “🚀 Growth” section.

My primary goal is to make sure that this newsletter continues to add value to you.

Please share your feedback with me.

In this week’s issue:

🛒 eCommerce - 0 listings

☁ SaaS - 2 listings

🕸 Content/Service/Other - 2 listings

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is a leading online marketplace focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with pre-vetted due diligence service providers.

Our large and growing network of verified independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, commercial, and other key areas of business diligence.

Submit your project. Review qualified proposals. Hire service provider.

🛒 eCommerce

No listings

☁ SaaS

B2B Sales Data Platform - $2M

For sale is an 8-month-old B2B data platform that serves sales teams, marketers, and developers.

Competitors: ZoomInfo, Lusha, People Data Labs, Clearbit

Pricing starts at $250/m and goes up to $250k/year for licensing

700M contacts; 140M work e-mails; 100M personal e-mails & phone numbers;

30-Day Revenue: $10k; Profit: $7k; Margin: 70%

Est. TTM Revenue: $250k; Profit: $125k; Margin: 50%

Asking: $2M; Multiple: 16.00x

✅ What I Like

I am a big fan of these types of data businesses. Huge TAM and they can be very profitable with a lot of end markets. There are a few large competitors to learn from. The founders were able to scale this one to profitability pretty quickly.

Take a look at the 2Q 2022 investors presentation for ZoomInfo for insights on this market: Investor Overview & Financial Results

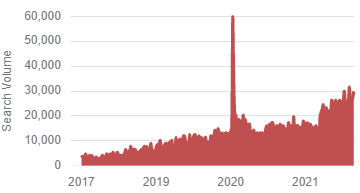

I think ZoomInfo search history is a decent proxy for demand growth…

❓ Questions & Concerns

Very young business. Valuation is based on their most recent funding offer from VCs. There are a lot of competitors in this space. Requires a lot of capital and a sales team to really scale. Tech due diligence is really important for this type of business. You want to understand their data collection systems and practices. How are they acquiring customers? Not enough history to really know their CLTV and other important metrics.

🚀 Growth

It reminds me of when Hubspot went upmarket and it created opportunities for smaller competitors such as Pipedrive. There may be a similar dynamic in this space with ZoomInfo = Hubspot.

How can this offering differentiate itself from the competition?

A new owner may want to look into niching down on an industry instead of being a “data for all” solution. Having partnerships and integrations with CRMs and other tools would be helpful. I’d avoid competing on CPC as that can be very expensive.

BCG published a good article on how to grow a data business: Building a Business from Data Is Hard—Here’s How the Winners Do It

You can view the listing on MicroAcquire.

__ __ __ __ __ __

App for Golfers & Courses - $120k

For sale is a 3-year-old mobile app that increases revenue and tee times for golfers and golf courses. There’s also a white-label solution that can be adapted to other niches.

Competitors: GolfNow, Zest Golf, Tee Times the USA

B2B2C-model with both golf courses and golfers as paying customers

Currently only active in Sweden; Just rolled out to global app store;

Notable brand ambassadors & investors; Raised 300k EUR;

20k+ registered users

TTM Revenue: $47k; Profit: $0; Margin: 0%

Asking: $120k

✅ What I Like

There are some well-known brand ambassadors such as Sergio Garcia (2017 Masters Champion). The listing mentions that the tech stack is very solid with all the integrations necessary for global expansion. Fun business for someone who is into Golf.

❓ Questions & Concerns

There’s revenue but no profit. Tough to value this type of business. The app has low penetration in Sweden, it’s home country. Expanding globally will require a lot of capital and know-how. Is there any analysis showing the market opportunity? Golfers are typically an older demographic. Would there be any resistance to them using a mobile app? A lot of risks in this business.

🚀 Growth

The very first thing I would do is figure out the ideal customer. Is it a large golf course? A small golf course? A public golf course?

Is it easier to sign-up a golf course or a consumer? Tough to say without having more information about this app. I believe the focus should be on signing up the golf courses which naturally leads to more consumers.

The new owner should leverage the brand ambassadors as much as possible. I would produce case studies showing the value proposition that this solution offers. Clearly demonstrate the ROI for the golf course. I think demos, videos, and in-person sales are going to drive the needle here.

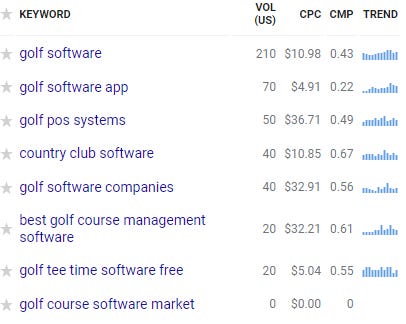

There are not a lot of online searchers for golf course software and CPC is expensive…

Perhaps targeted advertising on content websites and media brands that focus on golf would produce a positive ROI.

I would also explore an ad-supported business model. Instead of charging consumers, they are shown display advertising. Might not work for this mobile app but something I would look into. Creates less friction to sign-up.

You can view the listing on MicroAcquire.

🕸 Content/Service/Other

Online Business Broker - $175k

For sale is a 3-year-old boutique M&A sell-side advisory firm for internet-based businesses.

Competitors: Website Closers, Quiet Light Brokerage, Website Properties

3-person team; All operated remotely; Currently focuses on just 1 state;

6-8% commission on closed transactions;

TTM Revenue: $441k; Profit: $420k; Margin: 95%

Asking: $175k; Multiple: 0.42x

✅ What I Like

Do you dream about joining the fabulous & exciting world of business brokers? Here’s your chance. 😂

According to IBIS, the US business broker market size is $1.3B and growing 3.4% in 2022.

❓ Questions & Concerns

Important to understand what exactly you’re buying. Is it just a website? Is it a reputation? Are there relationships that can be transferred? Is the existing team staying on? Keep in mind that you’re not buying revenue. There’s a reason that the current owner only focused on one state - CPC advertising is very expensive. Tons of competitors in this space. This industry doesn’t have a great reputation so you’ll need to do a lot of due diligence.

🚀 Growth

There are some difficulties in scaling this type of business. I think there’s a huge gap between the established players (FE Int’l, Website Closers, Flippa, Empire Flippers) and everyone else that is only going to continue to grow bigger.

A new business owner has to really examine the competitive landscape and figure out the value proposition that they want to offer. Do you compete on price, service, or something else?

There are a few growth levers for this type of business:

Focus on website SEO and CPC

Cold outreach to prospective clients

Industry events where your clients hang out

Partnerships

You can view the listing on MicroAcquire.

— — — — — —

IT Services in Data Analytics & Migration - $4.5M

For sale is a 34-year-old IT services business that focuses on Microsoft technologies in data analytics and migration. Seller is retiring.

Located in Sacramento, CA but can be relocated; 21 employees;

Revenue generated from installation & ongoing services

TTM Revenue: $3.2M; Profit: $1.8M; Margin: 56%

Asking: $4.5M; Multiple: 2.50x

✅ What I Like

A lot of operating history. Fundamentals seem solid with great margins. There is a focus on two specific niches. One-time as well as recurring revenue. Appears that there are some government contracts. Seller is open to financing and transition for the right buyer. Multiple seems very reasonable.

❓ Questions & Concerns

I’d want to understand client retention and CLTV. Any client concentration? How has growth looked over the past few years? How are they acquiring customers? Any risk of losing employees? How easy is it to hire for this type of business? Requires experience in this industry.

🚀 Growth

I think focusing on client retention is just as important as winning new clients for an IT services business.

Referrals are typically the most powerful client acquisition channel as it’s low-cost and has a high conversion rate. I would make sure that it is easy & seamless for clients to make referrals.

You can view the listing on BizBuySell.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

DeepBench - Access a cutting-edge expert network. $200 discount.

OpenPhone - The best VoIP phone solution that I have found. I use this for DueDilio. You get a $20 credit if you sign-up.

Eloquens - Knowledge marketplace. I’ve purchased a few templates from them.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.