The Business Inquirer #094

In this week's issue, I highlight 4 listings including a podcast production agency, a MarTech startup, online courses for nurses, and more.

The Business Inquirer covers the most interesting business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

In this week’s issue:

🛒 eCommerce - 1 listing

🕸 Content/Service/Other - 3 listings

🛠 Tools & Resources

The Business Inquirer is brought to you by DueDilio.

DueDilio is a leading online marketplace focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with pre-vetted due diligence service providers.

Our large and growing network of verified independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, commercial, and other key areas of business diligence.

Submit your project. Review qualified proposals. Hire service provider.

🛒 eCommerce

Goat Milk Soap - $485k

For sale is 5-year-old Capure Goat Milk Soap UK e-commerce brand. Sells DTC and Amazon FBA. Cool product and listing.

$18 AOV; 43k e-mail subs;

TTM Revenue: $412k; Profit: $243k; Margin: 59%

Asking: $485k; Multiple: 2.00x

✅ What I Like

You show me a website featuring goats and I’m buying whatever they’re selling…

Apparently, I’m not the only one…

❓ Questions & Concerns

There’s an interesting detail in the listing:

“All products are manufactured in the UK by Capure's parent company and shipped out to fulfilment centres”.

Does this mean that the new owner is locked into a contract to continue buying products from the parent company? A lot of due diligence is required here.

🚀 Growth

I think the biggest opportunity may be to launch this product in the US. I’d utilize TikTok, IG, and other influencer platforms. Would this soap have any special appeal to expectant and new mothers? That would be an interesting market to explore.

You can view the listing on Flippa.

🕸 Content/Service/Other

Podcast Production Agency - $825k

For sale is a 4-year-old outsourced podcast production services business with clients that range from individuals to large businesses.

Priced from $1.5k to $7k per month; $18k CLTV;

Owner works 1-3 hours per week; Operated remotely;

20% of new clients are from referrals; 2k e-mail subscribers;

TTM Revenue: $400k; Profit: $232k; Margin: 58%

Asking: $825k; Multiple: 3.56x

✅ What I Like

At first glance, there’s a lot to like in this business. It’s in a growing industry, with high AOV with recurring revenue, great margins, and fully remote operations.

❓ Questions & Concerns

There’s a lot of competition in this space. How is this service different than some of the software that’s available? If the typical client pays $2,500 per month and gross monthly revenue is around $33k then it translates to around 13 clients. Not perfect math here but I’d want to understand client churn and what’s prevented them from scaling faster. Why doesn’t the current owner put more time into the business? Who does the actual production work?

In a business like this you also want to pay close attention to the contracts with existing clients. What’s the chance that they all bolt if a new owner comes in?

I’ve also recently heard that Website Closers doesn’t have the best reputation in this industry. The message I received was that buyers need to triple-check all the numbers on their listings.

🚀 Growth

They Got Acquired just published an article highlighting three companies serving this industry that had an exit. A good read to understand some opportunities in this space.

With more than 850,000 active podcasts, roughly two out of five Americans have listened to a recorded audio episode within the last month, according to the PEW Research Center.

First, I would want to understand the ideal client for this business. I don’t think it’s someone who is just starting out. It’s probably a podcaster who has some revenue coming in and wants to take their production to the next level. Luckily, it shouldn’t be too hard to build a target list for this business and do direct outreach.

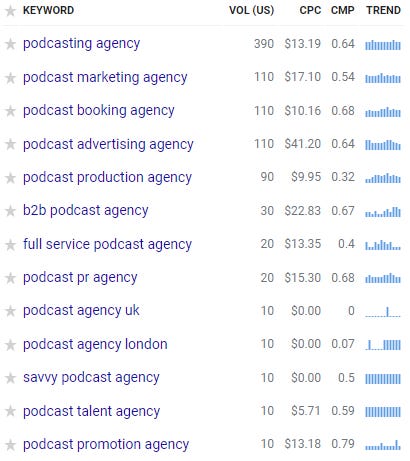

CPC can get expensive for this niche but with an $18k CLTV perhaps it’s not an issue…

You can view the listing on Website Closers.

__ __ __ __ __ __

Customer Research - Open to Offers

For sale is 7-year-old BestFit which is a data technology company that has developed a unique method for their clients to obtain actionable customer psychographic data. This startup was submitted by a subscriber. Ping me if you’re interested.

Mainly serves financial services, insurance, IT, HR, and retail industries

All revenue is one-time; Developing a self-service SaaS model;

Marquee clients include IBM, Zurich Insurance, Hermes, and more

Highly motivated seller with flexible valuation and seller financing

TTM Revenue: $500k; Profit: $300k; Margin: %

Asking: Open to Offers

✅ What I Like

Interesting opportunity for the right individual. This startup helps marketers have a better understanding of their customers. Very large TAM. Existing product with great traction. Marquee clients and some awards. A single shareholder who is very motivated and offering seller financing. Good opportunity to take over and grow the business.

❓ Questions & Concerns

This requires the right individual or a strategic acquirer. Buyer has to be familiar with MarTech industry and would help to have connections in this space. I think the focus should be on transitioning this to a SaaS model. This transition could be costly. The website needs to be redone. There’s a long sales cycle. Marketing can be expensive.

🚀 Growth

First, the website needs to be completely redesigned and professionalized. I would give it a more corporate feel highlighting client logos, testimonials, and solutions. Don’t sell products, sell results.

I once consulted for a social listening startup out of MIT Media Lab. We sold to the same clients as BestFit - marketers at F500. We had good results getting our product in front of the “innovation labs” of large F500 clients through cold e-mail.

I think showcasing at industry conferences is expensive but could yield some good results.

Partnering with marketing agencies might be an interesting angle here as well. Maybe create a white-label solution for them to offer to their clients.

You can view the listing on teQatlas. Ping me if you’d like a direct intro.

— — — — — —

Online Education for Nurse Practitioners - $8M

For sale is a 3-year-old online education business that is tailored to nurse practitioners. Its courses focus on how to start niche practices from IV infusion therapy to women's and men's health and even COVID testing mobile clinics.

Competitors: FHEA

Revenue from single courses, subscriptions, affiliate deals, and sponsorships

Tech stack: WordPress, Teachable, Aweber

174 active clients; 12k member FB group; 12k e-mail subs; 244 5-star Trustpilot reviews; Podcast gets 1k listeners;

Bootstrapped; Owner willing to stay on in reduced capacity;

TTM Revenue: $3M; Profit: $1.6; Margin: 53%

Asking: $8M; Multiple: 5.00x

✅ What I Like

The seller built an incredible online education business in just 3 years. Really impressive. Simple tech stack that’s easy to maintain. Clearly defined market and audience. The podcast, e-mail list, FB group, and Trustpilot reviews create a moat against competitors. Great margins. Diversified revenue sources. A lot of tailwinds. The listing is very detailed.

❓ Questions & Concerns

Is there any “leakage” of course materials? Meaning, can you find free copies of these courses online somewhere? Who creates and updates the courses? What’s the CAC and how are clients acquired? Will the existing team stay on?

🚀 Growth

The listing indicates there’s a +62% annual growth rate. Ya know - if it ain’t broke, don’t fix it. I’d just continue doing whatever it is they’re doing.

I wonder if there’s an opportunity to add a job board.

You can view the listing on MicroAcquire.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Logology - Best automated logo & brand identity tool I’ve come across.

OpenPhone - The best VoIP phone solution that I have found. I use this for DueDilio. You get a $20 credit if you sign-up.

Eloquens - Knowledge marketplace. I’ve purchased a few templates from them.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.