The Business Inquirer #098

In this week's issue, I highlight two listings including a #1 rated mobile app and a Missouri MSP.

The Business Inquirer covers the most interesting business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter

Hello Friends!

We’re now back with the Tuesday edition of the newsletter. I had to take a few weeks off due to the move down to Miami but now I’m back to a normal publishing schedule.

In this week’s issue:

☁ SaaS - 1 listing

💼 Service/Media/Other - 1 listing

🛠 Tools & Resources

This issue of The Business Inquirer is brought to you by Microns.io.

Delivered straight to your inbox every week, Microns.io is a newsletter that helps you discover the best micro-startups for sale. Join 3,500+ entrepreneurs and investors looking for their next micro-startup acquisition opportunity and, along the way, learn about how great deals are done.

☁ SaaS

Outdoor Navigation & Hiking App - Open to Offers

For sale is the #1 mobile app for hiking & outdoor navigation in the UK market. This is a proprietary deal from my friends over at BizNexus.

#1 ranking in UK Health & Wellness category

20k reviews with 4.7-star rating in the app store

Seller financing available; Seller is motivated;

TTM Revenue: $700k; Profit: $350k; Margin: 50%

Asking: Open to Offers

✅ What I Like

The top ranking and reviews provide a moat. The app dominates industry keywords and share of eyeballs in the app store. The app was recently rebuilt to prepare it for expansion. A lot of opportunities to expand this outside the UK as well as to focus on individual outdoor sports. The seller is motivated.

❓ Questions & Concerns

The seller of the app is a turnaround investor who optimizes for cash flow. There may not have been a lot of investment into topline growth which would eat into the margin. Going after new geographies and markets would require time and investment.

🚀 Growth

Copied directly from the listing:

There is a clear opportunity to expand outside of the UK, and furthermore the foundation has been built to enable this. The current owner is a turnaround private equity buyer. When they purchased the app, it was localized for the UK market with its offering of OS Maps. The current owner undertook a complete re-write of the app to support multiple map layers. Thus the app can seamlessly expand to other countries and geographies. It has great potential to expand globally. Geographic expansion, sales and marketing potential is huge given the product, its ranking and base-level marketing spend. Great SEO and social media marketing potential. Customer segmentation and offering improvement toward different sports e.g. hiking, running, mountain biking and other sports requiring maps.

You can view the listing on BizNexus or e-mail deals@biznexus.com for more details.

💼 Service/Media/Others

Missouri MSP - $390k

For sale is a 20+ year-old managed service provider (MSP) servicing Southwest Missouri and surrounding areas.

Most revenue is recurring

4-person team in place

TTM Revenue: $1M; Profit: $282k; Margin: 28%

Asking: $390k; Multiple: 1.38x

✅ What I Like

A lot of operating history. Business has transitioned from one-time services into a recurring revenue MSP. Team already in place with an experienced GM who handles the day-to-day. Valuation seems reasonable.

❓ Questions & Concerns

The glaring risk here is the GM who handles the day-to-day. What happens if they depart? Is there someone else who can pick up the work? Not a lot of cash flow in the business to invest in growth. MSPs are currently a very in-demand business from buyers. Why is this one still available?

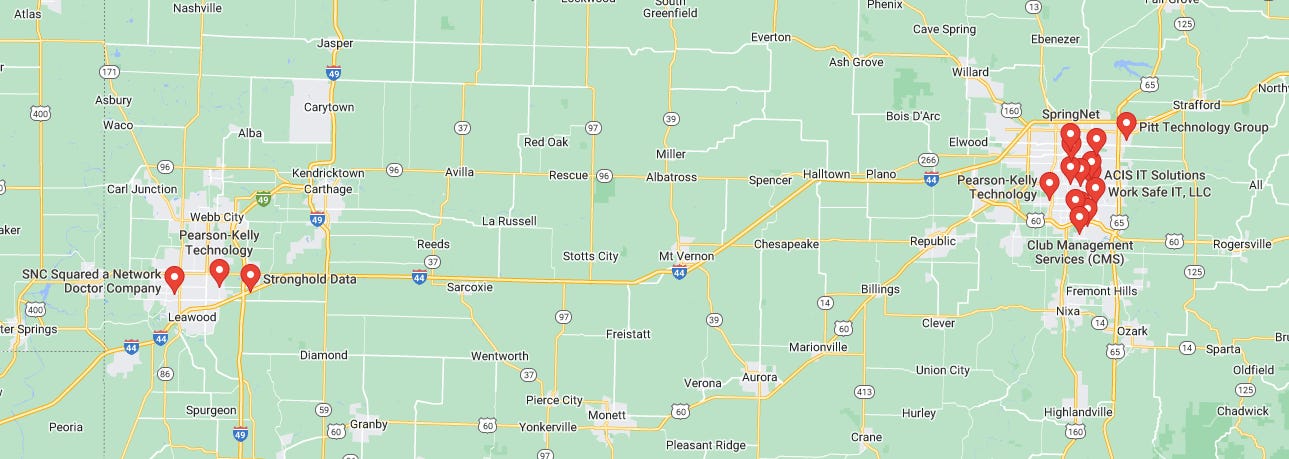

Below is a Google map of all MSPs based in Southwest Missouri. I’d want to really understand this market and the competition.

🚀 Growth

There are a few basic ways to expand this type of business:

Expand to other geographies

Increase service offerings

Increase pricing + margin

Consolidate competitors

TechTarget has a nice, basic guide on MSPs - Guide to building and executing an MSP business model

Client reviews and testimonials are important for any business but especially for a service business. As an example, here’s a page of St. Louis based MSPs that are on Clutch - Top IT Managed Service Providers in St. Louis - 2022 Reviews | Clutch.co. I’d want to make sure that the business is listed in relevant directories like Clutch, Truspilot, Google and that there is a clear process for collecting client reviews.

You can view the listing on BizBuySell.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Logology - Best automated logo & brand identity tool I’ve come across.

OpenPhone - The best VoIP phone solution that I have found. I use this for DueDilio. You get a $20 credit if you sign-up.

Eloquens - Knowledge marketplace. I’ve purchased a few templates from them.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.