The Business Inquirer #099

In this issue, I highlight three listings including an online business marketplace, an education platform, and something "exotic".

The Business Inquirer covers the most interesting business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter

Hello Friends!

In this week’s issue:

☁ SaaS - 1 listing

💼 Service/Media/Others - 2 listings

🛠 Tools & Resources

This issue of The Business Inquirer is brought to you by Scott Oldford.

Scott Oldford is one of the top online business mentors and advisors and he also owns dozens of businesses that collectively generate tens of millions of dollars a year in multiple niches, countries (and even languages), across the world.

In his new "Investing with Scott" newsletter, he gives you a behind-the-scenes look into acquiring, building, and scaling businesses based on his experience of helping 100's of Entrepreneurs scale past 7 & 8 figures.

As an Entrepreneur since he was 7 and by 16 having a million dollar business while ending up a million in debt and now by 31, becoming a decamilionaire, he has a massive amount of insight, understanding, knowledge, and wisdom for scaling and building businesses.

You can check it out right here, perfect for Entrepreneurs and Investors alike.

☁ SaaS

Education Platform - Open to Offers

For sale or investment is a 2-year-old education platform that makes it easy for teachers to make their own learning games.

Competitors: Kahoot, Quizizz, Quizlet

7k paying clients; 750k MAU; Subscription model;

Bootstrapped; 60/40 ownership split;

TTM Revenue: $418k; Profit: $80k; Margin: 19%

Asking: Open to Offers

✅ What I Like

Evergreen niche. Bootstrapped business with no debt. Business is open to acquisition or investment. Large customer base and TAM. Usage statistics seem to be strong.

❓ Questions & Concerns

Not a lot of operating history. The business has $0 CAC which means they haven’t systemized a customer acquisition process yet. How are they acquiring customers? Are they selling to teachers or school systems? Is there enough margin to actually start paying for customer acquisition? How does this product compare to competitors?

🚀 Growth & More

The target market is clearly defined. Where do teachers spend their time? Are there trade publications? Is there an opportunity to sell this into school systems instead of to individual teachers?

You can view the listing on BitsForDigits.

💼 Service/Media/Others

Platform for Booking Dancers - $765k

For sale is a 22-year-old online platform to book male and female dancers for events, parties, and social gatherings. I assume that this is for hiring exotic dancers. Interesting business but not for everyone.

Marketplace/lead gen business model; Services available in all 50 states;

$167 AOV; Website has 35k unique monthly visitors; 200k e-mail list subs;

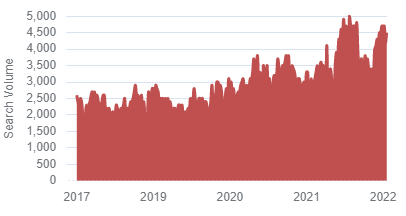

Focus on SEO with ranking for 3k major keywords

Two employees including sales agent and full-time manager

TTM Revenue: $288k; Profit: $255k; Margin: 89%

Asking: $765k; Multiple: 3.00x

✅ What I Like

I like the marketplace model. A lot of operating history. Low owner involvement with the team in place. Great margin. Strong social media presence. Low CAPEX and operating costs. Demand seems to be consistent for this type of service.

❓ Questions & Concerns

Clearly this type of business is not for everyone. May be limited exit options down the line. I’d want to really understand regulations, compliance, and insurance around this industry. I imagine that there’s some decent turnover in supply side. How is that handled? SEO is a large part of the customer acquisition strategy. This is always risky as you’re at the whim of Google algo updates. How has this impacted the business previously? What does the $167 AOV mean as it seems low? The listing is from Website Closers which means that it needs extra due diligence.

🚀 Growth & More

In essence, this is a marketplace or lead gen type business. Focusing on SEO and referral partnerships are the two key customer acquisition channels.

I’ve personally found a lot of value in the Sharetribe Academy. Take a look at this module about marketplace growth: Marketing and growth for marketplaces

You can view the listing on Website Closers.

__ __ __ __ __ __

Online Business Marketplace - $1M

For sale is a 3-year-old marketplace to buy content sites, e-commerce sites, and other online businesses. I wonder if it’s BlogsForSale?

100% remote team; $1.1M in deals in LTM;

10-20% commission on final selling price; Ad revenue;

All business is generated from SEO & referrals

TTM Revenue: $325k

Asking: $1M

✅ What I Like

Could be an interesting opportunity for someone who wants to get into the online M&A space. Low CAPEX business model. All leads are organic and from referrals. There are a lot of tailwinds for this industry.

❓ Questions & Concerns

Not a ton of detail in the listing. Not even sure if the asking price is correct. Personally, I think this is a very crowded space with new marketplaces and aggregators popping up each week.

🚀 Growth & More

There are a lot of growth levers for this type of business. The main ones are SEO, referrals, education, and partnerships.

Again the Sharetribe Academy guide to growing a marketplace would be helpful here: Marketing and growth for marketplaces

You can view the listing on BizBuySell.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Logology - Best automated logo & brand identity tool I’ve come across.

OpenPhone - The best VoIP phone solution that I have found. I use this for DueDilio. You get a $20 credit if you sign-up.

Eloquens - Knowledge marketplace. I’ve purchased a few templates from them.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.