The Business Inquirer #104

In this week's issue, we highlight 4 listings including an online tutoring business, a personal protection FBA brand, a B2B marketplace, and more.

The Business Inquirer covers the most interesting business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter

Hello Friends!

In this week’s issue:

🛒 eCommerce - 1 listing

☁ SaaS - 1 listing

💼 Service/Media/Others - 2 listings

🛠 Tools & Resources

This issue of The Business Inquirer is brought to you by DueDilio.

DueDilio is a leading marketplace to hire highly vetted due diligence service providers.

Our large and growing network of verified independent professionals, boutique, and mid-size firms specialize in finance, technology, operations, and other key areas of business diligence.

Submit your project. Review proposals. Hire a service provider.

🛒 eCommerce

FBA Personal Defense Brand - $750k + Inv

For sale is a 2-year-old FBA personal defense brand. Launched by a husband and wife team that unfortunately experienced health issues in 2022 which caused a reduced focus on the business.

Sold only through Amazon

Top 2 SKUs make up 26% and 23% of revenue; Over 2,400 reviews combined;

Boopos partial financing is available

TTM Revenue: $668k; Profit: $268k; Margin: 40%

Asking: $750k; Multiple: 2.80x

✅ What I Like

Young business but the owners were able to scale it pretty quickly. I believe that a typical FBA business has net margins of 20-30% so a 40% margin is very good. There’s some product concentration in the top two SKUs but 50% is not bad. Opportunity to expand the product to DTC, Walmart, and other channels. Safe to assume that these products are not hard to manufacture and there are a lot of suppliers. The owners spend less than 10 hours per week on the business.

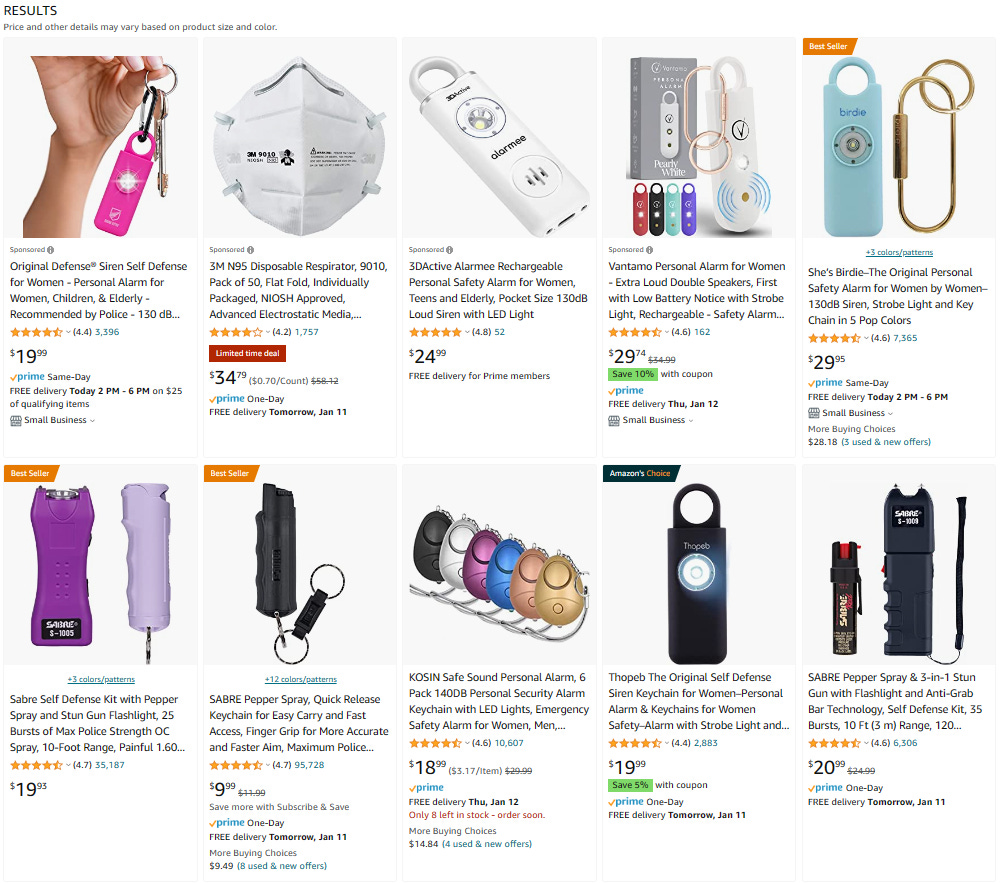

Here are some of the top Amazon search results for “personal protection devices”:

Unfortunately, it does feel like crime is increasing across the US. Even if it’s just perception and not reflected in actual statistics, the personal protection product category should benefit long-term.

❓ Questions & Concerns

Not a lot of operating history for this business. Is there any IP? What makes these products unique and differentiated? How do the reviews look? How many are repeat purchases? How many are returned? There’s not a lot of Google search volume (see below) for this product category.

🚀 Growth

Some possible growth channels include:

Launch DTC store using Shopify

Launch products on Walmart and other marketplaces

Advertise products in specific publications for teachers, hospital workers, EMTs, moms, seniors, etc

Partner with influencers and blogs in this space

Introduce additional products

Remarket the same products but to a specific niche (ex: Seniors)

You can view the listing on Quiet Light Brokerage

☁ SaaS

Cybersecurity - Open to Offers

For sale is a 10-year-old cybersecurity software providing an automated solution for secured configuration management.

100% owned by the founder; 6-10 employees; ~40 customers;

110% customer retention; 40% Y/Y revenue growth;

Annual recurring revenue; Services and support agreements;

TTM Revenue: $2.2M; Profit: $865k; Margin: 39%

Asking: Open to Offers

✅ What I Like

A lot of operating history. Clients are mainly in regulated industries such as banking, healthcare, insurance, and gov’t. These clients tend to be stickier. Several revenue streams including annual subscriptions, services, and support agreements. Cybersecurity is a rapidly growing industry with a lot of exit opportunities down the road.

❓ Questions & Concerns

Not a lot of detail in this listing. Very heavy due diligence is required. I would want to understand how clients are acquired. How long is the sales cycle? How easy is it to hire employees in this sector? Is there customer concentration risk? What’s the churn and LTV? Why is the owner looking to cash out now?

You can view the listing on BitsForDigits.

💼 Service/Media/Others

Online Wholesale & Liquidation Marketplace - $290k

For sale is a 5-year-old online B2B marketplace that features wholesale and liquidation auctions on clothing and other household items. Clients use the marketplace to purchase inventory for their eBay, Amazon, and Shopify stores to resell.

Competitors: B StockSupply, Bulq, DirectLiquidation, Liquidation.com

Went through Y Combinator; Returned investor money and $0 debt now;

Business is automated with custom software

Freelancer handles customer support

TTM Revenue: $345k; Profit: $39k; Margin: 11%

Asking: $290k; Multiple: 7.44x

✅ What I Like

Interesting listing for the right acquirer. I love the marketplace business model. Very difficult to start but once there’s scale, it prints cash. There’s a good amount of detail in this listing. With customer returns becoming a huge problem for retailers, I believe liquidation marketplaces such as this one are part of the solution.

From the article:

About 5 to 10 percent of in-store purchases are returned. But that rises to 15 to 40 percent for online purchases, according to David Sobie, co-founder and CEO of Happy Returns.

In the next several years, as e-commerce grows globally, “the amount of returns is going to be over a trillion dollars a year,” Tobin Moore, the CEO of Optoro said.

❓ Questions & Concerns

Building a two-sided marketplace is notoriously difficult. What’s the strategy for acquiring supply and demand? This marketplace is built on custom code which may present its own challenges. There’s a lot of competition in this space. Valuation is aggressive.

You can view the listing on Acquire (formerly known as MicroAcquire).

__ __ __ __ __ __

Online Tutoring - $325k

For sale is a 3-year-old online tutoring service. Their business model centers around connecting US-based immigrants with highly qualified educators based within the Eastern European region.

70 tutors on the platform; 12 subject areas;

1,000 active clients; Each client takes 8.1 classes on average; $65 AOV;

Growth primarily through word of mouth & referrals

Owner spends 2 to 6 hours per week on the business

TTM Revenue: $311k; Profit: $105k; Margin: 34%

Asking: $325k; Multiple: 3.10x

✅ What I Like

It sounds like this tutoring service targets US/Israel/Canada immigrants from Eastern European countries. Good to have a well-defined target audience. Since all growth has been through referrals, I assume they have solid brand recognition within the community. A lot of ways to grow this business.

❓ Questions & Concerns

This is a two-sided marketplace but with even more moving pieces. Not clear if the actual tutoring is done in English or in some other language. How easy is it to hire tutors? Not an easy business to operate regardless of what the listing/broker may say.

🚀 Growth

Several growth drivers for this business:

Develop a content marketing & SEO strategy

Advertise in online and offline communities for Eastern Europeans

Expand the number and types of classes that are offered

You can view the listing on SellerForce.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.