The Business Inquirer - Issue #1 (11/2/2020)

This week's email provides an intro to the newsletter, highlights a WordPress tutorial and a swimwear business, and what I learned last week.

Every week I write an e-mail highlighting interesting online businesses for sale and add my own commentary. If you would like to receive it directly in your inbox, subscribe now.

Hello Friends!

In this week’s e-mail:

Intro - Welcome to The Business Inquirer!

WordPress Tutorial Videos - Affiliate/Display/Udemy

Aqua Adapt - Dropshipping/eCom store

What I Learned Last Week

Intro

Welcome to the first issue of The Business Inquirer!

I’m really excited to share with you some of the more interesting online for-sale businesses I come across. My definition of an “interesting” business is much more broad than simply a good acquisition target. My goal is to highlight businesses from which we can learn, get inspired, and in some cases, may be good acquisition targets. Along the way I will also do my best to share some tips, insights, personal thoughts, and other (hopefully relevant) tidbits.

First – I want to make it clear that I have absolutely no edge in this. I am not a VC, I’ve never written a newsletter, I’ve never had a big exit (except being fired from a job 😊), and no special relationships with brokers. I’m learning as I go along.

Second – I’m doing this for fun & to learn. Please help me by sharing your thoughts, ways I can improve, things you would like to see here, or just say “hello”. I’ll share your comments whenever it’s appropriate. If you would like to contribute to this newsletter in any way, I’m all ears and open to suggestions.

Third – I may not always be able to provide all the business detail due to NDA restrictions. If a business description looks vague or if there are obvious numbers missing – it’s because I either didn’t have the data or was under NDA.

A bit about me…

Past: Equity research analyst, investment banking sales, consulting

Present: Founder/CEO @ Transactionly; Owner @ PRSNL Branding; Publisher @ The Business Inquirer; Pursuing a few other entrepreneurial endeavors as well.

Connect with me on LinkedIn & Twitter.

Now let’s begin this journey…

Affiliate/Display Advertising/Courses Business - (Asking: $150k)

Description

For sale is a strong brand firmly positioned in the WordPress tutorial niche. Business earns revenue through affiliates, advertising, and Udemy video courses. Highlights include over 200 in-depth WordPress tutorial videos, 538k video views in the LTM, 8.5k YouTube subscribers, 1.3m lifetime video views, and over 56k students on Udemy. $60k of the revenue comes just from Udemy.

Annual Revenue: $129k

Annual Profit: $107k

Profit Margin: 82.9%

Asking Price: $150k

Multiple: 1.4x

What I Like ✅

Pure online business with low overhead and high profit margins.

Fits the build once, sell twice mantra.

Revenue seems to be diversified between affiliate, advertising, and Udemy.

Doesn’t require deep industry knowledge.

Multiple seems reasonable if revenue and profit numbers are verified.

Several ways to expand the business in the future: add community, additional content, change affiliate networks, offer adjacent services, add simple merchandise.

Clear exit opportunities: sell to hosting provider, sell to theme/plugin dev, sell to someone with existing content business.

Search volume is strong on an absolute basis

I think there may be leverage here to negotiate down the price (see below). Create some margin of safety.

What I Don’t Like ❌

There’s a lot of existing content and resources for WordPress.

Just relying on WordPress tutorials is risky. Would be better if the business had a more diversified product.

This listing can be found here.

eCommerce - Aqua Adapt (Asking: $5k)

Important Note: This is actually NOT a business I would acquire. This is easy to start from scratch and create a better competitor.

Description

Aqua Adapt is a Shopify store setup about 5-months ago which sells color changing swim trunks for men through a dropshipper in China. The business is young but in the summer months they generated a gross monthly revenue of $18k, monthly profit of $3,612, for a profit margin of 20%. I won’t go into too much detail but you can see the actual listing here.

Why I’m Highlighting This Business

First, I think the product is simple and interesting.

Second, I think this could be a great starter business for someone who is new to ecommerce.

The concept of color changing swim trunks is actually unique and could have a wide appeal. To some degree, the Aqua Adapt guys actually proved the concept (if their data is true) but they didn’t really want to do the extra work required to try and grow the business.

On the other hand, the Sea’Sons guys did do the work and are selling these trunks for $70 a pair. They’re based in the UK and looks like they may actually manufacture their own.

Here’s my train of thought around this business…

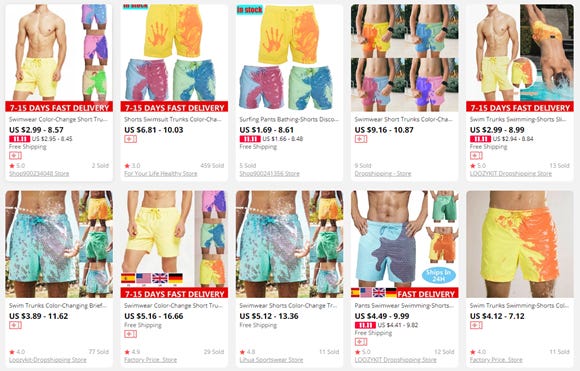

Google tells us that there’s some competition in the space but really not too much. The products are all the same…

One of the competitors you can see is Swimsuitsnova and sells these for around $40. The reviews on their website seem too good to be true when you compare to all the mixed reviews on Amazon… (pro tip: don’t use the word “nova” in any product name”)

What are the biggest complaints we see with these trunks…

Incorrect sizing (Aliexpress large is very different than American large)

Deceptive advertising. Color doesn’t actually change simply with water but with temperature change. So the water has to be warm for them to change color. (insert joke here 😂)

Quality seems to be hit or miss. Some think it’s OK, others expected something better.

Looking at the few merchants who sell these types of shorts, it feels like no one really put any effort into properly marketing or presenting these. I’m seeing photos directly from Aliexpress, sizing in CM instead of i, and not a lot of great descriptions. Just look at the confusing sizing details provided on one of the websites…

Sourcing for this product is extremely easy. There are many sellers and few options available on Aliexpress. Pricing appears to be anywhere from $2 - $17.

The product images supplied by the manufacturers actually aren’t terrible. They can probably be used initially until the store is generating enough revenue to justify taking more quality/unique product photos…

We can easily find the same color changing “technology” available in women’s swimwear on Aliexpress…

Interestingly, for women there actually doesn’t seem to be as much competition in this “color changing” swimwear niche…

Here’s how I’d think about starting a competitor…

Think about whether it makes more sense to try this with women’s swimwear instead of men’s. Women spend more on clothes so perhaps that’s the better route.

Order some samples from a few different vendors to see if quality varies. Inquire about using a higher quality fabric.

Come up with a brand name. I’d think if something classic or simple would be better. There are a lot of simple domains available for this concept.

At first, use the stock photos but eventually you’d have to get higher quality product photos and videos made. Differentiate yourself from the competition.

Purchase a nice Shopify theme to show off the product. Don’t use the same theme that everyone else uses.

I think $25-$65 is the right price for these depending on how they’re presented and cost.

For advertising/growth - check out THIS other listing for a swimwear brand and replicate their process. Read the comments as there are some good ideas in there. I may highlight this business in a future newsletter.

Ok - that’s the end of the business highlights for this week.

What do you think? Interesting? Easy to understand? How can I improve?

Please use this form for any feedback or to contact me.

What I Learned Last Week

There’s an audience for this newsletter.

I posted my idea for the newsletter on Reddit and a few business focused FB groups. I received close to 100 signups and some great responses to my questionnaire. Optimistically I expected 20 people to subscribe. Starting with ~100 subscribers adds fuel.

Feels like there are opportunities in equity markets.

Energy, Materials, Natural Resource stocks have been out of favor by investors for a long time. Their share (weighting) of the S&P 500 is at or close to all time lows. As Warren Buffet says: “Be greedy when others are fearful, and fearful when others are greedy”.

Gold mining companies started reporting their Q3 earnings and there are some very strong numbers. Very impressive cash flow generation at current gold price. They’re all hiking their dividends. Newmont hiked dividend by 60%. Agnico hiked by 75%, Alamos by 33%. If this is interesting, check-out the latest from Crescat Capital.

For a deep-dive on the dynamics in the Natural Resources space I would highly recommend reading Goehring & Rozencwajg.

Onfolio invests in and manages websites for themselves and for their investors.

Their blog is a must-read for anyone interested in learning about websites management and investing. Their latest post is titled What We Learned From Buying 30 Sites in 2019. Go read the actual post but some of their “General Learnings” when buying a business..

Know where your specific skillset lies.

View as many deals as you can and learn

Practice on a smaller scale with starter sites or even start your own website to learn

Many ways to make money in the space but you need to have an idea of your desired outcome.

Speak with brokers to learn different perspectives. Brokers are there to help. If something doesn’t make sense, ask them. Be selective in the brokers you talk to as not all are created equal. Also, don’t waste their time if you’re just window shopping.

The number of asset classes are multiplying.

Stocks, bonds, and precious metals have been the traditional asset classes. Today we can add crypto, private equity, art, cars, and a few others to that list. I think it’s safe to say that the number of asset classes available to investors is and will continue to expand. I can see a future where investors will be able to purchase shares in a portfolio of websites, Shopify stores, sneaker collections, cars, ISAs, etc – maybe even from their 401K. Just as mutual fund companies have made public market investing accessible to the public, there will be similar structures in place to facilitate the same type of investment in new asset classes. Of course it’s already happening in many ways: Coinbase for crypto, Acquicent for cars, Masterworks for art, etc.

This is why I think it’s important to create. Just do something. This “something” may become more valuable than you expect. 🚀

Sneaker market expected to grow to $30B by 2030.

This Business Insider article titled “Sneaker Selling Side Hustle: Your guide to making thousands reselling hypes pairs like Air Jordans and Yeezys” is an interesting read. Market is growing and there are many adjacent business opportunities.

Substack is version 0.5 today.

Very frustrating to use without a lot of documentation or help. Took me a few hours to write this newsletter and a full day to get it to look (almost) right on Substack. They’ll probably improve but today it would be insanely easy to create a better product. This morning I’m reading Twitter may acquire Substack. Makes sense.

That’s all for this first issue of The Business Inquirer.

As always, please don’t hesitate to contact me with any questions, comments, or feedback.

If you liked this post from The Business Inquirer, why not share it?

Important Disclaimer: This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

How would you think about acquisition in a dropshipping business? Cost of customer acquisition is ever increasing, lack of unique products... is the main value is in its email list? I have dabbled in dropshipping this summer (who hasn't?!) and the "typical" business practice is awful