The Business Inquirer #167

Sharing a party supplies rental business, a construction consulting firm, a dry cleaner in SC, a wellness marketplace, an events RSVP SaaS, a PM tool for SMBs, and a luxury pillow brand.

Hello Friends!

In this week’s issue:

🛒 eCommerce - 1 listing

☁️ SaaS - 2 listings

💼 Marketplace - 1 listing

🏡 Main Street - 3 listings

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

🛒 eCommerce

Endorsed Pillow Company - $170k (inv. included)

Founded in 2021

Distressed sale; $130k of inventory included;

Sold DTC through Shopify

Revenue: $495k

Profit: $29k

Margin: 5.9%

Multiple: 5.78x (including inventory); 1.38x (excl. inventory)

💬 Quick Take

This luxury pillow company presents a unique opportunity for an experienced digital marketer or e-commerce specialist. The brand has been endorsed by well-known publications and has demonstrated resilience despite previous mismanagement. However, the low margin and reduced revenue highlight the challenges that need to be addressed. The inventory included in the sale is a significant value add, but the reliance on a single product line and the need to re-engage paid advertising channels are potential hurdles.

✅ What I Like

Strong Endorsements: Endorsements from Wirecutter, Forbes, and SleepFoundation add significant credibility and brand value.

Proven Sales Performance: Achieving $1.1M in revenue in the second year indicates strong market demand and product-market fit.

Minimal Management Required: The business operates with minimal active management, making it a potentially easy acquisition for a buyer.

Included Inventory: $130K of inventory included in the asking price adds immediate tangible value.

Organic Traffic: The reliance on organic traffic suggests that the brand has built a loyal customer base without heavy marketing expenditure.

Affiliate Sales Potential: The existing affiliate sales via ShareASale can be expanded with proper management.

3PL Setup: The use of a 3PL in Las Vegas simplifies logistics and reduces overhead costs.

Contracted Services: Key operations like customer service and supply chain management are handled by contractors, reducing the need for in-house staff.

❓ Concerns

Reduced Revenue: The significant drop in revenue from $1.1M to $495K may indicate underlying challenges that need addressing.

Founder Dispute Impact: The previous mismanagement and stockouts due to a founder dispute could have harmed the brand’s reputation and customer trust.

Reliance on Hero Product: With 90% of sales coming from one product, the business is highly vulnerable to changes in consumer preferences or supply chain disruptions.

Discontinued Advertising: The cessation of social media and Google ads could result in declining brand visibility and customer acquisition.

No Amazon Presence: The business is not currently selling on Amazon, missing out on a major sales channel.

Dependency on Contractors: While contractors reduce management needs, they may also lead to a lack of control and potential inconsistencies in service quality.

💼 Due Diligence Questions

Revenue Decline: Can you provide a detailed breakdown of the revenue decline from $1.1M to $495K? What were the main contributing factors?

Customer Feedback: Is there any data or feedback on how the stockouts and mismanagement affected customer satisfaction and repeat purchase rates?

Inventory Turnover: What is the current rate of inventory turnover, and how does it compare to industry benchmarks?

Contractor Agreements: Are there formal agreements in place with the contractors, and how stable are these relationships?

Advertising Strategy: What was the return on investment (ROI) for the previous Meta and Google ad campaigns?

Affiliate Sales Management: How are affiliate relationships currently managed, and what are the terms with key affiliates?

Supply Chain Stability: Have there been any recent issues with the supply chain, and what measures are in place to mitigate future risks?

Product Diversification: Are there any plans or R&D efforts to diversify the product line beyond the hero product?

3PL Performance: How reliable is the 3PL provider in Las Vegas, and are there any contingencies in place for logistical challenges?

Customer Demographics: Is there a detailed breakdown of customer demographics and purchasing behavior that can guide future marketing efforts?

🚀 Growth Levers

Revitalize Paid Marketing: Re-engaging with Meta ads and branded searches on Amazon could reignite demand and drive sales.

Amazon Re-entry: Relaunching on Amazon could open up a significant revenue channel and reduce customer acquisition costs.

Expand Product Line: Introducing complementary products could diversify revenue streams and reduce dependency on the hero product.

Improve Inventory Management: Implementing better inventory management systems can prevent stockouts and ensure consistent sales.

Leverage Endorsements: Use existing endorsements in new marketing campaigns to build brand credibility and attract new customers.

Nurture Affiliate Relationships: Revamping the affiliate program with better incentives and support could drive more sales.

Explore International Markets: Expanding to international markets could unlock new customer segments and revenue opportunities.

Enhance Customer Experience: Improving customer service and engagement could increase repeat purchases and build brand loyalty.

🙋🏻♂️ The Buyer

Digital Marketing Expertise: A buyer with a strong background in digital marketing will be able to capitalize on the business's untapped potential.

E-commerce Experience: Familiarity with e-commerce platforms, particularly Shopify and Amazon, is crucial for optimizing sales channels.

Operational Efficiency Focus: A buyer who can streamline operations and improve inventory management will see immediate gains.

Growth-Oriented: An ideal buyer is someone eager to explore and implement growth levers, including reactivating paid advertising and expanding product lines.

Brand Builder: A buyer who can leverage strong endorsements and build a compelling brand story will likely see success.

☁️ SaaS

Project Management for SMBs - $499k

Founded in 2009

158 paid accounts; 1,500 seats; ARPA $65;

Revenue: $237k

Profit: $134k

Margin: 56%

Multiple: 3.7x

💬 Quick Take

This integrated platform for SMBs offers a compelling mix of simplicity and efficiency by addressing the common pain point of fragmented workflows. With a high gross profit margin and consistent growth in its latest product edition, this SaaS business is positioned well for scalability. However, the declining legacy product and the need for a more robust sales and marketing strategy are areas that potential buyers should scrutinize. Overall, this is a solid acquisition opportunity for a buyer with the expertise to drive further growth.

✅ What I Like

High Profit Margin: An 80% gross profit margin and consistent EBITDA between 40% and 54% indicate strong financial health.

Recurring Revenue Model: The subscription-based revenue model ensures a stable and predictable income stream.

Minimal Maintenance: With under 4 hours of monthly maintenance, this business requires minimal operational input, making it attractive for passive income or growth-focused strategies.

Strong Customer Satisfaction: High NPS scores and positive G2 reviews reflect strong customer satisfaction and product-market fit.

Unified Platform: Combining project management and customer support into a single tool addresses a significant pain point for SMBs.

Low Operational Overhead: The small team size and streamlined operations mean low fixed costs and high flexibility.

Established Brand: The business has built a strong brand reputation since its founding in 2009, providing a solid foundation for future growth.

❓ Concerns

Customer Concentration: With only 158 paid accounts on the latest version, there may be a risk of revenue concentration if a few key accounts churn.

Marketing Gaps: The business seems to have limited marketing efforts, which could hinder growth potential and market reach.

Competitive Market: The platform operates in a crowded market with competitors like Asana, HelpScout, and Zendesk, requiring differentiation and strong marketing to stand out.

Scaling Challenges: Transitioning from a product-focused company to a sales and marketing-driven organization may present operational challenges.

Limited Sales Team: The absence of a dedicated sales team could slow down customer acquisition and revenue growth.

💼 Due Diligence Questions

Customer Migration: What percentage of legacy product users have transitioned to the new platform, and what is the plan to migrate the remaining users?

Churn Rate: What is the churn rate for both the legacy and the latest product versions, and what are the key reasons for churn?

Marketing Strategy: What marketing efforts have been undertaken, and how effective have they been in driving customer acquisition?

Competitor Analysis: How does the platform differentiate itself from competitors like Asana, HelpScout, and Zendesk?

Sales Pipeline: What is the current sales pipeline, and are there any existing partnerships or channels for customer acquisition?

Revenue Concentration: What percentage of revenue comes from the top 10 customers, and how diverse is the customer base?

Product Development: What new features or product enhancements are planned, and how do they align with customer needs?

Pricing Strategy: How was the current pricing model determined, and is there flexibility to adjust pricing as needed?

Operational Risks: What risks exist in the current operational model, especially with such minimal maintenance requirements?

Expansion Plans: What are the growth opportunities in new markets, and what resources would be needed to capitalize on them?

🚀 Growth Levers

Expand Marketing Efforts: Increase digital marketing, content marketing, and SEO to drive brand awareness and customer acquisition.

Leverage Customer Success: Invest in customer success initiatives to reduce churn, increase satisfaction, and upsell to existing customers.

Develop a Sales Team: Build a dedicated sales team to focus on outbound sales and partnership development.

Optimize Pricing: Reevaluate the pricing strategy to maximize revenue while remaining competitive in the market.

Introduce New Features: Continue to innovate and add new features based on customer feedback to enhance the platform’s value proposition.

Customer Migration Incentives: Offer incentives or discounts to encourage legacy product users to transition to the new platform.

Strategic Partnerships: Form partnerships with complementary service providers or platforms to expand the customer base and add value.

🙋🏻♂️ The Buyer

SaaS Expertise: The ideal buyer has a strong background in SaaS businesses, particularly in scaling subscription-based models.

Marketing and Sales Experience: A buyer with experience in digital marketing and sales team development will be well-positioned to accelerate growth.

Customer Success Focus: Understanding the importance of customer success and retention will be crucial to sustaining and growing revenue.

Operational Efficiency: A buyer who can maintain or improve the low operational overhead while scaling the business will see immediate benefits.

Product Development Vision: The buyer should have a clear vision for product development to ensure the platform remains competitive and valuable to users.

__ __ __ __ __ __ __ __ ____ __ ____ __ __

Events Management Tool - $950k

Founded in 2016

Hosted 20k events; 10k users; Low workload;

Revenue: $475k

Profit: ~$94k

Margin: 20%

Multiple: 10.1x

💬 Quick Take

This online event management platform stands out for its simplicity and design-focused approach, offering a more aesthetically pleasing alternative to heavily branded competitors. With 10,000 customers and a strong ARR of $475K, the business is profitable and requires minimal effort to maintain. However, the high asking price relative to cash flow and the need for further investment in development and marketing to drive growth are notable concerns.

✅ What I Like

Simplicity and Usability: The platform’s user-friendly design makes it an attractive option for customers who prefer a streamlined, aesthetically pleasing event management tool.

Established Customer Base: With 10,000 customers and $475K in ARR, the business has a solid foundation of recurring revenue.

Low Maintenance: The business requires only 2-3 hours of customer support work per week, making it easy to manage.

Scalable Technology: Built with Ruby on Rails and JavaScript, the platform is scalable and can accommodate future growth and feature expansions.

Niche Market Appeal: The platform’s focus on a less feature-heavy, design-centric approach appeals to a specific niche, allowing it to stand out in a crowded market.

❓ Concerns

High Valuation: The asking price of $950K represents a 10.1x multiple on cash flow, which is relatively high and challenging to justify.

Limited Feature Set: The platform’s simplicity may limit its appeal to larger or more complex events that require additional functionality.

Investment Required: Significant growth will likely require further investment in design, development, and marketing resources, increasing operational costs.

Competitive Market: The event management space is competitive, with well-established players like Eventbrite and Cvent offering comprehensive solutions.

💼 Due Diligence Questions

Customer Retention: What is the current churn rate, and what strategies are in place to improve customer retention?

Growth Strategy: What are the specific plans for expanding the platform’s feature set and market reach?

Competitive Landscape: How does the platform differentiate itself from competitors, and what are the risks of new entrants in the market?

Pricing Flexibility: Is there room to adjust pricing to better align with market demand and increase revenue?

Customer Acquisition Costs: What is the average cost of acquiring a new customer, and how effective have current marketing efforts been?

Technical Scalability: Are there any technical limitations to the current platform, and what resources would be needed to address them?

Customer Demographics: What is the breakdown of customer demographics, and how does this inform marketing and product development strategies?

Revenue Breakdown: What percentage of revenue comes from one-time event publishing vs. subscriptions, and how does this impact cash flow?

Operational Risks: What are the risks associated with the minimal operational involvement, and how can they be mitigated?

🚀 Growth Levers

Expand Marketing Efforts: Increase investment in digital marketing, content marketing, and SEO to drive customer acquisition and brand awareness.

Develop Additional Features: Introduce new features to cater to larger and more complex events, expanding the platform’s market appeal.

International Expansion: Explore opportunities to expand into international markets where event management tools are in high demand.

Enhance Customer Experience: Continuously improve the platform’s user interface and experience to increase customer satisfaction and retention.

Explore Partnerships: Form partnerships with other service providers or platforms to expand the customer base and add value.

Referral Program: Implement a referral program to encourage existing customers to bring in new users.

Increase Pricing: Consider adjusting the pricing model to better reflect the value provided and increase average revenue per user (ARPU).

Leverage Customer Feedback: Use customer feedback to guide product development and ensure the platform meets evolving customer needs.

🙋🏻♂️ The Buyer

SaaS Experience: The ideal buyer has experience in scaling SaaS businesses, particularly in niche markets like event management.

Design and Development Expertise: Access to design and development resources is crucial for expanding the platform’s feature set and enhancing its market appeal.

Marketing Savvy: A buyer with strong marketing skills, particularly in digital marketing and SEO, will be well-positioned to scale the business.

Customer-Centric Approach: A focus on customer experience and retention will be key to sustaining and growing the platform’s user base.

Strategic Vision: The buyer should have a clear vision for how to expand the platform’s reach and increase its value proposition in a competitive market.

💼 Marketplace

Connecting Nutritionists with Wellness Brands - $495k

Founded in 2020

Revenue: $138k

Profit: $45k

Margin: 33%

Multiple: 11.0x

💬 Quick Take

This startup offers a unique and innovative platform that connects health and wellness brands with registered dietitians, providing a vital link for credibility and growth in the industry. Despite its relatively small size, the business has established a strong niche in a growing market. The high valuation and the need for significant investment to scale may be a challenge, but the potential for growth is substantial with the right resources and strategy.

✅ What I Like

Unique Niche: The platform is the only one-stop-shop specifically connecting health and wellness brands with registered dietitians, filling a crucial gap in the market.

Strong Market Potential: The health and wellness industry is booming, with increasing demand for credible nutrition information, making this platform highly relevant.

Established Platform: Built on modern tech stacks like React JS and Laravel, the platform is robust and scalable.

Growth Opportunities: Multiple avenues for growth, including expanding to new markets, increasing digital marketing, and developing new product features.

❓ Concerns

High Valuation: The asking price represents an 11x multiple on cash flow, which is on the higher side for a business of this size.

Dependency on Founder: The business may be highly dependent on the founder's expertise and relationships, which could be a risk if not managed properly.

Market Competition: Competing with PR agencies and influencer platforms could be challenging, especially as the business moves upmarket.

Scalability Challenges: Significant resources will be needed to scale the platform, including hiring a sales team, increasing marketing efforts, and expanding the tech stack.

Cash Flow Constraints: The current cash flow may limit the business's ability to reinvest in growth without external funding.

Customer Acquisition Costs: Understanding and controlling customer acquisition costs will be crucial as the business scales and enters new markets.

💼 Due Diligence Questions

Customer Acquisition: What are the current customer acquisition costs, and how do these compare to lifetime customer value?

Revenue Breakdown: What percentage of revenue comes from different customer segments, and what is the growth trend for each segment?

Churn Rate: What is the platform's current churn rate, and what strategies are in place to improve customer retention?

Competitive Advantage: How does the platform differentiate itself from PR agencies and influencer platforms, and what is the risk of new entrants?

Scalability: What are the specific challenges and opportunities in scaling the platform’s tech stack, and what investment will be needed?

Pricing Strategy: Is there flexibility in the current pricing model, and how does it compare to competitors in the market?

Expansion Plans: What markets or verticals have been identified as potential expansion opportunities, and what resources are needed to pursue them?

Partnership Potential: Are there existing or potential partnerships that could accelerate growth, and what are the terms?

🚀 Growth Levers

Expand into New Markets: Explore opportunities to enter new geographical markets or industry verticals where dietitian services are in demand.

Develop New Features: Add new product features that cater to enterprise clients, such as advanced analytics or bespoke matchmaking services.

Increase Digital Marketing: Invest in digital marketing strategies, including SEO, content marketing, and social media campaigns, to drive customer acquisition.

Hire a Sales Team: Build a dedicated sales team to focus on outbound sales and developing strategic partnerships with health and wellness brands.

Leverage Conference Marketing: Increase brand visibility and credibility by participating in industry conferences and events.

Enhance Customer Experience: Continuously improve the platform’s user experience to increase customer satisfaction and retention.

Focus on Content Marketing: Develop a robust content marketing strategy that positions the platform as a thought leader in the health and wellness space.

Monetize Partnerships: Explore opportunities to earn commissions or fees from successful partnerships facilitated through the platform.

🙋🏻♂️ The Buyer

Experience in Scaling Startups: The ideal buyer has a background in scaling tech startups, particularly those with a multi-sided platform model.

Industry Expertise: Knowledge of the health and wellness industry, especially in areas related to nutrition, will be crucial for understanding market dynamics.

Marketing and Sales Focus: A buyer with strong marketing and sales expertise will be able to accelerate growth through targeted campaigns and strategic partnerships.

Operational Capacity: The buyer should have the resources to invest in expanding the team, improving the tech stack, and scaling the business operations.

🏡 Main Street

Dry Cleaners in SC - $1.2M

Founded in 2002

HQ in Charleston, SC

Real estate is not included but can be negotiated

Revenue: $1.0M

Profit: $535k

Margin: 53.5%

Multiple: 2.24x

💬 Quick Take

This dry cleaning business in Charleston, SC, presents a solid opportunity with strong cash flow and a loyal customer base. The absence of a website, social media, and delivery service indicates significant potential for growth with minimal digital or logistical investment. However, the reliance on aging equipment and the limited online presence could be potential risks that need addressing. The real estate component adds value, especially with the option to extend SBA loan terms.

✅ What I Like

Strong Cash Flow: The business generates a substantial cash flow of $535k from $1M in gross revenue, indicating efficient operations and profitability.

Loyal Customer Base: With over 20 years in the community, the business enjoys strong customer loyalty, which is essential for consistent revenue.

Prime Location: The business is located in a desirable area, and the option to purchase the real estate offers long-term investment stability.

Opportunity for Expansion: The plant has excess capacity, allowing for potential growth by adding drop-off locations or offering delivery services to high-end neighborhoods.

Recent Equipment Investment: A $60,000 boiler was installed two years ago, reducing concerns about major equipment failure and ensuring continued efficient operation.

❓ Concerns

Aging Equipment: While the boiler is new, other equipment may be older and could require costly repairs or replacement in the near future.

Limited Growth Initiatives: The current owners haven’t pursued modern growth strategies, such as delivery services or online marketing, which suggests untapped potential but also the need for significant investment in these areas.

Dependence on Local Foot Traffic: The business currently relies heavily on local customers, which could limit growth opportunities if not expanded through other channels.

High Employee Dependence: With six employees, labor costs are a significant expense. Turnover or inefficiencies in staff management could impact profitability.

Real Estate Not Included: The real estate is not included in the asking price, requiring an additional investment or separate negotiation.

💼 Due Diligence Questions

Equipment Age and Condition: What is the age and condition of all major equipment? Are there any upcoming maintenance or replacement needs?

Customer Demographics: Who are the primary customers? Are there opportunities to attract higher-value clients or expand to new demographics?

Real Estate Valuation: What is the current market value of the real estate, and are there any zoning or development restrictions?

Revenue Breakdown: What percentage of revenue comes from different services (dry cleaning, laundry, alterations)? Are there any underperforming segments?

Employee Tenure and Roles: How long have the employees been with the business, and what are their specific roles? Are there any key employees critical to the operation?

Utility Costs: What are the monthly utility costs, especially related to the operation of the boiler and other equipment?

Contractual Obligations: Are there any long-term contracts with suppliers or customers that the new owner needs to be aware of?

Competitor Analysis: Who are the main competitors in the area, and how does this business compare in terms of service and pricing?

Customer Retention Strategies: What strategies are currently in place to retain customers, and how effective have they been?

Historical Financials: Can the seller provide detailed financial statements for the past 3-5 years to verify consistency in cash flow and revenue?

🚀 Growth Levers

Online Presence: Establish a website and social media profiles to increase visibility, attract new customers, and offer online booking services.

Delivery Service: Introduce a premium delivery service to cater to high-end customers in exclusive zip codes, providing convenience and expanding the customer base.

Drop-off Locations: Open additional drop-off locations in nearby areas to increase the volume of clothes processed at the main plant.

Loyalty Programs: Implement a customer loyalty program to reward repeat customers and encourage more frequent visits.

Partnerships: Form partnerships with local hotels, restaurants, and corporate offices to secure bulk cleaning contracts.

Service Diversification: Expand services to include specialty cleaning, such as wedding dresses or delicate fabrics, to attract a broader clientele.

Eco-friendly Initiatives: Introduce environmentally friendly cleaning options to appeal to eco-conscious customers and differentiate from competitors.

Referral Programs: Create a referral program that incentivizes existing customers to bring in new clients, increasing the customer base.

Real Estate Development: If purchasing the real estate, consider potential expansions or leasing out unused space for additional income.

Seasonal Promotions: Offer seasonal promotions and discounts to drive business during slower periods and attract new customers.

🙋🏻♂️ The Buyer

Experienced Operator: The ideal buyer has experience in the dry cleaning or related service industry and can navigate the operational complexities.

Tech-savvy Marketer: A buyer with digital marketing expertise can leverage the untapped potential of an online presence to grow the business.

Growth-oriented Entrepreneur: Someone who sees the potential for expansion through delivery services, drop-off locations, and partnerships will thrive.

Local Market Knowledge: A buyer familiar with Charleston’s local market will have an advantage in understanding customer needs and growth opportunities.

__ __ __ __ __ __ __ __ ____ __ ____ __ __

Construction Consulting Services in Northeast - $4.1M

Founded in 2004

Revenue: $4.1M

Profit: $1.3M

Margin: 32%

Multiple: 3.12x

💬 Quick Take

This construction consulting firm offers an impressive opportunity with its strong cash flow, excellent reputation, and strategic location in the Northeast. The valuation appears reasonable, especially with the included working capital and assets. However, the success of this acquisition hinges on the buyer's ability to continue the firm's growth trajectory and manage the transition smoothly, particularly in maintaining client relationships and the skilled workforce.

✅ What I Like

Strong Cash Flow: With a cash flow of $1.3M, the business generates significant profitability, providing a solid return on investment.

Established Reputation: The firm has long-standing relationships and a strong reputation in the Northeast, ensuring ongoing business with both private and public clients.

Diverse Service Offerings: The broad range of services, including construction management, CPM scheduling, and litigation support, diversifies revenue streams and reduces dependency on any single market segment.

Included Assets: The deal includes $300,000 in Net Working Capital and $85,000 in fixed assets, which adds tangible value to the acquisition.

High-Quality Team: A well-trained and experienced team is in place, ensuring continuity of operations and client relationships post-acquisition.

Owner’s Commitment to Transition: The seller's willingness to provide a comfortable transition period and consider a consulting agreement post-sale ensures a smooth handover.

Competitive Advantage: The firm’s competitive edge in the region, supported by its reputation and relationships, positions it well against competitors.

❓ Concerns

Transition Risks: The success of the transition relies heavily on maintaining client relationships and the retention of key employees, which could be challenging.

Market Saturation: The Northeast construction consulting market may be competitive, and the firm's continued success will depend on its ability to sustain its competitive advantage.

Growth Assumptions: The projected 20%+ annual revenue growth assumes successful expansion efforts, which may not materialize if market conditions change.

Dependence on Key Relationships: The firm’s strong relationships with contractors and agencies are crucial; any disruption could impact business performance.

Leased Facility: Operating from a leased office space introduces a level of uncertainty regarding future rental costs and lease terms.

Limited Geographic Reach: While there is growth potential in expanding territory, the current business is concentrated in the Northeast, limiting diversification.

Dependency on Construction Industry: The firm's success is tied to the health of the construction industry, which can be cyclical and influenced by economic factors.

💼 Due Diligence Questions

Client Retention: What percentage of revenue is generated from repeat clients, and how stable are these relationships?

Employee Retention: What is the average tenure of key employees, and are there any retention agreements in place?

Contract Terms: Are there any long-term contracts with clients, and what are the terms? Are there any upcoming contract renewals?

Revenue Breakdown: Can the seller provide a detailed breakdown of revenue by service type and client? This will help assess the sustainability of different revenue streams.

Market Position: How does the firm compare to competitors in terms of pricing, service quality, and market share?

Lease Agreement: What are the terms of the current lease, and are there any upcoming rent increases or potential relocations?

Growth Assumptions: What specific strategies have been identified to achieve the projected 20%+ annual revenue growth, and what are the associated risks?

Litigation History: Has the firm been involved in any litigation, and what are the potential risks related to ongoing or past disputes?

Working Capital: How is the $300,000 in working capital allocated, and are there any liabilities that could impact its availability?

SBA Pre-qualification: What are the specific terms of the SBA pre-qualification, and what financial requirements must the buyer meet?

🚀 Growth Levers

Geographic Expansion: Expand the firm's services beyond the Northeast, targeting other regions with similar market dynamics to increase revenue.

Sales Force Investment: Invest in a dedicated sales team to drive business development and secure new contracts with private and public clients.

Service Diversification: Introduce new services, such as sustainability consulting or digital project management, to differentiate the firm from competitors.

Technology Integration: Implement advanced project management software to improve efficiency, reduce costs, and offer enhanced services to clients.

Strategic Partnerships: Form partnerships with complementary service providers to offer bundled services and attract larger contracts.

Client Segmentation: Develop specialized services tailored to high-value client segments, such as government agencies or large construction firms.

Online Presence: Strengthen the firm’s online presence through a revamped website and targeted digital marketing campaigns to attract new clients.

Recurring Revenue Models: Explore opportunities to introduce subscription-based services or retainer agreements to create more predictable revenue streams.

Cost Control: Implement rigorous cost control measures to maintain high margins while scaling operations, particularly as the business expands into new territories.

Reputation Management: Enhance the firm’s reputation through thought leadership, case studies, and industry awards to solidify its position as a market leader.

🙋🏻♂️ The Buyer

Experienced Consultant: The ideal buyer has a background in construction consulting or a related field, with the ability to leverage existing relationships and industry knowledge.

Growth-driven Entrepreneur: A buyer who is focused on scaling the business through geographic expansion and service diversification will thrive in this opportunity.

People-oriented Leader: A buyer who values and can manage a skilled team will be crucial to maintaining the firm’s competitive advantage.

Client-focused Professional: Understanding and maintaining client relationships will be key, making this a good fit for someone with strong client management skills.

__ __ __ __ __ __ __ __ ____ __ ____ __ __

Party Supplies Rental in NY - $1.7M

Founded in 1950s

Located in Westchester, NY

Revenue: $2.5M

Profit: $500k

Margin: 20%

Multiple: 3.4x

💬 Quick Take

This 70-year-old party rental company offers an opportunity to acquire a well-established business in a high-income area with a strong reputation and loyal customer base. The steady demand for rental services in affluent areas, combined with the company's extensive inventory and operational infrastructure, provides a solid foundation for continued success. However, the business's reliance on seasonal demand and the potential challenges of managing a large workforce should be carefully considered.

✅ What I Like

Established Reputation: With 70 years in the business, this company has a trusted name and a strong market presence.

Affluent Location: Operating in a high-income area ensures a steady demand for premium rental services.

Strong Cash Flow: The business generates $500K in cash flow, indicating solid profitability.

Loyal Customer Base: The company enjoys repeat business from a diverse client base, including charities, schools, and private events.

Extensive Inventory: With an inventory valued between $750K and $3M, the business is well-equipped to meet a wide range of customer needs.

Operational Fleet: The fleet of 8 trucks, with 5-6 active daily, demonstrates the business's capacity to handle multiple events simultaneously.

❓ Concerns

Seasonal Workforce: The reliance on a fluctuating workforce may lead to operational challenges, particularly in managing quality and efficiency during peak seasons.

Lease Terms: The lease has only 4 years remaining with one 5-year option, which could pose a risk if lease terms are not favorable in the future.

High Inventory Costs: Maintaining a large inventory can tie up significant capital and may require regular investment to keep items in good condition.

Operational Complexity: Managing a fleet of trucks and a large warehouse requires strong logistical and operational expertise.

Geographical Constraints: The business’s current operations are concentrated in specific areas, which might limit growth potential without significant expansion efforts.

Dependence on Large Events: A significant portion of revenue likely comes from large events, which can be vulnerable to economic downturns or changes in event trends.

Competitive Market: The party rental industry is competitive, with numerous players offering similar services, potentially squeezing margins.

💼 Due Diligence Questions

Inventory Valuation: Can the seller provide detailed records to verify the current value and condition of the inventory?

Lease Terms: What are the specific terms of the lease, and what options are available for renewal or renegotiation?

Customer Concentration: What percentage of revenue comes from the top 10 clients, and how diversified is the customer base?

Fleet Condition: What is the age and condition of the operational fleet, and what are the projected maintenance or replacement costs?

Workforce Management: How does the company manage the seasonal workforce, and what challenges have been encountered in maintaining quality and efficiency?

Revenue Breakdown: How is revenue distributed across different types of events and clients, and what trends have been observed in recent years?

Growth Opportunities: Are there any untapped markets or services that could be explored to drive growth?

Competitive Landscape: Who are the main competitors in the area, and what differentiates this business from them?

Financial Stability: How has the business performed during economic downturns, and what strategies have been used to maintain revenue?

Seller Transition Plan: What support and training will the seller provide to ensure a smooth transition for the new owner?

🚀 Growth Levers

Expand Service Area: Explore opportunities to extend the geographical reach beyond current markets, potentially targeting new affluent areas.

Diversify Service Offerings: Introduce new services, such as event planning or specialized rentals, to attract a broader range of clients.

Invest in Digital Marketing: Increase online presence and digital marketing efforts to capture more leads and expand brand awareness.

Enhance Inventory Management: Implement advanced inventory management systems to optimize the use and maintenance of rental items.

Focus on High-Margin Events: Identify and target higher-margin events or clients to increase profitability.

Seasonal Promotions: Develop targeted promotions or discounts during off-peak seasons to smooth out revenue fluctuations.

Build Strategic Partnerships: Partner with event planners, venues, or corporate clients to secure recurring business and long-term contracts.

🙋🏻♂️ The Buyer

Operational Expertise: The ideal buyer has experience in managing operations, particularly in logistics, inventory, and workforce management.

Industry Knowledge: Familiarity with the event rental industry or related sectors will be beneficial in understanding market dynamics and customer needs.

Growth-Oriented: A buyer with a vision for expanding services, markets, and customer base will be well-positioned to drive future growth.

Customer Relationship Focus: The ability to build and maintain strong customer relationships will be key to sustaining and growing the business.

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

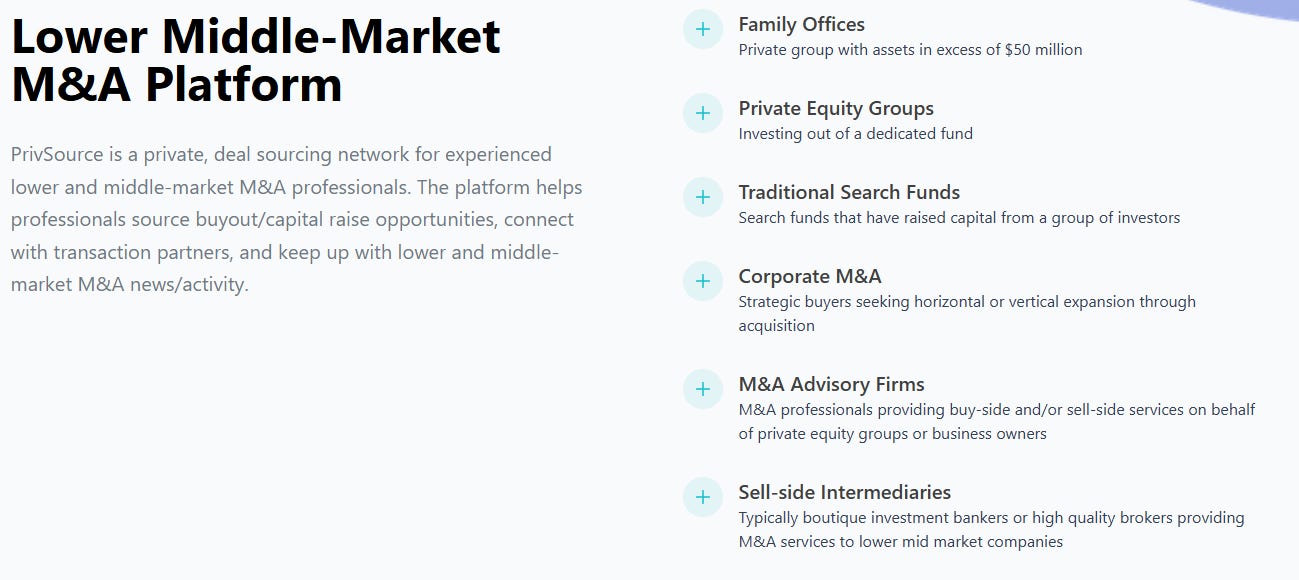

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Access or share deal flow with your peers through Deal Flow Scout

Assemble your M&A deal team with DueDilio.

If you enjoyed reading this newsletter, why not share it?