The Business Inquirer #29

In this issue, I highlight 7 listings including a plant subscription e-comm, an AR SaaS, a computer vision course, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

In this week’s issue:

🛒 eCommerce - 3 listings

☁ SaaS - 2 listings

🕸 Content/Marketplace/Service - 2 listings

🧐 What I Learned Last Week

🛒 eCommerce

Air Plant Subscription - $120k

For sale is a 1.5-year-old e-commerce brand that sells monthly subscriptions to receive a different air plant each month. These plants don’t require any soil.

Competitors: Air-plants, Sucstu, Succulentsbox

Subscription costs $23.95 including shipping. COGS are $5-$6.

TTM Revenue: $18k; Profit: $6k; Margin: 33%

Last month revenue: $2.5k; Profit: $1.6k; Margin: 64%

Asking: $120k; Multiple: 6.25x

✔ What I Like

Plants in general have exploded in popularity since COVID and air plants are no exception…

I’ve seen a lot of focus on succulents but I have not seen as much with air plants. This could be a good differentiator. I don’t think this upward trend is a fad. There’s clear improvement between TTM numbers and how the business performed last month. I personally looked into starting a succulent business and there are a lot of interesting opportunities in this space.

❓ Questions & Concerns

Young, unproven business. With current shipping delays, how has this impacted the business? The listing doesn’t say if this is dropshipping or you have to hold inventory. Any customer returns? Why are last month's numbers so much better than TTM? What’s the CAC? Is the rich valuation justified somehow?

You can view the listing on MicroAcquire.

————

Vacuum & Air Purifier - $6.9M + inv

For sale is a 23-year old e-commerce brand in the vacuum cleaner and air purifier industry. Amazon is the largest sales channel.

Diversified revenue from Amazon (38%), website (20%), HomeDepot (20%), and others

Large amount of website content and YouTube channel drive organic traffic

TTM Revenue: $5.0M; Profit: $1.5M; Margin: 30%

Asking: $6.9M + inv; Multiple: 4.60x

✔ What I Like

Very well aged business with proven SOPs. Diversified revenue channels. Relatively simple products which most likely don’t have a lot of returns. Air purifiers have seen a steady uptick in demand.

❓ Questions & Concerns

The listing mentions stock issues. Is this due to supply or capital constraints? Any regulations around the air purifier business? What has been the recent impact on COGS? How does the product mix shift and how has it trended over time? Any possibility to expand to commercial use or add adjacent products? Any recurring revenue from filters? How do normalized, ex-COVID numbers look for air purifiers?

You can view the listing on Quiet Light Brokerage.

————

FBA CPAP Accessory - $305k

For sale is a 1.5-year-old Amazon FBA business selling anti-snoring chin straps that are compatible with almost all CPAP devices.

No employees, simple supply chain, one hour to maintain

TTM Revenue: $214k; Profit: $72k; Margin: 34%

Last month revenue: $21k; Profit: $10k; Margin: 48%

Asking: $305k; Multiple: 4.24x

✔ What I Like

Healthy profit margin. Simple one-product business. Valuation is reasonable. Search volume looks OK.

❓ Questions & Concerns

I’m always cautious when a listing says “one hour a week to maintain”. Relying on just one product and one sales channel is risky. Not clear how inventory, packaging, and shipping are handled. Listing says there are no online competitors, clearly not true. A lot of questions here. Any business younger than 24-months requires extra due diligence.

You can view this listing on MicroAcquire.

☁ SaaS

AR for Plastic Surgery - $290k

For sale is a 13-year-old augmented reality SaaS that caters to the plastic surgery industry. The software demonstrates the “after” surgery look to prospective patients.

B2B & B2C revenue

Organic growth without marketing spend

27% Y/Y growth; 1% annual churn

TTM Revenue: $98k; Profit: $85k; Margin: 87%

Asking: $290k; Multiple: 3.41x

✔ What I Like

Well aged business serving a very specific niche. I like that end-users are B2B and B2C. VA and developer transfer with the business. Multiple seems reasonable. Opportunity to expand to other niches. I like SaaS.

❓ Questions & Concerns

How’s the revenue distributed between B2B and B2C? How many clients & client concentration? What’s the CAC? How are clients acquired without advertising? Says owner works just 1-hour a week - why? Listing almost reads “too good to be true”.

You can view the listing on Quiet Light Brokerage.

————

No Code Website Builder - $35k

For sale is a 2.5-year-old no code website builder which uses Airtable as the CMS.

Competitors: Sheet2site, Pory

Tech: PHP, Java, Laravel

TTM Revenue: $17.5k; Profit: $16.6k; Margin: 95%

Last month revenue: $1.2k; Profit: $1.1k; Margin: 92%

Asking: $35k; Multiple: 2.65x

✔ What I Like

No code tools are on-trend. The margins are healthy but there’s no marketing built in. Airtable has a strong and growing ecosystem. A few competitors to learn from. Numerous exit opportunities.

❓ Questions & Concerns

Not a fully validated product. The seller hasn’t worked on the product in a while. It may need some technical touchups. There is no tested marketing playbook.

You can view the listing on MicroAcquire.

🕸 Content/Marketplace/Service

Self-Publishing Platform - $695k

For sale is a 7-year-old UK based self-publishing platform that provides complete publishing packages, independent publishing services, marketing, and more to authors and writers. This is a productized service business.

Competitors: Austin McCauley, Authoright, Xlibris

4 person team; Tech stack: WordPress, Zapier, PipeDrive

TTM Revenue: $555k; Profit: $134k; Margin: 24%

Asking: $695k; Multiple: 5.19x

✔ What I Like

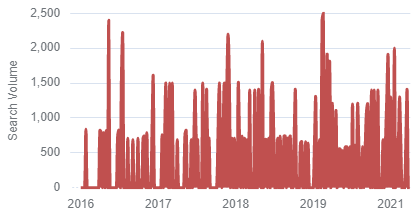

Well aged business. Listing mentions that they’re the market leader in the UK with a lot of reviews - moat. Self-publishing books, courses, and content is on-trend. There’s healthy search volume on the topic.

❓ Questions & Concerns

Can the business be expanded globally or is it tied to the UK? What has worked to become market leader in the UK and can it be replicated abroad? How sticky are clients? What levers can expand that margin? Is there any recurring revenue? Valuation seems rich.

You can view the listing on MicroAcquire.

————

Computer Vision Courses - $3.5M

For sale is a 7-year-old online-based information product business that teaches computer vision. Revenue is generated from selling books, courses, and memberships. Considered the gold standard in the industry.

Recently introduced monthly subscriptions generating $40k/m

All traffic and sales are organic through search and 215k e-mail subscribers

Team transfers with the business. Can be operated anywhere

TTM Revenue: $1.9M; Profit: $1.1M; Margin: 58%

Asking: $3.5M; Multiple: 3.18x

✔ What I Like

Courses are a great business model, especially with a moat. Nice margin. Well aged business. Strong e-mail list. Multiple isn’t crazy. Transitioning to subscriptions is a smart move. Opportunities to create a job board and other monetization from this audience. Can these courses be licensed to colleges/universities/trade schools?

❓ Questions & Concerns

Computer vision is a niche tech field. How often do the course materials need to be updated? Are there opportunities to partner with a job board? What’s the customer LTV? Listing says there’s a lot of demand for skilled computer vision engineers but I’m not sure.

You can view the listing on Quiet Light Brokerage.

🧐 What I Learned Last Week

——

Angels + Entrepreneurs

A few weeks ago I signed up for Neil Patel’s deal flow community called Angels + Entrepreneurs. It’s relatively inexpensive at $39/year. I was hoping to find a good community, interesting deal flow, and opportunities to learn. So far I’ve been disappointed in the whole experience. Tons of marketing emails that look and read scammy. No activity in the community part. Questionable deal flow. Perhaps it’ll improve but for now, buyer beware. Ping me if you’ve joined and disagree.

——

Pay attention to rising costs

I recently had dinner with a friend who runs an Amazon business selling various BBQ rubs. Her packaging costs have doubled and tripled over the last few months. I won’t make any predictions on whether this is a permanent change or a temporary abnormality but either way, it’s something to pay attention to. If you’re exploring a business that sells physical goods, the P&L may simply not reflect this exponential increase in COGS. Be careful. Perform extra due diligence.

——

USA Facts 2021

I’ve been a longtime fan of USAFacts. Each year they publish their annual data-driven report on the state of the nation. It’s a great read from a personal and business perspective.

USAFacts provides a data-driven portrait of the American population, US governments’ finances, and governments’ impact on society. We are a nonpartisan, not-for-profit civic initiative without a political agenda. We provide vital spending, revenue, demographic, and performance information as a free public service and are committed to maintaining and expanding our available data in the future.

They recently published their latest 2021 report that you can read here.

——

10 Common Flippa Scams

Mushfiq Sarker needs no introduction but for the 100 or so new subscribers - he’s an OG in the website operating and investing space. He runs The Website Flip. Last week he had a great post about the 10 most common Flippa scams and red flags. I think it’s a must-read for anyone thinking of transacting on the marketplace.

Fake revenue screenshots

Fake P&L numbers

Fake (purchased) traffic

Google Analytics data missing

Selling at a “low” price (multiple)

Listing description is “Too Good To Be True”

Seller is not answering questions in detail

Duplicate content

Random (and sudden) spike in revenues

Starter/Template Sites

Those are important red flags for any business listing, just not websites or Flippa.

——

No code is the future

I’m actively working on developing the next version of DueDilio. We’re seeing enough demand where I need something more automated that resembles a true online marketplace. Speaking with dev shops, there’s a stark difference between legacy and no-code.

Legacy: “Yes, we can build this. It’ll take us 3-months and cost $30k - $100k”

No-Code: “Yes, we can build this. We first have to approve your project due to high demand. If approved, this will take us 2-weeks and cost $2k - $5k.”

One of those business models is not going to be around for much longer. No-code is the future and it’s an area of the market that’s worth keeping an eye on. Businesses will be available for sale. There will be opportunities. When? No idea.

If your wheels are turning and you’re thinking an online marketplace selling no-code businesses would work - let’s talk.

——

How private capital is being allocated

BDO recently released its Private Capital Pulse Survey. Two important charts…

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Hey Roman, I just came across your newsletter. Great stuff. I just have 1 quick question. How do you get google keyword stats embedded in search (I'm referring to the self publishing books picture)?