The Business Inquirer #30

In this issue, I highlight 10 listings including a fitness job board, an SMS marketing app, sauna & hot tub dropshipping, AG consulting, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

I need your help. If you’re a searcher, PE/VC, Sponsor, SMB acquirer - can I ask you a few questions about your due diligence process? Just need a 15-minute call that you can easily book via Calendly HERE.

This morning someone left feedback on the last issue with some great questions. All feedback is anonymous so if you’d like my response, please provide a way for me to contact you. As a quick answer - I am listing price agnostic. I highlight what I think is interesting. I don’t write this newsletter to focus on middle-market PE or anything along those lines. Admittedly, I’ve been less focused on content websites. I suggest The Website Flip or Alternative Assets for some great content around the website space. (Substack wouldn’t let me link those due to size constraints.) I am thinking through ways to expand this newsletter and separating listings by price is one idea.

Keep the feedback coming. I appreciate all of it.

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 3 listings

🕸 Content/Marketplace/Service - 5 listings

🧐 What I Learned Last Week

🛒 eCommerce

Hot Tubs & Sauna Dropshipping - $1M

For sale is a 3.5-year-old e-commerce brand selling hot tubs and saunas through a dropshipping model. The business secured licensing agreements with US-based manufacturers to sell their products online and ship directly from manufacturers.

Leads are received directly from manufacturers (5-20/wk)

The busiest time for saunas: Oct - May; Hot tubs: April - Oct

256 SKUs; $4,200 AOV

TTM Revenue: $1.8M; Profit: $201k; Margin: 11%

Asking: $1M; Multiple: 4.97x

✔ What I Like

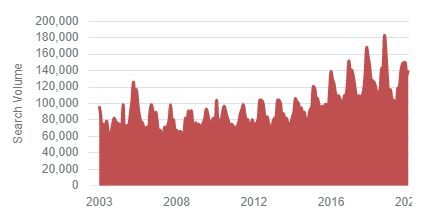

I like the dropship model as it’s asset and capital light. High AOV with leads coming directly from manufacturers. Looks like demand has been ticking up even before COVID…

I see a lot of organic ways to market the product through content, affiliate, and paid channels. There’s also an opportunity to expand to adjacent products and add upsells. There are some search terms that have seen strong growth recently…

❓ Questions & Concerns

Who handles returns, maintenance and warranty? Margin is very low so I assume the CAC is high. Multiple clearly reflects the strong growth over the last year but is it sustainable? How is this business differentiated from others? How secure are the licensing deals? How is website traffic generated?

You can view the listing on Website Closers.

————

Furniture Dropshipping - $170k

For sale is a 19-year-old dropshipping business with 4 websites selling furniture and home goods in the US market. Original owners built the lifestyle business and ready to retire now.

$284-$306 AOV

TTM Revenue: $275k; Profit: $48k; Margin: 17%

Asking: $170k; Multiple: 3.54x

✔ What I Like

I like dropshipping. I like lifestyle businesses. Very well aged business that appears to be serving various markets through their websites. Opportunity to shift from B2C to B2B (not easy). The broker here is Ryan Condie who’s a good dude.

❓ Questions & Concerns

Are the owners ready to retire or have COGS multiplied, margins compressed, shipping is impossible, and logistics are a nightmare? I’d want to “retire” from that business as well. No paid marketing has been done and with 17% margins, it’d be hard to implement. Heavy due diligence is required here.

You can view the listing on Quiet Light Brokerage.

☁ SaaS

Virtual Team Building - $1.1M

For sale is a 6-year-old SaaS that facilitates remote team building by hosting virtual activities such as trivia and escape rooms, all through Zoom.

TTM hosted 500+ events. 90%+ margins per event

Past clients include AMZN, FB, NKE, CRM

TTM Revenue: $660k; Profit: $526k; Margin: 80%

Asking: $1.1M; Multiple: 2.09x

✔ What I Like

Not surprising that demand for virtual team building activities has soared…

The business hasn’t spent any money on paid advertising with referrals and repeat customers being the two largest sources of revenue. Organic Google search is the third-largest source of business. There’s an opportunity to grow through partnerships, affiliates, and paid advertising. Valuation is reasonable and the margins are great.

❓ Questions & Concerns

There are a lot of businesses for sale which have had a strong uptick in demand due to COVID. I’m always cautious of those P&Ls and valuations. Is a buyer making a purchase at the top? How sustainable is the current run rate?

You can view the listing on Quiet Light Brokerage.

————

Local SMS Marketing - $79k

For sale is a 2.5-year-old SMS technology app that provides marketing automation to local businesses to get better reviews and manage communication.

Competitors: Podium, Signpost

Tech: .Net, AWS, Twilio

$2,400 ARPU (Avg Revenue Per User)

TTM Revenue: $36k; Profit: $32k; Margin: 89%

Asking: $79k; Multiple: 2.47x

✔ What I Like

I like the SMS space as I think it’s just starting to gain traction. More and more companies will be using SMS to build relationships with clients. This is on-trend and I’ve written about this previously. Very nice ARPU and margin. Valuation is reasonable. Bootstrapped business without investors clamoring for an exit at some unruly valuation.

❓ Questions & Concerns

Assuming the tech is there, marketing is the only question here. What’s the CAC? Who are the main clients? How to build a flywheel into the product? What is the competition doing?

You can view the listing on MicroAcquire.

————

Shopify + QuickBooks App - $48k

For sale is a 2.5-year-old Shopify app that automates the sales recording and inventory process using QuickBooks.

Competitors: A2X, Bold, Webgility

5-star rating Shopify Marketplace

300% Y/Y growth; $12k ARR

TTM Revenue: $10k; Profit: $7k; Margin: 70%

Asking: $48k; Multiple: 5.71x (ARR)

✔ What I Like

Shopify is a growing ecosystem. 5-star rating offers a moat. The listing mentions a proven CAC, just add $$$. Opportunity to list on QBO marketplace. Many exit options down the line. Gut feeling is there’s room to negotiate sales price here.

❓ Questions & Concerns

Need tech help to add some requested features. What is the CAC? How is this product differentiated? Any chance Shopify would build-in these features? Valuation is questionable. A couple of competitors are good, three’s a crowd.

You can view the listing on MicroAcquire.

🕸 Content/Marketplace/Service

Fitness Industry Job Board - $90k

For sale is a 2.5-year-old online job board specifically for CrossFit and fitness industry jobs. Founded by a former gym owner to address a market need.

Competitors: Ideafit, Fitnessjobs, ExcerciseJobs

Tech: Jobboard.com, MailChimp, Google Analytics

TTM Revenue: $30k; Profit: $27k; Margin: 90%

Asking: $90k; Multiple: 3.33x

✔ What I Like

Big fan of the business model. High margins. Self-sustaining. Demand for fitness instructors is slowly coming back post-COVID…

Doing paid ads wouldn’t be too expensive…

The product is built on Jobboard.com which costs $149-$1,499 per month. There may be an easy win here just by moving to a more affordable tech stack like WordPress or a no-code platform.

❓ Questions & Concerns

Another listing where the seller says they spend 10min a day on the business. Always raises a red flag for me. I’d want to understand the traffic numbers and what has worked in terms of marketing. What’s the CAC? How are they pricing ads?

You can view the listing on MicroAcquire.

————

Entrepreneur Focused Magazine - $3M

For sale is 5.5-year-old Influencive which is a blog/magazine catering to entrepreneurs with content focused on business, success, and emerging technology.

71k e-mail list; 818k FB; 193k IG; 280k YT; 50k TWTR;

100k to low millions of monthly visitors

TTM Revenue: $100k; Profit: $40k; Margin: 40%

Asking: $3M; Multiple: Crazy

✔ What I Like

Well-aged brand catering to a desirable demographic. Large social media following. The website could be redesigned to make it more readable. Opportunity to create a newsletter.

❓ Questions & Concerns

I’ve never heard of this brand. Everything here has to be meticulously verified. Who are the advertisers? Website visitors? How’s social media engagement? Where’s the money going to get to 40% margins? Are there opportunities to diversify revenue away from just advertising? I don’t know what to think of this valuation. I assume that someone who is familiar with this type of business can make some sense of it.

You can view the listing on MicroAcquire.

————

Video Editing Agency - $10M

For sale (or investment?) is 1.5-year-old Dava Marketing, a subscription-based video editing Agency catering to creators.

35 person team. +$25k MRR monthly; $0 marketing spend.

Sales team on commission-only

TTM Revenue: $622k; Profit: $250k; Margin: 40%

On track to do $2.5M - $3.5M in revenue in 2021

Asking: $10M;

✔ What I Like

No charts required to know that this type of business is printing money. Nice website. Good margins. Strong growth in MRR. No marketing spend (yet). They’re adding education and online tools to capture lower end of the market. Graphic design adds some diversified revenue.

❓ Questions & Concerns

Listing is a bit confusing. There will be a lot of competition if there isn’t yet. How do you differentiate? Grew with no marketing but at some point, there will be a CAC that will heavily eat into margin. Agency businesses are a lot of work. How easily can you hire video editors? I’ve never heard anyone have success with commission-only sales people.

You can view the listing on MicroAcquire.

Here are two other Agency businesses for sale: Content Creation, Graphic Design.

————

Agriculture & Food Mfg Consulting - $2.1M

For sale is an 18-year-old agricultural & food mfg consulting business specializing in pest management, food safety auditing, and employee training.

$3k - $10 avg contract size; 90% client retention; 200+ clients;

TTM Revenue: $1M; Profit: $367k; Margin: 37%

Asking: $2.1M; Multiple: 5.72x

✔ What I Like

Well aged business. Low client churn with a high AOV. Profit margin is healthy. Opportunity to expand services to marijuana growers and adjacent industries.

❓ Questions & Concerns

How are new clients acquired? Is there any client concentration risk? How easy is it to hire for this business? Valuation seems on the higher side. Obviously, you’d have to know this industry.

You can view this listing on Website Closers.

————

Newsletter for Biz/Tech/Productivity - $11k

For sale is a 1-year-old weekly newsletter providing tools, SaaS, good reads, personal growth tips, and other learnings at the intersection of entrepreneurship, productivity, and technology. Monetized through sponsorships & classified ads.

TTM Revenue: $4k; Profit: $3.8k; Margin: 95%

Asking: $11k; Multiple: 2.89x

✔ What I Like

Diverse topics that should appeal to a wide reader base. A lot of sponsorship opportunities. Interesting that seller chose MicroAcquire to list this.

❓ Questions & Concerns

How many readers? What’s the open, CTR rate? Acquisition strategy?

You can view this listing on MicroAcquire.

🧐 What I Learned Last Week

——

New business creation

Gusto has released their survey of pandemic entrepreneurs. Some interesting data in there but three things that stood out to me were that 1) 51% of new business owners started their business out of economic need, 2) 33% of all new business owners needed a side job to cover expenses, and 3) 49% of new business owners are not concerned about their business failing due to lack of financial assistance. I’d want to see historical data for all of those, otherwise tough to benchmark.

——

Revenue derived from remarketing

There was an interesting discussion in the private Trends FB group about iOS 14 and how its new privacy features have impacted remarketing on the platform.

This is something to keep an eye on during online business due diligence.

On the same topic, I recently had drinks with a friend who runs a very large electronics e-commerce business. He talked about Google Shopping and he’s seeing ROAs that he hasn’t seen in 10-15 years (on the positive side).

——

Shopify app store report

I recently discovered Marketplace Apps which is an online database of 50k+ extensions and plugins. Great place to find a micro-SaaS to buy. They just released a detailed report on the Shopify App Store. Tons of great data and charts.

Let’s get started with some high-level stats:

There are 5,918 apps in the store, made by 3,578 developers across 12 categories.

The average review in the store is 4.3 from 511,266 total reviews.

The average number of reviews per app is 118.1 but the median reviews left per app is 10.

There are 1,700 Free apps (29%), 1,375 Freemium apps (23%) and 2,843 Paid apps (48%)

2,642 apps offer a free trial (44%). The most popular trial offered is a “7 day free-trial” (952 apps) followed by 14 day-free trial (689 apps)

The median paid plan prices are - Plan 1 = $9.90, Plan 2 = $25.00, Plan 3 = $50.0, Plan 4 = $89.50 (Note: all in $USD)

I’ve reached the size limit of this newsletter so I can’t add any charts in here but go check out the report. I think it’s a must-read.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.