The Business Inquirer #32

In this issue, I highlight 7 listings including a Keto snack subscription brand, virtual mailbox business, a content Agency, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 3 listings

🕸 Content/Marketplace/Service - 2 listings

🧐 What I Learned Last Week

🛒 eCommerce

Uni DTC - $175k

For sale is a 1.5-year-old DTC brand selling high-quality Uni. Admittedly, I’m only highlighting this business because I’m a big fan of Uni. Uni in pasta, Uni in sushi, Uni in toothpa…nevermind.

Competitors: Trueworld Seafood, Yama Seafood

TTM Revenue: $132k; Profit: $35k; Margin: 27%

Asking: $175k; Multiple: 5.00x

✔ What I Like

I don’t know anything about the food business. My wife and I love Uni. We’d eat into all the profits. 😋 Seems like we’re not alone as the popularity of Uni has grown…

Maybe there’s an opportunity to add additional high-value items like truffles, caviar, etc then you can grow the brand into a purveyor of fine foods. Can this be a subscription business?

❓ Questions & Concerns

I can buy Uni at almost any Asian supermarket and sometimes even Whole Foods. Why would I want it delivered? How’s the supply chain? How stable are the costs? Who’s the target market? How much repeat business? How is this different than competing brands?

You can view the listing on MicroAcquire.

——

Keto Snack Subscriptions - $8.5M

For sale is a 6-year-old keto snack subscription brand that also includes a marketplace. Interesting business with a detailed listing.

21k subscribers; 357k social media followers

Data and marketplace component

TTM Revenue: $9.1M; Profit: $1.5M; Margin: 17%

Asking: $8.5M; Multiple: 5.67x

✔ What I Like

An interesting business with a lot of components. You have the subscription, the marketplace, and the data. Right now subscriptions dominate but there’s an opportunity to grow the marketplace and monetize the data. Demand for keto snacks started to pick up in 2017 but interesting to see some seasonality here…

❓ Questions & Concerns

There’s always the concern that some negative news would come out about keto diet. Are there any bottlenecks with production? How easy is it to procure the snacks? I assume that costs have been going up across the board for packaging, shipping, etc. There are a lot of moving pieces to his business.

You can view the listing on Website Closers.

☁ SaaS

WordPress Security - $245k

For sale is a collection of WordPress security plugins.

2.7k customers; 46k free users;

$81k ARR; $485 LTV;

TTM Revenue: $85k; Profit: $56k; Margin: 66%

Asking: $245k; Multiple: 4.38x

✔ What I Like

WordPress continues to be the top CMS and website builder with ~183k websites created each year. I’ve had WP websites hacked and know first hand the importance of having some layer of security. Cybersecurity in general is a very on-trend area. I like that the majority of revenue is recurring with a high LTV. Opportunity to convert the 46k free users into paid. Perhaps an opportunity to optimize pricing. Are there similar plugins that could be rolled up?

❓ Questions & Concerns

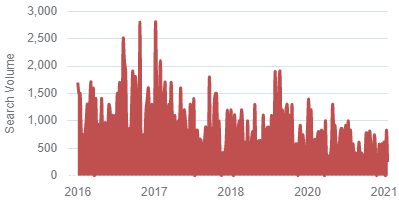

Interest in WordPress and search volume for “WordPress Security” has been declining…

I think that a lot of security features are now included in website hosting plans. What type of upkeep do these plugins require? What's been the marketing playbook? What type of churn? How are the reviews compared to competitors?

You can view the listing on FE International.

————

Website Monitoring - $150k

For sale is a 6-year-old Drupal and WordPress website monitoring SaaS. This real-time platform alerts you instantly when a security issue is detected or critical updates are required.

Competitors: Newrelic, Automattic, Acquia

Priced at $179/month; No churn; No marketing efforts;

TTM Revenue: $34k; Profit: $25k; Margin: 74%

Asking: $150k; Multiple: 6.00x

✔ What I Like

This is a project started by a developer who has no marketing know-how. Sometimes this presents opportunities, other times it can be a trap. Support is limited to a few tickets per year. Cybersecurity and dev ops are hot areas right now. Good margins. Competitors to learn from.

❓ Questions & Concerns

6-years with only $34k in revenue is a cold start. There’s no marketing playbook here which presents a challenge. How is this product differentiated from the competition? Has the tech been ignored and requires an overhaul? What type of maintenance is required? Valuation seems high for something that’s not growing.

You can view the listing on MicroAcquire.

————

Virtual Mailbox - Open to Offers

For sale is a tech-enabled virtual mailbox service with recurring revenue. The primary target markets are home-based business owners and people with nomadic lifestyles. Not much detail in the listing but an interesting business.

~30k monthly subscribers

TTM Revenue: $3.9M; Profit: $1.7M; Margin: 44%

Asking: Open to Offers

✔ What I Like

Seeing strong demand for virtual mailbox services…

I think the demand for this type of service is directly correlated with new business formation and remote work. Looking at the chart above, the upward trend started around early-2020, which makes sense. I think truck drivers and traveling nurses could be another strong market for this product. Creators may be another market to explore.

❓ Questions & Concerns

As people return to physical offices, how will this business be impacted? What’s the tech stack for this? Business is in San Francisco but can it be operated anywhere? How are customers acquired? How is this differentiated from the competition? What are the main expenses for this business and how are they trending?

You can view this listing on Link.

🕸 Content/Marketplace/Service

Content Agency - $620k

For sale is a 3-year-old content agency specializing in SaaS and SMEs. Listing has some good detail. 100% remote with most writers based in South Africa.

Competitors: Verblio, Crowd Content, ContentFly

80% of clients are US. Rest are Europe, AUD, South Africa

70% of revenue is from monthly subscriptions; $250k ARR

TTM Revenue: $252k; Profit: $141k; Margin: 56%

Asking: $620k; Multiple: 4.40x

✔ What I Like

There’s good detail in this listing itself. Opportunity to raise pricing, rank on some keywords, diversify product offering. Content marketing, especially for SaaS and SMEs is only going to increase in demand…

❓ Questions & Concerns

Sellers mention that their goal from the start was to grow and sell the biz in 3-years. This raises a few questions. Is it like a BMW which you want to lease but never own since it breaks down after 3-years? Probably not but have to ask those questions around sustainability. What’s the current capacity utilization? How difficult is it to hire additional writers? How’s the online reputation of this agency? What’s the marketing playbook and CAC? Customer churn? Is there any differentiation?

You can view the listing on MicroAcquire.

————

Remote Work Community, Job Board - $35k

For sale is a 6-year old online community and platform of remote working professionals. Includes Facebook Group, IG account, website, job board, and e-mail list. Pre-revenue.

Competitors: RemoteOK, NomadList

Tech: Squarespace, Symphony, CMS

41k FB Group; 11.6k IG followers; 1.1k e-mail list;

Asking: $35k

✔ What I Like

Complete package to start a media brand that caters to this remote worker audience. A lot of options for monetization. You can start or buy a newsletter to help engage with and monetize the audience.

❓ Questions & Concerns

Have to figure out the engagement of social media and FB group. What’s the quality of the audience? What types of CTR can you expect from the group and IG account? $35k for pre-revenue seems rich. Can this be replicated for a fraction of that?

You can view the listing on MicroAcquire.

🧐 What I Learned Last Week

——

Buying social media accounts

I’ve been a big fan of Stefan, Wyatt, and the Alternative Assets team. They’re doing something unique (and difficult). Basically becoming the Motley Fool of alternative asset investing. Their latest launch is Social Media Accounts Insider.

How it works

We monitor public and private marketplaces where social media accounts are for sale (Fameswap, Trustiu, and more)

Next, we scrape the data and feed into our database

After removing the junk (the bottom 80% - 90% of accounts), we then compare against our benchmarks to uncover the most statistically undervalued assets

We apply a proprietary formula to determine the Inferred Value

Finally, we do moderate due diligence to ensure the sale is worth considering

——

Why do sellers sell

While reading a listing, I often wonder “if this business is so great, why are you selling?” Of course there are many answers to this question. Mushfiq Sarker of The Website Flip wrote a great article on why sellers sell niche websites.

——

COVID and the consumer

In April 2021, Forerunner surveyed over 1,000 consumers aged 25+ to check in on their behaviors. Heartcore Consumer Insights did a great job summarizing the findings.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.