The Business Inquirer - #8 (12/21/2020)

In this week's issue I highlight a Shopify app, mask dropshipping, an affiliate website in office furniture niche, and what I learned last week. Happy Holidays!

Every week I highlight interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Join The Business Inquirer Facebook Group.

Hello Friends! Happy Holidays!

In this week’s issue:

SaaS - Shopify App

Dropshipping - Masks.com

Affiliate - Office Chair Reviews

What I Learned Last Week

SaaS - Shopify App for Inventory & Sales Management (Asking: $87.5k)

Description

For sale is a Shopify app which helps merchants with sales and inventory record management using QuickBooks. The app was launched in 2018 and the seller now wants to move on due to other software projects seeing faster growth.

Details

Trademarked Shopify automation app

SaaS pricing of $9/$19/$39/$69/$139

5-Star rating (2 reviews)

Ruby on Rails tech stack

80 installs (45 paid, 35 trials)

$1k MRR last month

TTM Revenue: $5,900

TTM Profit: $3,300

Gross Profit Margin: 56%

Asking Price: $87,500 (open to offers)

Profit Multiple: 26.52x

🤓 Why I’m Highlighting This Business

I haven’t seen too many Shopify apps come for sale recently so I wanted to highlight this one. The asking price here seems aggressive to me but the seller is open to offers. For the right price, this could be a nice business for someone who wants to get into Shopify app store.

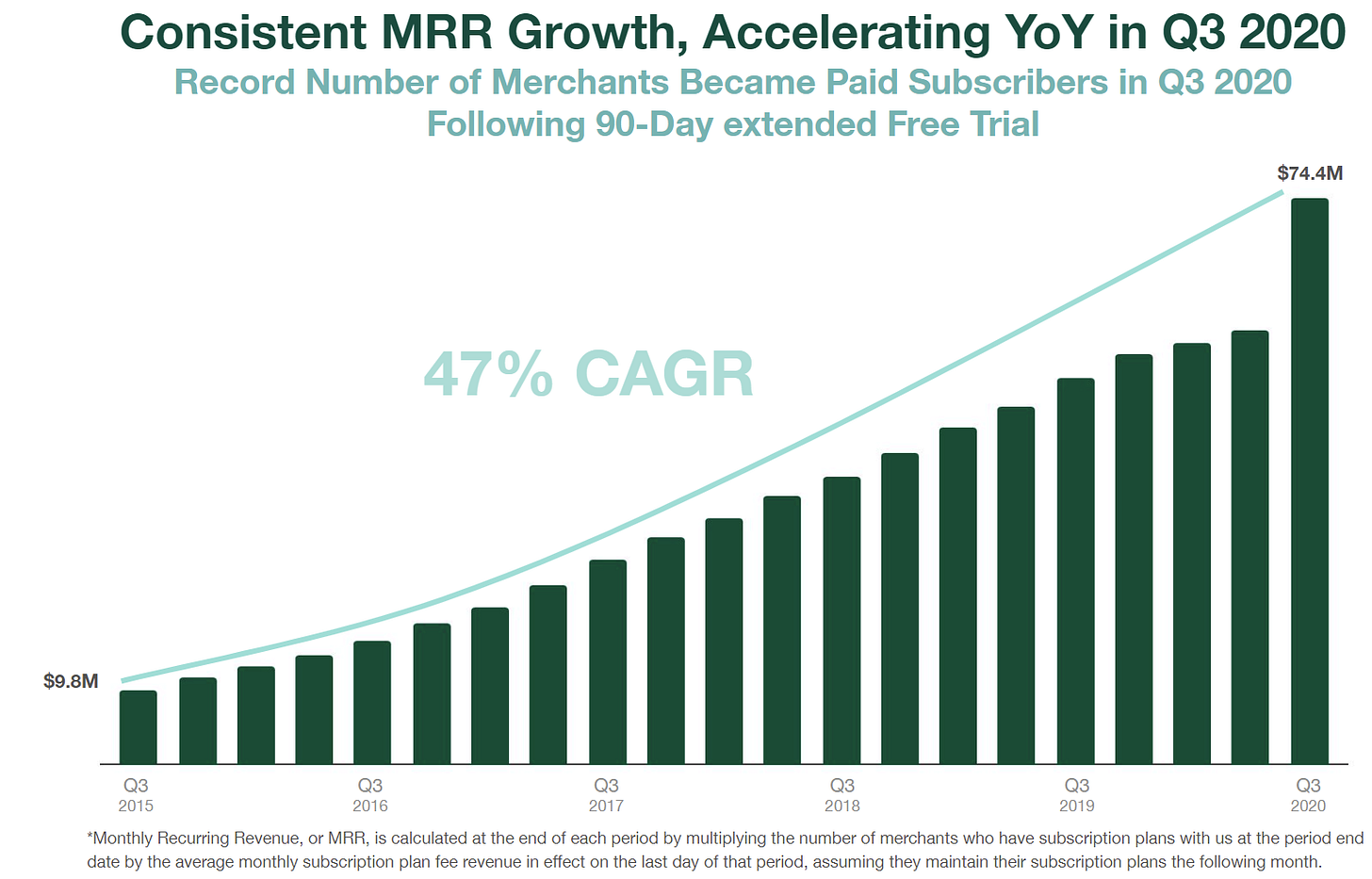

Shopify is a great platform to enter as an app publisher. Record number of merchants became subscribers in 3Q2020…

Search volume for “Shopify” is growing steadily…

✅ What I Like:

Shopify is a growing platform. It’s one of the beneficiaries of the boom in entrepreneurship since COVID (see charts above).

80 installs is a good base

Proven business model with quantifiable CAC

Understandable shortcomings of the app. 3+ users download and uninstall weekly due to lack of features. There is clear feedback on which features are needed.

Built on Ruby on Rails which is popular tech, easy to find devs

3 existing competitors. Biggest competitor (QB Sync by Bold) has 3.4 star rating.

Opportunity to be a standalone app in the QuickBooks Online marketplace. That’s a new market.

Seller is a technical founder. Probably some easy wins if you just focus on marketing.

Seller open to offers

❌ What I Don’t Like:

Valuation seems rich

Requires $$$ investment

Need to add features immediately. Means either hiring a dev or doing it yourself if you’ve got the tech skills

Need to spend $ on marketing

Shopify makes it easy to switch apps. Not a lot of stickiness unless you’ve really got the best features and price.

🚀 How I Would Grow This:

Frankly, I’m not super familiar with the Shopify app ecosystem so I’ll simply highlight some obvious, low-hanging fruit. Really the same framework I would apply to any business.

Go through the negative competitor reviews and make a list of the biggest complaints. Make sure you address those in your app and highlight them in the marketing. Support and glitches seem to be the most mentioned from what I’ve read.

Hire a Ruby on Rails dev and add the most requested feature(s)

Current 5 pricing options seems excessive. Competitors have 4. Maybe you can differentiate by narrowing it down to 2 or 3 pricing options to remove confusion.

45 paid installs and only 2 reviews is not good. Ask current paid users to review the app on the app store. Offer them some incentive if you have to.

Look into the requirements to list on the QBO marketplace.

You can view the listing on MicroAcquire.

eCommerce/Dropshipping - Masks.com (Asking: $975k)

Note: Just an interesting business to study.

Description

Masks.com is an online retailer of cloth face masks supplying schools, businesses, nonprofits, and government agencies. All products are dropshipped directly from the manufacturer. Historical profit margin has been 15%. The domain is NOT for sale - it’s leased.

Details

Masks.com domain is leased and is not being sold as part of this listing. Domain lease cost is $1k/month.

Started 5-months ago. Built on Shopify

No sales team. No partnerships. No marketing spend. One-person business.

250 B2B customers. 11% repeat purchase

2,000+ licensed exclusive fashion mask and gaiter designs

Relationship with Hanes who manufacture the masks

Relationship with Printer who print the mask designs

Business is fully automated with dropshipping

20k+ contact list of every superintendent, procurement manager in USA

$300k+ in outstanding quotes for new clients

New RPQ system in place to handle bulk orders and requests

Monthly gross revenue: $127,000 - $297,000

Monthly net profit: $14,756 - $54,442

December to-date: $150k revenue, $50k profit

Asking: $975,000 BIN: $1,250,000

Profit Multiple: 0.27x - 5.5x

🤓 Why I’m Highlighting This Business

I can’t think of a more here and now business than Masks.com so it’s interesting to view the numbers. The seller is a marketer who clearly got in at the right place, at the right time. Not to diminish what he accomplished - quiet the opposite. In 5-months he was able to secure the Masks.com lease, licensing deals, 250 B2B clients, Hanes as the mask manufacturer, + more. Impressive. A lot to learn from in this listing just in terms of the business.

Not easy to put a value on this business. You’re not buying the domain but you are buying the exclusive right to take over the lease at $1k/month. The business has been successful selling B2B but the 15% profit margin is very low. Why do you need the premium domain if you’re just selling B2B? I own covidmaskusa.com - no reason someone can’t use a similar domain for this business. How sustainable is this business? Without some pandemic, no one is going to be buying masks. That’s why the multiple for the biz is so low. The listing is very detailed so I’d encourage you to check it out.

You can view the listing on Flippa.

Affiliate - BestRatedOfficeChair.com (Asking: $13,852)

Description

For sale is Best Rated Office Chair review website generating revenue from Amazon Associates.

Details

Started almost 6 years ago

Built on WordPress

87 articles

Authority Score 26. 5k backlinks. 3.1k keywords

Last 6-Month income: $170 - $720 ($375 avg)

2019 average monthly income: $340 before Amazon dropped payouts, $140 using today’s payouts

Asking: $13,852 (dutch auction)

Multiple: 36.9x 6-month average income

🤓 Why I’m Highlighting This Business

Website is in a popular niche with a lot of opportunities to grow and monetize. Valuation is not cheap but also not excessive if there are some low-hanging fruit to improve rankings and revenue.

Search traffic is strong but could easily drop to normal trend…

✅ What I Like:

Good niche with strong search trends even before pandemic

2019 prior to pandemic the website still generated $140/month using today’s payouts

Many growth and monetization opportunities

Existing content is detailed

❌ What I Don’t Like:

Unclear how Dec 2020 Google update has impacted the website

Current numbers are all inflated due to pandemic

Website could use some improvement

Undiversified revenue stream

Valuation is not cheap.

🚀 How I Would Grow This:

Do SEO audit. Quick look at the code suggests there are many simple areas to improve.

Update all content to reflect that it’s not stale (add 2020 date to it)

Some existing content needs to be edited. Some of the English is clearly not native.

Website is running slow. Look into speeding it up.

Research additional keywords to generate new content. I’m sure no new content has been added in a while.

Look into additional affiliate programs besides Amazon.

Add display advertising as a source of revenue

Updating the website design would be a good idea. Something more visual.

You can view the listing on Motion Invest.

🧐 What I Learned Last Week

Starting point always matters

Shopify was founded in 2006. In 2019, close to 50% of their revenue has come from merchants who joined the platform prior to 2017. That’s an interesting statistic and clearly illustrates the power of starting early.

——

Use caution when exploring pandemic dependent businesses

I suspect that we’re going to start seeing a lot of pandemic related businesses come for sale. One immediate example would be the Masks.com business above. Other types of businesses I’d be cautious of would be related to home office, home chefs, masks, supplements related to COVID, home/patio furniture, etc. These are businesses which either benefited greatly from the pandemic or were created due to the pandemic. They’ll have very strong past performance and most likely paint a very rosy picture of the future. Be careful.

——

Sales volume of online businesses is exploding

Empire Flippers published their year-in-review for 2020. Have to applaud their transparency. Check out their article titled “10 Things that Separate Us from the Rest”.

I think these business broker models are very interesting. Seems to me like Flippa, Empire Flippers, and MicroAcquire are leading the charge. New ones will spring up which focus on newsletters, blogs and other digital assets. It’s a space that I’m monitoring relatively closely for opportunities. I think you should too.

——

Google rolled out a core update in early December

A few times a year Google rolls out an update which has an impact on website rankings. From what I’ve seen and read, it’s something that’s impossible to prepare for but can be addressed after the fact. Mushfiq Sarker of the Website Flipping Newsletter wrote a good post about how the latest update has impacted his online properties. It’s a good, quick read where he outlines some winners and losers.

——

Crypto assets are ripping higher

Seems like we could be entering a new bull market for crypto assets such as Bitcoin, Ethereum, etc. Plenty of crazy commentary and price targets out there on Twitter and the interwebs. Most estimates are going to be wrong as usual - it’s not going to $0 but it’s also not going to $500,000. It’ll be volatile but I wouldn’t be surprised to see an average Bitcoin price of $40k -$60k in 2021. Impossible to predict with any certainty and ignore anyone that tries (myself included).

Bitcoin price has surpassed the prior peak on strong volume…

Coinbase is the most popular platform to purchase crypto currency…

Coinbase mobile app seeing positive download and DAU trends…

——

That’s all for this issue of The Business Inquirer!

I wish everyone a very safe, healthy, and happy holiday season.

If you enjoyed reading this newsletter, why not share it?

As always, please don’t hesitate to contact me with any questions, comments, or feedback. I also check all comments in the web version of this newsletter.

Let’s connect: LinkedIn, Twitter

Join The Business Inquirer Facebook Group.

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.