The Business Inquirer - Issue #2 (11/9/20)

In this issue I highlight a web scraping SaaS, a social media marketing agency that may be illegal, specialty knife retailer, a swimwear dropshipping business, and what I learned last week.

Every week I write a newsletter highlighting interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Hello Friends!

In this week’s e-mail:

SaaS - Web Scraping

Social Media Marketing Agency - illegal?

eCommerce - Specialty Knives

eCommerce/Dropshipping - Swimwear & Dresses for Women

What I Learned Last Week

SaaS - Web Scraping (Asking: $50k)

Description

For sale is an 11-month old no-code SaaS platform allowing users to extract data from any website and convert that data into a structured format. Pricing tiers consist of $49/$149/$249 per month and there are 76 paying customers. Top competitors in this space include ScraperHub, ScrapeHero, Simplescraper.

Details

Annual Revenue: $5,550

Last Month Revenue: $1,000

# of Customers: 76 (paying)

Asking Price: $50k

Multiple: 4.17x (using a $12k ARR)

🤓 Why I’m Highlighting This Business:

In my prior life I sold alternative data to hedge funds and some of this included web data. I am also working on a few business ideas that involve scraping/aggregating website data. With first-hand experience, I know that extracting web data is a very profitable business with a lot of use cases. It’s low cost but high value-add.

“Web Scraping” search volume…

✅ What I Like:

In the past, web scraping was a complicated process that required specific expertise. With no-code, it democratizes the process and makes it accessible to everyone

It’s an evergreen field with a lot of use cases for many industries. I think a lot of people aren’t yet aware that it is possible to systematically scrape website data.

76 paying clients in 11-months is a nice customer base from which to expand

Many growth opportunities

Product is built on Node + React which are widely used languages. If you’re non-tech, it would be easy to bring on a developer to help you

hiQ vs LinkedIn legal case basically cleared the way from a legal perspective to scrape any publicly available data

Price negotiable. I bet this team would be open to many offers with creative terms.

❌ What I Don’t Like:

The listing itself doesn’t provide a lot of detail. How are they marketing it? Who are the clients? What is the brand?

Valuation is rich.

There is a lot of competition in the space so this SaaS has to offer something differentiated (courses, documentation, pricing, etc.)

You probably do need to have a developer available to you if you’re non-tech to make sure this thing runs smoothly.

🚀 How I Would Grow This:

Create a website that is conversion focused.

If you go to a lot of the competitors you’ll see that they mostly highlight what their product does. Not the right approach here. Highlight what value the product will provide to the user. So instead of “We’ll automatically scrape website data of any retailer for you while you sleep” replace with “We empower you and your team with the data to outsmart the competition - while they sleep”. Something along those lines.

Ask those 76 paying clients to write reviews and offer social proof on the website. No many competitors do this.Niche down by industry

Instead of offering general web scraping - niche down to a specific industry like legal, retail, investing, marketing, energy, analytics, etc. Then clearly explain and provide examples of the value that web scraping can provide to each of those industries.Add service component

From the listing, it seems to me like the only current offering is a DIY web scraping platform. I would add a service and education component to this to take it up the value chain.Legitimize the service

Right now a lot of people view web scraping as a gray area. If you look at many of the competitors, they’re based overseas (Ukraine, India, etc.). I would differentiate myself here. Make people more comfortable with using a web scraper.Conduct client interviews

What else do those 76 paying clients want to see? What are they doing with the scraped data? Do they need help doing it?

You can view the listing HERE.

Social Media Marketing Agency - illegal? (Asking $19k)

Description

YouMeViral is a 2-year old social media marketing agency selling views, likes, and followers to influencers. They sell this service through their website and have an e-mail list of 40k clients. The website collects the orders and the actual work is outsourced to other companies.

Details

Based in India and founded by an SEO “expert”

Monthly unique visitors have fluctuated from 3k to 23k (US/DE/UK)

Monthly gross revenue has fluctuated from $0 to $22k with 80% profit margins

🤓 Why I’m Highlighting This Business:

I think it’s an interesting albeit questionable business. I never knew what the economics of this type of business could look like. My understanding is that selling followers/likes/views is illegal but I don’t know if that’s undisputed or if it applies outside of the USA.

The numbers that the seller provided are verified (traffic, revenue). Of course there’s no way to figure out what they did to obtain those numbers and if it was legal. Website itself is terrible with broken English. Business listing is both detailed and vague at the same time. Paypal account banned? Answers in comments are vague. Doesn’t seem like anyone wants to touch this listing.

We all know that sometimes you get a diamond in the rough and there’s a non-0% chance that this could be one of those but who knows. I messaged the seller asking if they would be willing to just sell the e-mail list. An e-mail list with 40k influencers who want to buy followers could be worth something.

You can view the listing is HERE.

eCommerce - specialty knife retailer (Asking: $1.15m)

Note: This business is under NDA so I am unable to provide more detail.

Description

For sale is a top-rated global internet retailer with the largest selection of specialty knives for law enforcement, military, or civilian self-defense. Internet traffic to the website has doubled over the last 30-days during pandemic and sales are reflecting a similar increase. The business is currently operated out of San Diego but can easily be relocated and operated from a home office or small storage facility. A seasoned, full-time Operations Manager will stay on with the new owner. SBA pre-approved.

Details

Gross Revenue: $862,107

Total Income: $325,720

Margin: 38%

Price: $1,150,000

Multiple: 3.53x (net) or 1.33x (gross)

✅ What I Like:

Self-defense market overall is expanding with “Folding Knives” being the top category. According to Grand View Research…

The global self defense products market size was valued at USD 2.4 billion in 2018 and is expected to expand at a CAGR of 5.9% from 2019 to 2025. Growing incidences of civil unrest across the globe is the major factor driving the global market. Apart from civil tensions, recreational activities such as camping and hunting also contribute to the demand for self-defense weapons.

Online distribution to witness the fastest growth…

Online distribution of these products is expected to witness the fastest growth over the forecast period. Due to growing population of tech savvy people and popularity of online shopping, manufacturers are resorting to convenient methods of distribution to reach out to the large customer base. Third party retailers such as Amazon.com, PepperEyes.com, Flipkart, and Xboom Utilities are some of the common suppliers of personal defense products.

Google search trends for “knife” are strong and the CPC isn’t crazy for some of these.

Pocket knives have risen among Amazon’s best-selling products according to Thinknum Alternative Data.

Tough to really tell from the listing but it appears that this retailer sells knives to the government and I assume has some relationships there which are not easy to acquire.

Could this business be expanded to Amazon/eBay/Etsy?

I bet you can do some interesting IG influencer marketing with this business. Get Jocko Willink to mention you.

Could be opportunities to expand beyond self-defense knives and into other segments like hunting, EDC, etc.

Listing mentions the business is easy to relocate and is turnkey

Full-time Operations Manager is willing to stay on with the new owner

There are few large retailers in this space which offers opportunities for acquisitions.

❌ What I Don’t Like:

Listing really doesn’t make it clear if this is a dropshipping business or if you need to take inventory.

There may be legal considerations when selling and shipping knives to different states.

Risk of knife manufacturers going direct to consumer.

Would be more comfortable with a margin higher than 38% but not enough detail to understand what exactly the expenses are for this business.

I think it helps if you’re really interested/passionate about knives.

You can view the listing HERE.

eCommerce/Dropshipping - women’s swimwear (Asking $58k)

Note: I briefly mentioned this business in last week’s email. A lot to learn here.

Description

For sale is Sandwater Swimwear, a 2-year old dropshipping store which sells women’s swimwear, accessories, and summer dresses. Store is built on Shopify.

Details

Monthly Gross Revenue: $3,475

Monthly Net Profit: $1,942

Margin: 56% (70% mentioned in listing)

Asking Price: $58k

Multiple: 2.5x

Ad Spend: $0

Conversion Rate: 2.58% (benchmark is 1.75%)

AOV: $65

Return rate < 1%

95% of traffic is from IG

USA/Australia/UK/France/Spain are main markets

$0 Ad spend

1.6k email list

🤓 Why I am Highlighting This Business

I briefly mentioned this business last week as a great example of a business where you can learn a lot from the listing. If I was managing or starting a DTC brand then I would certainly learn how this business grew with $0 ad spend.

Here is one great answer from the owner when asked about the IG ambassadors that are driving sales/traffic:

The ambassadors are female Instagrammers who represent the spirit of Sandwaterswimwear and help to build brand awareness as well as increase its social media presence. Since the beginning of the ambassador program, they have massively helped earn legitimacy among customers by posting pictures wearing our swimwear and clothes and by sharing their photos on their accounts.

The relationship with the ambassadors has been built through Instagram DMs. They are paid a 30% commission fee every time someone uses their network code.

If you look at the tagged photos in the main Instagram Page @sandwaterswimwear you will still see hundreds of tagged photos from our ambassadors that can be used for promotional purposes and that have helped us extremely when reaching out to new clients and future ambassadors.

Email marketing is an area that is still untouched. Having a network of 1,100+ ambassadors makes it an extremely attractive opportunity for retargeting and maintaining relationships with this big network. It can be extremely helpful for future promotional campaigns as well as for sales. I am also willing to provide the future buyer the exact transcripts I have used that have been extremely effective when reaching out to potential new clients/ambassadors as well as for abandon carts and retargeting.

Here’s another great comment from the owner when asked about suppliers:

Items are manufactured in China, they all come from Aliexpress suppliers. Due to the commitment to other projects, the items haven´t been updated often - around 3 times a year. This represents a huge opportunity for the new owner to update products more frequently which would surely bring new revenue. The owner has been in charge of doing this since the business was started.

This is a really interesting listing from an experienced owner/seller. I won’t go into more details for this listing but you can find it HERE.

🧐 What I Learned Last Week

Immigrant Founders = Big Results

My friends over at One Way Ventures are raising another fund and they shared a great slide about immigrant founders which I copied below. One Way specifically invests in immigrant founders and they have an excellent track record. Their founder, Semyon Dukach was on one of the MIT blackjack teams. He’s smarter than the average bear. Copied slide is below but also ping me if you’d like details on the fundraise.

Quant models for online assets

During my time in the asset management industry I built some quant models to invest in global large cap stocks. Employing a systematic, quantitative approach to investing takes the human and emotional aspect out of the equation. We now have quant models for almost every asset class including stocks, bonds, real estate, crypto, and more. This got me thinking about building a quant model for ranking and investing in online assets like websites. Information is certainly harder to come by and it’s often messy but I think it may be a worthwhile project.

Several new online communities have sprung up for digital asset acquisition

MicroAcquire announced last week that they are starting a private, premium buyer FB community. You can request access here.

Our goal is to create the largest community of entrepreneurs looking to acquire SaaS companies.

The Website Investing newsletter has also rolled out an online community specifically for website investors. You can find it here.

I’m curious to see how these communities grow. In my view, the digital asset acquisition path is still one that’s relatively new and not widely adopted. On the other hand, if I’m writing a newsletter about it then perhaps we’ve already seen the top in this market 😉.

I understand the desire to view deal flow but I am less convinced that serious acquirers want to get together in a community and share tips. There’s still a lot of money chasing few deals. Having an information edge is an advantage. I could be wrong about this so I’m really interested to see the growth of these communities.

Online reputation management is big business

A few weeks back I purchased a consulting business doing personal branding. I’ve been looking into this space for a while as I think it’s going to be a long-term winner. The idea is that online reputation/presence is going to be more and more important not just for businesses but for individuals as well. During my research I recently came across BrandYourself. They offer an online tool which helps you automate online reputation management. You connect your social media accounts and it uses an algorithm to flag any suspicious posts/photos. It’s an interesting product. The reason I’m writing about them is because the business has appeared on both Shark Tank and Dragon’s Den. They generate around $4m per year in revenue. Maybe this number shouldn’t surprise me but it did. Unfortunately the business is losing money and the Founder owns just 10%. Reputation Defender is another one of these businesses. I’ve seen them advertise on CNBC. Last year they raised $30M from prominent investors. You can read about them here.

Here are some interesting 2020 online reputation management statistics from Reputation X:

85% of consumers trust online reviews as much as personal recommendations.

Consumers read an average of 7 reviews before trusting a business.

Every additional one-star Yelp rating causes an increase in the business’s revenue as high as 9%.

Google controls 75.34% of global desktop search traffic. Bing is number two at 9.94% of search engine market share.

“Best” and “right now” mobile queries have grown by over 125% in the last two years.

95% of businesses use social media in their recruiting process.

Online social recruiting is on the rise in HR departments, having grown 54% in the past five years.

73% of companies consider LinkedIn the most effective site for finding qualified candidates.

Up to 69% of job seekers reported they would reject a job offered by a company with bad reputation, even when unemployed.

87% of people do comparative shopping for every single purchase they make, and they shop on multiple channels.

76% of American consumers purchased a product after seeing a brand’s social post.

Videos are the #1 branded content used by marketers. Nearly 93% of marketers say that they’ve landed a customer thanks to videos on social media.

86% of B2B organizations prefer LinkedIn for social media marketing, while 98% of B2C companies report using Facebook.

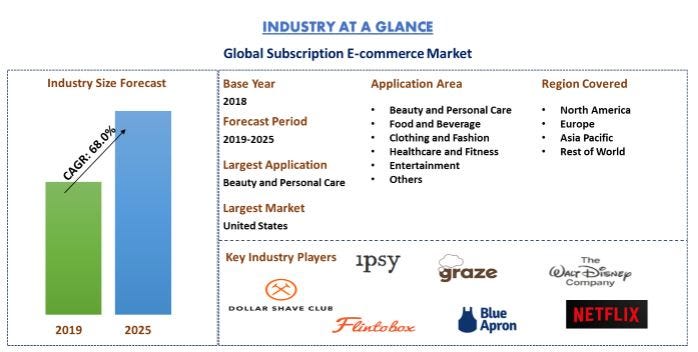

Global subscription ecommerce market is expected to reach $478 B by 2025, a CAGR of 68%

There are a lot of interesting insights in this report from UnivDatos. The quick take is that the DTC market is predicted to expand massively with beauty & personal care leading the way.

On an estimate, it is predicted by 2030, almost 90% of the human population aged 6 years or older will be online. Over the last few years, it is found that nearly 15% of online shoppers have subscribed to some sort of e-commerce services.

The subscription e-commerce market is mainly dominated by women, i.e. nearly 45% of women shoppers have subscribed to at least one e-commerce service while 40% of men shoppers subscribed for the same. However, men shoppers outperformed women when having three or more active subscriptions - 42% vs. 28%, respectively.

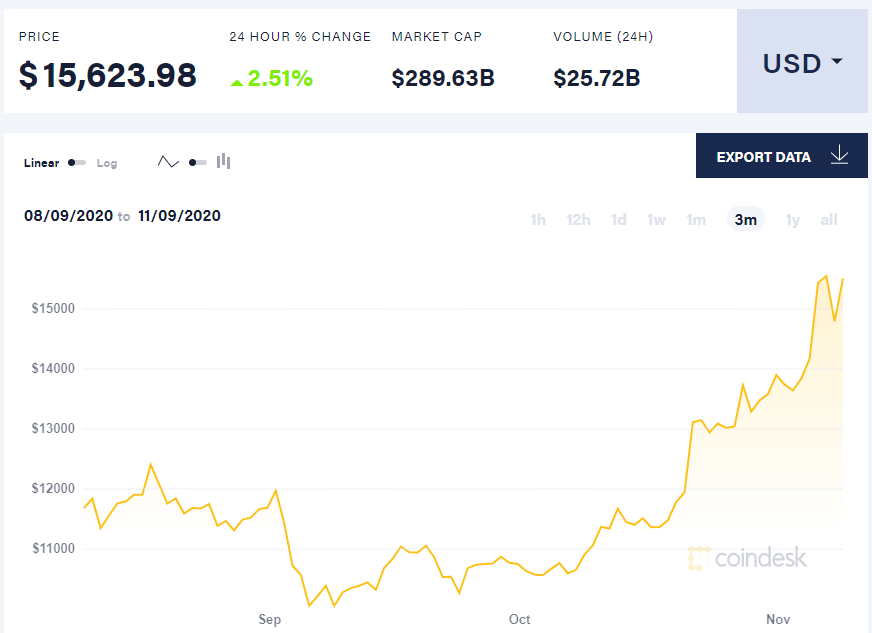

Bitcoin has been on a tear over the last few weeks

Feels like we may be entering a new bull market for bitcoin and other cryptocurrencies. Not really surprising considering all the recent news with institutional adoption - PayPal, Fidelity, KPMG and many more.

Freelance platforms are not widely adopted and there’s a lot of untapped growth

On Saturday my wife and I had lunch/drinks with some friends who own a specialty medical office. They’re doing a rebrand and were gushing about a service they recently found which allows them to run a logo design contest. They were absolutely amazed by this service. These are young people in their early 40s. Of course if you’re a subscriber to this newsletter then I assume platforms like Fiverr, UpWork, 99 Designs, etc. are old news. Saturday’s conversation got me thinking that there’s still a huge untapped market for those platforms. There’s an opportunity to bring access to those platforms to local businesses who may not be aware they exist.

That’s all for this issue of The Business Inquirer.

As always, please don’t hesitate to contact me with any questions, comments, or feedback. If you enjoyed reading this post, why not share it?

Important Disclaimer: This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.