The Business Inquirer - Issue #4 (11/23/2020)

In this issue I provide an overview of the pet niche and highlight five businesses for sale along with what I learned last week.

Every week I highlight interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Hello Friends!

In this week’s e-mail:

Pet Niche Overview

5 Pet Niche Content Websites

What I Learned Last Week

Pet Niche🐩🐈🐟

I thought I’d try something a little bit different. A few readers have reached out to inquire about pet niche websites and I’ve seen a few for sale recently. Below we’ll take a VERY high level look at the niche and then I’ll highlight 4 content websites for sale at different price points.

✅ What I like about the pet niche…

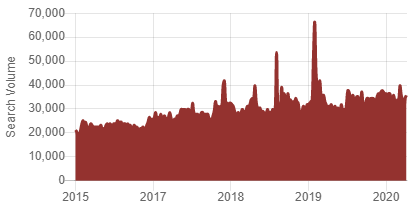

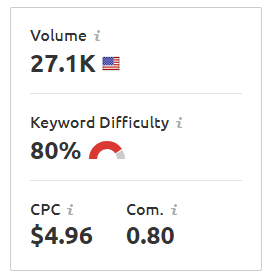

Niche is growing with search volumes steadily increasing. Three ways to interpret the Google search volume charts below: 1) Cat owners are smarter than dog owners and simply don’t need help in choosing pet food 😅 or 2) there are significantly more dog owners compared to cat owners or 3) both. Either way, the search volume is steadily growing for both and has almost doubled since 2015.

Pet owners are a very engaged group. According to a study from Mars Petcare, the world’s largest pet care company…

65% of pet owners post about their pets on social media 2x per week, on avg.

30% of pet owners follow celebrity pets on social media

Common Thread has a lot of great data on the global pet industry and ecommerce trends. I thought the two charts below were particularly interesting…

The American Pet Products Association estimates the US pet industry TAM to be ~$99B in 2020.

Pet Food & Treats - $38.4B

Vet Care & Pet Product Sales - $30.2B

Supplies, Live Animals & OTC Medicine - $19.8B

Grooming/Insurance/Boarding/Training/Other - $10.7B

All of this tells us two things 1) there are a lot of opportunities to make money in the pet niche and 2) for this reason it’s competitive with high CPC…

According to BuiltWith there are 45,100 global animal ecommerce website.

AuthorityHacker put together a nice list of the 12 Best Pet Affiliate Programs of 2020. Here’s another list which highlights 36 Dog Affiliate Programs to Make Money from bloggingcage. My understanding is that pet affiliates pay some of the higher commissions right up there with hosting, travel, and financial products.

Here are some things that I would think about when entering this niche…

Do you want an authority website or niche down?

Research competition & long tail keywords for cat, dog, bird. Go deep and focus on some trending breeds (There’s a Pomsky (pomeranian/husky) in my building that’s a looker)

Research the products which pay the highest affiliate fees. Cast a wide net to include CBD, vitamins, courses, accessories, insurance, etc.

If you can start a content website for one of the faster growing regions (Asia Pac) then I’d look into that.

Affiliate/Ad - Pet Care (Asking: $39.5k)

Description

For sale is a 5-year old pet care content website earning revenue from Amazon Associates and display advertising. The WordPress site features informational posts and reviews for a pet-related product.

Details

Revenue from AdThrive display (90%), Amazon Associates (10%)

82% of traffic is organic. US/UK/CA

No new content since May 2020. All previous content from freelancers

Monthly Revenue: $978

Monthly Net Profit: $942

Net Profit Margin: 96%

Asking Price: $39,564

Multiple: 43x Oct 2020 net profit

You can view the listing HERE.

Affiliate/Ad - Pet Care (Asking: $95.4k)

Description

For sale is a 4-year old pet care content site earning revenue from Amazon Associates and display advertising. The WordPress site features informational posts and reviews for a specific pet.

Details

Revenue from Mediavine display (75%), Amazon Associates (25%)

89% organic traffic. US/UK/IN

Monthly Revenue: $2,367

Monthly Net Profit: $2,327

Net Profit Margin: 98%

Asking Price: $95,406

Multiple: 38x Oct 2020 net profit

You can view the listing HERE.

Affiliate/Ad - Dog Care (Asking: $300k)

Description

For sale is a 2-year old content website earnings Amazon Associates & display advertising revenue.

Details

Revenue split between Mediavine & Amazon Associates

930% Y/Y revenue growth. 1000% Y/Y SDE growth

90 pages of content written by freelancers.

200,000 unique monthly visitors

TTM Revenue: $97,473

TTM Net Profit: $93,131

Profit Margin: 96%

Asking Price: $300,000

Multiple: 3.2x TTM net profit

You can view the listing HERE.

Affiliate/Ad - Pet Care (Asking: $611k)

Description

For sale is a 4-year old content site generating affiliate and advertising revenue. The WordPress site features reviews and guides for pet products.

Details

Revenue from affiliates (59%), advertising (40%), Amazon Associates (1%)

87% organic traffic. US/CA/UK

2,100 subscriber e-mail list

Would need to hire new writers as current ones are not transferrable

Monthly Revenue: $18,580

Monthly Net Profit: $18,502

Net Profit Margin: 99%

Asking Price: $610,581

Multiple: 39.2x Oct 2020 net profit

You can view the listing HERE.

Affiliate - Pet Care (Asking: $1.1M)

Description

For sale is a 3-year old site in the pet care niche generating affiliate revenue. The WordPress site provides guides, product reviews, and best practices for a specific type of pet.

Details

Revenue from affiliates (88%), Amazon Associates (12%)

95% organic traffic. US/UK/CA

TTM Revenue +100%

No new content in past 6 months

Monthly Revenue: $26,479

Monthly Net Profit: $26,465

Net Profit Margin: 99%

Asking Price: $1,137,976

Multiple: 40x Oct 2020 net profit

You can view the listing HERE.

🧐 What I Learned Last Week

Apple will cut App Store commissions

Last week Apple said that it will cut App Store commissions by half to 15% for small app makers.

Apple says the App Store Small Business Program will begin Jan. 1 and that developers who qualify will receive reduced App Store fees for paid app and in-app purchases. New developers who haven’t published on the App Store before will also qualify for the lower, 15% commission fee.

The new App Store Small Business Program is open to any developer who earns less than $1M in annual sales. According to Apple a “vast majority” of iOS developers should be able to qualify.

I have to assume that this automatically increases revenue for a majority of mobile apps and would send valuations higher.

——

There are 5 stages to a website flip

Mushfiq Sarker publishes the excellent Website Flipping Newsletter. Last week he had a particularly interesting article where he talks in detail about the 5 stages of a website flip:

Acquisition

Takeaway: Before building or acquiring, keep an idea of the Timeline, Monetary, and Strategic goals for an exit.

Stabilization (2-4 weeks)

Takeaway: Take a few weeks to stabilize the site, improve the foundation, and monitor earnings and traffic. A strong foundation is key to future growth.

Growth (3-9 months)

Takeaway: Fuel the growth of your website with a combination of different easy wins.

Exit Optimization (3-6 months)

Takeaway: Make sure to understand when you want to exit and optimize for that.

Exit Execution

Takeaway: The “exit” here is to reduce your time commitment in the business so you can move on to the next venture with the cash influx.

I really didn’t do justice in summarizing the newsletter so please go and check it out. Mushfiq goes into a lot of detail with each stage with case studies and a database of strategies to get easy wins. I’d highly recommend subscribing if website flipping is in your wheelhouse. (I don’t know Mushfiq, I am not affiliated with him, no incentive here)

——

How are newsletters bought and sold?

I recently came across LetterXChange on Reddit.

A user who I assume to be the founder was advertising a newsletter that was for sale on their platform. I was surprised when I went to their broker platform and only saw one newsletter for sale. That piqued my curiosity…

How do newsletters get sold? Are there newsletter brokers? It can’t all be private transactions.

How are newsletters valued? Is it similar to websites?

I did some digging and according to WHOIS, LetterXChange was registered in Sept 2020. I have to assume they can’t be the only newsletter broker, yet a simple Google search wasn’t much help.

There may be an opportunity for a scrappy upstart brokerage to spring up focused on newsletters. Let’s not use any variation of “Flippa” or “Flipper” in the name though. 😂

Here’s one reason a newsletter brokerage may NOT be a great idea though…

——

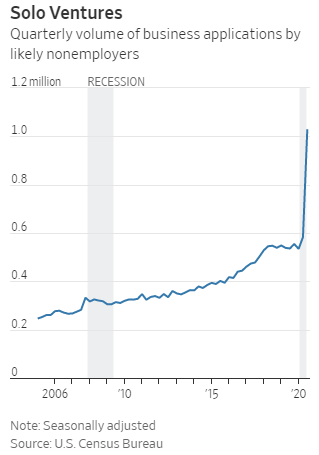

Strong rebound in entrepreneurship in the US

I strongly believe in the power of entrepreneurship. It improves the overall standard of living, creates wealth, drives innovation, boosts national income and tax revenue. WSJ recently had a great article about the rebound in entrepreneurship in the US brought on by COVID. I won’t rehash the article but I found the charts below to be particularly illustrative.

Self employment rebounded more fully from the spring downturn than payroll employment…

Huge spike in new business applications…

“A working hypothesis is that individuals realize that the new normal is going to be different from the old normal,” said John Haltiwanger, an economist at the University of Maryland who studies the Census Bureau data. New entrepreneurs “are engaging in activity that is associated with that new structure,” he said.

Theoretically, these new entrepreneurs will need a lot of tools to run their business.

——

Contrarian Thinking newsletter by Codie Sanchez

I recently discovered Contrarian Thinking & Grow Getters newsletters by Codie Sanchez. Both are newsletters deal with business, growth, motivation, ideas, and the digital economy. I may be doing a guest post for them in the near future. Check it out and subscribe if it resonates with you.

——

That’s all for this issue of The Business Inquirer!

For those celebrating in the USA - have a happy and healthy Thanksgiving holiday.

Please let me know what you thought of today's newsletter…

As always, please don’t hesitate to contact me with any questions, comments, or feedback. I also check and reply to all comments in the web version of this newsletter.

If you enjoyed reading this post, I would really appreciate it if you share it?

Let’s connect: E-Mail, LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.