What I Learned Last Week 10.13.2023

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

I am currently overseas on vacation (back next week).

This newsletter is written by guest editors Corey and Riley, two searchers looking for digitally native businesses <$2M in total transaction value. If you’re interested in networking, please reach out to corey@skyviewadvisory.com and riley@skyviewadvisory.com.

I am very grateful to Corey & Riley for their assistance with this newsletter.

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Smash.vc

Buying a business with the SBA?

Would having a capital partner help?

At Smash.vc, they do two things:

Buy minority stakes in existing small businesses.

Partner with entrepreneurs trying to acquire new ones.

If you're actively looking to buy a cash-flowing business using an SBA loan, hit them up if you'd like a partner.

They contribute capital, give advice, or help with growth when asked... but stay out of the way the rest of the time.

Silent partners there to help when necessary, nothing more.

If interested👉 go say hi.

📰 Articles

Mind the Gap

Chenmark’s most recent newsletter reflects on a recent competitive bidding process and their conservative valuation of the business, highlighting how bidding lower than other buyers can be disappointing but adds value when underwriting a long investment horizon.

— — — — — — — — — — — —

When and How to Sell Your Company

Navigating when to sell your business can be difficult; this week’s issue of The Wise Exit walks through key lessons on how and when to sell with Daniel Lewis, a founder who grew and exited his business, Ravel.

— — — — — — — — — — — —

Understanding Proposed Changes to Noncompete Agreements

The proposed FTC ban on noncompetes this year, as well as the ban passed in New York (not yet signed), will have significant impacts on M&A. Middle Market Growth outlines the current situation and explains how sellers are increasingly pushing back on traditional noncompete clauses following the proposals.

— — — — — — — — — — — —

Franchise Owners Face Increasing Labor Costs as States Weigh Minimum Wage Increases

BizBuySell discusses the current rising wage environment and its relation to franchises. A useful article for any business relying heavily on labor.

— — — — — — — — — — — —

SBA Programs That Entrepreneurs Often Overlook

WSJ discusses underused resources that are available through the Small Business Association (SBA), including:

Small Business Development Centers

Score mentoring program

Federal contracting-assistance programs

Small Business Innovation Research programs

🧵 Best of X (Twitter)

Can you baby-Peter-Thiel-Roth-IRA your search fund investing…

Things to keep in mind when raising money…

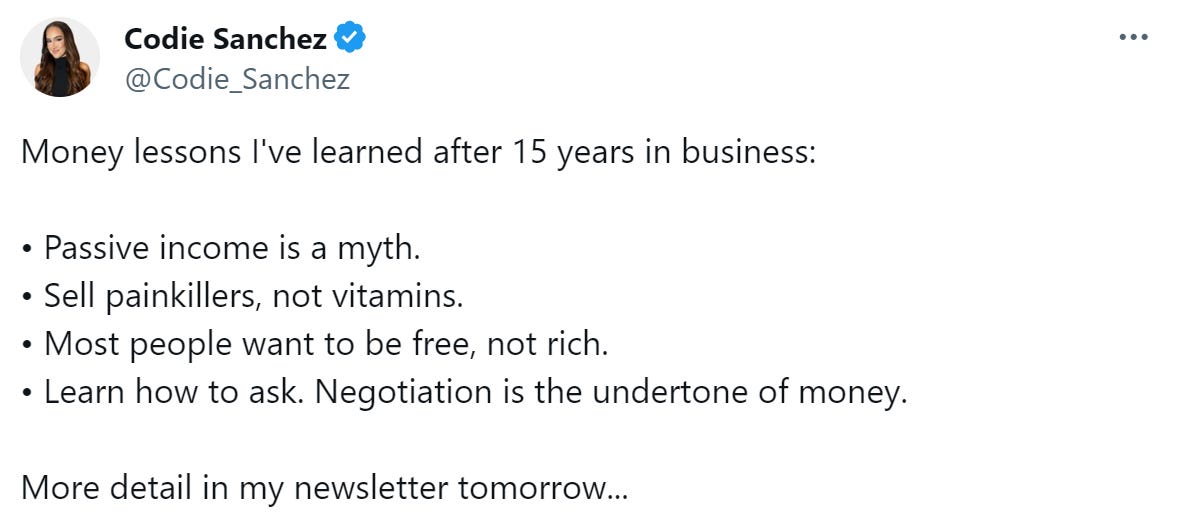

Money lessons learned…

Don’t take everything the lender says at face value…

Sieva giving away all his secrets…

If I were spinning up a new business right now…

Text

🗓️ Events

Booth Kellogg EtA Conference (Nov 1) - Chicago, IL

Main Street Summit (Nov 8-9) - Columbia, MS

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($500k - $10m revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7-10 new deals each week

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?