What I Learned Last Week 10.18.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

What’s the market like now for selling a business? (Q4 2024)

The market for selling online businesses in Q4 2024 is cautiously optimistic, with signs of recovery from the challenges of the past two years. Interest rates are declining, and the anticipation of economic stabilization after the November election is fueling hope for stronger M&A activity in 2025. However, trends vary across sectors, with SaaS and e-commerce businesses — especially those incorporating AI and sustainability — attracting buyers. Buyers remain cautious, preferring businesses with diversified revenue streams and lower risk profiles.

Key insights include:

Recovery in progress: Optimism is rising, with more sellers expected to enter the market as conditions improve, particularly after the election.

Sector trends: SaaS, e-commerce (especially AI-driven), and recurring revenue models are in demand, while agencies and content businesses are facing more challenges.

Risk aversion: Buyers prioritize businesses with diversified income and customer portfolios, avoiding those heavily reliant on a single revenue source or platform.

Fundamentals matter: Well-run businesses with strong financials and operational excellence continue to command high interest.

2025 outlook: Expect increased M&A activity driven by lower interest rates, post-election confidence, and sellers capitalizing on a more favorable market.

— — — — — — — — — — — —

America’s New Millionaire Class: Plumbers and HVAC Entrepreneurs

The WSJ article highlights the growing trend of private equity (PE) firms investing in skilled trades such as plumbing, HVAC, and electrical services. This influx of investment is creating new opportunities for business owners in these fields, often resulting in multimillion-dollar buyouts. While the involvement of PE firms is transforming small, family-run businesses into larger operations, it has also introduced both benefits and challenges for workers and owners alike.

Key insights include:

Private-equity investment surge: PE firms are increasingly acquiring HVAC, plumbing, and electrical companies, creating significant buyouts for small business owners.

Financial windfalls: Many small business owners are cashing out for seven- or eight-figure sums, a shift from the tradition of passing down businesses within families.

Business growth: PE-backed companies improve operations by expanding services, increasing efficiency, and boosting wages for employees, though some workers feel pressured to prioritize sales over repairs.

Entrepreneurial opportunities: Tradespeople with entrepreneurial ambitions can build businesses worth millions and find ready buyers, as demand for essential services like HVAC continues to rise.

Cultural shift: The trades, long considered steady but unglamorous, are now seen as viable paths to significant wealth, with PE buyouts adding shine to these careers.

Here’s Axial’s take on this article with data from their platform.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

18 months after buying an HVAC business: game-changing wins, painful mistakes, and key lessons for scaling success…

Franchise vs. SMB for rollups: Franchises offer smoother scaling, but SMBs give autonomy and potentially better economics…

Private equity in 2024: deal volumes lag, valuations soar, and exits stall — PE’s wild ride continues…

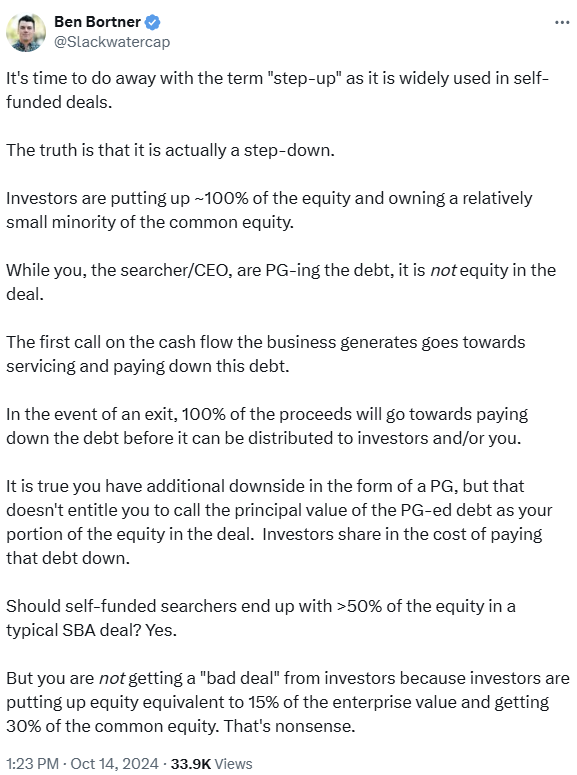

Good discussion on so-called ‘step-up’ in self-funded deals…

Key questions for identifying promising small business acquisitions — focus on competitive strengths, growth potential, and risk mitigation…

🗓️ Events

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

HBS ETA Conference (Oct 19) - Cambridge, MA

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

iGlobal Independent Sponsors (Dec 4) - New York, NY

SBIA Northeast PE Conference (Jan 8-9 2025) - New York, NY

SBIA Southeast PE Conference (Feb 13-14 2025) - Nashville, TN

iGlobal Independent Sponsors (Mar 4-5 2025) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27 2025) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Love Vibration“ by Essel 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?