What I Learned Last Week 1.10.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

Why Is Small Business Administration Lending Suddenly Surging?

The article highlights the surge in SBA loans with $8.8 billion in 7(a) loans approved in the first quarter (this is not calendar but govt fiscal), marking a 38% increase from the prior year. Changes in SBA rules, a rise in business acquisitions, and the growing availability of small loans and lines of credit are driving this trend. Additionally, Baby Boomer retirements are providing a steady stream of established businesses for sale, contributing to the lending boom.

Key insights include:

Record Loan Growth: SBA loans reached near-record levels, with 7(a) loans seeing their second-fastest start since 1991.

Rule Changes: Recent SBA updates allow multiple loans for acquisitions in different industries and permit seller equity arrangements.

Business Acquisitions: Baby Boomers selling profitable, resilient businesses are fueling acquisition activity.

Small Loan Focus: Growth is also driven by small loans and Express Lines of Credit, which are faster and more accessible.

Shift in Lending Trends: Banks and credit unions are stepping into smaller loans, leveraging technology for efficiency.

Top Lenders: Newtek Bank, Live Oak Banking Company, and Huntington National Bank lead in loan approvals, collectively accounting for 20% of total volume.

If you hit a paywall, you can use this to get around it: 12ft

— — — — — — — — — — — —

Cold Bore Capital Management: Interview With Co-Founder & Partner Matt Schachman About The Veteran-Led PE Firm

I thought this was a good interview and helpful for anyone considering going down a similar path of starting their own firm.

Cold Bore Capital, a veteran-led private equity firm, focuses on small-cap buyouts in the lower-middle market, targeting businesses with EBITDA of $500K to $5 million. Co-founded by Matt Schachman, the firm leverages the problem-solving skills of elite military veterans to scale small businesses into competitive middle-market platforms. Its approach combines operational improvements and M&A strategies to drive growth.

Key insights include:

Veteran Expertise: The firm’s operations team, composed of military veterans, applies leadership and execution skills to business growth.

Focus Areas: Investments prioritize B2B services, including business process outsourcing and route-based services like landscaping.

Differentiation: A hands-on, value-added approach sets Cold Bore apart, emphasizing people, processes, and technology alongside capital.

Success Stories: Highlights include successfully exiting a landscaping platform and raising new funds amid challenges like COVID-19.

Unique Strategy: The firm builds smaller platforms and scales them via organic growth and acquisitions, targeting $10-25 million EBITDA platforms.

— — — — — — — — — — — —

From engineering to ownership: How Jon DeCoste found focus and acquired his dream business.

The article from The Come Up profiles Jon DeCoste, an entrepreneur who transitioned from a successful engineering and sales career to pursue business ownership through the Entrepreneurship Through Acquisition (ETA) model. Jon shares insights into his self-funded search, the challenges and lessons of evaluating businesses, and the highs and lows of buying an established company. By December 2024, he successfully acquired an Alberta-based business.

Key insights include:

ETA Strategy: ETA involves buying existing businesses rather than starting from scratch, balancing risks and rewards.

Self-Funded Search: Jon financed his search independently, prioritizing flexibility but facing financial and emotional challenges.

Business Criteria: Focused on Western Canada, oil and gas, and industrial sectors, with EBITDA targets of $750K–$4M.

Lessons Learned: Importance of persistence, people dynamics, and aligning opportunities with personal goals and strengths.

Advice for Searchers: Weigh the funded vs. self-funded approach, build a strong support network, and focus on deal flow and connections.

🧵 Online Highlights

I scroll, so you don’t have to.

Long post with good lessons for business owners and operators…

Successful business acquisition requires both on-market and off-market deal sourcing strategies…

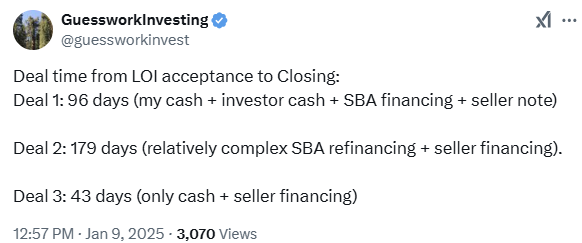

The complexity of financing structures influences deal closing times…

Most streamlined deal structure for investors in SMBs…

Don’t leave working capital discussions until the last minute…

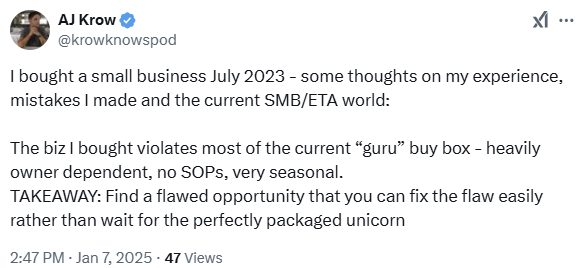

I often discuss the “buy box” with searchers. Important to get your search criteria dialed in…

Key learnings from buying and fixing a flawed business instead of waiting for the perfect opportunity…

These types of background checks are often overlooked but they’re an important part of due diligence…

To stand out as a business buyer, you must personalize your approach, demonstrate industry knowledge, and show proof of funding to effectively engage overwhelmed brokers or seller…

🗓️ Events

UM Ross EtA Conference (Jan 23-24) - Ann Arbor, MI

Babson College EtA Conference (Feb 7) - Boston, MA

SBIA Southeast PE Conference (Feb 13-14) - Nashville, TN

MIT EtA Conference (Feb 28) - Cambridge, MA

iGlobal Independent Sponsors (Mar 4-5) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3) - Sundance, UT

SMBash (Apr 2-4) - Dallas, TX

🎵 Listening: “This Rhythm (feat. RAHH)“ by Prospa, RAHH 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?