What I Learned Last Week 11.10.2023

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Smash.vc

Buying a business with the SBA?

Would having a capital partner help?

At Smash.vc, they do two things:

Buy minority stakes in existing small businesses.

Partner with entrepreneurs trying to acquire new ones.

If you're actively looking to buy a cash-flowing business using an SBA loan, hit them up if you'd like a partner.

They contribute capital, give advice, or help with growth when asked... but stay out of the way the rest of the time.

Silent partners there to help when necessary, nothing more.

If interested👉 go say hi.

📰 Articles

Growth Is No Longer Easy

Andrew Pierno of XO Capital delves into their firsthand experience with the challenges of business growth post-2020-2022, a period initially marked by effortless expansion. Andrew reflects on the impact of a gloomy economic outlook, cuts in customer spending, and changes in factors such as Google's ranking algorithms that make growth more difficult. He notes that these shifts necessitate a change in strategy, from relying on product demand to actively engaging in a multitude of growth tactics.

Past Growth Ease: Previously, growth required little effort but now demands discipline due to changing market conditions.

Revenue Decline: Andrew’s agency experienced a significant drop in monthly recurring revenue, indicating tougher times.

Market Challenges: Customers are cutting back on spending, impacting businesses.

Strategic Shift: There's a shift from development-focused strategies to growth-centric approaches due to decreased demand.

Economic Downturn: There are signs of a market downturn, with companies lowering asking prices and some returning money to investors.

Adaptation to Change: Growth strategies now involve a wide range of experiments and an active social media presence.

— — — — — — — — — — — —

What Makes a Great Acquisition?

In Mario Gabriele's "What Makes a Great Acquisition?" on The Generalist, key factors for a successful acquisition are discussed, emphasizing the role of leadership, culture compatibility, timing, and experience.

Leadership: Outspoken CEOs with extensive networks often achieve better acquisition results.

Culture Compatibility: The success of an acquisition can hinge on the cultural fit between the acquiring and acquired companies.

Timing: Acquiring companies early in M&A waves can lead to better outcomes due to lower prices and more options.

Experience: Companies that frequently engage in acquisitions tend to improve their processes and outcomes over time

— — — — — — — — — — — —

What happens when a company sells for less money than it raised in funding?

When a company sells for an amount close to what it raised in funding, the liquidation preference usually means investors get paid first, which can leave little for common shareholders like founders. However, founders might still gain through employment offers from the acquiring company, including bonuses or equity. In some cases, investors might waive their returns to facilitate the sale. Rarely, a 'management carve-out' might be negotiated, ensuring founders receive a cut regardless of liquidation preference.

🧵 Best of X (Twitter)

“Time in the market is more important than timing the market” - applies to business ownership as well…

Business buying insights…

Asking “Why are they selling” is an important part of due diligence…

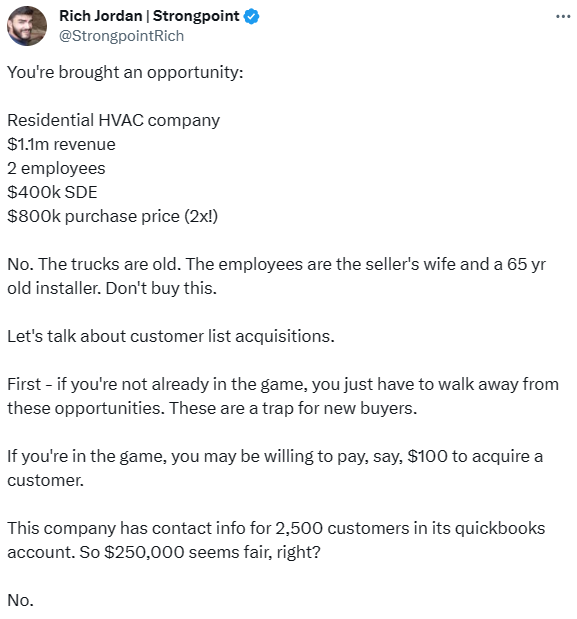

Know what you’re buying. Often it’s not a business but a customer list. Value it appropriately…

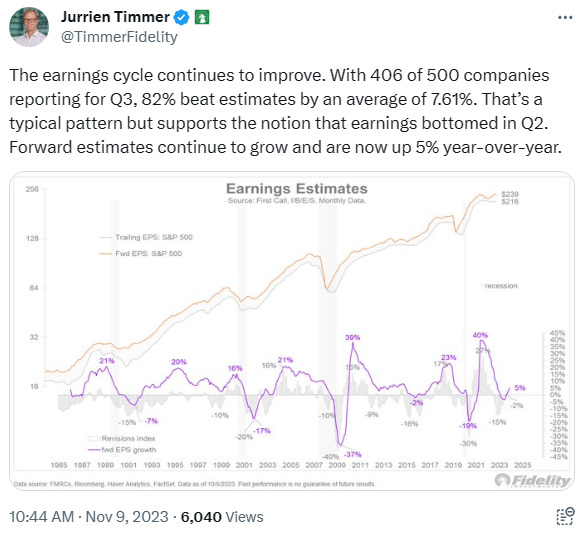

The devil is in the details but it appears corporations are seeing a rebound in earnings…

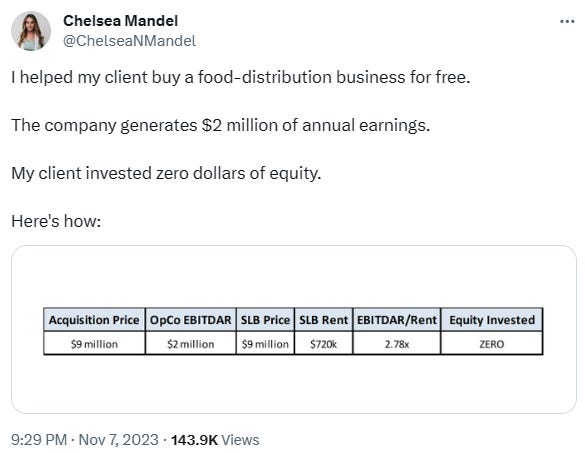

Using a leaseback in deal structuring…

A bit biased coming from an SBA loan broker but I generally agree with this point…

Tips on mitigating key-man risk…

🗓️ Events

South Florida Searcher Meetup (Dec 7) - Miami, FL

University of Michigan ETA Conference (Jan 18-19) - Ann Arbor, MI

MIT ETA Conference (Feb 16) - Cambridge, MA

Wharton ETA Club (Spring 2024) - Philadelphia, PA

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($500k - $10m revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7-10 new deals each week

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?