What I Learned Last Week 11.1.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

To those of you celebrating, I wish you and your family a very Happy Diwali! May this festival of lights bring joy, prosperity, and endless happiness into your lives.

📅 If you’re in the Boston area, attorney Dave Sterrett and his firm are organizing an ETA meetup next week on November 7th at Puttshack. RSVP to rebecca@legaldealmakers.com. 📅

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other - How to acquire these 'boring businesses' from retiring boomers?

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

An investor's notes from the McGuireWoods Independent Sponsors Conference

Posted on Searchfunder, the notes offer insights from the McGuireWoods Independent Sponsor Conference, addressing trends and challenges for independent sponsors and investors in the SMB (small and medium-sized business) acquisition space. The conference touched on deal flow, deal structuring, and best practices for sponsor-investor relationships, particularly in a market impacted by macroeconomic uncertainties like Fed decisions and weak earnings in some B2B sectors. These insights aim to aid sponsors and investors in navigating current market dynamics effectively.

Key insights include:

Deal Flow Trends: The summer was slow for deal flow, and while activity has increased post-Labor Day, volume remains generally light. Many SMB sellers are reportedly waiting for a stronger financial year to improve valuations before selling.

LOIs and Funding: Sponsors seeking proprietary deals find it easier to secure exclusivity without committed funding, whereas those in auction environments struggle to compete with funded private equity and strategic buyers.

Deal Structures and Earnouts: Earnouts can be contentious; sponsors are advised to approach them cautiously, as technical accounting disputes often lead to conflicts over whether performance metrics are met.

Sponsor-Investor Dynamics:

One-Stop Funding Caution: Experienced sponsors prefer not to obtain debt and equity from the same source due to potential conflicts of interest, though first-time sponsors are often more open to this arrangement.

Timing of Investor Engagement: Lead investors prefer early engagement (before an LOI is signed), but sponsors using syndicates generally delay wider investor outreach until they have exclusivity.

Investor Prioritization: Sponsors prioritize investors with a history of co-investments and strong capital commitment reliability, with experience and resources as secondary considerations.

Control and Governance: First-time sponsors show higher concern about control issues, while seasoned sponsors are less worried, likely due to having built solid, aligned relationships with their investors over time.

— — — — — — — — — — — —

My Due Diligence Soapbox

The article from Big Deal Small Business newsletter highlights the importance of rigorous due diligence in small business acquisitions, emphasizing that due diligence should focus on identifying unmanageable risks rather than simply validating the seller’s claims. The author argues that while "no deal is perfect," this maxim shouldn’t justify ignoring potential hazards. Proper due diligence is likened to distinguishing between "hazardous" (manageable risks) and "dangerous" (uncontrolled risks) situations, and the aim is to identify and mitigate every risk possible before committing to a deal.

Key insights include:

Distinction Between Hazard and Danger: Hazards are potential risks on the path to acquisition, but they only become "dangerous" if ignored or unmitigated.

Purpose of Due Diligence: Contrary to common beliefs, the main goal of due diligence is to "kill the deal" if an unmanageable risk is identified. This approach prioritizes uncovering deal-breaking issues over mere verification.

Setting Criteria Pre-LOI: Buyers should establish their risk tolerance and deal criteria before submitting an LOI, as this ensures decisions are aligned with personal and financial thresholds.

Parallel Processes: Once an LOI is accepted, closing processes (e.g., legal steps, financing) and due diligence should proceed simultaneously, with diligent focus on uncovering risks rather than waiting for red flags.

Take a Calculated Risk, Not Just Any Risk: The article concludes by reminding acquirers that due diligence is about making informed, calculated decisions—not about ignoring potential issues just to finalize a deal.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

Master working capital expectations or risk losing out to simpler offers…

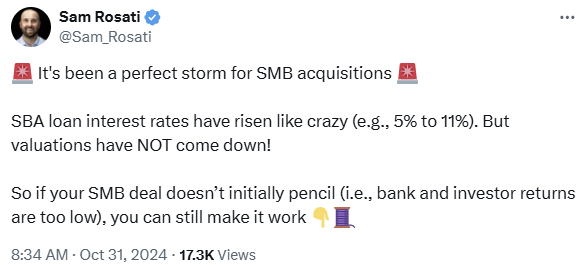

Navigate today's tough SMB acquisition market with these strategies — optimize DSCR, negotiate seller terms, and rethink your salary expectations…

Want steady deal flow? Relentlessly follow up with sell-side bankers and brokers — it's a grind, but essential for PE and SMB buyers…

Thinking SBA 7(a) loan? Be ready to pledge personal assets — here’s what they don’t tell you about collateral shortfalls…

Want a near-guaranteed PE exit? Build a platform with multiple add-ons — sponsors are hungry for turnkey growth…

Deal caution: sharing too many growth ideas with the seller might just inspire them to go it alone…

🤔 Other

How to acquire these 'boring businesses' from retiring boomers?

This Reddit thread explores the feasibility of acquiring small, established "boring" businesses from retiring owners, especially when the buyer lacks technical expertise in the business’s specific industry. Here’s a summary of the key points and advice offered:

Key Insights:

Leadership Skills Over Technical Expertise: Many contributors suggest that success hinges more on leadership and business management than on direct technical skill. A new owner must gain respect from technically skilled employees and delegate effectively.

Importance of Transition Period and Seller Support: Retiring owners often care about the business's legacy and may stay involved temporarily to help the new owner transition smoothly. Seller financing can also ensure that the seller has a vested interest in the business’s continued success.

Team and Managerial Support: Buyers without industry knowledge are advised to bring in skilled managers or partners who understand the technical side. A strong management team helps bridge gaps in expertise and keeps operations stable.

Due Diligence and Risk Awareness: Proper due diligence is essential to identify key risks, including over-reliance on the previous owner and lack of documented processes. Buyers should verify that critical processes are systematized and manageable without the former owner’s unique knowledge.

Realistic Expectations: Many buyers find that "boring businesses" are far from passive investments. Even with managers in place, owners often deal with unforeseen issues and responsibilities. For some, owning a business is akin to “buying a job” rather than achieving passive income.

Alternative Deal Structures: Options like seller financing, partial ownership, or phased buyouts can reduce upfront risk. Joint ventures or partnerships may also distribute responsibility and bring in needed expertise.

The overall advice cautions buyers to consider if they can manage both the business's operational needs and its strategic growth while being ready to handle the inevitable challenges that come with small business ownership.

🗓️ Events

Succession 2024 (Nov 5) - New York, NY

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

University of Minnesota ETA Conference (Nov 15) - Minneapolis, MN

iGlobal Independent Sponsors (Dec 4) - New York, NY

SBIA Northeast PE Conference (Jan 8-9 2025) - New York, NY

SBIA Southeast PE Conference (Feb 13-14 2025) - Nashville, TN

iGlobal Independent Sponsors (Mar 4-5 2025) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27 2025) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “All Night Long - Nu disco mix“ by HP Vince, Dave Leatherman 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?