What I Learned Last Week 11.15.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

Building an Effective Teaser: Insights From Axial Investors

The article outlines key insights from Axial investors on crafting effective investment teasers in the lower middle market M&A space. These teasers serve as introductory documents to attract potential buyers, balancing clarity, conciseness, and anonymity to pique interest.

Key insights include:

Essential elements: Include financial history (3+ years preferred), management team insights, and key metrics like recurring revenue and gross margins.

Visuals: 83% of investors value charts and visuals to succinctly convey financial data and trends.

Avoidable mistakes: Overemphasis on projections, neglecting owner intentions, and focusing too much on general industry data.

Additional context: Cultural aspects, motivations for sale, and clarity on deal structure help signal alignment.

Best practices: Highlight unique strengths, use concise formats, and provide actionable insights into the investment opportunity.

— — — — — — — — — — — —

Dealmakers See Turning Tide for M&A in 2025

The article reflects insights from ACG Chicago’s Midwest Capital Connection, highlighting a cautiously optimistic outlook for M&A activity in 2025. After a slow 2024, dealmakers anticipate increased transaction volumes driven by renewed buyer-seller alignment, the deployment of private equity dry powder, and advances in AI applications. Challenges like protracted processes and valuation disagreements remain, but recent months have shown positive market shifts.

Key insights include:

M&A Activity Trends: Renewed interest among fatigued sellers and private equity firms needing to exit investments or deploy capital.

Challenges in Deals: Extended timelines for due diligence, valuation gaps, and election-related uncertainty have hindered deal closures.

Earnouts Growth: Contingent considerations are rising but require careful structuring to avoid disputes.

AI’s Role: Predicted to be a major growth driver by enhancing efficiency, customer engagement, and revenue generation.

Market Outlook: Increased leveraged buyouts and acquisition financing expected to fuel activity in 2025.

— — — — — — — — — — — —

From Corporate to Business Owner: The Realities of ETA

The article examines one person's journey from a corporate role to Entrepreneurship Through Acquisition (ETA), illustrating the allure of autonomy and wealth versus the challenges of small business ownership. It draws on a real-life case study detailing the operational, cultural, and personal adjustments required when transitioning to a $500k EBITDA manufacturing business. Key takeaways focus on setting realistic expectations, understanding the demands of small business management, and leveraging support networks.

Key insights include:

Motivations for ETA: Freedom from corporate politics, potential for wealth creation, and career control attract professionals to ETA.

Operational Challenges: Owners face resource constraints, hands-on responsibilities, and a lack of corporate infrastructure, requiring a problem-solving mindset.

Cultural Issues: Inherited toxic cultures may necessitate clear values, morale-building strategies, and tough personnel decisions.

Identity Shift: Transitioning requires adapting to less strategic and more execution-focused leadership roles, often without a specialized support team.

Support and Community: Peer groups, mentors, and industry organizations provide essential advice and reduce isolation.

Exit Strategies: Assessing the financial and mental toll of ownership can guide decisions on exiting, scaling, or returning to corporate roles.

Long-Term Wealth Creation: Success often depends on patience, realistic expectations, and eventually delegating operational tasks to focus on growth.

The journey highlights the importance of self-awareness, resilience, and aligning personal goals with the realities of ETA.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

Deals with 100% seller financing are rare and you should typically avoid them…

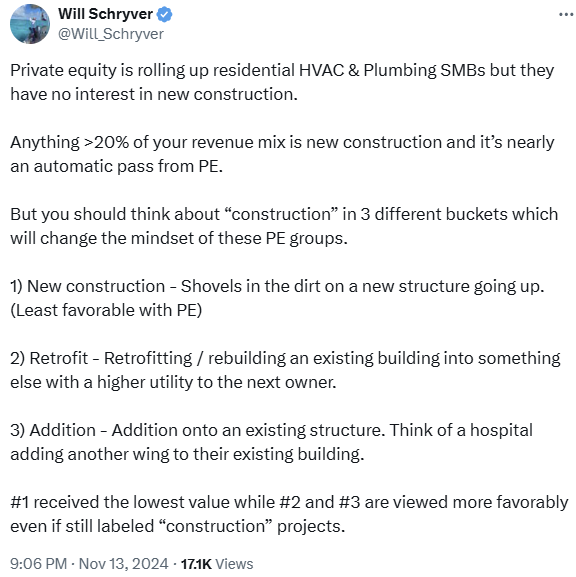

PE loves HVAC/Plumbing—but hates 'new construction.' Here’s how to reframe it…

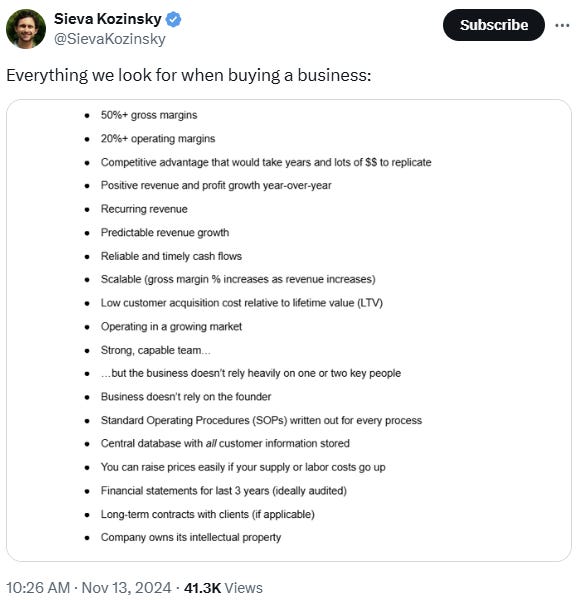

Incorporate this into your buy box…

PE market optimism is building for 2025 — Q2 could bring a wave of deals…

Here’s why breaking $5M unlocks freedom — and how to get there...

The ‘silver tsunami’ is a myth — most boomer businesses aren’t sellable…

🗓️ Events

University of Minnesota ETA Conference (Nov 15) - Minneapolis, MN

iGlobal Independent Sponsors (Dec 4) - New York, NY

SBIA Northeast PE Conference (Jan 8-9 2025) - New York, NY

SBIA Southeast PE Conference (Feb 13-14 2025) - Nashville, TN

iGlobal Independent Sponsors (Mar 4-5 2025) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27 2025) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Keep Control Plus“ by Sono 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?