What I Learned Last Week 11.22.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other - Lawsuits & Earnouts

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

Understanding Seller Notes in M&A: Insights from 100 LOIs

The article from Axial explores the use of seller notes in M&A through analysis of 100 Letters of Intent (LOIs). Seller notes allow business sellers to defer a portion of the purchase price, receiving payments over time with interest, and are used to bridge valuation gaps, reduce upfront buyer equity needs, and align seller incentives with long-term business success. There’s a lot of great data in this article.

Key insights include:

Seller notes typically account for a significant portion of deal structures in lower middle market M&A.

They often accompany earnouts to balance buyer and seller risk.

Specific percentages of seller notes and earnouts vary widely by industry and deal specifics.

— — — — — — — — — — — —

How to Evaluate a Business (Part 1)

This post from Chris Munn outlines effective methods for evaluating a business for acquisition, emphasizing the importance of financial recasting to determine actual profitability. It explains key metrics like EBITDA, SDE, and DFCF, and how adjustments to expenses (e.g., rent, salaries, and insurance) can reveal a more accurate picture of a business's cash flow and value.

Key insights include:

Understanding the limitations of reported financial metrics like SDE.

Recasting financial statements to uncover accurate earnings.

Factoring operational changes like increased rent or hiring costs.

Evaluating businesses based on their Buyer’s Discretionary Earnings (BDE).

— — — — — — — — — — — —

Legal Costs in Small Business Acquisitions: Fixed-Fee vs. Hourly Billing

The guide from DueDilio discusses how attorneys support small business acquisitions and compares legal cost structures like fixed-fee, hourly billing, and hybrid models. It emphasizes the role of legal counsel in due diligence, drafting agreements, and compliance, helping buyers manage transaction risks effectively.

Key insights include:

Fixed-fee models provide predictable costs, while hourly billing offers flexibility for simpler deals.

Hybrid approaches allow targeted legal support tailored to buyer needs.

Factors affecting costs include deal complexity, seller cooperation, and state regulations.

Retainers and milestone-based payments are common practices.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

Franchises can be a great alternative to buying a traditional SMB…

Know your strengths and hire professionals to fill in the gaps…

Why are you the 'lucky one' seeing this deal? If others passed, dig deeper — leftovers rarely make for great investments…

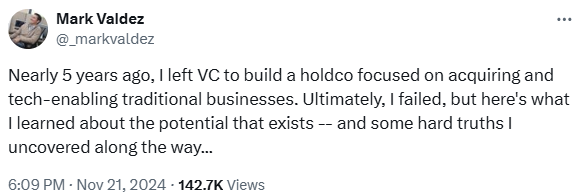

Traditional businesses are hungry for real tech solutions, not buzzwords — huge opportunity if you can bridge the gap…

SMB deals fall apart for surprising reasons — working capital fights, seller remorse, or even sales tax liens — nail the details to avoid deal killers…

Ping Chris if you’re interested in this deal…

🤔 Other

Lawsuits and earnouts in PE deals and tuck-ins

The discussion on Reddit delves into the complexities of earnouts in PE deals, focusing on disputes over earnout payments and the importance of clear contract terms. Contributors agree that PE firms typically adhere to the "letter of the law" in contracts but note that ambiguities or post-acquisition resource constraints often lead to disputes. Earnouts are rarely intentionally defaulted on but can be complicated by factors like cost allocations or changes in management priorities.

Key insights include:

Strong legal counsel is essential for drafting enforceable, clear earnout clauses.

Sliding scale earnouts reduce risk compared to all-or-nothing terms.

PE firms, even in minority deals, often play a decisive role in earnout outcomes.

Ambiguities or conflicts often stem from unclear definitions or unexpected post-deal conditions.

🗓️ Events

iGlobal Independent Sponsors (Dec 4) - New York, NY

SBIA Northeast PE Conference (Jan 8-9 2025) - New York, NY

SBIA Southeast PE Conference (Feb 13-14 2025) - Nashville, TN

iGlobal Independent Sponsors (Mar 4-5 2025) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27 2025) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Somedays - Dombresky Remix“ by Sonny Fodera, Jazzy, D.O.D, Dom Dolla 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?